The Canadian Imperial Bank of Commerce has announced:

that it has completed the offering of 32 million Basel III-compliant Non-cumulative Rate Reset Class A Preferred Shares Series 45 (Non-Viability Contingent Capital (NVCC)) (the “Series 45 Shares”) priced at $25.00 per share to raise gross proceeds of $800 million.

The offering was made through a syndicate of underwriters led by CIBC World Markets Inc. The Series 45 Shares commence trading on the Toronto Stock Exchange today under the ticker symbol CM.PR.R.

The Series 45 Shares were issued under a prospectus supplement dated May 26, 2017, to CIBC’s short form base shelf prospectus dated March 16, 2016.

CM.PR.R is a FixedReset, 4.40%+338, NVCC Compliant issue announced 2017-05-25. It will be tracked by HIMIPref™ and has been added to the FixedResets subindex.

The issue traded 2,454,817 shares today in a range of 24.96-07 before closing at 24.98-00. This volume places it eighteenth on the all-time (well, back until 1993-12-31, anyway) list, just behind TD.PR.H on 2004-4-6 and just ahead of BCE.PR.P on 2002-6-13. Vital statistics are:

| CM.PR.R | FixedReset | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2047-06-02 Maturity Price : 23.14 Evaluated at bid price : 24.98 Bid-YTW : 4.25 % |

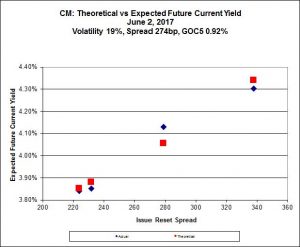

Implied Volatility analysis for FixedResets continues to suggest the issue may be a little expensive:

The theoretical price implied by the above calculation is 24.77.

On June 8 2022 CIBC announced an offering of $800 million of NVCC notes to “be used for general banking purposes of CIBC”. This is exactly the amount needed to redeem CM.PR.R and the timing seems perfect too. Who thinks CM.PR.R will be redeemed?

On June 8 2022 CIBC announced an offering of $800 million of NVCC notes

Good catch, DrSpinz!

The news release is HERE:

At +338, I’d have to say CM.PR.R is highly likely to be redeemed; the closing quote June 8 was 25.11-15.

I see from page 209 of the RBC 2021 Annual Report that they have a stack of LRCNs outstanding with a reset spread of 265.5bp.

That’s a nice loss for the buyers!

[…] is a FixedReset, 4.40%+338, NVCC Compliant issue that commenced trading 2017-6-2 after being announced 2017-05-25. It has been tracked by HIMIPref™ and is currently part of the […]