On March 18 I reported:

Assiduous Readers will remember that Manulife was bailed out by the regulators again after a hedge fund claimed the terms of its contract with the firm allowed it to deposit unlimited funds with the firm at a guaranteed rate of up to 5%.

It turns out the bail-out was unnecessary! Manulife won the court case

‘Not so fast!’ scream the plaintiffs:

A pivotal court ruling that dismissed three lawsuits against Canadian life insurers has been formally appealed, extending a battle between the companies and three investment funds over the fine print of decades-old contracts.

…

This week the funds appealed all three cases, arguing that the core argument made by Justice Brian Scherman of the Court of Queen’s Bench for Saskatchewan when dismissing the lawsuits is incorrect. Justice Scherman ruled that the contracts were designed to be used for insurance purposes only, and that “in the some 30 years since universal life insurance policies have been sold, there is no judicial record of these policies being used in the manner proposed” by the investment funds.In its appeal of the ruling that related to Manulife, Mosten Investment LP argued “the learned Chambers Judge erred in law in his interpretation of the contract.”

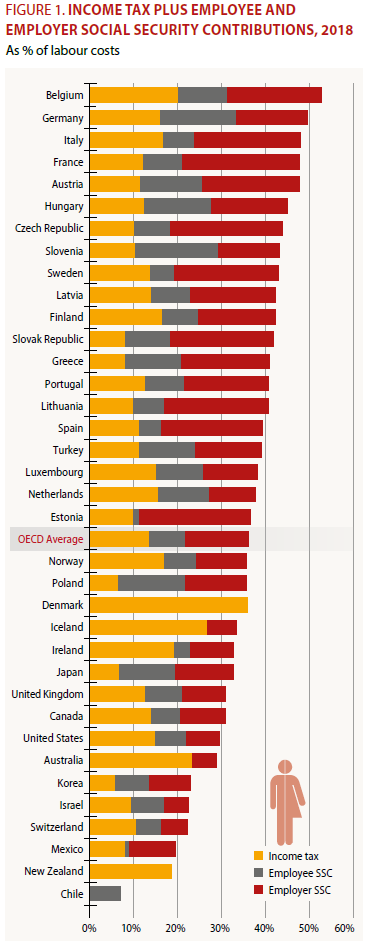

There is a fascinating chart made available in the OECD release of its publication “Taxing Wages”:

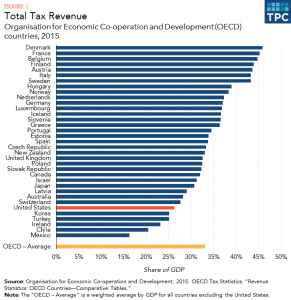

Of course, this just refers to taxes on wages; it does not include things like sales tax and property tax. In the interest of avoiding vitriolic attacks by worshippers of the Awesome and Holy United States of Free America, I will also publish a chart more favourable to that glorious nation:

Of course, neither chart includes the cost of health insurance, which is a big ticket item in the Awesome and Holy United States of Free America, but that’s because health insurance is FREE ENTERPRISE, dammit, and any free citizen has a CHOICE between between buying Health Insurance, dying, or being bankrupted by medical bills.

Reasonable people can argue all day and all night regarding whether a single-payer system like Canada’s is better or worse than the US system. Each has its own advantages and disadvantages. But to take tax rates as a straight-up, single-number meaningful comparison of anything at all is simply ridiculous and annoys me.

PerpetualDiscounts now yield 5.45%, equivalent to 7.08% interest at the standard equivalency factor of 1.3x. Long corporates now yield 3.82%, so the pre-tax interest-equivalent spread (in this context, the “Seniority Spread”) is now about 325bp, unchanged from the figure reported April 10.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.4469 % | 2,137.8 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.4469 % | 3,922.8 |

| Floater | 5.48 % | 5.76 % | 45,645 | 14.26 | 3 | -0.4469 % | 2,260.8 |

| OpRet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1292 % | 3,284.6 |

| SplitShare | 4.87 % | 4.61 % | 75,842 | 3.82 | 8 | 0.1292 % | 3,922.5 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1292 % | 3,060.5 |

| Perpetual-Premium | 5.57 % | -17.16 % | 81,232 | 0.09 | 10 | -0.0079 % | 2,959.7 |

| Perpetual-Discount | 5.39 % | 5.45 % | 78,217 | 14.68 | 23 | 0.0019 % | 3,114.4 |

| FixedReset Disc | 5.22 % | 5.42 % | 184,836 | 14.89 | 61 | 0.0987 % | 2,202.9 |

| Deemed-Retractible | 5.20 % | 5.80 % | 99,151 | 8.13 | 27 | 0.0094 % | 3,082.3 |

| FloatingReset | 4.22 % | 4.34 % | 53,154 | 2.68 | 5 | 0.0754 % | 2,421.7 |

| FixedReset Prem | 5.06 % | 3.63 % | 282,841 | 2.19 | 23 | 0.1432 % | 2,592.0 |

| FixedReset Bank Non | 1.98 % | 4.02 % | 145,072 | 2.69 | 3 | -0.1809 % | 2,635.7 |

| FixedReset Ins Non | 4.98 % | 6.69 % | 106,882 | 8.27 | 22 | -0.0930 % | 2,264.6 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| SLF.PR.G | FixedReset Ins Non | -2.16 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 14.92 Bid-YTW : 8.87 % |

| TRP.PR.C | FixedReset Disc | -1.78 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-04-17 Maturity Price : 13.27 Evaluated at bid price : 13.27 Bid-YTW : 5.84 % |

| TRP.PR.A | FixedReset Disc | -1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-04-17 Maturity Price : 14.83 Evaluated at bid price : 14.83 Bid-YTW : 6.05 % |

| MFC.PR.J | FixedReset Ins Non | -1.09 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.92 Bid-YTW : 6.69 % |

| HSE.PR.E | FixedReset Disc | 1.00 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-04-17 Maturity Price : 20.20 Evaluated at bid price : 20.20 Bid-YTW : 6.47 % |

| RY.PR.Z | FixedReset Disc | 1.12 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-04-17 Maturity Price : 18.93 Evaluated at bid price : 18.93 Bid-YTW : 5.17 % |

| MFC.PR.M | FixedReset Ins Non | 1.12 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.90 Bid-YTW : 7.39 % |

| TRP.PR.G | FixedReset Disc | 1.84 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-04-17 Maturity Price : 19.40 Evaluated at bid price : 19.40 Bid-YTW : 5.90 % |

| IAF.PR.B | Deemed-Retractible | 1.89 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.16 Bid-YTW : 6.11 % |

| TRP.PR.B | FixedReset Disc | 2.40 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-04-17 Maturity Price : 12.80 Evaluated at bid price : 12.80 Bid-YTW : 5.66 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| BMO.PR.F | FixedReset Prem | 2,191,850 | YTW SCENARIO Maturity Type : Call Maturity Date : 2024-05-25 Maturity Price : 25.00 Evaluated at bid price : 25.22 Bid-YTW : 4.93 % |

| PWF.PR.K | Perpetual-Discount | 150,395 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-04-17 Maturity Price : 22.08 Evaluated at bid price : 22.36 Bid-YTW : 5.54 % |

| IFC.PR.G | FixedReset Ins Non | 149,035 | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.50 Bid-YTW : 6.99 % |

| POW.PR.G | Perpetual-Premium | 101,854 | YTW SCENARIO Maturity Type : Call Maturity Date : 2019-05-17 Maturity Price : 25.50 Evaluated at bid price : 25.70 Bid-YTW : -3.64 % |

| PVS.PR.F | SplitShare | 82,900 | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2024-09-30 Maturity Price : 25.00 Evaluated at bid price : 25.01 Bid-YTW : 4.93 % |

| TRP.PR.E | FixedReset Disc | 63,700 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-04-17 Maturity Price : 17.00 Evaluated at bid price : 17.00 Bid-YTW : 5.90 % |

| There were 31 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| ELF.PR.H | Perpetual-Discount | Quote: 24.95 – 25.50 Spot Rate : 0.5500 Average : 0.3163 YTW SCENARIO |

| TD.PF.B | FixedReset Disc | Quote: 18.85 – 19.24 Spot Rate : 0.3900 Average : 0.2480 YTW SCENARIO |

| TD.PF.D | FixedReset Disc | Quote: 21.03 – 21.63 Spot Rate : 0.6000 Average : 0.4699 YTW SCENARIO |

| IFC.PR.E | Deemed-Retractible | Quote: 23.86 – 24.25 Spot Rate : 0.3900 Average : 0.2818 YTW SCENARIO |

| BAM.PF.D | Perpetual-Discount | Quote: 21.85 – 22.20 Spot Rate : 0.3500 Average : 0.2521 YTW SCENARIO |

| NA.PR.C | FixedReset Disc | Quote: 22.28 – 22.57 Spot Rate : 0.2900 Average : 0.2117 YTW SCENARIO |