The Financial Services Authority has released its Financial Risk Outlook 2009 report, a very good review of the current situation, its causes and possible effects.

I will note in passing that it’s hard to learn about these releases! The FSA restricts its eMail notifications to journalists, citing “high demand”. I don’t understand! I spend seven hours per day deleting eMail offering me many interesting pills, and the FSA can’t send me an eMail that I’ve specifically requested? This makes no sense.

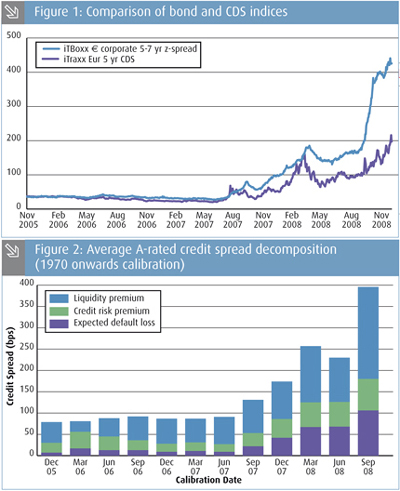

One highly interesting and topical subject is the decomposition of corporate bond yields, which have been discussed many times on PrefBlog – for instance, in the post announcing BoE Releases October 2008 Financial Stability Report. According to the Financial Times:

Fears are mounting over possible dividend cuts by life assurers, after a demand from the Financial Services Authority that they hold enough capital to survive fresh market shocks.

Life assurers are being told to test whether they would have a capital buffer after what is in effect a 60 per cent reduction in equity markets from current levels, as well as a significant increase in bond defaults, according to people who are aware of the project.

…

In the latest tests – regarded as more extreme than the December exercise – the FSA has told companies to test whether they would have a capital buffer in the event of a 1980s-style sharp and deep recession, according to people familiar with the plans.This includes a 20 per cent reduction in equity markets from current levels, followed by another 39 per cent decline, which would take the FTSE 100 index to around the 2,000 level.

It is also asking companies to test whether they would have a capital buffer after a further significant increase in the returns that investors demand for holding bonds that are more risky than gilts and a significant decline in property prices.

The tests represent yet another change in approach by the FSA, which has alternated between pragmatism and strict solvency demands.

“Its like dealing with the police if they kept changing the crime laws,” added the executive.

Tergiversations by regulators are nothing new … but then, neither are flip-flops by the Financial Times, as noted in a very informative article published by The Actuary:

In October 2008, the Financial Times opined that “life assurers should not be using rising yields on corporate bonds to reduce estimates of their future liabilities. The higher yields… represent a higher risk of default and added potential costs”. However, a later article suggested that “the markets are utterly divorced from fundamental value or risks of defaults”.

The Actuary article provides a review of the Liquidity Premium from an investment standpoint:

The spread on corporate bonds over the liquid risk-free rate (for example, government bonds) represents compensation for several different factors:

A Expected default losses

B Unexpected default risk, such as default and recovery rate risk

C Mark-to-market risk, such as the risk of a fall in the market price of the bond

D Liquidity risk, such as the risk of not finding a ready buyer at the theoretical market price.Investors concerned with the realisable value of their investment in the short-term require compensation for all these risks.

However, investors who can hold bonds to maturity need compensation only for A and B. Such investors can enjoy the premiums for C and D, and we refer to these collectively as a ‘liquidity premium’.

The traditional method for credit deductions only allowed directly for expected default losses, albeit measured on a prudent basis. The Financial Services Authority (FSA), in its September 2008 Insurance Sector Briefing, observed that insurers should allow for both expected losses and the risk of unexpected losses, although they have since deferred any recommendations until 2009.

… while pointing out the dangers of blind adherence to classical structural models:

These models are not without their issues. For example, in the Bank of England model, the residual premium on Sterling investment grade bonds fell from 155bps at 30 September 2008 to a negative premium of -9bps on 10 October, before rising to 118bps by the end of October. This is due to the use of equity market volatility to quantify credit default risk — on 10 October equity markets fell 10% with corresponding spikes in volatility, while credit markets were largely unaffected.

Nevertheless, structural models provide a valuable new tool for actuaries to quantify liquidity premiums, and also strong evidence of their existence.

The FSA does not go out of its way to talk tough on this issue, but does note:

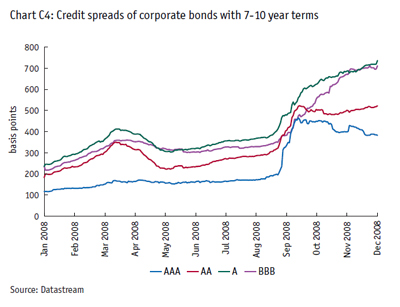

As most life insurers hold corporate bonds to back various classes of business, analysis of market developments should be a key consideration for them in determining the discount rate used to value long-term liabilities. In setting this discount rate, most insurers make an assessment of the extent to which bond spreads can be explained by liquidity premiums, rather than the probability of default. Bond spreads have widened significantly, particularly in the third quarter of 2008, and whether insurers attribute this to an increase in the liquidity premium or an increase in credit default risk affects the value of their liabilities. Moreover, asset values will themselves be affected by the increased risk of corporate bond defaults. It is therefore critical that insurers holding corporate bond portfolios properly review underlying credit developments, in order to understand the state of their balance sheets and their capital positions.

Some insurers may have experienced difficulty with the valuation of their assets and, in particular, corporate bonds, because of the considerable reduction in market activity in many asset classes.

and provides a picture:

The FSA returns to this issue when discussing annuities:

Insurers operating predominantly or exclusively in annuity business are exposed to a concentration of longevity and credit risk. Market conditions have added to the impact of these risks, increasing the risk profile of this part of the sector. The risks arising from widening corporate bond spreads (as outlined above) are a particular issue for annuity business, in which long-term assets such as corporate bonds are used to match long-term liabilities (such as annuities in payment).

and included an exhortation to be prudent when decomposing the spreads in their “key messages to insurers”.

Also of interest was the FSA’s distinction between the much reviled “originate and distribute” model and the more precise “acquire and arbitrage” practice:

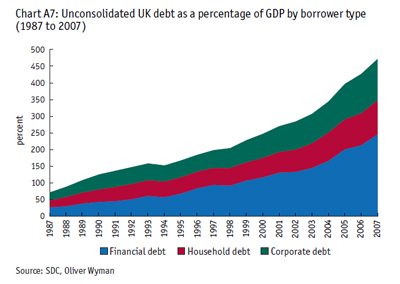

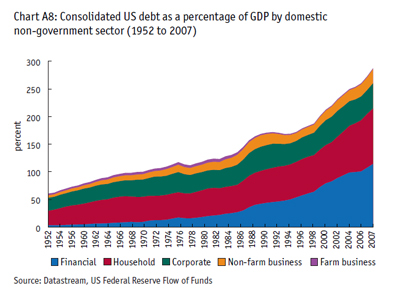

The need to support the growing levels of property and mortgage lending led to the increasing scale and size of securitised markets, and their mounting complexity were accompanied by a significant escalation in the leverage of banks, investment banks and off balance-sheet vehicles, and the growing role of hedge funds. (Chart A5 and A6) Large positions in securitised credit and related derivatives were increasingly held by banks, near banks, and shadow banks, rather than passed through to traditional hold-to-maturity investors.

Hence, the new model of securitised credit intermediation was not solely or indeed primarily one of originate and distribute. Rather, credit intermediation passed through multiple trading books in banks, leading to a proliferation of relationships within the financial sector. This ‘acquire and arbitrage’ model resulted in the majority of incurred losses falling on banks and investment banks involved in risky maturity transformation activities, rather than investors outside the banking system. This explosion of claims within the financial system resulted in financial sector balance sheets becoming of greater consequence to the economy.

[…] appears to imply that they have held their default estimates constant and ascribed every single bp of spread widening to liquidity. Page 20 of the copy-protected PDF […]

[…] I am trying to obtain is a view as to how well their default assumptions reflect credit spreads. Given that an unrealized loss of $5,200-million translated into impairment charges of $128-million […]

[…] UK’s Financial System Authority says, in its Financial Risk Outlook 2009 (previously reported on PrefBlog: Hence, the new model of securitised credit intermediation was not solely or indeed primarily one […]