The Federal Reserve Bank of San Francisco has published a working paper by Jens H. E. Christensen, Jose A. Lopez and Glenn D. Rudebusch titled Inflation Expectations and Risk Premiums in an Arbitrage-Free Model of Nominal and Real Bond Yields:

Differences between yields on comparable-maturity U.S. Treasury nominal and real debt, the so-called breakeven inflation (BEI) rates, are widely used indicators of inflation expectations. However, better measures of inflation expectations could be obtained by subtracting inflation risk premiums from the BEI rates. We provide such decompositions using an estimated affine arbitrage-free model of the term structure that captures the pricing of both nominal and real Treasury securities. Our empirical results suggest that long-term inflation expectations have been well anchored over the past few years, and inflation risk premiums, although volatile, have been close to zero on average.

This contradicts the results of Haubrich, et al, from the FRB-Cleveland, (paper reviewed on PrefBlog) who claimed:

The inflation risk premium on a ten-year bond varied between 38 and 60 basis points during our [1982-2008] sample period.

while the FRBNY paper by Adrian & Wu (discussed below) claimed a 0-40bp Inflation Risk Premium for 5-10 year time horizons.

The Christensen group first did a Principal Component Analysis of Treasury yields:

Researchers have typically found that three factors, often referred to as level, slope, and curvature, are sufficient to account for the time variation in the cross section of nominal Treasury yields (e.g., Litterman and Scheinkman, 1991). This characterization is supported by a principal component analysis of our weekly data set, which consists of Friday observations from January 6, 1995, to March 28, 2008, for eight maturities: three months, six months, one year, two years, three years, five years, seven years, and ten years. Indeed, as shown in Table 1, 99.9 percent of the total variation in this set of yields is accounted for by the first three principal components. Furthermore, the loadings across the eight maturities for the first component are quite uniform; thus, like a level factor, a shock to this component will change all yields by a similar amount. The second component has negative loadings for short maturities and positive loadings for long ones; thus, like a slope factor, a shock to this component will steepen or flatten the yield curve. Finally, the third component has U-shaped factor loadings as a function of maturity and is naturally interpreted as a curvature factor.

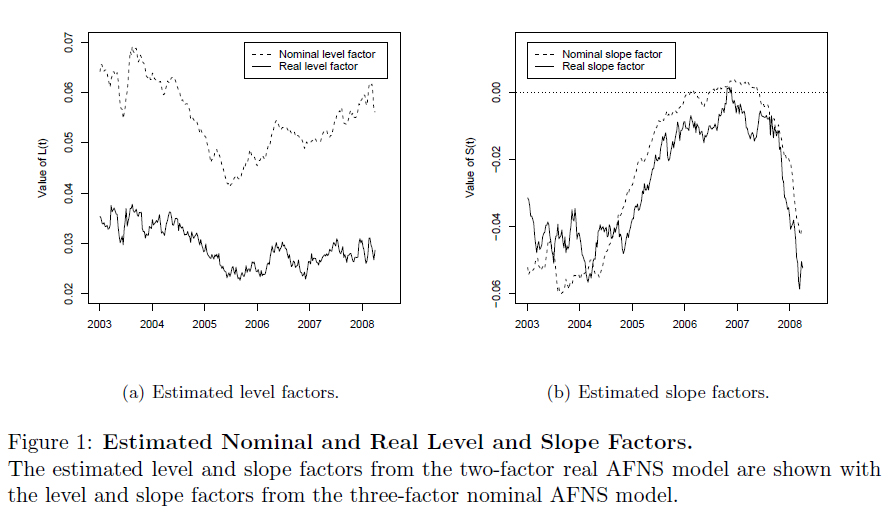

Only the first two principal components are required to explain real yields – best of all, the “slope” component is well-correlated with that of nominals:

After developing the model, they conclude:

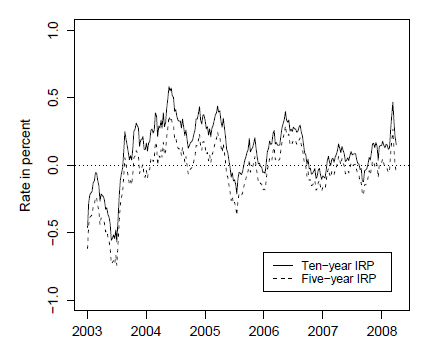

Finally, for our preferred specification, we subtract each model-implied expected inflation rate from the comparable-maturity model-implied BEI rate and obtain the associated inflation risk premium (IRP). At both the five- and ten-year horizons, these premiums are fairly small, as shown in Figure 5.(17) Indeed, during our sample, these inflation premiums have varied in a range around zero of about ±50 basis points.(18)

Footnote 17: This result provides some support for the argument that the gain to the U.S. Treasury from issuing TIPS bonds instead of nominal bonds may be quite limited, as argued in Sack and Elsasser (2004).

Footnote 18: Again, in theory, the sign of the inflation risk premium depends on the covariance between the real stochastic discount factor and inflation, but there are real-world considerations as well. For example, a liquidity premium for holding TIPS instead of nominal Treasury bonds would show up as a negative inflation risk premium.

Finally, the authors conclude:

This paper estimates an arbitrage-free model with four latent factors that can capture the dynamics of both the nominal and real Treasury yield curves well and can decompose BEI rates into inflation expectations and inflation risk premiums. The model-implied measures of inflation expectations are correlated closely with survey measures, while the estimated inflation risk premiums fluctuate in fairly close range around zero. The empirical results suggest that long-term inflation expectations have been well-anchored in the period from year-end 2002 through the first quarter of 2008.