There’s a fundamental disagreement about the Citigroup bail-out:

“While there was consensus that Citigroup was too systemically significant to be allowed to fail, that consensus appeared to be based as much on gut instinct and fear of the unknown as on objective criteria,” according to a report today from Neil Barofsky, special inspector general for the Troubled Asset Relief Program. “The conclusion of the various government actors that Citigroup had to be saved was strikingly ad hoc.”

…

“It may have been ad hoc, but it worked,” said Michael Goldstein, professor of finance at Babson College in Massachusetts. “Fear of the unknown is a perfectly good reason to try to buy some time and not take the chance of the U.S. economy going into another Great Depression.”

Well, I’m no big fan of the regulators, but expecting a standard bureaucratic binder with plans regarding ‘What to do if the world melts down’ seems a bit much. Once they started concentrating on their jobs – the concentration being assisted by the prospect of hanging in the morning – they did all right. Like the man said, more or less, no plan survives contact with the enemy.

However, the US is eating its seed corn:

Now, as governments in China and India boost funding for expansion of their universities, Governor Jerry Brown’s proposed 16 percent cut in the higher-education budget jeopardizes the flow of talent that powers Google Inc., Apple Inc. and the rest of California’s knowledge-based economy. The elite University of California system may no longer be able to guarantee admission to the top 12.5 percent of the state’s high-school seniors. Annual tuition for residents, which was less than $4,500 a decade ago, is scheduled to rise to at least $11,124 in the next school year.

… but the current pace of innovation remains satisfactory:

Vivus Inc.’s experimental impotence drug Avanafil helped 80 percent of men achieve erections and two-thirds to have intercourse, Chief Executive Officer Leland Wilson said.

…

Because Avanafil is metabolized fairly rapidly, men may be able to use it safely twice a day, at the beginning and end of the day, Tam said.

News of the breakthrough got the Canadian preferred share market all excited today, with PerpetualDiscounts up 65bp while FixedResets gained 4bp on heavy volume.

It was the deep-discount issues that did particularly well, as will be seen on the Performance table, but let’s look at some specific:

| CM Straight Perpetuals | |||||||

| Ticker | Dividend | Quote 1/12 |

Quote 1/13 |

Bid Change | Current Yield at bid 1/12 |

Current Yield at bid 1/13 |

Current Yield Change |

| CM.PR.J | 1.125 | 21.76-84 | 22.17-39 | +0.41 | 5.17% | 5.07% | -10bp |

| CM.PR.I | 1.175 | 22.46-55 | 22.75-96 | +0.29 | 5.23% | 5.16% | -7bp |

| CM.PR.H | 1.20 | 22.86-95 | 23.19-35 | +0.33 | 5.25% | 5.17% | -8bp |

| CM.PR.G | 1.35 | 24.60-65 | 24.63-75 | +0.03 | 5.49% | 5.48% | -1bp |

| CM.PR.P | 1.375 | 24.90-93 | 24.90-94 | 0.00 | 5.52% | 5.52% | 0bp |

| CM.PR.E | 1.40 | 24.89-10 | 25.05-18 | +0.16 | 5.62% | 5.59% | -3bp |

| CM.PR.D | 1.4375 | 25.33-36 | 25.32-50 | -001 | 5.68% | 5.68% | 0bp |

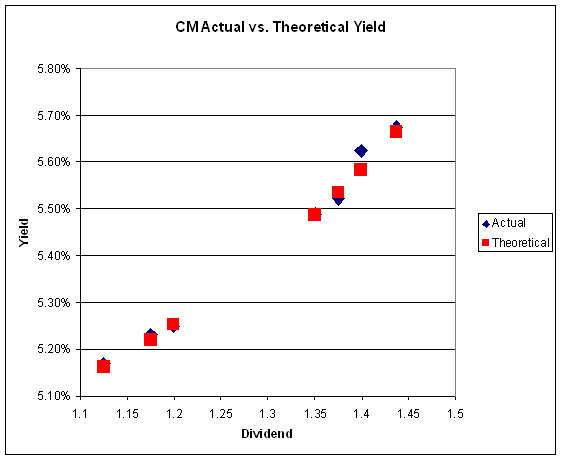

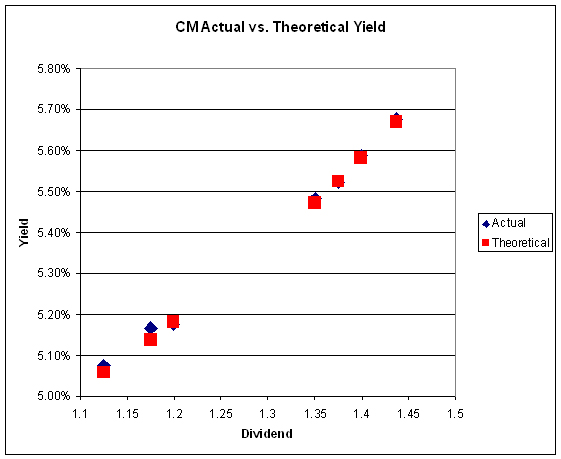

Analysis of the data using the Straight Perpetual Implied Volatility Calculator produces the following table:

| Fits to Implied Volatility | ||||||

| Issuer | 2010-12-31 | 2011-1-12 | 2011-1-13 | |||

| Yield | Volatility | Yield | Volatility | Yield | Volatility | |

| CM | 4.90% | 18% | 4.70% | 19% | 4.00% | 25% |

| Calculations are performed with a time horizon of three years for all issues | ||||||

Plots are:

All this does not appear to be bond-related, by the way: long corporates did nothing all day, NUTHIN’.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0736 % | 2,323.8 |

| FixedFloater | 4.81 % | 3.49 % | 27,535 | 19.18 | 1 | -0.4403 % | 3,539.0 |

| Floater | 2.57 % | 2.36 % | 43,466 | 21.32 | 4 | 0.0736 % | 2,509.1 |

| OpRet | 4.81 % | 3.35 % | 66,739 | 2.31 | 8 | 0.0337 % | 2,389.4 |

| SplitShare | 5.33 % | 1.76 % | 566,949 | 0.90 | 4 | 0.0201 % | 2,453.2 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0337 % | 2,184.9 |

| Perpetual-Premium | 5.65 % | 5.25 % | 132,278 | 5.19 | 20 | 0.1378 % | 2,029.1 |

| Perpetual-Discount | 5.35 % | 5.37 % | 244,964 | 14.88 | 57 | 0.6525 % | 2,065.0 |

| FixedReset | 5.24 % | 3.41 % | 291,015 | 3.07 | 52 | 0.0360 % | 2,272.4 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| PWF.PR.I | Perpetual-Premium | -1.18 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2012-05-30 Maturity Price : 25.00 Evaluated at bid price : 25.15 Bid-YTW : 5.37 % |

| SLF.PR.E | Perpetual-Discount | 1.00 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 21.12 Evaluated at bid price : 21.12 Bid-YTW : 5.38 % |

| GWO.PR.H | Perpetual-Discount | 1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 23.44 Evaluated at bid price : 23.69 Bid-YTW : 5.15 % |

| POW.PR.D | Perpetual-Discount | 1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 22.75 Evaluated at bid price : 22.95 Bid-YTW : 5.47 % |

| RY.PR.F | Perpetual-Discount | 1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 22.52 Evaluated at bid price : 22.68 Bid-YTW : 4.97 % |

| RY.PR.E | Perpetual-Discount | 1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 22.45 Evaluated at bid price : 22.61 Bid-YTW : 5.04 % |

| SLF.PR.B | Perpetual-Discount | 1.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 22.34 Evaluated at bid price : 22.51 Bid-YTW : 5.37 % |

| TD.PR.O | Perpetual-Discount | 1.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 23.92 Evaluated at bid price : 24.19 Bid-YTW : 5.01 % |

| SLF.PR.D | Perpetual-Discount | 1.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 20.90 Evaluated at bid price : 20.90 Bid-YTW : 5.37 % |

| RY.PR.D | Perpetual-Discount | 1.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 22.45 Evaluated at bid price : 22.61 Bid-YTW : 5.04 % |

| SLF.PR.A | Perpetual-Discount | 1.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 21.96 Evaluated at bid price : 22.32 Bid-YTW : 5.35 % |

| CM.PR.I | Perpetual-Discount | 1.29 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 22.58 Evaluated at bid price : 22.75 Bid-YTW : 5.17 % |

| SLF.PR.C | Perpetual-Discount | 1.30 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 20.96 Evaluated at bid price : 20.96 Bid-YTW : 5.36 % |

| RY.PR.A | Perpetual-Discount | 1.42 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 22.67 Evaluated at bid price : 22.85 Bid-YTW : 4.93 % |

| BNS.PR.K | Perpetual-Discount | 1.43 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 23.76 Evaluated at bid price : 24.04 Bid-YTW : 4.99 % |

| CM.PR.H | Perpetual-Discount | 1.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 22.96 Evaluated at bid price : 23.19 Bid-YTW : 5.18 % |

| GWO.PR.I | Perpetual-Discount | 1.61 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 21.95 Evaluated at bid price : 22.08 Bid-YTW : 5.13 % |

| MFC.PR.B | Perpetual-Discount | 1.61 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 21.78 Evaluated at bid price : 22.07 Bid-YTW : 5.31 % |

| BNS.PR.M | Perpetual-Discount | 1.66 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 22.54 Evaluated at bid price : 22.70 Bid-YTW : 4.96 % |

| BMO.PR.J | Perpetual-Discount | 1.68 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 22.87 Evaluated at bid price : 23.05 Bid-YTW : 4.94 % |

| MFC.PR.C | Perpetual-Discount | 1.68 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 21.20 Evaluated at bid price : 21.20 Bid-YTW : 5.37 % |

| CM.PR.J | Perpetual-Discount | 1.88 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 22.04 Evaluated at bid price : 22.17 Bid-YTW : 5.08 % |

| BNS.PR.L | Perpetual-Discount | 2.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 22.63 Evaluated at bid price : 22.80 Bid-YTW : 4.94 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| MFC.PR.A | OpRet | 236,475 | TD crossed 25,000 at 25.80; Nesbitt corssed 100,000 at the same price. Desjardins crossed 99,400 at the same price again. YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2015-12-18 Maturity Price : 25.00 Evaluated at bid price : 25.78 Bid-YTW : 3.49 % |

| BNS.PR.Y | FixedReset | 114,220 | Nesbitt crossed 50,000 at 25.00, then bought blocks o 14,200 and 30,000 from anonymous at the same price. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 24.91 Evaluated at bid price : 24.96 Bid-YTW : 3.55 % |

| BAM.PR.P | FixedReset | 110,660 | RBC crossed 100,000 at 27.30. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-30 Maturity Price : 25.00 Evaluated at bid price : 27.30 Bid-YTW : 4.44 % |

| TRP.PR.A | FixedReset | 106,579 | RBC crossed 97,900 at 25.91. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-01-30 Maturity Price : 25.00 Evaluated at bid price : 26.00 Bid-YTW : 3.58 % |

| BAM.PR.R | FixedReset | 104,350 | RBC crossed 100,000 at 26.30. YTW SCENARIO Maturity Type : Call Maturity Date : 2016-07-30 Maturity Price : 25.00 Evaluated at bid price : 26.18 Bid-YTW : 4.47 % |

| CM.PR.H | Perpetual-Discount | 102,468 | RBC crossed 20,600 at 23.21, then sold 10,000 to anonymous at 23.45. Desjardins crossed 20,000 at 23.25. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-13 Maturity Price : 22.96 Evaluated at bid price : 23.19 Bid-YTW : 5.18 % |

| There were 56 other index-included issues trading in excess of 10,000 shares. | |||

[…] PerpetualDiscounts gained 61bp (with a continued increase in implied volatility, as discussed yesterday) and FixedResets were up 21bp. Volume was […]