The Bank of Canada has published the January 2011 Monetary Policy Report:

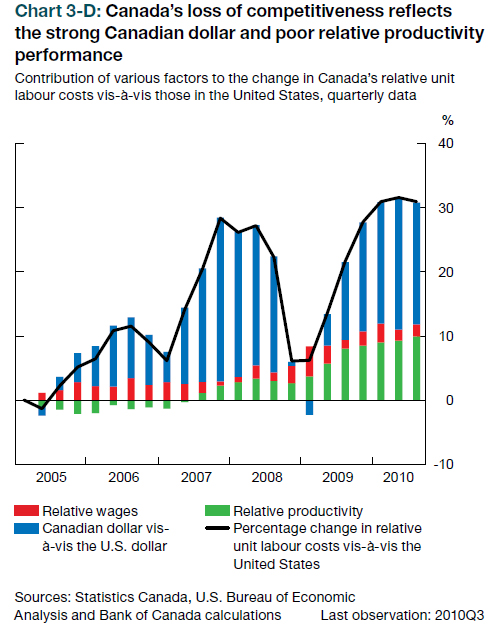

Underlying pressures affecting prices remain subdued, reflecting the considerable

slack in the Canadian economy. Core inflation is projected to edge gradually up to 2 per cent by the end of 2012, as excess supply in the economy is slowly absorbed. Inflation expectations remain well anchored. Total CPI inflation is being boosted temporarily by the effects of provincial indirect taxes, but is expected to converge to the 2 per cent target by the end of 2012.

There are two main upside risks to inflation, relating to higher commodity prices and the possibility of greater-than-projected momentum in the Canadian household sector:

- The global economy could be stronger than currently anticipated, particularly if measures to moderate demand in emerging-market economies prove insufficient. This could boost commodity prices, which would increase incomes in Canada and support stronger investment activity and household spending.

- There could be stronger-than-expected momentum in household expenditures in Canada. With exceptionally stimulative financing conditions, borrowing could continue to grow faster than income.

Volume picked up a little as performance slipped on the Canadian preferred share market, with PerpetualDiscounts down 22bp and FixedResets losing 13bp.

PerpetualDiscounts now yield 5.29%, equivalent to 7.41% interest at the standard equivalency factor of 1.4x. As I write this, however, the Canadian Bond Indices website has collywobbles, so you’ll just have to wait for this week’s evaluation of the Seniority Spread.

Update: Long Corporates now yield about 5.5%, so the pre-tax interest-equivalent spread is now about 190bp, down sharply from the 205bp reported January 12.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0852 % | 2,337.4 |

| FixedFloater | 4.75 % | 3.43 % | 26,377 | 19.23 | 1 | 0.3946 % | 3,584.4 |

| Floater | 2.56 % | 2.35 % | 41,074 | 21.33 | 4 | -0.0852 % | 2,523.8 |

| OpRet | 4.80 % | 3.39 % | 65,847 | 2.29 | 8 | 0.1542 % | 2,393.6 |

| SplitShare | 5.30 % | 1.80 % | 489,288 | 0.88 | 4 | -0.2046 % | 2,465.1 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1542 % | 2,188.7 |

| Perpetual-Premium | 5.64 % | 5.22 % | 141,826 | 5.31 | 20 | 0.0196 % | 2,031.1 |

| Perpetual-Discount | 5.31 % | 5.29 % | 262,772 | 14.98 | 57 | -0.2239 % | 2,082.4 |

| FixedReset | 5.23 % | 3.42 % | 283,343 | 3.05 | 52 | -0.1294 % | 2,275.9 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| ELF.PR.F | Perpetual-Discount | -5.68 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-19 Maturity Price : 20.91 Evaluated at bid price : 20.91 Bid-YTW : 6.39 % |

| PWF.PR.P | FixedReset | -1.47 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2016-03-01 Maturity Price : 25.00 Evaluated at bid price : 25.40 Bid-YTW : 4.03 % |

| NA.PR.M | Perpetual-Premium | -1.21 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-06-14 Maturity Price : 25.00 Evaluated at bid price : 25.39 Bid-YTW : 5.67 % |

| BAM.PR.P | FixedReset | -1.11 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-30 Maturity Price : 25.00 Evaluated at bid price : 27.50 Bid-YTW : 4.25 % |

| TRP.PR.C | FixedReset | -1.09 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2016-02-29 Maturity Price : 25.00 Evaluated at bid price : 25.50 Bid-YTW : 3.94 % |

| SLF.PR.D | Perpetual-Discount | -1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-19 Maturity Price : 21.27 Evaluated at bid price : 21.27 Bid-YTW : 5.28 % |

| BAM.PR.O | OpRet | 1.09 % | YTW SCENARIO Maturity Type : Option Certainty Maturity Date : 2013-06-30 Maturity Price : 25.00 Evaluated at bid price : 25.89 Bid-YTW : 3.60 % |

| CIU.PR.A | Perpetual-Discount | 1.12 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-19 Maturity Price : 22.35 Evaluated at bid price : 22.50 Bid-YTW : 5.18 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| BAM.PR.B | Floater | 202,576 | TD crossed 175,000 at 18.78 and sold 11,300 to Nesbitt at the same price. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-19 Maturity Price : 18.71 Evaluated at bid price : 18.71 Bid-YTW : 2.82 % |

| SLF.PR.B | Perpetual-Discount | 92,046 | TD crossed 80,000 at 23.12. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-19 Maturity Price : 22.90 Evaluated at bid price : 23.12 Bid-YTW : 5.23 % |

| CM.PR.I | Perpetual-Discount | 91,353 | TD crossed 69,700 at 23.08. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-19 Maturity Price : 22.90 Evaluated at bid price : 23.09 Bid-YTW : 5.10 % |

| BNS.PR.M | Perpetual-Discount | 72,700 | TD crossed 25,000 at 23.15. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-19 Maturity Price : 22.92 Evaluated at bid price : 23.10 Bid-YTW : 4.88 % |

| BAM.PR.T | FixedReset | 70,050 | Scotia crossed 25,000 at 25.00. TD crossed 15,000 at 24.97. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-19 Maturity Price : 23.05 Evaluated at bid price : 24.85 Bid-YTW : 4.69 % |

| TRP.PR.B | FixedReset | 65,813 | Nesbitt crossed 60,000 at 25.45. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-07-30 Maturity Price : 25.00 Evaluated at bid price : 25.41 Bid-YTW : 3.66 % |

| There were 49 other index-included issues trading in excess of 10,000 shares. | |||