TransAlta Corporation has announced:

that it has agreed to issue to a syndicate of underwriters led by RBC Capital Markets, CIBC and Scotiabank for distribution to the public 6,000,000 Cumulative Redeemable Rate Reset First Preferred Shares, Series G (the “Series G Shares”). The Series G Shares will be issued at a price of $25.00 per Series G Share, for aggregate gross proceeds of $150 million. Holders of the Series G Shares will be entitled to receive a cumulative quarterly fixed dividend yielding 5.30% annually for the initial period ending September 30, 2019. Thereafter, the dividend rate will be reset every five years at a rate equal to the 5-year Government of Canada bond yield plus 3.80%.

Holders of Series G Shares will have the right, at their option, to convert their shares into Cumulative Redeemable Floating Rate Reset First Preferred Shares, Series H (the “Series H Shares”), subject to certain conditions, on September 30, 2019 and on September 30 every five years thereafter. Holders of the Series H Shares will be entitled to receive cumulative quarterly floating dividends at a rate equal to the three-month Government of Canada Treasury Bill yield plus 3.80%.

TransAlta Corporation has granted the underwriters an option, exercisable in whole or in part prior to closing, to purchase up to an additional 2,000,000 Series G Shares at the same offering price. The Series G Shares will be offered by way of prospectus supplement under the short form base shelf prospectus of TransAlta Corporation dated December 9, 2013. The prospectus supplement will be filed with securities regulatory authorities in all provinces of Canada.

The net proceeds of the offering will be used for general corporate purposes in support of our business, to reduce short term indebtedness and to fund capital investments of the Corporation and its affiliates. The offering is expected to close on or about August 15, 2014.

This issue will join the extant issues:

| TA FixedResets | ||||

| Ticker | Initial Dividend | Next Reset | Issue Reset Spread | Bid 2014-8-6 |

| TA.PR.D | 4.60% | 2016-3-31 | +203bp | 18.67 |

| TA.PR.F | 4.60% | 2017-6-30 | +310bp | 22.10 |

| TA.PR.H | 5.00% | 2017-9-30 | +365bp | 23.95 |

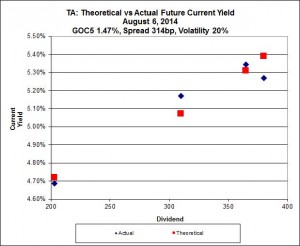

The issue looks quite expensive according to Implied Volatility Theory, which estimates its fair value at about 24.45:

About half of this calculated richness is due to today’s tumble in the extant issues – the last bids on 2014-8-5 were 18.87, 22.28 and 24.40, respectively. Plugging those bids into the model results in a Spread of 311bp, Volatility of 19%, a better fit to the curve, and a theoretical price of 24.73 for the new issue.