The Globe & Mail reports that new rules for retail bond desks are coming:

Many investors would for the first time find out exactly how much commission they are paying to buy and sell bonds. Industry convention is to hide the commission in the purchase or sale price of the bond, but the new rules would force it to be broken out.

The rules would also require better disclosure of the bond’s yield – the real interest rate based on the price.

Perhaps most importantly, and contentiously, IIROC plans a “fair pricing rule” to enable regulators to punish dealers who trade bonds at prices far from the true market price.

Thoroughly precious and idiotic. There are some fine alternatives available for retail investors who don’t know what they’re doing: funds. I have no idea what this “yield disclosure” thingy might mean; perhaps it simply means that dealers will be required to print the yield on their confirms, as they are for Money Market instruments.

Look for retail bond offerings at brokerages to be even more sharply reduced than they are now. When you buy your GIC, you’ll know you’re getting best execution on the price!

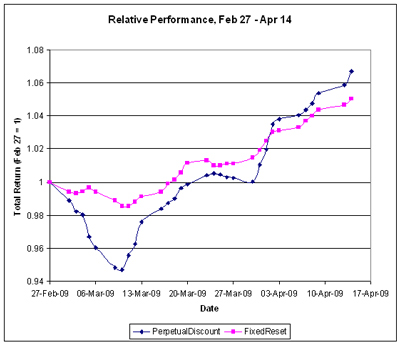

The market continued its rally today with heavy volume. Performance for the past two weeks has been impressive:

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 1.4599 % | 929.9 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 1.4599 % | 1,503.9 |

| Floater | 5.25 % | 5.28 % | 64,517 | 15.04 | 2 | 1.4599 % | 1,161.7 |

| OpRet | 5.16 % | 4.56 % | 141,674 | 3.88 | 15 | 0.0407 % | 2,107.9 |

| SplitShare | 6.76 % | 10.43 % | 45,700 | 5.65 | 3 | 0.8944 % | 1,710.6 |

| Interest-Bearing | 6.12 % | 8.99 % | 27,769 | 0.69 | 1 | -0.3052 % | 1,947.5 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.7653 % | 1,601.3 |

| Perpetual-Discount | 6.81 % | 6.92 % | 146,539 | 12.68 | 71 | 0.7653 % | 1,474.8 |

| FixedReset | 5.99 % | 5.50 % | 659,594 | 7.51 | 35 | 0.3595 % | 1,880.7 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| CIU.PR.A | Perpetual-Discount | -2.19 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 17.41 Evaluated at bid price : 17.41 Bid-YTW : 6.72 % |

| BAM.PR.J | OpRet | -1.79 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2018-03-30 Maturity Price : 25.00 Evaluated at bid price : 19.75 Bid-YTW : 8.95 % |

| PWF.PR.F | Perpetual-Discount | -1.52 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 18.81 Evaluated at bid price : 18.81 Bid-YTW : 7.01 % |

| CIU.PR.B | FixedReset | -1.27 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-01 Maturity Price : 25.00 Evaluated at bid price : 26.41 Bid-YTW : 5.55 % |

| POW.PR.D | Perpetual-Discount | -1.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 17.63 Evaluated at bid price : 17.63 Bid-YTW : 7.15 % |

| BNS.PR.J | Perpetual-Discount | 1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 20.00 Evaluated at bid price : 20.00 Bid-YTW : 6.60 % |

| SLF.PR.D | Perpetual-Discount | 1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 15.86 Evaluated at bid price : 15.86 Bid-YTW : 7.10 % |

| BMO.PR.L | Perpetual-Discount | 1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 21.37 Evaluated at bid price : 21.37 Bid-YTW : 6.92 % |

| BNS.PR.L | Perpetual-Discount | 1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 17.18 Evaluated at bid price : 17.18 Bid-YTW : 6.58 % |

| RY.PR.C | Perpetual-Discount | 1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 17.99 Evaluated at bid price : 17.99 Bid-YTW : 6.51 % |

| RY.PR.I | FixedReset | 1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 23.58 Evaluated at bid price : 23.62 Bid-YTW : 4.29 % |

| IAG.PR.C | FixedReset | 1.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 23.05 Evaluated at bid price : 23.10 Bid-YTW : 5.92 % |

| CM.PR.P | Perpetual-Discount | 1.12 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 19.83 Evaluated at bid price : 19.83 Bid-YTW : 6.97 % |

| SLF.PR.A | Perpetual-Discount | 1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 16.66 Evaluated at bid price : 16.66 Bid-YTW : 7.21 % |

| GWO.PR.F | Perpetual-Discount | 1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 20.77 Evaluated at bid price : 20.77 Bid-YTW : 7.19 % |

| PWF.PR.E | Perpetual-Discount | 1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 19.83 Evaluated at bid price : 19.83 Bid-YTW : 6.97 % |

| PWF.PR.H | Perpetual-Discount | 1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 20.66 Evaluated at bid price : 20.66 Bid-YTW : 6.99 % |

| BNA.PR.A | SplitShare | 1.28 % | Asset coverage of 1.7-:1 as of February 28 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2010-09-30 Maturity Price : 25.00 Evaluated at bid price : 23.80 Bid-YTW : 10.43 % |

| W.PR.J | Perpetual-Discount | 1.32 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 20.68 Evaluated at bid price : 20.68 Bid-YTW : 6.83 % |

| BMO.PR.M | FixedReset | 1.36 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 22.98 Evaluated at bid price : 23.06 Bid-YTW : 4.11 % |

| BNS.PR.N | Perpetual-Discount | 1.47 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 19.97 Evaluated at bid price : 19.97 Bid-YTW : 6.61 % |

| CM.PR.I | Perpetual-Discount | 1.50 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 16.95 Evaluated at bid price : 16.95 Bid-YTW : 6.97 % |

| BMO.PR.J | Perpetual-Discount | 1.57 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 17.45 Evaluated at bid price : 17.45 Bid-YTW : 6.57 % |

| CM.PR.G | Perpetual-Discount | 1.58 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 19.28 Evaluated at bid price : 19.28 Bid-YTW : 7.04 % |

| BNA.PR.C | SplitShare | 1.68 % | Asset coverage of 1.7-:1 as of February 28 according to the company. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2019-01-10 Maturity Price : 25.00 Evaluated at bid price : 12.72 Bid-YTW : 13.84 % |

| HSB.PR.D | Perpetual-Discount | 1.69 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 17.40 Evaluated at bid price : 17.40 Bid-YTW : 7.27 % |

| BAM.PR.I | OpRet | 1.76 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2013-12-30 Maturity Price : 25.00 Evaluated at bid price : 23.10 Bid-YTW : 7.55 % |

| GWO.PR.H | Perpetual-Discount | 1.79 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 17.10 Evaluated at bid price : 17.10 Bid-YTW : 7.17 % |

| POW.PR.A | Perpetual-Discount | 1.83 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 19.50 Evaluated at bid price : 19.50 Bid-YTW : 7.24 % |

| TD.PR.Q | Perpetual-Discount | 1.94 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 21.51 Evaluated at bid price : 21.51 Bid-YTW : 6.54 % |

| GWO.PR.G | Perpetual-Discount | 2.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 18.68 Evaluated at bid price : 18.68 Bid-YTW : 7.04 % |

| MFC.PR.B | Perpetual-Discount | 2.12 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 17.37 Evaluated at bid price : 17.37 Bid-YTW : 6.79 % |

| MFC.PR.C | Perpetual-Discount | 2.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 16.34 Evaluated at bid price : 16.34 Bid-YTW : 6.98 % |

| RY.PR.W | Perpetual-Discount | 2.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 19.60 Evaluated at bid price : 19.60 Bid-YTW : 6.37 % |

| TD.PR.Y | FixedReset | 2.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 22.94 Evaluated at bid price : 23.00 Bid-YTW : 4.16 % |

| TD.PR.A | FixedReset | 2.37 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 23.25 Evaluated at bid price : 23.29 Bid-YTW : 4.33 % |

| BAM.PR.K | Floater | 2.96 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 8.35 Evaluated at bid price : 8.35 Bid-YTW : 5.28 % |

| CM.PR.J | Perpetual-Discount | 3.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 16.55 Evaluated at bid price : 16.55 Bid-YTW : 6.83 % |

| PWF.PR.L | Perpetual-Discount | 3.55 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 18.65 Evaluated at bid price : 18.65 Bid-YTW : 6.87 % |

| POW.PR.C | Perpetual-Discount | 3.61 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 20.40 Evaluated at bid price : 20.40 Bid-YTW : 7.17 % |

| ELF.PR.F | Perpetual-Discount | 4.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 16.00 Evaluated at bid price : 16.00 Bid-YTW : 8.36 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| HSB.PR.E | FixedReset | 164,185 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-30 Maturity Price : 25.00 Evaluated at bid price : 25.21 Bid-YTW : 6.52 % |

| RY.PR.T | FixedReset | 140,859 | Nesbitt crossed 48,000 at 25.82. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-09-23 Maturity Price : 25.00 Evaluated at bid price : 25.70 Bid-YTW : 5.80 % |

| TD.PR.K | FixedReset | 140,571 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 25.46 Bid-YTW : 5.92 % |

| RY.PR.X | FixedReset | 133,486 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-09-23 Maturity Price : 25.00 Evaluated at bid price : 25.66 Bid-YTW : 5.77 % |

| RY.PR.L | FixedReset | 93,885 | Nesbitt bought 10,000 from National at 24.89; TD crossed 61,500 at 24.90. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 24.92 Evaluated at bid price : 24.97 Bid-YTW : 4.79 % |

| ENB.PR.A | Perpetual-Discount | 74,629 | Desjardins crossed 70,000 at 24.20. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-14 Maturity Price : 23.96 Evaluated at bid price : 24.21 Bid-YTW : 5.75 % |

| There were 49 other index-included issues trading in excess of 10,000 shares. | |||

Based on your comments about the G & M article, you would almost think your not a big fan of transparent price discovery. I agree that what is proposed is a tiny step in that direction and more of a token gesture. What would you suggest to improve retail price discovery?

It’s not really all that clear how the proposed programme relates to price discovery. Price discovery – as I use the phrase – means simply the establishment of a trading price.

In the institutional world you get price discovery by selling things at too cheap a price and buying them at too expensive a price. Then you discover you’ve underperformed, hence the term. It keeps life interesting.

One reader mentioned the FINRA site for the US markets. That would do very nicely, and probably provides secure employment for a great many regulators as well, which is the whole point, isn’t it?

My major objection to all this so-called investor protection is that on the planet I live on, it will in practice serve to protect investors by not allowing them to do anything. Like I said in the post – skimpy bond offerings? You ain’t seen skimpy bond offerings. Why should a dealer plough through all the paperwork?

It should be understood, by the way, that dealers ARE NOT YOUR FRIENDS. When an investor’s dealing with a bond salesman leave him naked and hungry in the streets, the salesman’s boss will ask “Why not bleeding?”. The best alternative for most retail investors is funds – either active or passive, take your pick. Pretending that the barracuda tank is really a kiddie-pool by hiring a few lifeguards will only increase the level of hypocracy in the system

Firstly, I just wanted to thank you for putting up this blog. Very good site, and I read your posts regularly. Thank-you for doing this.

Question with respect to YPG.PR.B

I know you have mentioned these in the past and you hold a position.

I was reading the prospectus again this evening, and wanted your thoughts on the “Exchange at the Option of YPG Holdings” paragraph on page 11 of the final prospectus.

It is unclear to me what constitutes a corporate reorganization, and in the event that YLO.un gets really beat up this provision could be rather dilutive to the YPG.PR.B shareholders…

Your thoughts?

Regards,

VC

My idea of price discovery would be where there is a clear volume identified bid and ask price, previous trades would be recorded by price and volume, and all trading activity would be routed through a clearing facility. At the present time in Canada, I think there is better price discovery in the illegal drug market than in the bond market. But that may be just the way dealers want it. If regulators are serious about promoting “fairness” in the bond market they would be better off pushing an exchange for bonds, even if it is for a few very liquid issues to start.

I can’t disagree more. It’s high time retail investors got a better break. Brokerages only sell you what they have in “inventory” and refuse to source what you know is available elsewhere. One simply can’t maintain accounts with every broker around in an attempt to access available bonds. Nine times out of ten, the only bonds you can buy through your own broker is what no one else wants as it’s either what may as well be labeled a “perpetual” or the ytm is so ridiculously low, you might as well buy a GIC.

My idea of price discovery would be where there is a clear volume identified bid and ask price, previous trades would be recorded by price and volume, and all trading activity would be routed through a clearing facility.

Why? Who’s going to pay for it and what’s in it for them once they’ve paid?

It’s high time retail investors got a better break.

Why? What’s in it for the break-givers?

Brokerages only sell you what they have in “inventory” and refuse to source what you know is available elsewhere.

Neither will anybody else. My local pharmacist doesn’t stock cigarettes and the greengrocer doesn’t offer hardware.

vancoffee

I’ve responded in the comments to the post YPG.PR.A / YPG.PR.B: Wildly Divergent Yields

[…] share market is on fire! Up strongly again today, continuing the two week rally highlighted yesterday, with volume still above normal […]

[…] brief remarks when the gist of the rules was leaked on April 14 attracted comments, both on the post and in my eMail. One Assiduous Reader writes in and says: I […]