Econbrowser‘s James Hamilton takes advantage of a lazy Saturday to post a lengthy and thoroughly worth-while post on The Federal Reserve’s Balance Sheet.

I won’t discuss it in detail here – it’s mostly explanatory and can speak for itself very well – but I will reproduce the table to encourage Assiduous Readers to review the extraordinary efforts the Fed is making to Save the World:

Balance sheet of the Federal Reserve.

Based on end-of-week values, in millions of dollars.

Data source: Federal Reserve Release H.4.1.

Reproduced from Econbrowser |

|

Aug 8, 2007 |

Sep 3, 2008

| Oct 1, 2008 |

Oct 22, 2008 |

| Securities |

790,820 |

479,726 |

491,121 |

490,617 |

| Repos |

18,750 |

109,000 |

83,000 |

80,000 |

| Loans |

255 |

198,376 |

587,969 |

698,050 |

|     Discount window |

255 |

19,089 |

49,566 |

107,561 |

|     TAF |

|

150,000 |

149,000 |

263,092 |

|     PDCF |

|

|

146,565 |

102,377 |

|     AMLF |

|

|

152,108 |

107,895 |

|     Other credit |

|

|

61,283 |

90,323 |

|     Maiden Lane |

|

29,287 |

29,447 |

26,802 |

| Other F.R. assets |

41,957 |

100,524 |

320,499 |

519,713 |

| Miscellaneous |

51,210 |

51,681 |

50,539 |

50,662 |

| Factors supplying reserve funds |

902,993 |

939,307 |

1,533,128 |

1,839,042 |

| |

| Currency in circulation |

814,626 |

836,836 |

841,003 |

856,821 |

| Reverse repos |

30,132 |

41,756 |

93,063 |

95,987 |

| Treasury general |

4,670 |

5,606 |

5,278 |

55,625 |

| Treasury supplement |

|

|

344,473 |

558,987 |

| Other |

46,770 |

51,278 |

77,816 |

50,860 |

| Reserve balances |

6,794 |

3,831 |

171,495 |

220,762 |

| Factors absorbing reserve funds |

902,993 |

939,307 |

1,533,128 |

1,839,042 |

| |

| Off balance sheet |

| Securities lent to dealers |

|

120,790 |

259,672 |

226,357 |

This being PrefBlog, of course, I have to find something with which to take issue! There’s not enough debate in blogs! The ability just to write essays and ignore criticism is the great failing of many blogs – and I don’t include Econbrowser in this category by the way, I consider the authors to meet very high standards for intellectually honesty.

Anyway, part of the post reads:

I had a call from a reporter this week asking me to explain why the Fed raised the interest rate paid on reserves. I think she was expecting a 30-second sound bite, but instead we went back and forth for about 15 minutes and I’m not sure even then that I succeeded in getting the basic idea across. At that point she asked me, “Do you see it as an encouraging development that the Fed has taken this step to address the credit crunch?” My immediate answer was no. It’s not an encouraging development because it means that the heroic efforts that the Fed has taken previously weren’t enough. The Fed’s first $100 billion didn’t do it. The Fed’s first $1 trillion didn’t do it. Having the Treasury take over the $5 trillion in debts and guarantees of Fannie and Freddie didn’t do it. The Treasury’s $3/4 trillion rescue/bailout package didn’t do it. And another quarter trillion will?

My disagreement, briefly stated, is:

- It’s not much of a development

- To the extent that it is a development, it’s encouraging

The Fed’s ambition to pay interest on reserve deposits has been discussed on PrefBlog on May 16, May 7, April 29 and January 29.

The Fed’s primer on reserve balances is getting a little dated at this point, but the current version is from May 2007 and contains the following language:

The Fed has long advocated the payment of interest on the reserves that banks maintain at Federal Reserve Banks. Such a step would have to be approved by Congress, which traditionally has been opposed because of the revenue loss that would result to the U.S. Treasury. Each year the Treasury receives the Fed’s revenue that is in excess of its expenses. The payment of interest on reserves would, of course, be an additional expense to the Fed.

The Congressional Budget Office estimates the cost of the measure to be in the $250-300-million range annually. Fed Governor Laurency Meyer was begging for authority to pay interest in 1998:

In recent years, developments in computer technology have allowed depositories to begin sweeping consumer transaction deposits into nonreservable accounts. In consequence, the balances that depositories hold at Reserve Banks to meet reserve requirements have fallen to quite low levels. These consumer sweep programs are expected to spread further, threatening to lower required reserve balances to levels that may begin to impair the implementation of monetary policy. Should this occur, the Federal Reserve would need to adapt its monetary policy instruments, which could involve disruptions and costs to private parties as well as to the Federal Reserve. However, if interest were allowed to be paid on required reserve balances and on demand deposits, changes in the procedures used for implementing monetary policy might not be needed.

Read the whole speech, it’s interesting (subject to the reader being a monetary policy geek).

So now the argument takes form:

- US Banks, for good reasons or bad, are subject to reserve requirements on certain types of account

- If the account is reservable, they will have to send a fraction of the money deposited to the Fed and get no interest

- Depositors want interest. Depositors LIKE interest

- Depositors will move to higher yielding money market funds unless the deposits pay a competitive rate

- Therefore, the banks must eat the cost of zero-interest reserves when setting rates

- Therefore, they encourage the move of deposits to sweep accounts, or other non-reservable vehicles

- This hinders the transmission of the Fed’s monetary policy

To illustrate the last point, consider a world in which:

- Deposits are 100% reservable

- Reserves pay the Fed Funds Target Rate

In such a world, deposits will pay Fed Funds less a spread, and – importantly – changes in the FF rate will be instantaneously transmitted to depositors and the Fed’s implementation of monetary policy will be very quickly transmitted to the real economy.

All of this may be what Prof. Hamilton referred to as the fifteen minute back and forth, but he doesn’t discuss the history of the policy in his post.

Be that as it may, since the Fed has been begging for the authority to pay interest on reserves, and since Congress finally gave them this authority in 2006 – to commence in 2011 – I don’t really consider the three-year advancement in the effective date to be all that exciting a development. But, to the extent that it may be considered a development, it’s a good one.

Zero-interest reserves are, effectively, a tax on deposits and they are an extremely destructive tax. I think we can all breathe a sigh of relief that interest on reserves did not become a political issue so close to an election, at the very least.

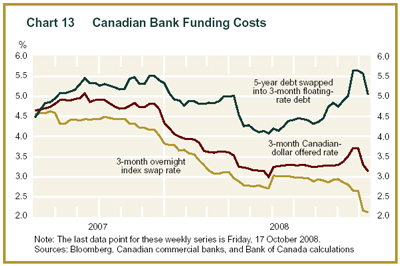

It should be noticed that transmission of monetary policy is an issue in Canada, despite the fact that we do not have a fractional reserve system. There were problems with the transmission of the penultimate rate cut which were resolved with extraordinary measures via the CMHC.

Update: It has been pointed out to me that the CBO estimate of the costs of paying interest on reserve balances is inoperable, given that reserve balances are now in the $200-billion range rather than the $8.3-billion assumed by the CBO.

However, it will be remembered that in times of crisis, the disintermediation that has occurred in good times reverses; that is, investors who invested directly in, say, Commercial Paper, cash in their chips and return to bank deposits on grounds of safety; the banks then invest these funds in that same Commercial Paper and earn a spread as the intermediary – the process is called reintermediation.

What we are now seeing is reintermediation on a grand scale: now that interest is being paid on excess reserves, the banks themselves can avoid the perceived credit risk of Commercial Paper and leave their funds on deposit with the Fed; it is the Fed that is now putting the cash to work via such programmes as the TAF (this fulfills some of the term-extension function of banks); Maiden Lane (the Bear Stearns assets – term extension and credit risk); the Primary Dealer Credit Facility (replacing brokerage paper); the Asset Backed Commercial Paper Money Market Fund Liquidity Facility; and currency swaps (which subcontract the same work in different countries to the respective central banks).

The effect of this reintermediation has been referred to as “the Bernanke Twist”, a reprise of Kennedy’s Operation Twist, and characterized as working on the risk-premium rather than the liquidity premium. On the other hand Macroblog takes the view (endorsed by his employer!) that the primary intent is to set a lower bound for the Fed Funds rate (why lend to a bank at 1% when you can lend to the Fed at 2%?) and thereby reinforce the Fed’s primacy in monetary policy.

I see no reason why both explanations cannot be correct; it is simply that the reintermediation has occurred by happenstance and taken everybody by surprise; I am not aware of any argument being made to support reintermediation in the years of discussion regarding interest on reserve balances, although I hardly consider myself to be an expert on Fed policy.

As an aside, I will note that all these academic distinctions between credit risk and liquidity risk do not necessarily apply in the real world of bozo-investing. Huge amounts of funds are controlled by retail stockbrokers and individuals who have no idea that such a distinction exists, let alone make a serious attempt to analyze it. Ask these guys, for instance, why Pepsico paper is trading so wide of Treasuries:

Pepsico (an AA2 issuer) tapped the market for $2bilion 5 year notes and $1billion 10 year notes.

The 5 year issue had been trading in the secondary market at around a 260 spread to the 5 year Treasury. The issue priced at T+ 4 3/8 percent.

The 10 year issue had been trading at a spread of about 270 basis points to the 10 year Treasury. The issue priced at T+ 4 ¼ percent.

Each issue required a gigantic concession to where outstanding paper was trading to successfully clear the market. So the 5 year priced nearly 180 basis points cheap to outstandings and the 10 year traded about 155 cheap to comparable paper.

… and you will get the answer “credit risk”. Not one of them will even think about calculating the default rate implied by a credit spread of 425bp on ten-year paper and ask themselves whether it’s reasonable.

As another example, is the lock-up of the Commercial Paper market. I mean, holy smokes, Lehman goes bust, Reserve Primary Fund breaks the buck by a few pennies and Whoosh! $89.2-billion gets withdrawn from US-based MMFs the next day. Sorry, these are not rational actions made by coldly calculating players carefully plotting default risk versus their risk aversion. This is sheer panic, referred to as liquidity risk for convenience.

In the current environment, the banks can’t operate properly. They can’t make a highly lucrative ten-year loan to a solid company like Pepsico, because they’re terrified that Charles Schumer will provide an investment opinion on their bank and cause a run. All this forces the Fed to reintermediate, with a little help from Treasury’s Supplementary Financing Programme which has been discussed by Econbrowser‘s James Hamilton; in this particular case, it is not just the Fed, but Treasury as well that is reintermediating, bulking up their balance sheet by selling their own bonds to finance a diversified portfolio of corporates.

In loose terms, this reintermediation was forseen (or at least allowed for) by the CBO in their previously referenced cost estimate of paying interest on reserves:

CBO projects that, after the Federal Reserve changes its policies in 2012, the required reserve balances will be greater than under the current policy structure and the balances will generate additional net income to the Federal Reserve. Although the Federal Reserve will pay interest on the added reserves at approximately the federal funds rate, it will invest the reserves in Treasury securities, earning a rate of return approximately 0.6 of a percentage point more than it pays. As a result of that differential, CBO estimates that the Federal Reserve will generate profits on the added revenues of about $119 million over the 2012-2016 period.

The CBO estimate applies to normal times, and I certainly support the proposition that the Fed should get out of the reintermediation business as quickly as possible! However, in these extraordinary times, I suggest that the Fed’s spread is much more than the 60bp. For instance, the most recent TAF auction lent 28-day money at 1.11%; given that four-week bills were at 42bp this represents a spread of 69bp … not much, maybe, but holy smokes! This is FOUR-WEEK PAPER we’re talking about, guys! With respect to the Commercial Paper Funding Facility:

The commercial paper purchased by the SPV will be discounted based on a rate equal to a spread over the three-month overnight index swap (OIS) rate on the day of purchase. The SPV will not purchase interest-bearing commercial paper. The spread for unsecured commercial paper will be 100 basis points per annum and the spread for ABCP will be 300 basis points per annum. For unsecured commercial paper, a 100 basis points per annum unsecured credit surcharge must be paid on each trade execution date.

So yes, while the huge amount of reserves currently on the books will come with interest costs far in excess of the $350-million projection, these reserves can be used to buy higher yielding commercial paper at what is (in normal times) a penalty rate. Hopefully, the gross-up of the Fed’s balance sheet will gradually disappear as first the banks, then ultimate investors, are feeling brave enough to reintermediate.

My interlocuter – who pointed out that $350-million gross interest expense was a massive understatement – also asked me how much I thought it would take to get the job done.

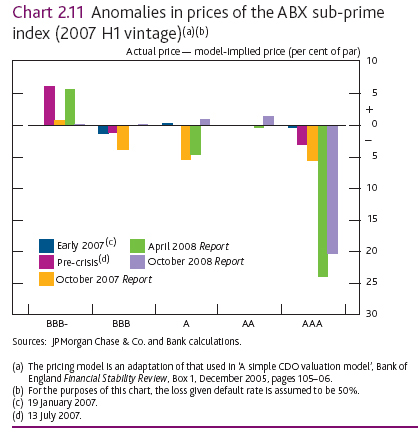

Well, I don’t know. There are a lot of excesses to unwind, and we won’t be able to say we’re done until all – or, at least, most – of the currently unfashionable assets have rolled off the books one way or another; by being paid off (as I continue to think will be largely the case; it will be recalled that the credit agencies are projecting ultimate losses of 20-25% on 2006 sub-prime paper and the AAA tranches held by the banks have about 20% subordination) or by … er … not being paid off, which is the position of the Apocalyptionists.

Until then, what the Fed is doing is pure Bagehot, albeit on a larger scale than Bagehot dreamed of, and in a fashion that has been the result of Whack-a-Mole firefighting more than careful advance planning: the Fed is providing liquidity as required at a penalty rate. The only question in my mind is whether the penalties are high enough … but as the market mood veers toward analysis from its current panic, the penalties can always be raised pour encourager les autres.

The only mistake so far, I think, is allowing Lehman to fail … but neither I, nor any responsible commentator I know of, dreamed at the time that the bankruptcy would have such enormous systemic effects.