Fabulous Fab, the bond salesman scapegoated for personally causing the Panic of 2007, and useful misdirection from the SEC’s incompetence, has claimed the SEC has no jurisdiction anyway:

The Securities and Exchange Commission can’t sue Fabrice Tourre over a Goldman Sachs Group Inc. deal involving collateralized debt obligations because the transaction wasn’t in the U.S., his lawyers told a judge.

The U.S. Supreme Court ruled in June that U.S. securities laws don’t apply to claims of foreign buyers of non-U.S. securities on foreign exchanges, lawyers for the Goldman executive director said in a court filing yesterday. The collateralized debt obligations known as Abacus at issue in the SEC’s complaint weren’t listed on any exchange and the sole investor in the notes was a foreign bank that purchased them overseas, according to the filing.

Another junk fund is starting:

Brompton Advantaged Tactical Yield Fund is an investment fund established under the laws of the Province of Ontario and governed by the Declaration of Trust. See “Overview of the Legal Structure of the Fund”.

Rationale The Fund has been created to provide investors with the opportunity to gain exposure to a diversified Portfolio focused on North American High-Yield Bond and Dividend Paying Equity securities, which offer attractive yields along with upside participation in the ongoing economic recovery. The Portfolio Manager expects that the Portfolio will initially be invested as to approximately 70% in High-Yield Bonds, 20% in Dividend Paying Equity securities, and 10% in Investment Grade Bonds.

This comes after the launch of the nonsensical iShares(R) DEX HYBrid Bond Index Fund, which has nothing to do with hybrid bonds, as the term is understood by the entire world except for the TMX and Blackrock’s marketting team. They just needed a word with HY in it (for High Yield, since “junk” is considered pejoritive) and didn’t want to use “HYacinth” … or “HYundai” … or … um … er … “HYmas” (licencing fees on that one would have been astronomical).

And, of course, all the junk coming out of new preferred issues. This is going to end badly.

Mixed results in the Canadian preferred share market on continued heavy volume, as PerpetualDiscounts were almost precisely flat on the day while FixedResets continued their recent slide by losing 16bp.

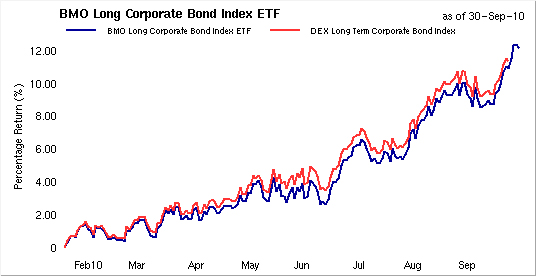

PerpetualDiscounts now yield 5.53%, equivalent to 7.74% interest at the standard equivalency factor of 1.4x. Long Corporates now yield about 5.15%, so the pre-tax interest-equivalent spread (also called the Seniority Spread) is now about 260bp, a meaningless apparent tightening from the 265bp reported September 29.

Long corporates have been on a tear this month:

And that’s a wrap for another month and another quarter!

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 1.1681 % | 2,144.0 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 1.1681 % | 3,248.0 |

| Floater | 2.84 % | 3.26 % | 77,956 | 19.07 | 3 | 1.1681 % | 2,315.0 |

| OpRet | 4.89 % | 3.21 % | 76,290 | 0.17 | 9 | -0.0258 % | 2,371.7 |

| SplitShare | 5.96 % | -26.36 % | 67,588 | 0.09 | 2 | 0.0000 % | 2,360.7 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0258 % | 2,168.7 |

| Perpetual-Premium | 5.69 % | 5.23 % | 141,706 | 5.32 | 14 | -0.1756 % | 1,994.6 |

| Perpetual-Discount | 5.52 % | 5.53 % | 206,213 | 14.53 | 63 | -0.0007 % | 1,978.8 |

| FixedReset | 5.26 % | 3.18 % | 323,260 | 3.27 | 47 | -0.1578 % | 2,260.5 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BMO.PR.L | Perpetual-Premium | -1.53 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-06-24 Maturity Price : 25.00 Evaluated at bid price : 25.80 Bid-YTW : 5.37 % |

| GWO.PR.I | Perpetual-Discount | -1.38 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-09-30 Maturity Price : 20.07 Evaluated at bid price : 20.07 Bid-YTW : 5.64 % |

| CM.PR.I | Perpetual-Discount | -1.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-09-30 Maturity Price : 21.39 Evaluated at bid price : 21.68 Bid-YTW : 5.41 % |

| HSB.PR.D | Perpetual-Discount | -1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-09-30 Maturity Price : 23.04 Evaluated at bid price : 23.25 Bid-YTW : 5.40 % |

| PWF.PR.F | Perpetual-Discount | -1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-09-30 Maturity Price : 23.28 Evaluated at bid price : 23.55 Bid-YTW : 5.66 % |

| TRI.PR.B | Floater | 1.56 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-09-30 Maturity Price : 23.11 Evaluated at bid price : 23.37 Bid-YTW : 2.21 % |

| TD.PR.O | Perpetual-Discount | 1.57 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-09-30 Maturity Price : 23.64 Evaluated at bid price : 23.89 Bid-YTW : 5.15 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| MFC.PR.C | Perpetual-Discount | 79,200 | RBC crossed 55,100 at 19.37. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-09-30 Maturity Price : 19.35 Evaluated at bid price : 19.35 Bid-YTW : 5.87 % |

| RY.PR.X | FixedReset | 73,636 | RBC crossed 49,000 at 28.10. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-09-23 Maturity Price : 25.00 Evaluated at bid price : 27.98 Bid-YTW : 3.24 % |

| MFC.PR.B | Perpetual-Discount | 68,448 | RBC crossed 55,000 at 20.02. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-09-30 Maturity Price : 19.88 Evaluated at bid price : 19.88 Bid-YTW : 5.90 % |

| RY.PR.Y | FixedReset | 64,900 | RBC crossed 50,000 at 28.07. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-12-24 Maturity Price : 25.00 Evaluated at bid price : 28.03 Bid-YTW : 3.20 % |

| CL.PR.B | Perpetual-Premium | 60,044 | Nesbitt crossed 12,300 at 25.51; TD crossed 20,700 at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2010-10-30 Maturity Price : 25.25 Evaluated at bid price : 25.46 Bid-YTW : -3.87 % |

| RY.PR.I | FixedReset | 53,945 | RBC crossed 50,000 at 26.70. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-26 Maturity Price : 25.00 Evaluated at bid price : 26.60 Bid-YTW : 3.15 % |

| There were 57 other index-included issues trading in excess of 10,000 shares. | |||