PrefBlog’s “There’s One Born Every Minute” Department has uncovered some exciting news:

In about a week, a structured product offering, the Manulife Floating Rate Senior Loan Fund, will close.

…

On Manulife’s deal, holders are slated to receive 6.75%.

…

It will try and achieve that 6.75% yield by investing in a broadly diversified portfolio consisting mostly of senior floating rate loans. Those loans will be at a spread above LIBOR. The sub-advisor is also allowed to invest up to 20% of the total in short duration debt securities.Given that the talk is that retail investors have committed almost $150-million to the offering, what does the success of Manulife’s deal mean?

From the prospectus – to which I am unable to link, given CDS’ abuse of its regulatory monopoly – we learn how they’re going to make that “6.75%”:

The following helpful table is also provided:

| Characteristics | Indicative Portfolio |

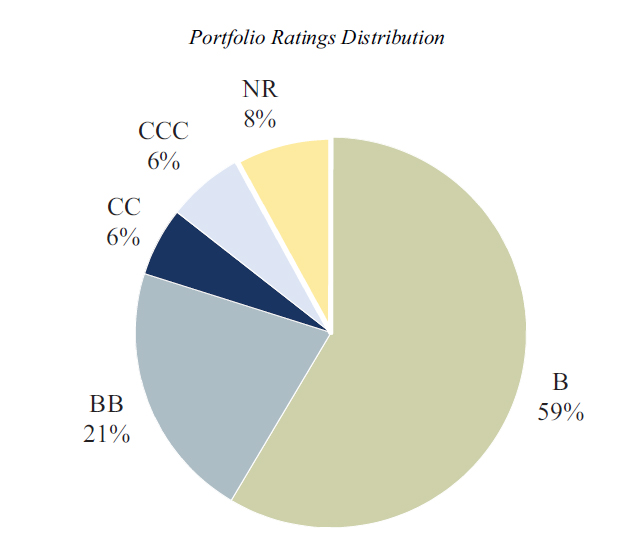

| Average Credit Quality | B+/B |

| Average Maturity (years) | 4.87 |

| Average Yield to Maturity | 6.50% |

| Option Adjusted Duration (years) | 0.74 |

Regretably, the term “Option Adjusted Duration” is not defined in the prospectus; I presume that the fact that this is much lower than the Average Maturity indicates at least qualitatively that a huge proportion of the portfolio is trading at or above its current call price. It is equally regrettable that they do not report the Option Adjusted Yield for the Indicative Portfolio. What a pity. I wonder why not.

So let’s see … they’re plan to pay 6.75% p.a., after paying new issue commission a little in excess of 5% and issue expenses of somewhere between 0.3% and 1.5% (depending on how much gets sold); and after paying Management & Service Fees totaling 1.5% p.a.; and after paying expenses, estimated at between 8bp and 100bp p.a. (depending on how much gets sold). And they’re planning to do this with a low-quality portfolio of floating rate issues which could substantially called away in the next year or so, and is now yielding 6.50%.

Nice work if you can get it.

It was another good day for the Canadian preferred share market, with FixedResets continuing their recent pattern of being decoupled from the returns of other preferred share classes: PerpetualPremiums and DeemedRetractibles were up 5bp, while FixedResets won 27bp. Volatility was low. Volume was on the low side of average, but dominated by FixedResets.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1138 % | 2,617.6 |

| FixedFloater | 3.93 % | 3.16 % | 33,366 | 18.78 | 1 | 0.2490 % | 4,178.4 |

| Floater | 2.66 % | 2.87 % | 82,301 | 20.05 | 4 | -0.1138 % | 2,826.3 |

| OpRet | 4.80 % | -0.38 % | 60,481 | 0.15 | 5 | 0.0927 % | 2,612.9 |

| SplitShare | 4.79 % | 4.13 % | 108,184 | 4.08 | 5 | 0.0235 % | 2,965.6 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0927 % | 2,389.2 |

| Perpetual-Premium | 5.19 % | 2.19 % | 86,486 | 0.44 | 31 | 0.0530 % | 2,385.1 |

| Perpetual-Discount | 4.84 % | 4.86 % | 179,679 | 15.66 | 4 | -0.0911 % | 2,688.6 |

| FixedReset | 4.86 % | 2.64 % | 242,012 | 3.53 | 81 | 0.2653 % | 2,521.4 |

| Deemed-Retractible | 4.87 % | 3.34 % | 134,911 | 0.64 | 44 | 0.0494 % | 2,460.9 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| MFC.PR.J | FixedReset | 1.18 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2018-03-19 Maturity Price : 25.00 Evaluated at bid price : 26.55 Bid-YTW : 2.76 % |

| CIU.PR.C | FixedReset | 1.68 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-05-06 Maturity Price : 23.52 Evaluated at bid price : 25.45 Bid-YTW : 2.55 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| MFC.PR.H | FixedReset | 51,080 | Scotia crossed blocks of 17,300 and 25,000, both at 26.70. YTW SCENARIO Maturity Type : Call Maturity Date : 2017-03-19 Maturity Price : 25.00 Evaluated at bid price : 26.76 Bid-YTW : 2.84 % |

| BNS.PR.T | FixedReset | 42,544 | RBC crossed 30,100 at 25.90. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-04-25 Maturity Price : 25.00 Evaluated at bid price : 25.91 Bid-YTW : 2.53 % |

| BNS.PR.N | Deemed-Retractible | 40,499 | RBC crossed 35,400 at 26.25. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-06-05 Maturity Price : 26.00 Evaluated at bid price : 26.25 Bid-YTW : -5.53 % |

| IFC.PR.C | FixedReset | 36,970 | TD crossed 22,600 at 26.75. YTW SCENARIO Maturity Type : Call Maturity Date : 2016-09-30 Maturity Price : 25.00 Evaluated at bid price : 26.76 Bid-YTW : 2.18 % |

| ENB.PR.F | FixedReset | 35,850 | YTW SCENARIO Maturity Type : Call Maturity Date : 2018-06-01 Maturity Price : 25.00 Evaluated at bid price : 25.94 Bid-YTW : 3.36 % |

| ENB.PR.D | FixedReset | 34,594 | TD bought 10,000 from RBC at 26.00. YTW SCENARIO Maturity Type : Call Maturity Date : 2018-03-01 Maturity Price : 25.00 Evaluated at bid price : 26.01 Bid-YTW : 3.26 % |

| There were 29 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| ENB.PR.D | FixedReset | Quote: 26.01 – 27.01 Spot Rate : 1.0000 Average : 0.5581 YTW SCENARIO |

| BAM.PR.G | FixedFloater | Quote: 24.16 – 24.97 Spot Rate : 0.8100 Average : 0.5795 YTW SCENARIO |

| PWF.PR.M | FixedReset | Quote: 25.53 – 26.00 Spot Rate : 0.4700 Average : 0.2972 YTW SCENARIO |

| RY.PR.I | FixedReset | Quote: 25.45 – 25.72 Spot Rate : 0.2700 Average : 0.1840 YTW SCENARIO |

| MFC.PR.E | FixedReset | Quote: 26.28 – 26.52 Spot Rate : 0.2400 Average : 0.1607 YTW SCENARIO |

| GWO.PR.G | Deemed-Retractible | Quote: 25.66 – 25.87 Spot Rate : 0.2100 Average : 0.1328 YTW SCENARIO |