There is increasing awareness that the economy is not all that great:

Bank of Nova Scotia economists are now raising the possibility of no move in the Bank of Canada’s benchmark interest rate until 2016.

Other observers have speculated on late next year or early in 2015 for the first rate hike by the central bank.

But Scotiabank’s Derek Holt, Mary Webb and Dov Zigler say the Bank of Canada is now signalling a hold of more than two years, citing signs in a recent speech by senior deputy governor Tiff Macklem, among other things.

…

“The BoC probably now envisages spare capacity remaining into 2016,” the Scotiabank economists said, adding the central bank now projects hitting its 2-per-cent target for annual inflation in mid-2015.They believe the Bank of Canada may change that forecast, to an even later date, when meets later this month and also issues its monetary policy report.

But that’s OK! We’ll all retire on the CPP:

A proposal to boost the retirement benefits for the middle class from the Canada Pension Plan through increases in contributions is rekindling momentum for pension reform ahead of a key December meeting with Finance Minister Jim Flaherty.

Prince Edward Island Finance Minister Wes Sheridan is trying to rally his colleagues around changes that would see the maximum CPP contribution rise to $4,681.20 a year from $2,356.20 starting in 2016, and the maximum annual benefit would increase to $23,400 from $12,150.

Qualifying for the maximum benefit would take an income of $102,000, up sharply from the current maximum insurable earnings cutoff of $51,000. The overall goal is to boost the savings rates of middle-income Canadians who earn less than six figures.

And – surprise! – middle-class jobs are scarce:

The top-10 list suggests there are really two sets of expanding job opportunities, at either end of the income spectrum – and not much in the middle.

If you’re entering the labour market – say you’re young, or you’re a newcomer to Canada – there are lots of points of entry at the low end of the scale. But they are not generally the types of jobs that lead you down a career path to something better, nor do these jobs fully employ many workers’ skill sets. If you are lucky enough to find full-time, full-year work in these types of jobs, paying $13 an hour or less, you would be making $26,000 a year before taxes, or less.

There is another cluster of job opportunities that pay median wages of $35 an hour or more, which translates to $70,000 a year before taxes, or more.

There are fewer opportunities in the middle, jobs that pay in the $20-something per hour range.

However, a bright note is that European distressed assets seem to have found a level:

Blackstone Group LP (BX) raised more than $4 billion in 2009 to buy European property assets anticipating that cash-strapped banks would be forced to sell as the region’s debt crisis worsened. Almost all of it sat idle for two years.

Today, the inaction has given way to a surge of deals, as lenders from Lloyds Banking Group Plc (LLOY) to Commerzbank AG (CBK) cut loose soured real estate, corporate and consumer loans. Sales of loan portfolios and other unwanted assets by European Union banks could reach 60 billion euros ($82 billion) in face value this year, according to PricewaterhouseCoopers LLP, the most since the firm began tracking data in 2010.

…

Apollo is among the most active investors, amassing loans with a face value of about 12 billion euros, including 11,000 mortgages in the U.K. Blackstone, the world’s largest alternative-asset manager, last year put $3.5 billion into distressed European mortgages and properties, the most its real estate group has plowed into the region in one year.

Investors also are buying European properties from real estate developers and taking over troubled companies or lending directly to them where banks have scaled back.

EU banks unloaded 29 billion euros of portfolio loans and assets such as mortgage-servicing units and branches in the first half of 2013, according to Richard Thompson, a partner at PwC in London. That compares with sales of 46 billion euros for all of last year, 36 billion euros in 2011 and 11 billion euros in 2010. The majority of sales have been distressed loans, Thompson said.

The arbitrary nature of corporate bond pricing (and hence the opportunity for profit) is well illustrated by this tale of woe:

Goldman Sachs Group Inc. (GS) mistakenly added about $1.5 million of interest costs to a Ford Motor Co. (F) bond sale last week by using the wrong Treasury note as a benchmark for the security, according to two people with knowledge of the transaction.

…

Typically, banks set the price of new corporate securities by using Treasury bonds with similar maturities. If the U.S. government issues notes in the middle of the week, underwriters don’t use that security as a benchmark until the following Monday.For Dearborn, Michigan-based Ford’s Sept. 26 offering, Goldman Sachs added a 1.45 percentage-point spread to the 1.375 percent Treasury note due September 2018 that was auctioned on Sept. 25, Bloomberg data show. Instead, the bonds should have been based off the 1.5 percent security that matures in August 2018.

Matthew Klein of Bloomberg offers an excellent perspective on endowment investing:

The modern style of institutional investing can be traced to Yale University’s David Swensen, who literally wrote the book on the subject. … Three core ideas inform his thinking.

1. Savers are paid to take risk. If you want to generate big returns you have to be willing to endure large losses at any point.

2. Universities and other institutional investors have long time horizons because they expect to exist forever. This makes them different from regular people who save for retirement.

3. Contrary to standard academic theory, which suggests that savers should invest in broad indexes and avoid fees, market imperfections create opportunities for talented money managers. They can improve a portfolio’s performance through a combination of high returns and diversification benefits.

…

The potential for a mismatch between assets and liabilities is one big problem with the Yale model. Another is the focus on hunting for the best hedge funds, private-equity managers and stock pickers. This is where most of the money is made (and lost) in the endowment business. According to the Yale endowment’s most recent report, “nearly 80 percent of Yale’s outperformance relative to the average Cambridge Associates endowment was attributable to the value added by Yale’s active managers, while only 20 percent was the result of Yale’s asset allocation.” That’s great for Yale, but it’s impossible for every institution to have the best managers.

In general, I think Mr. Klein overstates the need for liquidity – it’s important, but my views are closer to precept 2 than that which he espouses.

I don’t think there’s anything wrong with the Yale model, but there are definitely problems with the implementation – as I told one guy recently, just because I believe the “Warren Buffet style” of investment CAN work, doesn’t mean I think YOU can do it.

The field is filled with ignoramuses and charlatans and institutional boards aren’t any better at picking winners than any other retail investor who handles his investments as a part-time job. Hiring a small group of specialists to farm out the work to third party firms just makes matters worse, because then allocations are made on the basis of two salesmen talking to each other.

For an institution to outperform, I believe that you have to have most, if not all, of the investment expertise in-house. ‘You don’t need to sell anything, guys, you just have to outperform on a rolling four year basis or you’re fired.’ This is the Teachers/OMERS model – and it works.

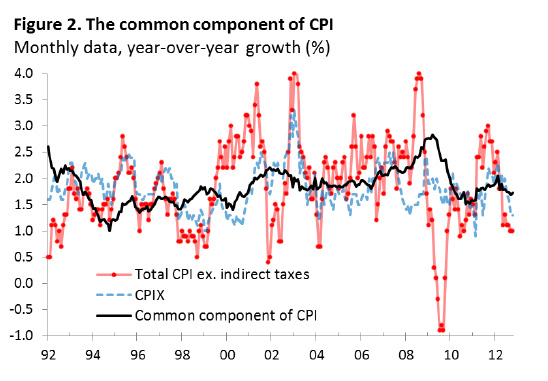

Canajans, eh? The Bank of Canada has published a working paper by Mikael Khan, Louis Morel and Patrick Sabourin titled The Common Component of CPI:An Alternative Measure of Underlying Inflation for Canada, in which the authors use factor analysis to find a common factor among 54 different components of the Consumer Price Index.

But, you ask, which of these 54 series was best correlated with this single underlying factor? Well, I’m glad you asked that question:

Table 2. Relationship between common component and individual components of the CPI

CPI components (y/y) Correlation % of explained variance Alcoholic beverages served in licensed establishments 0.86 0.74

This suggests a new currency ….

It was a mixed day for the Canadian preferred share market, with PerpetualDiscounts getting whacked for 40bp, FixedResets off 3bp and DeemedRetractibles gaining 4bp. Predictably, the Performance Highlights table is heavily populated by losing PerpetualDiscounts. Volume was slightly above average.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.3151 % | 2,525.5 |

| FixedFloater | 4.40 % | 3.70 % | 31,995 | 17.86 | 1 | -1.3692 % | 3,777.3 |

| Floater | 2.68 % | 2.91 % | 65,975 | 19.98 | 5 | -0.3151 % | 2,726.9 |

| OpRet | 4.64 % | 2.96 % | 60,751 | 0.48 | 3 | -0.0901 % | 2,632.7 |

| SplitShare | 4.76 % | 5.07 % | 60,910 | 4.03 | 6 | -0.0622 % | 2,946.7 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0901 % | 2,407.3 |

| Perpetual-Premium | 5.76 % | 1.77 % | 111,776 | 0.12 | 8 | -0.0644 % | 2,276.8 |

| Perpetual-Discount | 5.53 % | 5.56 % | 147,151 | 14.38 | 30 | -0.4041 % | 2,346.9 |

| FixedReset | 4.93 % | 3.68 % | 238,684 | 3.62 | 85 | -0.0261 % | 2,457.8 |

| Deemed-Retractible | 5.12 % | 4.43 % | 197,492 | 6.89 | 43 | 0.0438 % | 2,381.9 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| CIU.PR.C | FixedReset | -3.98 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-03 Maturity Price : 20.74 Evaluated at bid price : 20.74 Bid-YTW : 4.03 % |

| BAM.PF.D | Perpetual-Discount | -1.57 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-03 Maturity Price : 20.71 Evaluated at bid price : 20.71 Bid-YTW : 5.96 % |

| BAM.PF.C | Perpetual-Discount | -1.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-03 Maturity Price : 19.80 Evaluated at bid price : 19.80 Bid-YTW : 6.17 % |

| BAM.PR.G | FixedFloater | -1.37 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-03 Maturity Price : 21.93 Evaluated at bid price : 21.61 Bid-YTW : 3.70 % |

| CU.PR.F | Perpetual-Discount | -1.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-03 Maturity Price : 21.50 Evaluated at bid price : 21.50 Bid-YTW : 5.30 % |

| FTS.PR.F | Perpetual-Discount | -1.30 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-03 Maturity Price : 23.31 Evaluated at bid price : 23.61 Bid-YTW : 5.23 % |

| CU.PR.G | Perpetual-Discount | -1.29 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-03 Maturity Price : 21.37 Evaluated at bid price : 21.37 Bid-YTW : 5.33 % |

| FTS.PR.J | Perpetual-Discount | -1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-03 Maturity Price : 23.00 Evaluated at bid price : 23.30 Bid-YTW : 5.14 % |

| BAM.PR.M | Perpetual-Discount | -1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-03 Maturity Price : 19.75 Evaluated at bid price : 19.75 Bid-YTW : 6.06 % |

| SLF.PR.G | FixedReset | 1.47 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.49 Bid-YTW : 4.15 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TRP.PR.D | FixedReset | 91,600 | Nesbitt crossed 75,000 at 24.75. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-03 Maturity Price : 23.02 Evaluated at bid price : 24.70 Bid-YTW : 4.12 % |

| TD.PR.Y | FixedReset | 68,305 | To reset 10/31 at 3.5595%. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.14 Bid-YTW : 3.61 % |

| TD.PR.T | FixedReset | 63,782 | Scotia crossed 50,000 at 25.31. YTW SCENARIO Maturity Type : Call Maturity Date : 2018-07-31 Maturity Price : 25.00 Evaluated at bid price : 25.32 Bid-YTW : 2.28 % |

| IFC.PR.A | FixedReset | 63,200 | Scotia sold 21,600 to RBC at 24.55 and another 10,000 to Anonymous at the same price. RBC crossed 19,700 at the same price again. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.55 Bid-YTW : 4.08 % |

| BAM.PR.M | Perpetual-Discount | 39,904 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-03 Maturity Price : 19.75 Evaluated at bid price : 19.75 Bid-YTW : 6.06 % |

| BAM.PR.R | FixedReset | 39,592 | Scotia crossed 25,000 at 25.20. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-03 Maturity Price : 23.50 Evaluated at bid price : 25.21 Bid-YTW : 4.21 % |

| There were 37 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| RY.PR.B | Deemed-Retractible | Quote: 25.29 – 25.77 Spot Rate : 0.4800 Average : 0.3265 YTW SCENARIO |

| TCA.PR.Y | Perpetual-Discount | Quote: 50.00 – 50.40 Spot Rate : 0.4000 Average : 0.2505 YTW SCENARIO |

| MFC.PR.G | FixedReset | Quote: 25.53 – 25.86 Spot Rate : 0.3300 Average : 0.2089 YTW SCENARIO |

| TRP.PR.B | FixedReset | Quote: 20.13 – 20.50 Spot Rate : 0.3700 Average : 0.2530 YTW SCENARIO |

| HSB.PR.C | Deemed-Retractible | Quote: 24.90 – 25.34 Spot Rate : 0.4400 Average : 0.3314 YTW SCENARIO |

| GWO.PR.Q | Deemed-Retractible | Quote: 23.61 – 23.87 Spot Rate : 0.2600 Average : 0.1627 YTW SCENARIO |

[…] It will not have escaped the intelligent and assiduous reader that, in the context of a $60-billion portfolio, $75-million in projected fee savings is only slightly greater than the square root of fuck-all. I don’t want to issue any doom-filled forecasts here, but as I have pointed out in the past: […]