The big news today was the Bank of Canada rate cut:

The Bank of Canada today announced that it is lowering its target for the overnight rate by one-quarter of one percentage point to 3/4 per cent. The Bank Rate is correspondingly 1 per cent and the deposit rate is 1/2 per cent. This decision is in response to the recent sharp drop in oil prices, which will be negative for growth and underlying inflation in Canada.

Inflation has remained close to the 2 per cent target in recent quarters. Core inflation has been temporarily boosted by sector-specific factors and the pass-through effects of the lower Canadian dollar, which are offsetting disinflationary pressures from slack in the economy and competition in the retail sector. Total CPI inflation is starting to reflect the fall in oil prices.

Oil’s sharp decline in the past six months is expected to boost global economic growth, especially in the United States, while widening the divergences among economies. Persistent headwinds from deleveraging and lingering uncertainty will influence the extent to which some oil-importing countries benefit from lower prices. The Bank’s base-case projection assumes oil prices around US$60 per barrel. Prices are currently lower but our belief is that prices over the medium term are likely to be higher.

…

Although there is considerable uncertainty around the outlook, the Bank is projecting real GDP growth will slow to about 1 1/2 per cent and the output gap to widen in the first half of 2015. The negative impact of lower oil prices will gradually be mitigated by a stronger U.S. economy, a weaker Canadian dollar, and the Bank’s monetary policy response. The Bank expects Canada’s economy to gradually strengthen in the second half of this year, with real GDP growth averaging 2.1 per cent in 2015 and 2.4 per cent in 2016. The economy is expected to return to full capacity around the end of 2016, a little later than was expected in October.Weaker oil prices will pull down the inflation profile. Total CPI inflation is projected to be temporarily below the inflation-control range during 2015, moving back up to target the following year. Underlying inflation will ease in the near term but then return gradually to 2 per cent over the projection horizon.

The oil price shock increases both downside risks to the inflation profile and financial stability risks. The Bank’s policy action is intended to provide insurance against these risks, support the sectoral adjustment needed to strengthen investment and growth, and bring the Canadian economy back to full capacity and inflation to target within the projection horizon.

Prime did not follow, since the banks factor the near-total lack of competition in Canada into their decisions:

It is not clear yet if Canada’s big banks will lower their rates. Historically, Canada’s largest lenders have followed suit when the central bank cut its key interest rate. However, Toronto-Dominion Bank said Wednesday that it now weighs many factors before cutting its prime rate, sending the message that it would like to keep the status quo in order to sustain healthy loan margins. Officially, the remaining Big Six banks declined to comment, but some privately expressed a similar sentiment as TD.

When the overnight rate target was increased to 1% in 2010, prime followed, but things are different now for um, lots of reasons! Yes, lots. So suck it up, turds.

The BoC cut was not widely expected and the bond market went nuts:

The currency reached the weakest level in almost six years after the Bank of Canada reduced economic forecasts and lowered the benchmark rate target to 0.75 percent, from 1 percent, where it’s been since 2010. Government bonds climbed, pushing yields on two-, 10- and 30-year debt to record lows. Crude, Canada’s biggest export, has tumbled more than 50 percent since June amid a global glut.

…

The currency, nicknamed the loonie for the image of the aquatic bird on the C$1 coin, depreciated 1.8 percent to C$1.2340 per U.S. dollar at 5 p.m. Toronto time. It slid as much as 2.3 percent, the most since September 2011, to C$1.2394, the weakest level since April 2009. One Canadian dollar buys 81.04 U.S. cents.

…

The yield on Canada’s benchmark 10-year (GCAN10YR) bond dropped to as low as 1.365 percent before trading at 1.43 percent, 0.44 percentage point below the U.S. 10-year note yield. It’s the biggest difference since 2007.Yields on Canadian two-year securities touched 0.536 percent, and 30-year bond yields reached 2 percent.

None of the 22 economists in a Bloomberg News survey predicted the cut. The interest rate, which influences everything from car loans to mortgages, had been unchanged since September 2010. The last reduction was in April 2009.

At the close yesterday, the five-year was bid at 1.04%, and today’s closing bid was 0.86%. Eighteen basis points on the five year in a day? Twenty-three years I’ve been in the business, and while I no longer keep day-to-day records of Canada yields, I’ll guess I could count the number of days with that sort of move without having to take off my socks.

It’s a global thing:

In Tokyo, BOJ Governor Haruhiko Kuroda and colleagues cut their core inflation forecast to 1 percent for the fiscal year starting in April, from 1.7 percent, and maintained a pledge to increase the monetary base at an annual pace of 80 trillion yen ($674 billion). They also said they will boost the main part of a program to support economic growth to 10 trillion yen from 7 trillion yen. Eligibility for a facility aimed at stimulating bank lending was also widened.

Hours later in London, the Bank of England said policy makers Martin Weale and Ian McCafferty this month stopped voting for a rate increase. That left the nine-member Monetary Policy Committee unanimous for the first time since July as it warned U.K. inflation may drop to zero in the first quarter.

Inflation is slowing around the world. Malaysia on Wednesday reported that consumer prices rose 2.7 percent in December from a year earlier, the second-weakest pace in 2014. New Zealand’s fourth-quarter prices increased 0.8 percent from a year earlier, the slowest rate in six periods.

The Bank of Korea will seek an inflation target that is optimal for the economy, Governor Lee Ju Yeol said on Thursday, adding that the possibility of deflation is “limited.”

And Draghi wants US-style quantitative easing:

Mario Draghi called on the European Central Bank to make its biggest push yet to fend off deflation and revive the economy by unleashing a debt-buying spree of 1.1 trillion euros ($1.3 trillion).

The ECB president and his Executive Board proposed spending 50 billion euros a month through December 2016, two euro-area central-bank officials said. The plan still faces a tense debate in the Governing Council and may change before the final decision on Thursday, the people said, asking not to be identified as the talks are private. An ECB spokesman declined to comment.

…

The council’s debate will be complicated by arguments over whether the risks incurred in the new bond-buying plan should be shared across the region’s 19 central banks or kept within national boundaries. Dutch central-bank Governor Klaas Knot has said any decision to mutualize risk should be taken by elected politicians, not unelected central bankers.

But what about the Danes?

As Denmark tries to silence speculation it may follow Switzerland and abandon its euro peg, the nation’s business leaders are adding their voice to the debate.

The Confederation of Danish Industry, which represents about 10,000 companies, says the long-term cost of discarding the euro peg far outweighs any potential short-term benefit.

…

The central bank fought back speculation it might run out of ammunition to defend its peg by delivering a surprise rate cut on Monday, lowering its benchmark deposit rate to minus 0.2 percent. Danske Bank A/S, the country’s biggest lender, says the rate may be cut again tomorrow, to minus 0.3 percent as the ECB prepares to unveil the details of its bond-purchase program.

…

Denmark relies on trade with the European Union for about 70 percent of its total exports, meaning the country’s de facto euro membership saves its companies billions in exchange-rate hedges.

All these pegs … reminds me of my father’s commentary on political guidance with respect to currency movements under the Bretton Woods regime … “We will not devalue, we will not devalue, we will not devalue, whoops, we will not devalue again, we will not devalue again, we will not devalue again …”. If I ran a FX brokerage, I’d be hiking the margin on pegged currencies instead of all of them. Free markets are more reliable than politicians:

FXCM Inc., the New York-based retail broker, said Wednesday it’s increasing margin requirements for clients who trade currencies and gold after customers’ losses forced it to seek a $300 million lifeline. CME Group Inc., owner of the Chicago Mercantile Exchange, is altering how it handles volatility in emergencies after it was buffeted by trading halts last week.

…

The turmoil shows regulators need to consider boosting oversight of retail trading platforms such as FXCM, a member of the U.S. Commodity Futures Trading Commission said.“I am concerned that lower standards are putting this industry in a precarious position and placing retail foreign-exchange investors unnecessarily at risk,” said Commissioner Sharon Bowen, a Democrat who joined the CFTC last year. That market “is the least regulated part of the derivatives industry,” she said.

The National Futures Association, the U.S. derivatives industry’s self-funded market overseer, temporarily boosted the amount of money traders must put down to back currency transactions. The more stringent requirements apply to the Swiss franc, Swedish krona and Norwegian krone, the group said in a statement. The changes apply to retail trading.

So fear not. This gross failure of the political class to restrain markets will be lead to increased regulation, because if at first you don’t succeed, it’s the fault of them durn speculators.

It was a violently mixed day for the Canadian preferred share market, with PerpetualDiscounts up 90bp, FixedResets off 17bp and DeemedRetractibles gaining 64bp. A very lengthy Performance Highlights table is dominated by FixedReset and Floating Rate losers and Straight Perpetual winners. Volume was average.

Given the size of the move in the GOC yields, I amended my usual practice and entered a mid-week change in HIMIPref™’s rate assumptions – all yields given in the tables are performed with GOC-5 = 0.85% and 3-Month Bills = 0.59%. Prime remains at 3%, so it’s an ill wind that blows nobody any good!

PerpetualDiscounts now yield 4.94%, equivalent to 6.42% interest at the standard equivalency factor of 1.3x. Long corporates now yield about 3.75% (!) so the pre-tax interest-equivalent spread (in this context, the “Seniority Spread”) is now about 265bp, unchanged from January 14.

For as long as the FixedReset market is so violently unsettled, I’ll keep publishing updates of the more interesting and meaningful series of FixedResets’ Implied Volatilities. This doesn’t include Enbridge because although Enbridge has a large number of issues outstanding, all of which are quite liquid, the range of Issue Reset Spreads is too small for decent conclusions. The low is 212bp (ENB.PR.H; second-lowest is ENB.PR.D at 237bp) and the high is a mere 268 for ENB.PF.G.

Remember that all rich /cheap assessments are:

- based on Implied Volatility Theory only

- are relative only to other FixedResets from the same issuer

- assume constant GOC-5 yield

- assume constant Implied Volatility

- assume constant spread

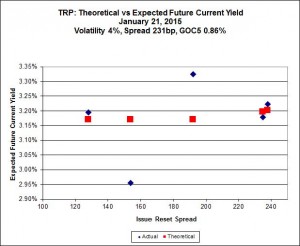

Here’s TRP:

So according to this, TRP.PR.A, bid at 20.90, is $1.02 cheap, but it has already reset (at +192). TRP.PR.C, bid at 20.31 and resetting at +154bp on 2016-1-30 is $1.38 rich.

[Update, 2015-1-22: The wrong chart was here yesterday, being a repeat of the TRP chart. I am considering executing the proofreader.

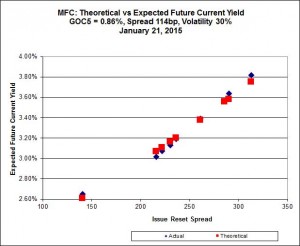

MFC.PR.F continues to be near the line defined by its peers, although it drifted up today and is having an effect on the calculation. Implied Volatility continues to be a conundrum. It is far too high if we consider that NVCC rules will never apply to these issues; it is still too low if we consider them to be NVCC non-compliant issues (and therefore with Deemed Maturities in the call schedule).

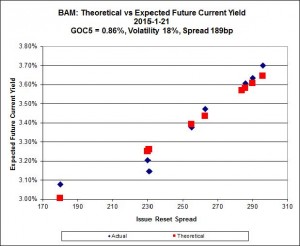

There continues to be cheapness in the lowest-spread issue, BAM.PR.X, resetting at +180bp on 2017-6-30, which is bid at 21.51 and appears to be $0.53 cheap, while BAM.PR.T, resetting at +231bp 2017-3-31 is bid at 25.20 and appears to be $0.89 rich.

Relative value changes were unusual today: the bid for BAM.PR.X gained $0.11 on the day, while BAM.PR.T’s bid is down $0.49. Sell on rumour, buy on news?

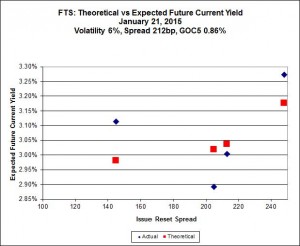

This is just weird because the middle is expensive and the ends are cheap but anyway … FTS.PR.H, with a spread of +145bp, and bid at 18.55, looks $0.83 cheap and resets 2015-6-1. FTS.PR.K, with a spread of +205bp, and bid at 25.15, looks $1.04 expensive and resets 2019-3-1

Pairs equivalence is all over the map, but the investment grade pairs (which are presumably more closely watched and easier to trade) do show a rising trend with increasing time to interconversio which, qualitatively speaking, is entirely reasonable. The average break-even rate is way down from recent levels.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -2.1319 % | 2,481.5 |

| FixedFloater | 4.42 % | 3.60 % | 19,907 | 18.28 | 1 | 0.6551 % | 4,001.9 |

| Floater | 3.06 % | 3.20 % | 54,600 | 19.23 | 4 | -2.1319 % | 2,638.0 |

| OpRet | 4.04 % | 1.31 % | 90,787 | 0.40 | 1 | 0.0394 % | 2,757.5 |

| SplitShare | 4.28 % | 4.13 % | 31,542 | 3.61 | 5 | -0.3321 % | 3,190.8 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0394 % | 2,521.4 |

| Perpetual-Premium | 5.41 % | -10.47 % | 55,691 | 0.09 | 19 | 0.3295 % | 2,513.0 |

| Perpetual-Discount | 5.07 % | 4.94 % | 106,705 | 15.48 | 16 | 0.8978 % | 2,737.4 |

| FixedReset | 4.23 % | 3.20 % | 200,525 | 17.28 | 77 | -0.1740 % | 2,531.2 |

| Deemed-Retractible | 4.89 % | -1.56 % | 95,703 | 0.10 | 39 | 0.6413 % | 2,648.9 |

| FloatingReset | 2.45 % | 2.38 % | 64,529 | 6.47 | 7 | -1.3274 % | 2,422.9 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BNS.PR.R | FixedReset | -3.70 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.76 Bid-YTW : 3.54 % |

| GWO.PR.N | FixedReset | -2.87 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 19.60 Bid-YTW : 5.11 % |

| BAM.PR.B | Floater | -2.71 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-21 Maturity Price : 16.49 Evaluated at bid price : 16.49 Bid-YTW : 3.20 % |

| TRP.PR.F | FloatingReset | -2.58 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-21 Maturity Price : 20.75 Evaluated at bid price : 20.75 Bid-YTW : 3.05 % |

| BAM.PR.K | Floater | -2.50 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-21 Maturity Price : 16.38 Evaluated at bid price : 16.38 Bid-YTW : 3.22 % |

| BAM.PR.R | FixedReset | -2.45 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-21 Maturity Price : 24.33 Evaluated at bid price : 24.66 Bid-YTW : 3.34 % |

| BAM.PR.C | Floater | -2.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-21 Maturity Price : 16.45 Evaluated at bid price : 16.45 Bid-YTW : 3.21 % |

| BAM.PR.T | FixedReset | -1.91 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-21 Maturity Price : 23.61 Evaluated at bid price : 25.20 Bid-YTW : 3.16 % |

| BNS.PR.B | FloatingReset | -1.72 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.60 Bid-YTW : 2.46 % |

| PWF.PR.P | FixedReset | -1.43 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-21 Maturity Price : 20.70 Evaluated at bid price : 20.70 Bid-YTW : 3.07 % |

| TD.PR.T | FloatingReset | -1.40 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.57 Bid-YTW : 2.38 % |

| PWF.PR.A | Floater | -1.36 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-21 Maturity Price : 19.35 Evaluated at bid price : 19.35 Bid-YTW : 2.70 % |

| IFC.PR.C | FixedReset | -1.19 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2016-09-30 Maturity Price : 25.00 Evaluated at bid price : 25.70 Bid-YTW : 2.66 % |

| SLF.PR.G | FixedReset | -1.07 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 19.34 Bid-YTW : 5.31 % |

| TD.PR.Z | FloatingReset | -1.04 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.73 Bid-YTW : 2.36 % |

| CU.PR.D | Perpetual-Discount | 1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-21 Maturity Price : 24.61 Evaluated at bid price : 25.05 Bid-YTW : 4.94 % |

| CU.PR.E | Perpetual-Discount | 1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-21 Maturity Price : 24.61 Evaluated at bid price : 25.05 Bid-YTW : 4.94 % |

| FTS.PR.J | Perpetual-Discount | 1.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-21 Maturity Price : 24.42 Evaluated at bid price : 24.85 Bid-YTW : 4.82 % |

| MFC.PR.B | Deemed-Retractible | 1.27 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.76 Bid-YTW : 4.85 % |

| SLF.PR.A | Deemed-Retractible | 1.33 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.05 Bid-YTW : 4.79 % |

| BAM.PF.D | Perpetual-Discount | 1.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-21 Maturity Price : 22.67 Evaluated at bid price : 23.07 Bid-YTW : 5.34 % |

| SLF.PR.B | Deemed-Retractible | 1.41 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2015-02-20 Maturity Price : 25.00 Evaluated at bid price : 25.20 Bid-YTW : -1.56 % |

| BAM.PR.N | Perpetual-Discount | 1.43 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-21 Maturity Price : 22.43 Evaluated at bid price : 22.70 Bid-YTW : 5.27 % |

| ENB.PR.Y | FixedReset | 1.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-21 Maturity Price : 21.59 Evaluated at bid price : 21.91 Bid-YTW : 3.92 % |

| GWO.PR.G | Deemed-Retractible | 1.46 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2015-02-20 Maturity Price : 25.00 Evaluated at bid price : 25.79 Bid-YTW : -27.06 % |

| GWO.PR.S | Deemed-Retractible | 1.47 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 26.23 Bid-YTW : 4.70 % |

| SLF.PR.C | Deemed-Retractible | 1.48 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.95 Bid-YTW : 5.05 % |

| SLF.PR.E | Deemed-Retractible | 1.52 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.10 Bid-YTW : 5.02 % |

| GWO.PR.R | Deemed-Retractible | 1.58 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.00 Bid-YTW : 4.86 % |

| PWF.PR.O | Perpetual-Premium | 1.61 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2015-02-20 Maturity Price : 26.00 Evaluated at bid price : 26.58 Bid-YTW : -22.03 % |

| SLF.PR.D | Deemed-Retractible | 1.61 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.00 Bid-YTW : 5.02 % |

| BAM.PF.C | Perpetual-Discount | 1.68 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-21 Maturity Price : 22.55 Evaluated at bid price : 22.95 Bid-YTW : 5.31 % |

| GWO.PR.Q | Deemed-Retractible | 1.72 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2020-09-30 Maturity Price : 25.25 Evaluated at bid price : 26.00 Bid-YTW : 4.59 % |

| IFC.PR.A | FixedReset | 1.76 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.42 Bid-YTW : 4.98 % |

| GWO.PR.I | Deemed-Retractible | 2.00 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.02 Bid-YTW : 5.06 % |

| GWO.PR.H | Deemed-Retractible | 2.13 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.95 Bid-YTW : 4.94 % |

| TRP.PR.A | FixedReset | 2.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-21 Maturity Price : 20.90 Evaluated at bid price : 20.90 Bid-YTW : 3.48 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| ENB.PR.J | FixedReset | 55,503 | RBC crossed 50,000 at 23.95. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-21 Maturity Price : 22.77 Evaluated at bid price : 23.84 Bid-YTW : 3.77 % |

| BAM.PF.E | FixedReset | 39,345 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-21 Maturity Price : 23.23 Evaluated at bid price : 25.25 Bid-YTW : 3.48 % |

| FTS.PR.H | FixedReset | 32,500 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-21 Maturity Price : 18.55 Evaluated at bid price : 18.55 Bid-YTW : 3.18 % |

| TD.PF.A | FixedReset | 32,350 | Scotia crossed 25,000 at 25.32. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-21 Maturity Price : 23.29 Evaluated at bid price : 25.35 Bid-YTW : 3.06 % |

| SLF.PR.D | Deemed-Retractible | 31,709 | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.00 Bid-YTW : 5.02 % |

| NA.PR.W | FixedReset | 30,800 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-01-21 Maturity Price : 23.21 Evaluated at bid price : 25.16 Bid-YTW : 3.11 % |

| There were 29 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| GWO.PR.S | Deemed-Retractible | Quote: 26.23 – 27.39 Spot Rate : 1.1600 Average : 0.6733 YTW SCENARIO |

| BNS.PR.R | FixedReset | Quote: 24.76 – 25.75 Spot Rate : 0.9900 Average : 0.5410 YTW SCENARIO |

| GWO.PR.N | FixedReset | Quote: 19.60 – 20.22 Spot Rate : 0.6200 Average : 0.4426 YTW SCENARIO |

| CU.PR.D | Perpetual-Discount | Quote: 25.05 – 25.43 Spot Rate : 0.3800 Average : 0.2368 YTW SCENARIO |

| GWO.PR.P | Deemed-Retractible | Quote: 26.19 – 26.56 Spot Rate : 0.3700 Average : 0.2505 YTW SCENARIO |

| POW.PR.G | Perpetual-Premium | Quote: 26.70 – 27.09 Spot Rate : 0.3900 Average : 0.3006 YTW SCENARIO |