The BCSC has released an attempt to justify their existence:

In support of Fraud Prevention Month, the British Columbia Securities Commission (BCSC) Chair and CEO Brenda Leong today announced the results of research commissioned by the BCSC into the fraud vulnerability of older British Columbians.

…

Key findings from the survey include:

- • One-in-eight British Columbians over 50 are vulnerable to investment fraud. When presented with an investment opportunity that guaranteed 14% to 25% monthly and no risk, 10% said they would either look into it further and 3% said they simply didn’t know, suggesting they are not sure enough to reject the offer.

- • Nearly two-in-five British Columbians over 50 (37%) are afraid of running out of money during retirement. This proportion is significantly higher among those vulnerable to fraud (49%) and those who have been past victims of fraud (47%). It is also higher among those with no savings (51%) and women under 65 (51%).

- • Only 44% of respondents have a reasonable expectation of annual returns on investments. When asked about annual rates of return, less than half of the respondents expected a rate of return of less than 6% (The five-year average nominal return between 2010 and 2014 on a portfolio containing three common investment types – three-month Treasury bills, Canadian bonds, and Canadian equities – was 5.98%).

I’ve had a look at the survey; I am surprised that so many felt that touted returns of “14% to 25% monthly and no risk” was worth looking into, but it’s not clear exactly what “looking into” means. There’s a clue in the report:

It looks to me as if only about half of those who would look into the scheme further are actually vulnerable … and vulnerable is a pretty loose term, too. I’m vulnerable to being hit by an asteroid, but I’m not worried about it, nor am I particularly interested in funding bureaucrats to follow me around with umbrellas.

Additionally, most of us will realize that the simple existence of a problem does not mean that the organization talking about it has a clue. If the BCSC is so convinced that the only appropriate response to a pitch like this from a friend or colleague (a rather important qualifier disclosed in the report but unmentioned in the press release) is to ignore it, then my questions are:

- What are they doing about it?

- Do they have any grounds to believe that what they’re doing will have any effect, or is it just guess-and-hope?

- How effective have their previous efforts along these lines been?

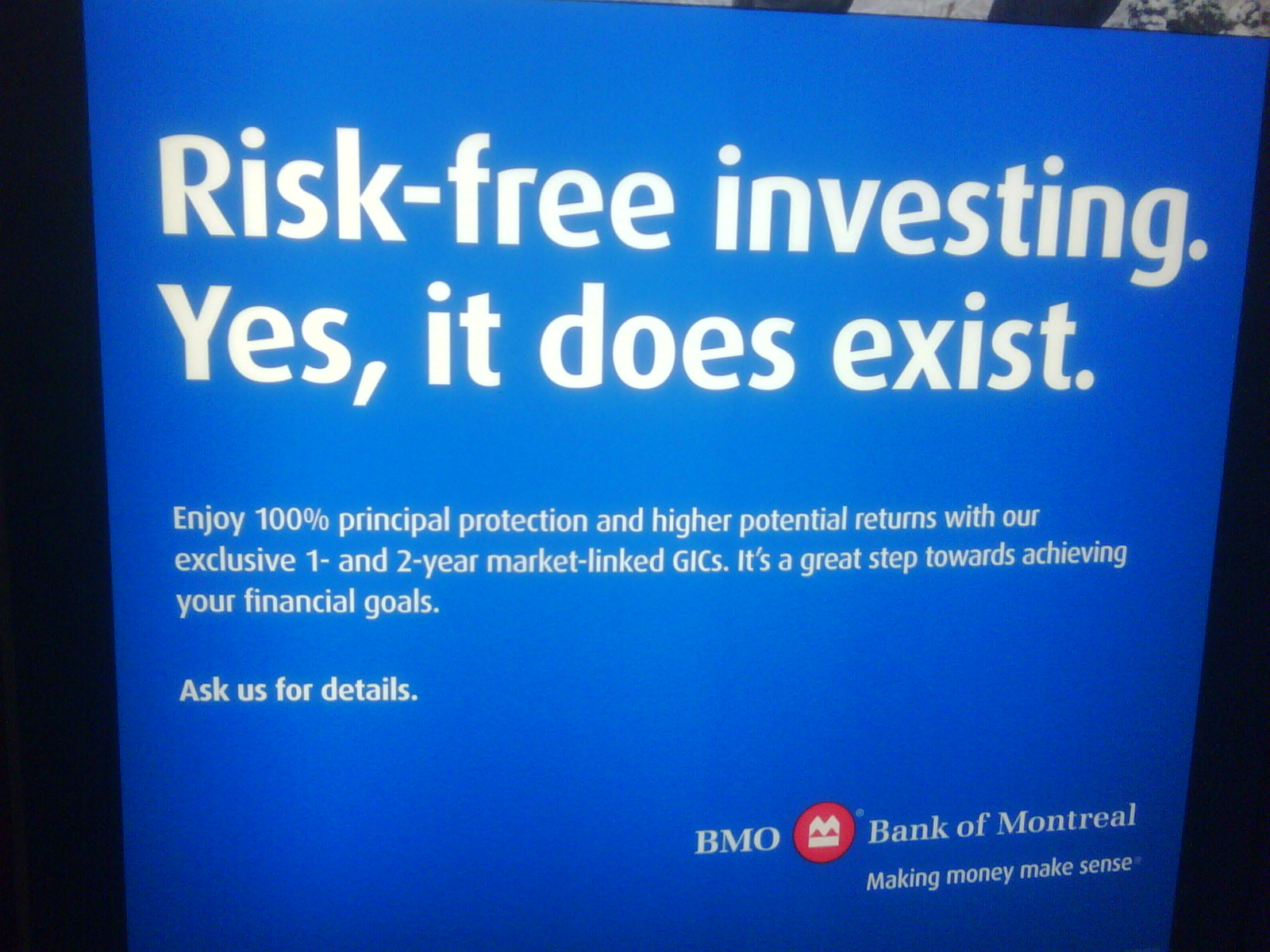

But there’s no discussion of this; in fact, I can only remember seeing one advertisement that discussed ‘investments with no risk’:

The second point of the BCSC press release is peculiar: according to the survey:

Do you agree or disagree with the following statement? I am afraid of running out of money during my retirement.

I don’t understand why anybody would disagree with that statement. Well … I tell a fib. I’ve met a couple of people who have so much loot it doesn’t matter what they do, as far as maintaining their standard of living for the next hundred years-odd is concerned. But most people are afraid of running out of money and quite rightly. So I’ll just write this section off as baffling.

The third sections was the most fun and – surprisingly – fairly accurately described in the press release except that they didn’t disclose that the 5.85% average was of an equal weighting of bonds, bills and equities. I wonder if we can take this as a BCSC endorsement of “1/N investing”, in which an investor choosing between N offered choices puts an equal amount into each of them. (This is a real thing, by the way. There’s been some research done on the way DC pension plans get allocated).

So everybody expecting an average return in the future of more than 6% has, according to the BCSC, an unreasonable expectation of annual returns on investments.

Just for fun, I looked at the policies of the CPPIB:

Using reasonable capital market assumptions, the Reference Portfolio is expected to earn at least the real rate of return over the long term that is required over the 75-year projection period in the latest Actuarial Report to sustain the plan at the minimum contribution rate specified therein, assuming all other assumptions by the Chief Actuary are realized. The 26th Actuarial Report assumes a 4.0% real rate of return over the long term. The Board expect the 65% equity/35% debt weighting of the Reference Portfolio to earn at least this rate of return (annualized over the long term).

Phew! Made it! I am relieved to learn that the Canada Pension Plan is in good hands! But maybe the BCSC should take its road-show down south … according to the National Association of State Retirement Administrators’ NASRA Issue Brief: Public Pension Plan Investment Return Assumptions:

Although public pension funds, like other investors, experienced sub-par returns in the wake of the 2008-09 decline in global equity values, median public pension fund returns over longer periods meet or exceed the assumed rates used by most plans. As shown in Figure 1, at 8.8 percent, the median annualized investment return for the 25-year period ended June 30, 2014, exceeds the median assumption of 7.75 percent (see Figure 4), while the 10-year return is below this level.

So the US pension plans appear to be basing their future expectations on past performance, just like the BCSC implies we all should be doing … and their future expectations are distributed accordingly:

Since we’re on the topic of pensions, it’s alarming to learn that Canadian DB pensions lost ground on funding in 2015Q1:

Canadian pension plans continued to see their funding decline in the first three months of 2015 as a result of declining long-term interest rates.

A survey of 449 pension plans by consulting firm Aon Hewitt shows average funding stood at 89 per cent as of March 30, a six-percentage-point drop from 95 per cent funding a year earlier.

…

The survey found only 18 per cent of pension plans in Canada were fully funded as of March 30, which a sharp decline from a year earlier, when 36 per cent of pension plans were fully funded.

OSFI released its 2015-16 Report on Plans and Priorities, but there was not much of interest in it:

In the insurance sector, we will continue to implement the reforms set out in the Update to the Life Insurance Regulatory Framework and the changes to property and casualty insurance capital requirements.

TransCanada has issued USD 750 million of 4.6% Senior Notes with a maturity date of March 31, 2045.

BSD.PR.A has been confirmed at Pfd-4(low) by DBRS:

DBRS Limited (DBRS) has today confirmed the rating of Pfd-4 (low) on the Preferred Securities issued by Brookfield Soundvest Split Trust (the Trust). The rating confirmation is in connection with the extension of the termination date from March 31, 2015 to March 31, 2020. The interest rate on the Preferred Securities for the extended term will remain the same at 6.0% per annum.

…

Since the last rating confirmation of the Preferred Shares at Pfd-4 (low) on December 5, 2014, the performance of the Company has been volatile, with downside protection fluctuating between 17.6% and 23.2%. The Portfolio consisted of 72.0% Canadian common stock, 22.0% REITs, 4.0% limited partnerships and 2.0% Canadian preferred stock. Downside protection available to holders of the Preferred Securities was 20.4% as of March 24, 2015. Based on the Q3 2014 Statement of Investments and the yield on the Portfolio as of March 24, 2015, the distribution coverage ratio is 0.63x. The rating on the Preferred Securities continues to be constrained by the large percentage of underlying securities in the Portfolio that are not rated by any rating agency and by the grind on the Portfolio due to distributions exceeding income.

The Canadian preferred share market closed the day on a violently mixed note, with PerpetualDiscounts up 33bp, FixedResets off 36bp and DeemedRetractibles gaining 6bp. The Performance Highlights table is predictably heavy with FixedReset losers, notably BAM, ENB and MFC issues. Floaters did well! Volume was quite high, with a very good crop of issues breaking the 100,000 mark.

For as long as the FixedReset market is so violently unsettled, I’ll keep publishing updates of the more interesting and meaningful series of FixedResets’ Implied Volatilities. This doesn’t include Enbridge because although Enbridge has a large number of issues outstanding, all of which are quite liquid, the range of Issue Reset Spreads is too small for decent conclusions. The low is 212bp (ENB.PR.H; second-lowest is ENB.PR.D at 237bp) and the high is a mere 268 for ENB.PF.G.

Remember that all rich /cheap assessments are:

» based on Implied Volatility Theory only

» are relative only to other FixedResets from the same issuer

» assume constant GOC-5 yield

» assume constant Implied Volatility

» assume constant spread

Here’s TRP:

TRP.PR.E, which resets 2019-10-30 at +235, is bid at 24.32 to be $1.23 rich, while TRP.PR.G, resetting 2020-11-30 at +296, is $1.01 cheap at its bid price of 24.98.

Another excellent fit, but the numbers are perplexing. Implied Volatility for MFC continues to be a conundrum, although it declined substantially today. It is still too high if we consider that NVCC rules will never apply to these issues; it is still too low if we consider them to be NVCC non-compliant issues (and therefore with Deemed Maturities in the call schedule).

Most expensive is MFC.PR.L, resetting at +216 on 2019-6-19, bid at 23.91 to be $0.64 rich, while MFC.PR.H, resetting at +313bp on 2017-3-19, is bid at 25.60 to be $0.69 cheap.

The fit on this series has suddenly become atrocious. It will be most interesting to see how long it takes for things to readjust.

The cheapest issue relative to its peers is BAM.PF.F, resetting at +286bp on 2019-9-30, bid at 23.52 to be $1.15 cheap (but, mind you, the bid is suspiciously low – see the discussion in the Performance Highlights table, below). BAM.PF.E, resetting at +255bp 2020-3-31 is bid at 24.12 and appears to be $1.36 rich.

This is just weird because the middle is expensive and the ends are cheap but anyway … FTS.PR.H, with a spread of +145bp, and bid at 16.20, looks $1.59 cheap and resets 2015-6-1. FTS.PR.K, with a spread of +205bp and resetting 2019-3-1, is bid at 23.70 and is $1.15 rich.

Investment-grade pairs predict an average over the next five years of a little over 0.20%. TRP.PR.A / TRP.PR.F has normalized. The DC.PR.B / DC.PR.D pair is still off the charts and now predicts an average bill rate over the next 4 3/4 years of -2.48%.

The two new junk pairs, AIM.PR.A / AIM.PR.B and FFH.PR.E / FFH.PR.F, are surprisingly well-behaved at +0.24% and +0.72%, respectively.

Shall we just say that this exhibits a high level of confidence in the continued rapacity of Canadian banks?

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 1.5866 % | 2,369.0 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 1.5866 % | 4,142.2 |

| Floater | 3.20 % | 3.21 % | 64,321 | 19.18 | 3 | 1.5866 % | 2,518.5 |

| OpRet | 4.06 % | 0.69 % | 111,633 | 0.22 | 1 | 0.1589 % | 2,768.0 |

| SplitShare | 4.35 % | 4.15 % | 34,526 | 3.46 | 4 | 0.0299 % | 3,218.1 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1589 % | 2,531.1 |

| Perpetual-Premium | 5.31 % | -0.62 % | 59,782 | 0.08 | 25 | -0.0283 % | 2,525.2 |

| Perpetual-Discount | 4.95 % | 4.94 % | 157,382 | 15.22 | 9 | 0.3259 % | 2,827.7 |

| FixedReset | 4.43 % | 3.49 % | 249,819 | 16.48 | 85 | -0.3632 % | 2,406.6 |

| Deemed-Retractible | 4.90 % | 0.93 % | 113,045 | 0.15 | 37 | 0.0565 % | 2,659.4 |

| FloatingReset | 2.46 % | 2.82 % | 79,035 | 6.28 | 8 | 0.0582 % | 2,359.7 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PF.F | FixedReset | -5.96 % | Not real. The day’s low was 24.21, nearly 3% above the last bid, so this is just more Toronto Stock Exchange nonsense. I have not checked whether this is due to inadequate Toronto Stock Exchange reporting or inadequate Toronto Stock Exchange supervision of market-makers. It’s bad enough whenever this happens … but pretty disgraceful when it happens on a quarter-end. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-31 Maturity Price : 22.59 Evaluated at bid price : 23.52 Bid-YTW : 4.03 % |

| BAM.PR.T | FixedReset | -3.29 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-31 Maturity Price : 20.55 Evaluated at bid price : 20.55 Bid-YTW : 3.95 % |

| BAM.PR.R | FixedReset | -2.67 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-31 Maturity Price : 20.05 Evaluated at bid price : 20.05 Bid-YTW : 4.03 % |

| ENB.PR.P | FixedReset | -2.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-31 Maturity Price : 19.50 Evaluated at bid price : 19.50 Bid-YTW : 4.44 % |

| ENB.PR.Y | FixedReset | -2.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-31 Maturity Price : 19.30 Evaluated at bid price : 19.30 Bid-YTW : 4.39 % |

| ENB.PR.F | FixedReset | -1.98 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-31 Maturity Price : 19.31 Evaluated at bid price : 19.31 Bid-YTW : 4.46 % |

| HSE.PR.A | FixedReset | -1.71 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-31 Maturity Price : 16.70 Evaluated at bid price : 16.70 Bid-YTW : 3.91 % |

| BNS.PR.Y | FixedReset | -1.69 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.48 Bid-YTW : 4.23 % |

| BAM.PF.G | FixedReset | -1.64 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-31 Maturity Price : 22.99 Evaluated at bid price : 24.55 Bid-YTW : 3.82 % |

| ENB.PR.T | FixedReset | -1.52 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-31 Maturity Price : 19.50 Evaluated at bid price : 19.50 Bid-YTW : 4.46 % |

| ENB.PR.D | FixedReset | -1.40 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-31 Maturity Price : 19.01 Evaluated at bid price : 19.01 Bid-YTW : 4.36 % |

| ENB.PR.H | FixedReset | -1.32 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-31 Maturity Price : 18.01 Evaluated at bid price : 18.01 Bid-YTW : 4.35 % |

| MFC.PR.J | FixedReset | -1.15 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.90 Bid-YTW : 3.67 % |

| MFC.PR.N | FixedReset | -1.02 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.15 Bid-YTW : 3.92 % |

| MFC.PR.I | FixedReset | -1.02 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.34 Bid-YTW : 3.71 % |

| BAM.PF.E | FixedReset | 1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-31 Maturity Price : 22.83 Evaluated at bid price : 24.12 Bid-YTW : 3.64 % |

| CIU.PR.C | FixedReset | 1.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-31 Maturity Price : 17.68 Evaluated at bid price : 17.68 Bid-YTW : 3.17 % |

| SLF.PR.G | FixedReset | 1.15 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 17.55 Bid-YTW : 6.34 % |

| MFC.PR.C | Deemed-Retractible | 1.17 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.21 Bid-YTW : 4.95 % |

| BAM.PR.C | Floater | 1.24 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-31 Maturity Price : 15.50 Evaluated at bid price : 15.50 Bid-YTW : 3.21 % |

| BAM.PR.K | Floater | 1.64 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-31 Maturity Price : 15.50 Evaluated at bid price : 15.50 Bid-YTW : 3.21 % |

| BAM.PR.B | Floater | 1.88 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-31 Maturity Price : 15.74 Evaluated at bid price : 15.74 Bid-YTW : 3.16 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| CU.PR.C | FixedReset | 445,232 | Desjardins crossed blocks of 116,100 and 170,000, both at 24.90. RBC crossed blocks of 17,000 and 85,000 at the same price. TD crossed 50,000 at the same price again. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-31 Maturity Price : 23.48 Evaluated at bid price : 24.82 Bid-YTW : 3.21 % |

| ENB.PR.B | FixedReset | 381,592 | RBC crossed 360,600 at 18.75. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-31 Maturity Price : 18.97 Evaluated at bid price : 18.97 Bid-YTW : 4.36 % |

| BMO.PR.S | FixedReset | 273,252 | Nesbitt crossed blocks of 150,000 and 60,000, both at 25.16. Scotia crossed 47,700 at the same price. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-31 Maturity Price : 23.28 Evaluated at bid price : 25.15 Bid-YTW : 3.14 % |

| TD.PF.D | FixedReset | 201,350 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-31 Maturity Price : 23.15 Evaluated at bid price : 25.02 Bid-YTW : 3.46 % |

| TD.PF.C | FixedReset | 175,374 | TD bought blocks of 18,800 and 12,400 from Canaccord at 24.69, and crossed blocks of 75,000 and 25,000, at the same price. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-31 Maturity Price : 23.07 Evaluated at bid price : 24.70 Bid-YTW : 3.17 % |

| TD.PF.B | FixedReset | 120,213 | TD crossed 100,000 at 24.90. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-31 Maturity Price : 23.10 Evaluated at bid price : 24.67 Bid-YTW : 3.17 % |

| CM.PR.G | Perpetual-Premium | 118,192 | Called for redemption effective April 30. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-04-30 Maturity Price : 25.00 Evaluated at bid price : 24.97 Bid-YTW : 1.47 % |

| IFC.PR.C | FixedReset | 111,603 | Nesbitt crossed 100,000 at 25.00. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.05 Bid-YTW : 3.55 % |

| There were 42 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| BAM.PF.F | FixedReset | Quote: 23.52 – 24.63 Spot Rate : 1.1100 Average : 0.6073 YTW SCENARIO |

| ENB.PR.F | FixedReset | Quote: 19.31 – 19.80 Spot Rate : 0.4900 Average : 0.3483 YTW SCENARIO |

| PWF.PR.R | Perpetual-Premium | Quote: 26.51 – 26.85 Spot Rate : 0.3400 Average : 0.2255 YTW SCENARIO |

| MFC.PR.I | FixedReset | Quote: 25.34 – 25.75 Spot Rate : 0.4100 Average : 0.2980 YTW SCENARIO |

| MFC.PR.H | FixedReset | Quote: 25.60 – 25.99 Spot Rate : 0.3900 Average : 0.2930 YTW SCENARIO |

| GWO.PR.N | FixedReset | Quote: 18.36 – 18.70 Spot Rate : 0.3400 Average : 0.2576 YTW SCENARIO |