Pembina Pipeline Corporation has announced:

that it has closed its previously announced public offering of cumulative redeemable minimum rate reset class A preferred shares, Series 11 (the “Series 11 Preferred Shares”) for aggregate gross proceeds of $170 million (the “Offering”).

The Offering was announced on January 6, 2016 when Pembina entered into an agreement with a syndicate of underwriters led by Scotiabank, BMO Capital Markets and RBC Capital Markets. A total of 6,800,000 Series 11 Preferred Shares, which includes 800,000 Series 11 Preferred Shares issued pursuant to the partial exercise of the underwriters’ option, were sold under the Offering.

Proceeds from the Offering will be used to reduce indebtedness under the Company’s credit facilities, as well as for capital expenditures and working capital requirements in connection with the Company’s 2016 capital program.

The Series 11 Preferred Shares will begin trading on the Toronto Stock Exchange today under the symbol PPL.PR.K.

Dividends on the Series 11 Preferred Shares are expected to be $1.4375 per share annually, payable quarterly on the 1st day of March, June, September and December, as and when declared by the Board of Directors of Pembina, for the initial fixed rate period to but excluding March 1, 2021.

Concurrently with the closing of the Offering, Pembina’s Board of Directors has declared the initial quarterly dividend for the Series 11 Preferred Shares in the amount of $0.1812, for the period of January 15, 2016 to March 1, 2016. The dividend will be payable on March 1, 2016, to shareholders of record on February 1, 2016.

All of Pembina’s dividends are designated “eligible dividends” for Canadian income tax purposes.

That’s very good of them to highlight the record date of the short first dividend! I wish more issuers would provide specifics – or at least estimates and intentions – on their announcements of closing.

PPL.PR.K is a FixedReset, 5.75%+500M575, announced January 6. The issue will be tracked by HIMIPref™ and has been assigned to the Scraps index on credit concerns.

The issue traded 333,090 shares today in a range of 23.40-24.70 before closing at 23.20-47, 10×10. VWAP was 24.09. Those who are outraged at the poor performance of this issue are reminded that the market in the last ten days has been horrid; epically horrid, as the kids say. From the close on the day of announcement, January 6, to the close today, January 15, the TXPL Price Index went from 661.34 to 565.59, a drop of 14.5%; the TXPL Total Return index went from 777.32 to 664.90, also a drop of 14.5%. So in context of the market, the drop to a bid of 23.20 from the issue price of 25.00, which is 7.2%, actually looks pretty good. Buyers of the new issue can celebrate!

I have the funny feeling I’m going to be telling this story quite a bit over the next few years, until my Assiduous Readers get fed up to the back teeth with the thing. But really: a market drop of 14.5% between announcement and closing? If I don’t cite the example when I tell the story, nobody will believe me.

In fact, I have a sneaking suspicion that the only person telling this story more often than me will be Scott Burrows, Pembina’s CFO. “Yes, sir”, he’ll say, drawling a little to emphasize his good old-fashioned common sense, “When the dealers approached me about a bought deal, I suddenly realized that my big toe had been hurting all day. Something terrible! And when my big toe hurts that much for so long, it means only one thing: the market’s about to drop by 14.5%. So I didn’t waste any time! I got that puppy out the door as fast as the agreement could be printed! I printed it backwards, so I could sign on the dotted line while waiting for the job to finish!”

And, oh, how I wish I could be a fly on the wall during his next performance and salary review. “Mick”, he’ll say to Michael Dilger, CEO, “Remember that $170-million preferred share issue I pushed out just before the market dropped 14.5%? Well, I’ve been doing some figuring, and I figure that gave the company a trading gain of a little under $25-million, mainly out of the pockets of the Big Banks, right out of the box. I couldn’t believe it when the first headhunter told me that, but when the third one called and casually mentioned it in the course of completely innocent conversation, I just had to check the numbers myself. Interesting, eh?”

Vital Statistics are:

| PPL.PR.K | FixedReset | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-01-15 Maturity Price : 22.38 Evaluated at bid price : 23.20 Bid-YTW : 6.20 % |

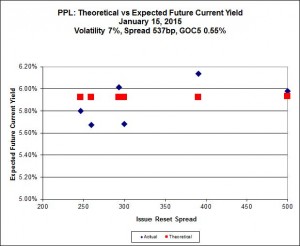

Implied Volatility of the PPL series provides some food for thought:

The Implied Volatility of 7% is dramatically lower than the 22% calculated on the announcement date. This may be ascribed to the following changes in price for the PPL FixedReset series:

| Change in PPL FR Prices 1/6 – 1/15 |

||||

| Ticker | Spread | Price 1/6 |

Price 1/15 |

Change |

| PPL.PR.A | 247 | 15.66 | 13.02 | -16.9% |

| PPL.PR.C | 260 | 16.50 | 13.88 | -15.9% |

| PPL.PR.E | 300 | 18.60 | 15.62 | -16.0% |

| PPL.PR.G | 294 | 17.72 | 14.51 | -18.1% |

| PPL.PR.I | 391 | 20.60 | 18.17 | -11.8% |

| PPL.PR.K | 500 | “25.00” | 23.20 | -7.2% |

So we verify that the drop in Implied Volatility can be ascribed to outperformance of the higher-spread issues. This is a mathematical equivalence, but it’s always good to check!

What surprises me, though is just how different the PPL Implied Volatility is from other series – the TD series, for example, discussed in the post New Issue: NA FixedReset, 5.60%+490, has an Implied Volatility of 29%.

It may have something to do with credit or, more precisely, credit perception. Assiduous Readers will be aware that the BAM series of FixedResets consistently has a lower Implied Volatility than the other series examined regularly; given that unreasonably high levels of Implied Volatility are associated with expectations of directionality in future prices, there might be a connection. Just how this might be explained and proven, however, is another question.

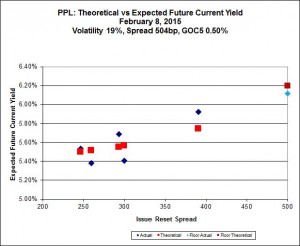

Update, 2016-2-8: It seems to have settled in-line with other issues at 23.50.

seriously. 5.75 coupon, 5.75 floor, 5.00 reset. what more does the market want? 5y yields are near zero and they want more MORE MORE!!!! we must be near a bottom.

what more does the market want?

Good credit quality?

I’ve updated the Implied Volatility analysis – it seems to be more or less reasonable compared to its siblings, provided one keeps in mind that Implied Volatility is extremely high for almost all series of FixedResets.