Treasuries continued to climb today:

Treasury 10-year notes gained, pushing yields near a one-year low, as Federal Reserve Chair Janet Yellen stuck to her call for gradual interest-rate increases.

Government bonds are surging this year as turmoil in equity and commodity markets boosts demand for fixed-income assets amid concern that global growth is slowing. Declining inflation expectations have supported longer-dated Treasuries, with the gap between yields on two-year notes and 10-year securities falling to the lowest in more than eight years. An auction of 10-year notes drew the lowest yield since 2012.

Yellen emphasized the Fed’s intent to hike rates; the schedule is up in the air:

In presenting the Fed’s semi-annual economic report to Congress, Yellen said the turbulence had “significantly” tightened financial conditions by pushing down stock prices, pushing up the dollar and raising some borrowing costs.

“These developments, if they prove persistent, could weigh on the outlook for economic activity and the labor market,” she told the House Financial Services Committee.

Yellen though made clear that the policy-setting Federal Open Market Committee remains committed to gradually raising rates, after increasing them in December for the first time in nine years.

“I do not expect the FOMC is going to be soon in a situation where it’s necessary to cut rates,” she added.

… and she suggested laws need to be clarified to allow for negative rates:

The Federal Reserve has not yet determined whether it would be able to legally implement negative interest rates in the U.S., Chair Janet Yellen said.

“I would say that remains a question that we still would need to investigate more thoroughly,” Yellen said Wednesday in response to questions from the House Financial Services Committee in Washington. “I am not aware of anything that would prevent us from doing it, but I’m saying we have not fully investigated the legal issues — that still needs to be done.”

A 2010 staff memo posted on the central bank’s website late last month cast doubt on whether the law that authorized the Fed to pay interest on excess reserves, or IOER, also would grant it the authority to charge interest.

DBRS put Algonquin Power & Utilities Corp. on Review-Developing; I have updated the post regarding S&P’s negative outlook.

It was a mixed day for the Canadian preferred share market, with PerpetualDiscounts gaining 16bp, FixedResets off 79bp and DeemedRetractibles up 38bp. The Performance Highlights table highlights very poor performance from the FTS issues, presumably as a result of worries regarding their credit quality. Volume was slightly below average.

PerpetualDiscounts now yield 5.85%, equivalent to 7.60% interest at the standard equivalency factor of 1.3x. Long corporates now yield about 4.1% (maybe a little more) so the pre-tax interest-equivalent spread (in this context, the “Seniority Spread”) is now about 350bp, a significant increase from the 335bp reported February 3.

For as long as the FixedReset market is so violently unsettled, I’ll keep publishing updates of the more interesting and meaningful series of FixedResets’ Implied Volatilities. This doesn’t include Enbridge because although Enbridge has a large number of issues outstanding, all of which are quite liquid, the range of Issue Reset Spreads is too small for decent conclusions. The low is 212bp (ENB.PR.H; second-lowest is ENB.PR.D at 237bp) and the high is a mere 268 for ENB.PF.G.

Remember that all rich /cheap assessments are:

» based on Implied Volatility Theory only

» are relative only to other FixedResets from the same issuer

» assume constant GOC-5 yield

» assume constant Implied Volatility

» assume constant spread

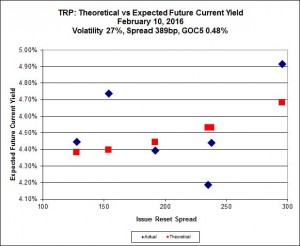

Here’s TRP:

TRP.PR.E, which resets 2019-10-30 at +235, is bid at 16.90 to be $1.28 rich, while TRP.PR.G, resetting 2020-11-30 at +296, is $0.87 cheap at its bid price of 17.50.

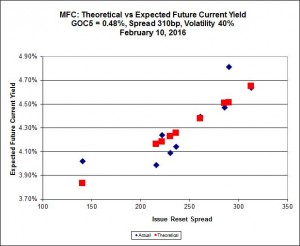

Most expensive is MFC.PR.L, resetting at +216bp on 2019-6-19, bid at 16.55 to be 0.69 rich, while MFC.PR.G, resetting at +290bp on 2016-12-19, is bid at 17.56 to be 1.18 cheap.

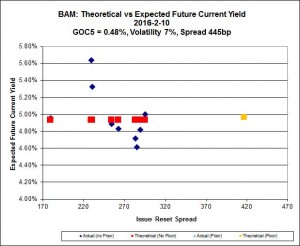

The cheapest issue relative to its peers is BAM.PR.R, resetting at +230bp on 2016-6-30, bid at 12.33 to be $1.77 cheap. BAM.PF.F, resetting at +286bp on 2019-9-30 is bid at 18.10 and appears to be $1.16 rich.

FTS.PR.K, with a spread of +205bp, and bid at 15.21, looks $0.34 expensive and resets 2019-3-1. FTS.PR.G, with a spread of +213bp and resetting 2018-9-1, is bid at 14.65 and is $0.61 cheap.

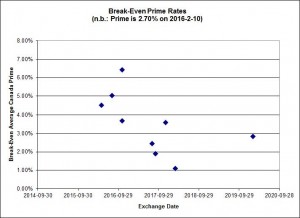

Investment-grade pairs predict an average three-month bill yield over the next five-odd years of -1.01%, with one outlier below -2.00% and one above 0.00%. Note that the range of the y-axis has changed. There are two junk outliers above 0.00%.

Shall we just say that this exhibits a high level of confidence in the continued rapacity of Canadian banks?

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 5.29 % | 6.43 % | 17,068 | 16.14 | 1 | 0.0000 % | 1,474.7 |

| FixedFloater | 7.69 % | 6.72 % | 24,685 | 15.52 | 1 | 0.0000 % | 2,584.5 |

| Floater | 4.69 % | 4.83 % | 72,175 | 15.77 | 4 | 0.4736 % | 1,635.3 |

| OpRet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1177 % | 2,714.3 |

| SplitShare | 4.87 % | 6.18 % | 76,727 | 2.69 | 6 | 0.1177 % | 3,176.3 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1177 % | 2,478.3 |

| Perpetual-Premium | 5.89 % | 5.90 % | 85,981 | 13.96 | 6 | -0.2742 % | 2,504.5 |

| Perpetual-Discount | 5.80 % | 5.85 % | 98,174 | 14.06 | 33 | 0.1618 % | 2,489.9 |

| FixedReset | 5.64 % | 4.92 % | 215,194 | 14.51 | 83 | -0.7949 % | 1,800.3 |

| Deemed-Retractible | 5.33 % | 5.82 % | 126,305 | 6.90 | 34 | 0.3756 % | 2,534.2 |

| FloatingReset | 3.09 % | 4.86 % | 49,092 | 5.54 | 16 | -1.3974 % | 1,966.8 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| PWF.PR.Q | FloatingReset | -24.47 % | Not real; there was no trading today. Not a single share. In fact, the issue hasn’t traded since February 5, so maybe the market maker took the day off. But I have not checked whether this lamentable state of affairs is due to inadequate Toronto Stock Exchange reporting or inadequate Toronto Stock Exchange supervision of market-makers.

YTW SCENARIO |

| BAM.PF.E | FixedReset | -6.96 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 15.50 Evaluated at bid price : 15.50 Bid-YTW : 5.54 % |

| FTS.PR.G | FixedReset | -5.48 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 14.65 Evaluated at bid price : 14.65 Bid-YTW : 4.92 % |

| FTS.PR.M | FixedReset | -4.85 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 16.89 Evaluated at bid price : 16.89 Bid-YTW : 4.87 % |

| FTS.PR.K | FixedReset | -4.34 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 15.21 Evaluated at bid price : 15.21 Bid-YTW : 4.71 % |

| TRP.PR.C | FixedReset | -4.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 10.66 Evaluated at bid price : 10.66 Bid-YTW : 4.98 % |

| TRP.PR.A | FixedReset | -3.80 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 13.66 Evaluated at bid price : 13.66 Bid-YTW : 4.84 % |

| TRP.PR.B | FixedReset | -3.79 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 9.90 Evaluated at bid price : 9.90 Bid-YTW : 4.80 % |

| TRP.PR.E | FixedReset | -3.70 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 16.90 Evaluated at bid price : 16.90 Bid-YTW : 4.68 % |

| CU.PR.C | FixedReset | -3.68 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 15.70 Evaluated at bid price : 15.70 Bid-YTW : 4.76 % |

| TRP.PR.G | FixedReset | -3.58 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 17.50 Evaluated at bid price : 17.50 Bid-YTW : 5.19 % |

| TRP.PR.H | FloatingReset | -3.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 8.70 Evaluated at bid price : 8.70 Bid-YTW : 4.97 % |

| BAM.PR.T | FixedReset | -3.32 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 13.10 Evaluated at bid price : 13.10 Bid-YTW : 5.68 % |

| FTS.PR.H | FixedReset | -3.30 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 12.00 Evaluated at bid price : 12.00 Bid-YTW : 4.42 % |

| GWO.PR.N | FixedReset | -3.26 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 12.15 Bid-YTW : 11.42 % |

| FTS.PR.I | FloatingReset | -2.99 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 9.72 Evaluated at bid price : 9.72 Bid-YTW : 4.91 % |

| SLF.PR.I | FixedReset | -2.79 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 16.75 Bid-YTW : 8.87 % |

| TRP.PR.D | FixedReset | -2.72 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 16.11 Evaluated at bid price : 16.11 Bid-YTW : 4.82 % |

| BAM.PR.X | FixedReset | -2.54 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 11.50 Evaluated at bid price : 11.50 Bid-YTW : 5.51 % |

| HSE.PR.C | FixedReset | -2.46 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 13.88 Evaluated at bid price : 13.88 Bid-YTW : 7.09 % |

| MFC.PR.G | FixedReset | -2.44 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 17.56 Bid-YTW : 8.45 % |

| MFC.PR.F | FixedReset | -2.08 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 11.76 Bid-YTW : 11.87 % |

| MFC.PR.J | FixedReset | -2.01 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 17.59 Bid-YTW : 8.23 % |

| CIU.PR.C | FixedReset | -1.96 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 10.00 Evaluated at bid price : 10.00 Bid-YTW : 4.70 % |

| BAM.PR.R | FixedReset | -1.91 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 12.33 Evaluated at bid price : 12.33 Bid-YTW : 5.88 % |

| BAM.PF.B | FixedReset | -1.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 16.10 Evaluated at bid price : 16.10 Bid-YTW : 5.25 % |

| VNR.PR.A | FixedReset | -1.38 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 16.47 Evaluated at bid price : 16.47 Bid-YTW : 5.25 % |

| RY.PR.J | FixedReset | -1.36 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 18.15 Evaluated at bid price : 18.15 Bid-YTW : 4.60 % |

| BAM.PF.G | FixedReset | -1.35 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 17.60 Evaluated at bid price : 17.60 Bid-YTW : 5.24 % |

| BAM.PR.K | Floater | -1.31 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 9.80 Evaluated at bid price : 9.80 Bid-YTW : 4.88 % |

| PWF.PR.P | FixedReset | -1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 11.70 Evaluated at bid price : 11.70 Bid-YTW : 4.66 % |

| IFC.PR.C | FixedReset | -1.23 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 16.00 Bid-YTW : 9.38 % |

| SLF.PR.G | FixedReset | -1.15 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 12.85 Bid-YTW : 10.79 % |

| W.PR.K | FixedReset | -1.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 22.78 Evaluated at bid price : 24.00 Bid-YTW : 5.50 % |

| BMO.PR.S | FixedReset | 1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 17.19 Evaluated at bid price : 17.19 Bid-YTW : 4.43 % |

| CIU.PR.A | Perpetual-Discount | 1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 19.40 Evaluated at bid price : 19.40 Bid-YTW : 5.95 % |

| BAM.PF.F | FixedReset | 1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 18.10 Evaluated at bid price : 18.10 Bid-YTW : 5.05 % |

| SLF.PR.B | Deemed-Retractible | 1.22 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.62 Bid-YTW : 6.97 % |

| RY.PR.L | FixedReset | 1.22 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.80 Bid-YTW : 3.88 % |

| SLF.PR.A | Deemed-Retractible | 1.32 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.52 Bid-YTW : 6.98 % |

| FTS.PR.F | Perpetual-Discount | 1.40 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 21.54 Evaluated at bid price : 21.80 Bid-YTW : 5.72 % |

| SLF.PR.C | Deemed-Retractible | 1.40 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.30 Bid-YTW : 7.48 % |

| GWO.PR.R | Deemed-Retractible | 1.63 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.24 Bid-YTW : 7.23 % |

| FTS.PR.J | Perpetual-Discount | 1.64 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 21.10 Evaluated at bid price : 21.10 Bid-YTW : 5.75 % |

| GWO.PR.Q | Deemed-Retractible | 1.89 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.68 Bid-YTW : 6.67 % |

| BMO.PR.T | FixedReset | 2.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 16.95 Evaluated at bid price : 16.95 Bid-YTW : 4.38 % |

| TD.PF.A | FixedReset | 2.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 17.10 Evaluated at bid price : 17.10 Bid-YTW : 4.38 % |

| GWO.PR.H | Deemed-Retractible | 2.18 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.60 Bid-YTW : 7.04 % |

| MFC.PR.K | FixedReset | 2.31 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 15.93 Bid-YTW : 9.28 % |

| PWF.PR.A | Floater | 3.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 10.85 Evaluated at bid price : 10.85 Bid-YTW : 4.36 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| HSE.PR.A | FixedReset | 270,860 | RBC crossed 256,900 at 8.25. Nice ticket! At just under one-third of par value! YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 8.30 Evaluated at bid price : 8.30 Bid-YTW : 6.87 % |

| FTS.PR.M | FixedReset | 146,598 | Scotia crossed 20,000 at 17.56 and 111,000 at 17.45. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 16.89 Evaluated at bid price : 16.89 Bid-YTW : 4.87 % |

| BMO.PR.Z | Perpetual-Discount | 106,708 | Nesbitt crossed 50,000 at 22.45; Scotia crossed 47,700 at the same price. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 22.09 Evaluated at bid price : 22.41 Bid-YTW : 5.58 % |

| NA.PR.X | FixedReset | 102,491 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 23.10 Evaluated at bid price : 24.88 Bid-YTW : 5.45 % |

| BMO.PR.Q | FixedReset | 101,900 | Scotia crossed 91,300 at 18.45. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.20 Bid-YTW : 7.58 % |

| BNS.PR.E | FixedReset | 60,415 | TD crossed 23,000 at 25.48; RBC crossed 25,000 at the same price. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-10 Maturity Price : 23.28 Evaluated at bid price : 25.43 Bid-YTW : 5.03 % |

| There were 28 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| PWF.PR.Q | FloatingReset | Quote: 8.12 – 11.75 Spot Rate : 3.6300 Average : 2.7545 YTW SCENARIO |

| BAM.PF.E | FixedReset | Quote: 15.50 – 16.67 Spot Rate : 1.1700 Average : 0.7248 YTW SCENARIO |

| TRP.PR.G | FixedReset | Quote: 17.50 – 18.18 Spot Rate : 0.6800 Average : 0.5011 YTW SCENARIO |

| RY.PR.P | Perpetual-Discount | Quote: 24.25 – 24.74 Spot Rate : 0.4900 Average : 0.3127 YTW SCENARIO |

| PWF.PR.E | Perpetual-Discount | Quote: 23.33 – 23.89 Spot Rate : 0.5600 Average : 0.3847 YTW SCENARIO |

| RY.PR.W | Perpetual-Discount | Quote: 22.50 – 22.98 Spot Rate : 0.4800 Average : 0.3272 YTW SCENARIO |

CIU.PR.C trading at $10. It is PFD 2+, and will likely reset at a yield of 4.6% or so. Reset rate is 136, and so will not likely be called anytime, but if it did, capital gains would be enormous. Am I missing something here, because this seems like a great investment to me?

In a similar vein, BMO.PR.Q, a rate reset with an increment of 115, resetting next month, trading at $18. The kicker is that it is non-NVCC compliant and expected to be called at par in a handful of years.

Bid-YTW : around 7.75%, for a P-2 rating.