The Congressional Budget Office released its Ten Year Outlook for the US Economy, and my-oh-my, but it’s gloomy:

Under an assumption that current laws and policies regarding federal spending and taxation remain the same,

CBO forecasts the following:

- A marked contraction in the U.S. economy in calendar year 2009, with real (inflation-adjusted) gross domestic product (GDP) falling by 2.2 percent.

- A slow recovery in 2010, with real GDP growing by only 1.5 percent.

- An unemployment rate that will exceed 9 percent early in 2010.

- A continued decline in inflation, both because energy

prices have been falling and because inflation excluding energy and food prices—the core rate—tends to ease during and immediately after a recession; for 2009, CBO anticipates that inflation, as measured by the consumer price index for all urban consumers (CPI-U), will be only 0.1 percent.- A drop in the national average price of a home, as measured by the Federal Housing Finance Agency’s purchase-only index, of an additional 14 percent between the third quarter of 2008 and the second quarter of 2010; the imbalance between the supply of and demand for housing persists, as reflected in unusually high vacancy rates and a low volume of housing starts.

- A decrease of more than 1 percent in real consumption in 2009, followed by moderate growth in 2010;

- the rise in unemployment, the loss of wealth, and tight consumer credit will continue to restrain consumption—although lower commodity prices will ease those effects somewhat.

- A financial system that remains strained, although some credit markets have started to improve; it is too early to determine whether the government’s actions to date have been sufficient to put the system on a path to recovery.

There is more commentary by Paul Krugman of the NYT and Menzie Chinn of Econbrowser.

And there are some straws in the wind regarding the future of US bank regulation:

The biggest U.S. banks may face the threat of lower profits or pressure to break up under greater regulation following the financial crisis.

Federal Reserve officials have made tackling the issue of firms that are too big to fail a priority. Options may include banning or restricting activities that could threaten the stability of the financial system, analysts said.

I continue to suggest that there needs to be a clear delineation of the difference between banking and investment banking. We want a rock-solid banking core, a somewhat more exciting layer of investment banking around that, surrounded by a wild-n-wooly world of hedge funds and shadow banks.

To that end, I suggest that capital rules be modified to emphasize the functionality of these layers. Banks buy-and-hold assets. Therefore, trading should attract a higher capital charge for them. Investment banks buy-and-sell assets. Therefore, aging assets should attract a higher capital charge for them. And, perhaps, hedging inefficiencies should be recognized such that a long and short hedge will attract a small, but non-zero, capital charge on the gross position.

There are indications that the CP market in the US is recovering:

Corporate borrowing in the commercial paper market expanded to the highest level since before Lehman Brothers Holdings Inc. filed for bankruptcy in September as companies took advantage of the lowest rates on record.

U.S. commercial paper outstanding rose $83.1 billion, or 4.9 percent, during the week ended Jan. 7 to a seasonally adjusted $1.76 trillion, the Federal Reserve said today in Washington. That’s the highest since the week ended Sept. 10, five days before Lehman’s filing.

Julia Dickson, OSFI Superintendent, gave a speech on regulatory pro-cyclicity, but there is not much substance to it.

Watson Wyatt has released some cheerful analysis:

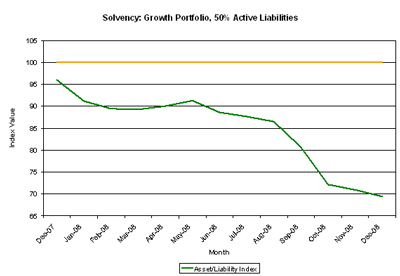

Market declines caused by the global financial crisis have left the solvency of Canadian defined benefit (DB) pension plans at historical lows and defined contribution (DC) plan members with shrinking retirement savings, according to an analysis by Watson Wyatt Worldwide, a leading global consulting firm.

The pension solvency funded ratio (the ratio of market value of plan assets to plan solvency liabilities) of the typical pension plan declined 27 percentage points in 2008, dropping from 96 percent at the beginning of the year to 69 percent at year-end. Watson Wyatt’s Pension Barometer, which reflects the combined impact of investment performance and interest rates on the solvency funded ratio of a typical Canadian pension plan, indicates that the funded status of the typical pension plan decreased 11 percentage points in the fourth quarter alone.

PerpetualDiscounts managed to stagger to another gain today, with some evidence that the market is becoming a little (just a little!) less sloppy. To my surprise, Fixed-Resets also did very well.

I’m almost finished fiddling with the format of the performance table, and am about to commence fiddling with the volume table. Once I’m happy with the machine-generated tables, I’ll be adding the occasional comment, as I did way back in 2008. Assiduous Readers will have no idea how happy I am that the drudgery of table preparation is now computerized …

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 6.95 % | 7.46 % | 29,065 | 13.58 | 2 | 1.4639 % | 877.3 |

| FixedFloater | 7.38 % | 7.11 % | 147,810 | 13.60 | 8 | 1.7415 % | 1,386.5 |

| Floater | 5.39 % | 5.15 % | 34,132 | 15.27 | 4 | 3.1073 % | 1,132.1 |

| OpRet | 5.35 % | 4.66 % | 124,934 | 3.87 | 15 | 0.4597 % | 2,007.8 |

| SplitShare | 6.10 % | 8.71 % | 82,094 | 4.19 | 15 | -0.6397 % | 1,821.5 |

| Interest-Bearing | 7.16 % | 11.53 % | 44,918 | 0.93 | 2 | 0.0000 % | 1,975.8 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1175 % | 1,555.3 |

| Perpetual-Discount | 6.88 % | 6.94 % | 239,673 | 12.59 | 71 | 0.1175 % | 1,432.4 |

| FixedReset | 5.90 % | 4.95 % | 741,157 | 15.15 | 18 | 0.4615 % | 1,807.9 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| MFC.PR.C | Perpetual-Discount | -3.59 % | Yield-to-Worst (at Bid) : 6.73 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 16.93 Evaluated at bid price : 16.93 |

| ELF.PR.G | Perpetual-Discount | -3.46 % | Yield-to-Worst (at Bid) : 8.26 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 14.50 Evaluated at bid price : 14.50 |

| FBS.PR.B | SplitShare | -3.39 % | Yield-to-Worst (at Bid) : 10.85 % YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2011-12-15 Maturity Price : 10.00 Evaluated at bid price : 8.55 |

| SBC.PR.A | SplitShare | -3.26 % | Yield-to-Worst (at Bid) : 10.68 % YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2012-11-30 Maturity Price : 10.00 Evaluated at bid price : 8.32 |

| CU.PR.A | Perpetual-Discount | -3.22 % | Yield-to-Worst (at Bid) : 6.60 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 21.93 Evaluated at bid price : 22.26 |

| DF.PR.A | SplitShare | -3.00 % | Yield-to-Worst (at Bid) : 8.06 % YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2014-12-01 Maturity Price : 10.00 Evaluated at bid price : 8.74 |

| CIU.PR.A | Perpetual-Discount | -2.64 % | Yield-to-Worst (at Bid) : 7.22 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 16.21 Evaluated at bid price : 16.21 |

| SLF.PR.C | Perpetual-Discount | -2.38 % | Yield-to-Worst (at Bid) : 7.42 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 15.16 Evaluated at bid price : 15.16 |

| LFE.PR.A | SplitShare | -2.14 % | Yield-to-Worst (at Bid) : 7.90 % YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2012-12-01 Maturity Price : 10.00 Evaluated at bid price : 9.15 |

| BNS.PR.K | Perpetual-Discount | -2.11 % | Yield-to-Worst (at Bid) : 6.65 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 18.11 Evaluated at bid price : 18.11 |

| BCE.PR.C | FixedFloater | -1.95 % | Yield-to-Worst (at Bid) : 7.45 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 25.00 Evaluated at bid price : 15.61 |

| BNS.PR.Q | FixedReset | -1.94 % | Yield-to-Worst (at Bid) : 4.50 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 21.69 Evaluated at bid price : 21.73 |

| PWF.PR.K | Perpetual-Discount | -1.89 % | Yield-to-Worst (at Bid) : 7.04 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 17.66 Evaluated at bid price : 17.66 |

| ENB.PR.A | Perpetual-Discount | -1.66 % | Yield-to-Worst (at Bid) : 5.86 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 23.48 Evaluated at bid price : 23.75 |

| FTN.PR.A | SplitShare | -1.41 % | Yield-to-Worst (at Bid) : 8.47 % YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2015-12-01 Maturity Price : 10.00 Evaluated at bid price : 8.39 |

| BNA.PR.B | SplitShare | -1.29 % | Yield-to-Worst (at Bid) : 9.00 % YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2016-03-25 Maturity Price : 25.00 Evaluated at bid price : 19.90 |

| SLF.PR.B | Perpetual-Discount | -1.19 % | Yield-to-Worst (at Bid) : 7.30 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 16.61 Evaluated at bid price : 16.61 |

| CL.PR.B | Perpetual-Discount | -1.12 % | Yield-to-Worst (at Bid) : 7.18 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 22.01 Evaluated at bid price : 22.01 |

| NA.PR.L | Perpetual-Discount | -1.09 % | Yield-to-Worst (at Bid) : 7.06 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 17.20 Evaluated at bid price : 17.20 |

| NA.PR.M | Perpetual-Discount | -1.09 % | Yield-to-Worst (at Bid) : 7.20 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 20.85 Evaluated at bid price : 20.85 |

| NA.PR.K | Perpetual-Discount | -1.02 % | Yield-to-Worst (at Bid) : 7.18 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 20.40 Evaluated at bid price : 20.40 |

| RY.PR.W | Perpetual-Discount | -1.01 % | Yield-to-Worst (at Bid) : 6.37 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 19.55 Evaluated at bid price : 19.55 |

| CM.PR.I | Perpetual-Discount | -1.01 % | Yield-to-Worst (at Bid) : 7.10 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 16.62 Evaluated at bid price : 16.62 |

| PPL.PR.A | SplitShare | 1.00 % | Yield-to-Worst (at Bid) : 7.89 % YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2012-12-01 Maturity Price : 10.00 Evaluated at bid price : 9.05 |

| PWF.PR.H | Perpetual-Discount | 1.05 % | Yield-to-Worst (at Bid) : 7.14 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 20.21 Evaluated at bid price : 20.21 |

| CM.PR.D | Perpetual-Discount | 1.05 % | Yield-to-Worst (at Bid) : 7.16 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 20.16 Evaluated at bid price : 20.16 |

| CM.PR.J | Perpetual-Discount | 1.06 % | Yield-to-Worst (at Bid) : 6.94 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 16.28 Evaluated at bid price : 16.28 |

| RY.PR.N | FixedReset | 1.16 % | Yield-to-Worst (at Bid) : 5.62 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 25.20 Evaluated at bid price : 25.25 |

| NA.PR.N | FixedReset | 1.17 % | Yield-to-Worst (at Bid) : 4.89 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 21.36 Evaluated at bid price : 21.66 |

| BNS.PR.R | FixedReset | 1.18 % | Yield-to-Worst (at Bid) : 4.74 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 21.50 Evaluated at bid price : 21.50 |

| ALB.PR.A | SplitShare | 1.19 % | Yield-to-Worst (at Bid) : 12.75 % YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2011-02-28 Maturity Price : 25.00 Evaluated at bid price : 21.27 |

| BAM.PR.H | OpRet | 1.19 % | Yield-to-Worst (at Bid) : 11.59 % YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2012-03-30 Maturity Price : 25.00 Evaluated at bid price : 21.25 |

| POW.PR.C | Perpetual-Discount | 1.32 % | Yield-to-Worst (at Bid) : 6.81 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 21.44 Evaluated at bid price : 21.44 |

| BCE.PR.I | FixedFloater | 1.33 % | Yield-to-Worst (at Bid) : 7.11 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 25.00 Evaluated at bid price : 15.97 |

| CM.PR.P | Perpetual-Discount | 1.41 % | Yield-to-Worst (at Bid) : 7.12 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 19.40 Evaluated at bid price : 19.40 |

| RY.PR.F | Perpetual-Discount | 1.43 % | Yield-to-Worst (at Bid) : 6.37 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 17.76 Evaluated at bid price : 17.76 |

| SLF.PR.A | Perpetual-Discount | 1.50 % | Yield-to-Worst (at Bid) : 7.08 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 16.96 Evaluated at bid price : 16.96 |

| TCA.PR.X | Perpetual-Discount | 1.59 % | Yield-to-Worst (at Bid) : 6.26 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 43.77 Evaluated at bid price : 44.70 |

| PWF.PR.M | FixedReset | 1.63 % | Yield-to-Worst (at Bid) : 5.43 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 24.85 Evaluated at bid price : 24.90 |

| BNA.PR.C | SplitShare | 1.77 % | Yield-to-Worst (at Bid) : 18.76 % YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2019-01-10 Maturity Price : 25.00 Evaluated at bid price : 9.20 |

| CM.PR.A | OpRet | 1.84 % | Yield-to-Worst (at Bid) : -21.17 % YTW SCENARIO Maturity Type : Call Maturity Date : 2009-02-07 Maturity Price : 25.50 Evaluated at bid price : 26.01 |

| RY.PR.A | Perpetual-Discount | 1.91 % | Yield-to-Worst (at Bid) : 6.23 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 18.15 Evaluated at bid price : 18.15 |

| POW.PR.A | Perpetual-Discount | 1.93 % | Yield-to-Worst (at Bid) : 7.23 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 19.50 Evaluated at bid price : 19.50 |

| RY.PR.C | Perpetual-Discount | 2.06 % | Yield-to-Worst (at Bid) : 6.39 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 18.30 Evaluated at bid price : 18.30 |

| BAM.PR.M | Perpetual-Discount | 2.14 % | Yield-to-Worst (at Bid) : 9.71 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 12.41 Evaluated at bid price : 12.41 |

| BCE.PR.Y | Ratchet | 2.17 % | Yield-to-Worst (at Bid) : 7.94 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 25.00 Evaluated at bid price : 14.10 |

| BAM.PR.K | Floater | 2.18 % | Yield-to-Worst (at Bid) : 5.98 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 10.33 Evaluated at bid price : 10.33 |

| RY.PR.L | FixedReset | 2.23 % | Yield-to-Worst (at Bid) : 4.95 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 24.70 Evaluated at bid price : 24.75 |

| BAM.PR.B | Floater | 2.31 % | Yield-to-Worst (at Bid) : 6.07 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 10.19 Evaluated at bid price : 10.19 |

| BNS.PR.O | Perpetual-Discount | 2.38 % | Yield-to-Worst (at Bid) : 6.54 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 21.50 Evaluated at bid price : 21.50 |

| TCA.PR.Y | Perpetual-Discount | 2.40 % | Yield-to-Worst (at Bid) : 6.25 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 43.78 Evaluated at bid price : 44.76 |

| LBS.PR.A | SplitShare | 2.82 % | Yield-to-Worst (at Bid) : 9.45 % YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2013-11-29 Maturity Price : 10.00 Evaluated at bid price : 8.40 |

| BAM.PR.I | OpRet | 2.96 % | Yield-to-Worst (at Bid) : 10.32 % YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2013-12-30 Maturity Price : 25.00 Evaluated at bid price : 20.50 |

| BCE.PR.G | FixedFloater | 3.23 % | Yield-to-Worst (at Bid) : 7.02 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 25.00 Evaluated at bid price : 16.00 |

| BCE.PR.Z | FixedFloater | 3.35 % | Yield-to-Worst (at Bid) : 7.59 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 25.00 Evaluated at bid price : 15.10 |

| BCE.PR.A | FixedFloater | 3.42 % | Yield-to-Worst (at Bid) : 6.87 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 25.00 Evaluated at bid price : 16.92 |

| PWF.PR.A | Floater | 3.52 % | Yield-to-Worst (at Bid) : 4.79 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 12.95 Evaluated at bid price : 12.95 |

| BAM.PR.N | Perpetual-Discount | 3.98 % | Yield-to-Worst (at Bid) : 9.61 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 12.54 Evaluated at bid price : 12.54 |

| TRI.PR.B | Floater | 4.17 % | Yield-to-Worst (at Bid) : 5.15 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 11.99 Evaluated at bid price : 11.99 |

| IAG.PR.A | Perpetual-Discount | 4.67 % | Yield-to-Worst (at Bid) : 6.64 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 17.50 Evaluated at bid price : 17.50 |

| BAM.PR.G | FixedFloater | 5.16 % | Yield-to-Worst (at Bid) : 9.73 % YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-01-08 Maturity Price : 25.00 Evaluated at bid price : 11.83 |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| BNA.PR.C | SplitShare | 493,445 | |

| BAM.PR.B | Floater | 390,981 | |

| BAM.PR.O | OpRet | 133,637 | |

| WFS.PR.A | SplitShare | 119,635 | |

| IGM.PR.A | OpRet | 82,856 | |

| MFC.PR.A | OpRet | 77,885 | |

| GWO.PR.X | OpRet | 75,713 | |

| BCE.PR.A | FixedFloater | 52,541 | |

| SBC.PR.A | SplitShare | 50,800 | |

| RY.PR.N | FixedReset | 37,805 | |

| LBS.PR.A | SplitShare | 37,200 | |

| BMO.PR.J | Perpetual-Discount | 32,815 | |

| RY.PR.I | FixedReset | 31,158 | |

| SBN.PR.A | SplitShare | 28,000 | |

| SLF.PR.C | Perpetual-Discount | 25,808 | |

| CM.PR.I | Perpetual-Discount | 25,731 | |

| RY.PR.D | Perpetual-Discount | 24,155 | |

| TD.PR.O | Perpetual-Discount | 24,100 | |

| CM.PR.J | Perpetual-Discount | 22,930 | |

| TD.PR.C | FixedReset | 21,025 | |

| BMO.PR.H | Perpetual-Discount | 20,121 | |

| GWO.PR.I | Perpetual-Discount | 19,700 | |

| RY.PR.H | Perpetual-Discount | 18,350 | |

| CM.PR.H | Perpetual-Discount | 17,238 | |

| BNS.PR.O | Perpetual-Discount | 16,905 | |

| CM.PR.D | Perpetual-Discount | 16,390 | |

| RY.PR.W | Perpetual-Discount | 15,600 | |

| RY.PR.A | Perpetual-Discount | 13,665 | |

| GWO.PR.G | Perpetual-Discount | 13,475 | |

| RY.PR.B | Perpetual-Discount | 13,290 | |

| TD.PR.R | Perpetual-Discount | 13,065 | |

| CU.PR.B | Perpetual-Discount | 12,650 | |

| POW.PR.B | Perpetual-Discount | 11,600 | |

| CM.PR.P | Perpetual-Discount | 11,121 | |

| GWO.PR.E | OpRet | 10,981 | |

| CM.PR.G | Perpetual-Discount | 10,800 | |

| RY.PR.F | Perpetual-Discount | 10,750 | |

| ELF.PR.G | Perpetual-Discount | 10,512 | |

| SLF.PR.B | Perpetual-Discount | 10,085 | |

| LFE.PR.A | SplitShare | 10,000 | |

Suggest changing “Yield-to-Worst (at Bid)” to just “YTW (at Bid)”:

YTW (at Bid) : 9.73 %

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-01-08

Maturity Price : 25.00

Evaluated at bid price : 11.83

Suggest changing “Yield-to-Worst (at Bid)” to just “YTW (at Bid)”:

The sound you just heard was me slapping my forehead.