The Cleveland Fed has released their Economic Trends, April 2009, with a variety of data and statistics.

Items of note are:

- February Price Statistics

- Financial Markets, Money, and Monetary Policy

- The Yield Curve, March 2009

- New Policy Moves and the Term Asset-Backed Securities Loan Facility

- International Markets

- China, SDRs, and the Dollar

- Economic Activity and Labor Markets

- U.S. Real Estate: Looking for Progress in Price Stability and Financing

- Real GDP: Fourth Quarter 2008 Final Estimate

- March Employment Situation

- An Overview of the Healthcare System

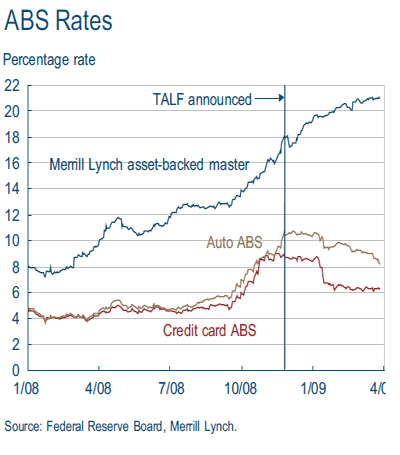

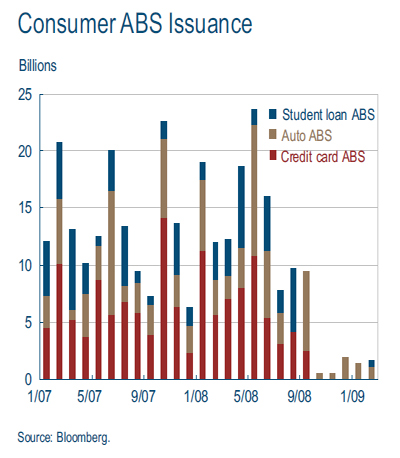

There were some good charts in the article on the TALF:

The TALF is designed to support the issuance of asset-backed securities (ABS) collateralized by student loans, auto loans, credit card loans, and loans guaranteed by the Small Business Administration.

…

Since the beginning of the financial crisis, however, those ABS markets have been under strain. With the strain accelerating in the third quarter of 2008, the market came to a near-complete halt—the chart below shows the dramatic drop in the issuance of new consumer ABSs.

Under the TALF, the Federal Reserve Bank of New York will provide nonrecourse funding to any eligible borrower owning eligible collateral. On a fixed day each month, borrowers will be able to request one or more three-year TALF loans. As the loan is nonrecourse, if the borrower does not repay the loan, the New York Fed will enforce its rights to the collateral.

Th ree requirements are intended to protect the Fed from the risk of losses. First, the ABS must have the highest investment-grade rating category from two or more major nationally recognized statistical rating organizations. Th is requirement should reduce the risk that the ABSs accepted will fall dramatically in value. Second, borrowers will pay a risk premium set to a margin above the Libor (usually 1 percent). Th ird, “haircuts” ranging from 5 percent to 15 percent will be fi gured into the loans. Th at is, the amount the TALF will extend a loan for can be only as high as the par or market value of the ABS minus the haircut. Th is requirement means that if the borrower defaults on the loan and the Fed seizes the collateral, the Fed loses nothing unless the value of the collateral has fallen more than the haircut.