The Bank of Canada has announced the release of its April 2009 Monetary Policy Report:

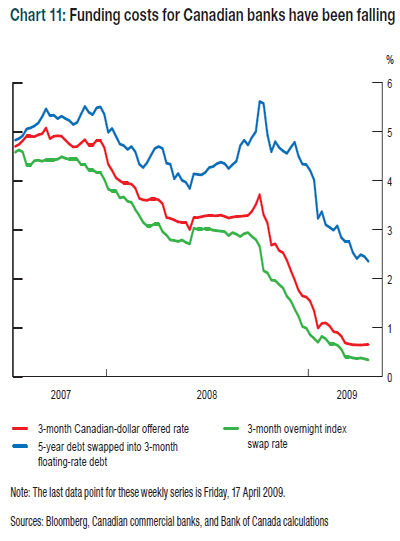

In the January Update, the Bank projected a sharp recession in Canada, followed by a relatively muted recovery starting in the third quarter of this year. As a result of the more severe, synchronized nature of the global downturn, the recession in Canada is even deeper than anticipated. As well, the Bank now expects the recovery to be delayed until the fourth quarter of 2009 and to be more gradual than projected in January. Nonetheless, the Bank is still projecting a rebound to above-potential growth in 2010, albeit with a lower estimate of potential output growth. As explained in January, the recovery should be supported by a number of factors, including the timeliness and scale of the Bank’s monetary policy response; our relatively well-functioning financial system and the gradual improvement in financial conditions in Canada; the past depreciation of the Canadian dollar; stimulative fiscal policy measures; the gradual rebound in external demand; the strength of Canadian household, business, and bank balance sheets; and the end of the stock adjustments in Canadian and U.S. residential housing.

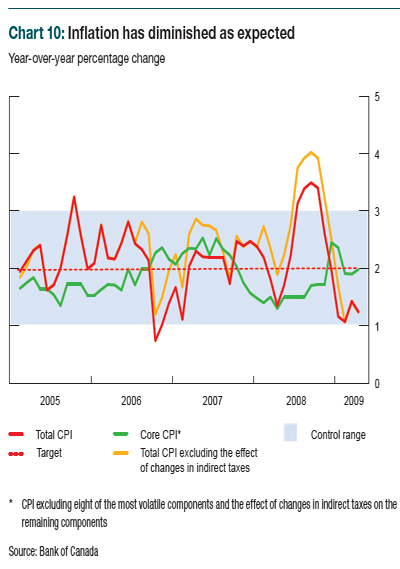

Inflation remains under control:

and they note that:

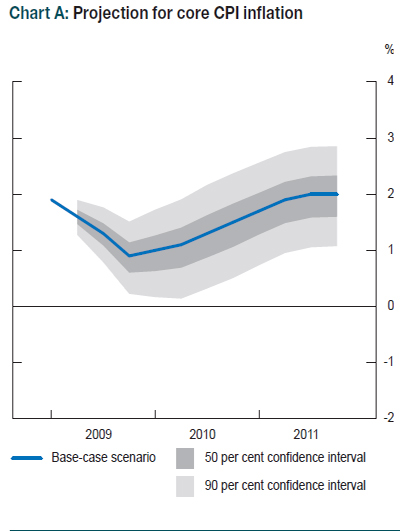

There was also a backgrounder on fan charts; these were recommended as a means of Central Bank communication by Michael Woodford of Columbia, as discussed on PrefBlog on January 17, 2008. These are used to indicate the degree of uncertainty in predictions: