Excess bank reserves at the Fed were last discussed on PrefBlog when reviewing a New York Fed working paper titled Why are banks holding so many excess reserves?.

The Federal Reserve Bank of Cleveland has released the Econotrends, January 2010 with an interesting article by John B. Carlson and John Lindner titled Treasury Deposits and Excess Bank Reserves:

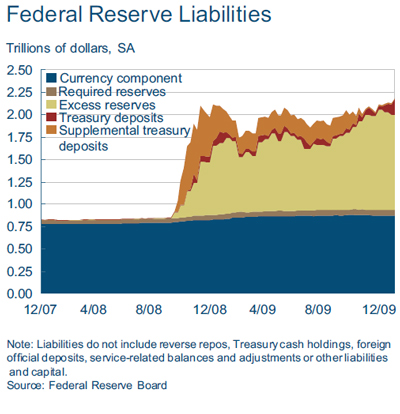

An interesting development on the Federal Reserve’s balance sheet is a decline in excess bank reserves. Th is decline has occurred despite an increase in the overall size of the Fed’s balance sheet. Th e key factor accounting for the decline in excess reserves is a substantial increase in U.S. treasury deposits at the Fed, which were made as a consequence of having issued new debt. When the treasury issues debt to the public and deposits the proceeds at the Fed in its general account, bank reserves decline. In normal times, the treasury typically holds some proceeds in Treasury Tax and Loan accounts at commercial banks, which keeps reserves in the banking system. Th is arrangement helps maintain a steady supply of reserves—a desirable outcome for when the Fed sought to keep the fed funds rate near a target rate.

Following the collapse of Lehman Brothers in September 2008, the Federal Reserve instituted a number of policies that sharply increased bank reserves in excess of required levels. Initially, the Fed sought to absorb most of the new reserves in order to keep the fed funds rate near its target rate. To help in this eff ort, the treasury issued short-term debt at special auctions (called the Supplementary Financing Program or SFP) and placed the proceeds in a new supplemental treasury account at the Federal Reserve. Still, the amount of reserves absorbed could not keep up with the amount of bank reserves that were being created with the Fed’s new credit policies. Subsequently, the fed funds target was lowered to zero, and the immediate need to absorb reserves abated.

In late 2009 the total level of treasury debt approached the limit authorized by Congress. As the SFP issues matured, the SFP deposits were used to redeem them, and excess reserves increased. In December Congress raised the debt ceiling, allowing the treasury to issue new debt. Th is time, the treasury deposited much of the proceeds into its general account with the Fed, which caused the observed decline in excess reserves.