Moody’s has downgraded Greece one notch:

Greece had its credit rating cut one step by Moody’s Investors Service as the government’s debt servicing costs surge on concern that the country will struggle to reduce its budget deficit.

Moody’s lowered the rating to A3 from A2, four grades above junk, the company said in a statement today. Moody’s also put a “negative” outlook on Greek debt, indicating it’s more likely to cut it again than raise it or leave it unchanged.

“This decision is based on Moody’s view that there is a significant risk that debt may only stabilize at a higher and more costly level than previously estimated,” a team led by Pierre Cailleteau in London said in the statement.

The Bank of Canada has released its April 2010 Monetary Policy Report:

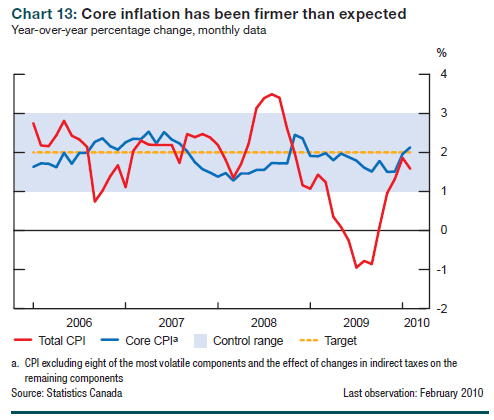

Core infl ation has been firmer than projected in January, the result of both transitory and more fundamental factors. Although core infl ation was expected to remain relatively stable over the near term, it rose from 1.5 per cent in November to 2.1 per cent in February (Chart 13). This upward movement partly refl ects transitory factors, such as the unusual pricing pattern for new passenger vehicles since the introduction of the 2010 models into the CPI in November, and the surge in the price of travel accommodation associated with the 2010 Winter Olympics in Vancouver.

More broadly, the firmness of core inflation over the past year, despite the large amount of excess supply in the economy, refl ects the resilience in the prices of some components of core services, including a significant rise income regulated prices (e.g., communications, tuition fees, and cable services). This resilience refl ects the slower-than-anticipated deceleration in wages, since labour costs represent a large portion of total production costs in core services. Shelter prices have also increased at a faster-than-expected rate, refl ecting the more rapid rebound in housing demand as households pulled forward some of their expenditures.

SEC boss Mary Schapiro has denied the Goldman charges are politically motivated:

“The SEC is an independent law enforcement agency. We do not coordinate our enforcement actions with the White House, Congress or political committees. We do not time our cases around political events or the legislative calendar.

“The fact is that regulatory reform has been pending for over a year. We have brought many cases related to the financial crisis over that period.

“On a personal level, I am disappointed by the rhetoric.

Yesterday, Lloyd Blankfein attacked the SEC’s fraud suit in calls to Goldman clients–describing it as a political hit job that will ultimately hurt the country.

He also brought up the exculpatory evidence that the SEC left out of its complaint, saying that a staffer of the supposedly swindled ACA knew that Paulson & Co. was planning to go short the Abacus CDO.

This case might even go to trial!

[The Financial Times] said that in conversations with private equity executives and others, Blankfein left clients with an impression he is eager to fight the case in court.

I hope so – it would be marvellous to see a rebuff of regulatory extortion. But given the highly unequal risks experienced by the two parties, a settlement of some kind seems more likely – that’s why regulatory extortion works in the first place, right?

Former (Republican) SEC boss Harvey Pitt thinks the SEC is taking a big risk:

this SEC litigation takes it places it hasn’t been before—

• challenging the premier firm of Goldman Sachs,

• about a synthetic derivative transaction,

• on which Goldman lost millions of dollars,

• where the parties were sophisticated and not in obvious need of SEC protection,

• after a year-and-a-half investigation,

• filed immediately after the President threatened vetoing financial reform legislation that doesn’t strongly regulate derivatives,

• and a few hours before release of the Inspector General’s Report on SEC inadequacies in attacking Alan Stanford’s Ponzi scheme,

• but apparently without giving Goldman advance notice of the filing,

• or exploring possible settlement, and

• splitting 3-2 along political lines in a major enforcement action.

What do I think? It can hardly have been something so overt as a call from Comrade Peace Prize ordering Schapiro to take down Goldman. That would be sufficiently unethical that neither party would have anything to do with such a thing (maybe). But a lot can be done with nods and winks … the SEC desperately needs a scalp … and Goldman – as the sole major investment bank to get through the crisis without blowing up – is the most luxuriant one out there.

There’s more commentary on the BNN Blog (hat tip: Assiduous Reader MS):

But after trillions of dollars in destroyed value, the near collapse of the global financial markets, millions in lost jobs and the deepest recession since the Second World War, is this the best the chief law enforcement agent on Wall Street can muster? That Goldman let a then little-known hedge fund pick some mortgage bonds and put them into a pedestrian-sized CDO?

It’s hardly the plot of an Oliver Stone movie. But it serves a purpose. Especially when the suit was filed four days before Goldman released its first quarter earnings, and published what it plans to set aside for bonuses.

It also doesn’t hurt if your objective is to gather support in Congress for a far-reaching financial services bill that was expected to hit the floor of the Senate this week.

Julie Dickson, Superintendent of Financial Institutions, has delivered a speech to the Empire Club. No new OSFI initiatives were announced, nor were there any hints regarding policy.

The International Monetary Fund has released the April 2010 Global Financial Stability Report, with chapters:

- Resolving the Crisis Legacy and Meeting New Challenges to Financial Stability

- Systemic Risk and the Redesign of Financial Regulation

- Making Over-the-Counter Derivatives Safer: The Role of Central Counterparties

- Global Liquidity Expansion: Effects on “Receiving” Economies and Policy Response Options

Continued heavy volume today saw PerpetualDiscounts getting wallopped for 41bp, while FixedResets were down a mere 4bp.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 2.61 % | 2.73 % | 53,239 | 20.85 | 1 | 0.0000 % | 2,117.9 |

| FixedFloater | 4.89 % | 2.96 % | 46,707 | 20.44 | 1 | 0.0000 % | 3,271.8 |

| Floater | 1.92 % | 1.66 % | 48,037 | 23.48 | 4 | -0.2190 % | 2,405.3 |

| OpRet | 4.92 % | 3.84 % | 100,104 | 1.07 | 10 | -0.1447 % | 2,295.0 |

| SplitShare | 6.42 % | 6.66 % | 142,435 | 3.58 | 2 | -1.0731 % | 2,125.8 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1447 % | 2,098.5 |

| Perpetual-Premium | 5.92 % | 4.79 % | 30,884 | 15.82 | 2 | -0.3268 % | 1,822.0 |

| Perpetual-Discount | 6.24 % | 6.28 % | 205,776 | 13.51 | 76 | -0.4106 % | 1,709.6 |

| FixedReset | 5.54 % | 4.42 % | 521,682 | 3.62 | 44 | -0.0363 % | 2,134.3 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| GWO.PR.L | Perpetual-Discount | -5.79 % | Not a particularly “real” loss, as the issue traded 21,484 shares in a range of 22.31-71 before the bids disappeared and the issue closed at 21.30-22.49 (!), with the closing bid more than a buck below the last trade. Good job Mr. Market Maker! YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-22 Maturity Price : 21.30 Evaluated at bid price : 21.30 Bid-YTW : 6.72 % |

| IAG.PR.E | Perpetual-Discount | -2.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-22 Maturity Price : 23.83 Evaluated at bid price : 24.02 Bid-YTW : 6.31 % |

| GWO.PR.I | Perpetual-Discount | -1.92 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-22 Maturity Price : 17.87 Evaluated at bid price : 17.87 Bid-YTW : 6.37 % |

| BNA.PR.D | SplitShare | -1.90 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2014-07-09 Maturity Price : 25.00 Evaluated at bid price : 25.81 Bid-YTW : 6.66 % |

| NA.PR.N | FixedReset | -1.84 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2013-09-14 Maturity Price : 25.00 Evaluated at bid price : 25.62 Bid-YTW : 4.46 % |

| PWF.PR.G | Perpetual-Discount | -1.42 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-22 Maturity Price : 22.57 Evaluated at bid price : 22.83 Bid-YTW : 6.49 % |

| GWO.PR.H | Perpetual-Discount | -1.29 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-22 Maturity Price : 19.16 Evaluated at bid price : 19.16 Bid-YTW : 6.41 % |

| BAM.PR.B | Floater | -1.24 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-22 Maturity Price : 17.55 Evaluated at bid price : 17.55 Bid-YTW : 2.25 % |

| PWF.PR.L | Perpetual-Discount | -1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-22 Maturity Price : 19.80 Evaluated at bid price : 19.80 Bid-YTW : 6.48 % |

| PWF.PR.I | Perpetual-Discount | -1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-22 Maturity Price : 23.17 Evaluated at bid price : 23.46 Bid-YTW : 6.42 % |

| TD.PR.G | FixedReset | 1.09 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-30 Maturity Price : 25.00 Evaluated at bid price : 26.89 Bid-YTW : 4.27 % |

| SLF.PR.F | FixedReset | 1.29 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-30 Maturity Price : 25.00 Evaluated at bid price : 26.65 Bid-YTW : 4.44 % |

| IAG.PR.C | FixedReset | 1.33 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-01-30 Maturity Price : 25.00 Evaluated at bid price : 26.60 Bid-YTW : 4.47 % |

| MFC.PR.E | FixedReset | 1.40 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-19 Maturity Price : 25.00 Evaluated at bid price : 26.01 Bid-YTW : 4.77 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| CM.PR.L | FixedReset | 301,451 | TD crossed blocks of 18,800 and 50,000 at 26.58. RBC crossed blocks of 48,600 and 29,800 at 26.58. Nesbitt crossed 75,000 at 26.60. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-30 Maturity Price : 25.00 Evaluated at bid price : 26.71 Bid-YTW : 4.69 % |

| CM.PR.M | FixedReset | 186,730 | Nesbitt crossed 100,000 at 26.65, sold 27,600 to Desjardins at the same price and finished by crossing 17,000 at the same price again. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 26.71 Bid-YTW : 4.75 % |

| HSB.PR.E | FixedReset | 84,498 | TD crossed 14,200 at 26.70; Nesbitt crossed 50,000 at 26.85. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-30 Maturity Price : 25.00 Evaluated at bid price : 26.85 Bid-YTW : 4.86 % |

| RY.PR.Y | FixedReset | 71,545 | TD sold 15,000 to anonymous at 26.60, then crossed 10,000 at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-12-24 Maturity Price : 25.00 Evaluated at bid price : 26.52 Bid-YTW : 4.58 % |

| TRP.PR.B | FixedReset | 63,562 | Nesbitt crossed 40,000 at 24.85. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-04-22 Maturity Price : 24.65 Evaluated at bid price : 24.70 Bid-YTW : 4.18 % |

| MFC.PR.E | FixedReset | 60,350 | RBC crossed 24,900 at 26.09. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-19 Maturity Price : 25.00 Evaluated at bid price : 26.01 Bid-YTW : 4.77 % |

| There were 62 other index-included issues trading in excess of 10,000 shares. | |||

[…] not the only one who thinks that the SEC’s extortion of $550-million from Goldman was conveniently timed: Republican […]