Joseph G. Haubrich, Peter H. Ritchken, George Pennacchi wrote a paper released in March 2009 titled Estimating Real and Nominal Term Structures Using Treasury Yields, Inflation, Inflation Forecasts, and Inflation Swap Rates:

This paper develops and estimates an equilibrium model of the term structures of nominal and real interest rates. The term structures are driven by state variables that include the short term real interest rate, expected inflation, a factor that models the changing level to which inflation is expected to revert, as well as four volatility factors that follow GARCH processes. We derive analytical solutions for the prices of nominal bonds, inflation-indexed bonds that have an indexation lag, the term structure of expected inflation, and inflation swap rates. The model parameters are estimated using data on nominal Treasury yields, survey forecasts of inflation, and inflation swap rates. We find that allowing for GARCH effects is particularly important for real interest rate and expected inflation processes, but that long-horizon real and inflation risk premia are relatively stable. Comparing our model prices of inflation-indexed bonds to those of Treasury Inflation Protected Securities (TIPS) suggests that TIPS were underpriced prior to 2004 but subsequently were valued fairly. We find that unexpected increases in both short run and longer run inflation implied by our model have a negative impact on stock market returns.

Of most interest to me is the conclusion on the inflation risk premium:

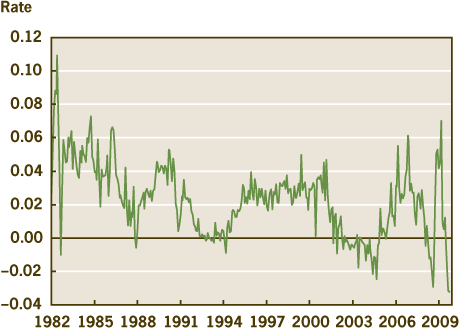

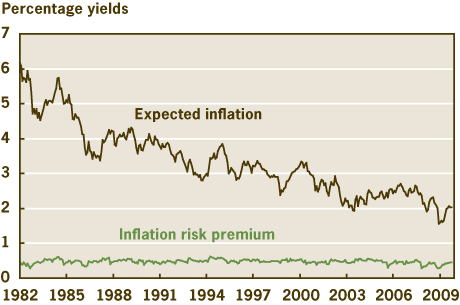

We can also examine how these risk premia varied over time during our sample period. Figure 8 plots expected inflation, the real risk premium, and the inflation risk premium for a 10-year maturity during the 1982 to 2008 period. Interestingly, while inflation expected over 10 years varied substantially, the levels of the real and inflation risk premia did not. The real risk premium for a 10-year maturity bond varied from 150 to 170 basis points, averaging 157 basis points. This real risk premium is consistent with the substantial slope of the real yield curve discussed earlier. The inflation risk premium for a 10-year maturity bond varied from 38 to 60 basis points and averaged 51 basis points. These estimates of the 10-year inflation risk premium fall within the range of those estimated by other studies.[Footnote]

Footnote: For example, a 10-year inflation risk premium averaging 70 basis points and ranging from 20 to 140 basis points is found by Buraschi and Jiltsov (2005). Using data on TIPS, Adrian and Wu (2008) find a smaller 10-year inflation risk premium varying between -20 and 20 basis points.

and

For example, D’Amico et al. (2008) find a large “liquidity premium” during the early years of TIPS’s existence, especially before 2004. They conclude that until more recently, TIPS yields were difficult to account for within a rational pricing framework. Shen (2006) also finds evidence of a drop in the liquidity premium on TIPS around 2004. He notes that this may have been due to the U.S. Treasury’s greater ssuance of TIPS around this time, as well as the beginning of exchange traded funds that purchased TIPS. Another contemporaneous development that may have led to more fairly priced TIPS was the establishment of the U.S. inflation swap market beginning around 2003. Investors may have arbitraged the underpriced TIPS by purchasing them while simultaneously selling inflation payments via inflation swap contracts.

and additionally:

Our estimated model also suggests that shocks to both short run and longer run inflation coincide with negative stock returns. An implication is that stocks are, at best, an imperfect hedge against inflation. This underscores the importance of inflation-linked securities as a means for safeguarding the real value of investments.

Joseph G. Haubrich of the Cleveland Fed provides a primer on the topic at A New Approach to Gauging Inflation Expectations, together with some charts:

The methodology is used in the Cleveland Fed Estimates of Inflation Expectations:

The Federal Reserve Bank of Cleveland reports that its latest estimate of 10-year expected inflation is 1.53 percent. In other words, the public currently expects the inflation rate to be less than 2 percent on average over the next decade.

The Cleveland Fed’s estimate of inflation expectations is based on a model that combines information from a number of sources to address the shortcomings of other, commonly used measures, such as the “break-even” rate derived from Treasury inflation protected securities (TIPS) or survey-based estimates. The Cleveland Fed model can produce estimates for many time horizons, and it isolates not only inflation expectations, but several other interesting variables, such as the real interest rate and the inflation risk premium. For more detail, see the links in the See Also box at right.

On October 15, ten-year nominal treasuries yielded 2.50%, while 10-Year TIPS yielded 0.46%, so the Cleveland Fed has decomposed the Break-Even Inflation Rate of 204bp into 1.53% expected inflation and 0.51% Inflation Risk Premium.

I find myself in the uncomfortable position of being deeply suspicious of this decomposition without being able to articulate specific objections to the theory. The paper’s authors claim:

Comparing our model’s implied yields for inflation-indexed bonds to those of TIPS suggests that TIPS were underpriced prior to 2004 but more recently are fairly priced. Hence, the ‘liquidity premium’ in TIPS yields appears to have dissipated. The recent introduction of inflation derivatives, such as zero coupon inflation swaps, may have eliminated this mispricing by creating a more complete market for inflation-linked securities.

but I have great difficulty with the concept that there is no significant liquidity premium in TIPS. The estimation of the 1-month real rate looks way, way too volatile to me. I suspect that the answer to my problems is buried in the estimation methods between the market price of inflation swaps and the forecasts of estimated inflation, but I cannot find it … at least, not yet!

Does this deal with the “deflation put” where if there is deflation the amount of principal received at maturity does not decline?

Nope, not a word.

I will point out that Jens Christensen estimates:

[…] contradicts the results of Haubrich, et al, from the FRB-Cleveland, (paper reviewed on PrefBlog) who claimed: The inflation risk premium on a ten-year bond varied between 38 and 60 basis points […]