Turnover was virutually non-existent in September, at about 1%.

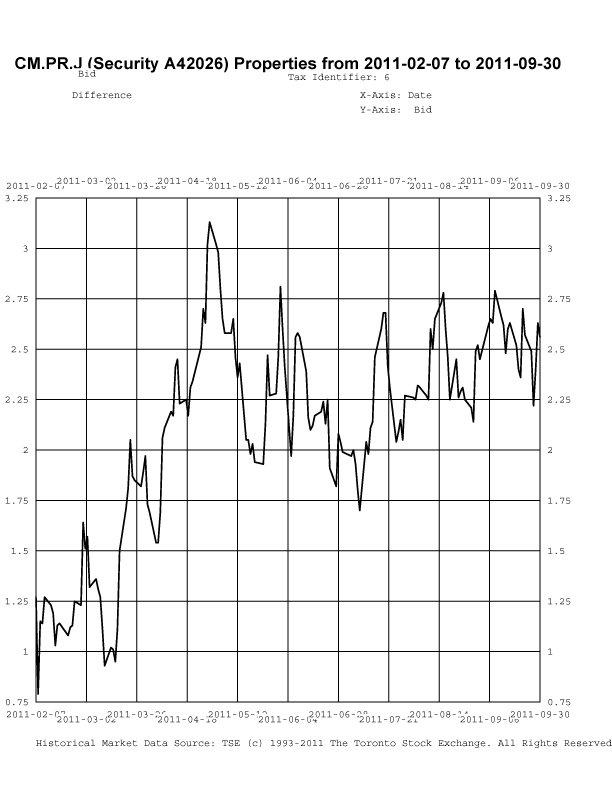

I lay a lot of the blame for lack of turnover on OSFI, and will illustrate my argument with a graph of the price difference between CM.PR.J and GWO.PR.I, which pay the same annual dividend; the differences in structure of the instruments are negligible, other than the fact that, of course, the issuer is different. However, while the market appears to have incorporated OSFI’s advisory on Non-Viability Contingent Capital to banks, it does not appear to have extrapolated this advisory to insurers and insurance holding companies, which is something I expect to happen in the relatively near future.

It will be recalled that OSFI has announced that CM.PR.J (and all other issues of its ilk) will not be eligible for inclusion in Tier 1 Capital to any degree whatsoever after 2022-1-31; that this implies the company will cease to regard it as “cheap equity” and instead consider it “expensive debt”, and that therefore redemption at par is anticipated by 2022 at the latest. My expectation, given the laudable objective of harmonizing insurance and banking regulation to the extent possible, is that this precept will apply, sooner or later, to GWO.PR.I and all other regulated financial issues which do not have an NVCC clause. See my definition of “DeemedRetractibles” for more discussion of this matter.

As I remarked in the September PrefLetter:

Most obvious is the very high price spread between the two issues, but it is also apparent that there is a high degree of volatility in this spread; this spread cannot be explained by fundamental factors, it is a market artifact arising from random fluctuations in supply and demand.

One might think, therefore, that my fund8 would have been frantically trading throughout the year, seeking to exploit these transient pricing differences – that is, after all, what my proprietary valuation software, HIMIPref™, is designed to indicate. This has not been the case and in fact, trading has been significantly lower than usual since the OFSI-derived activity in the first quarter.

The reason for this is the high degree of stratification in the market; while the difference in prices has fluctuated in a very wide range (a variance of about $1.00), taking advantage of these fluctuations implies giving up a great deal of valuation (since the assumption is that two issues are directly comparable). In order to take advantage of the low difference in price (in hopes of making $1 on the trade when the difference is high) it is necessary to sell GWO.PR.I and buy CM.PR.J, giving up $2 in “permanent valuation”.

The software is designed to correct for factors such as this; while one factor assumes that the price difference will return to zero (given that the issues are virtually identical in terms of characteristics), another factor assumes that the price difference will return to its average of about $2.50. In this case, though, the predicted effect from the first factor overwhelms the contribution from the second; GWO.PR.I is always calculated to be cheap relative to CM.PR.J; and the portfolio’s position in the former is maintained. In other words, there would be considerable risk in executing the swap since the probability of losing $2 (if the price difference returns to zero) outweighs the probability of gaining $1 (if the price difference returns to its upper limit).

As I remarked in the February, 2010, edition of this newsletter, the preferred share market has, to a certain extent, become OSFI’s casino, with valuation far more dependent upon potential regulatory decisions and their timing than it should be, with consequent loss of market efficiency – and the trading profits of investors similar to Hymas Investment Management, who seek to eke out excess returns by supplying that efficiency.

Trades were, as ever, triggered by a desire to exploit transient mispricing in the preferred share market (which may be thought of as “selling liquidity”), rather than any particular view being taken on market direction, sectoral performance or credit anticipation.

We can only hope that OSFI makes an announcement regarding the status of Straight Preferreds issued by insurers and insurance holding companies at some point in the near future, one war or the other.

Be that as it may, sectoral distribution of the MAPF portfolio on September 30 was as follows:

| MAPF Sectoral Analysis 2011-9-30 | |||

| HIMI Indices Sector | Weighting | YTW | ModDur |

| Ratchet | 0% | N/A | N/A |

| FixFloat | 0% | N/A | N/A |

| Floater | 0% | N/A | N/A |

| OpRet | 0% | N/A | N/A |

| SplitShare | 10.2% (+0.4) | 7.29% | 6.03 |

| Interest Rearing | 0% | N/A | N/A |

| PerpetualPremium | 0.0% (0) | N/A | N/A |

| PerpetualDiscount | 10.0% (+0.5) | 5.84% | 14.18 |

| Fixed-Reset | 9.3% (+0.5%) | 3.45% | 2.40 |

| Deemed-Retractible | 62.2% 59.4% (+2.8) | 6.20% | 7.98 |

| Scraps (Various) | 8.3% (-3.3) | 7.25% (see note) | 9.76 (see note) |

| Cash | +0.1% (-0.8) | 0.00% | 0.00 |

| Total | 100% | 6.10% | 8.02 |

| Yields for the YLO preferreds have been set at 10% for calculation purposes, and their durations at 5.00. The extraordinarily low price of these issues has resulted in extremely high calculated yields; I feel that substitution of these values results in a more prudent total indication. | |||

| Totals and changes will not add precisely due to rounding. Bracketted figures represent change from August month-end. Cash is included in totals with duration and yield both equal to zero. | |||

| DeemedRetractibles are comprised of all Straight Perpetuals (both PerpetualDiscount and PerpetualPremium) issued by BMO, BNS, CM, ELF, GWO, HSB, IAG, MFC, NA, RY, SLF and TD, which are not exchangable into common at the option of the company. These issues are analyzed as if their prospectuses included a requirement to redeem at par on or prior to 2022-1-31, in addition to the call schedule explicitly defined. See OSFI Does Not Grandfather Extant Tier 1 Capital, CM.PR.D, CM.PR.E, CM.PR.G: Seeking NVCC Status and the January, February, March and June, 2011, editions of PrefLetter for the rationale behind this analysis. | |||

The “total” reflects the un-leveraged total portfolio (i.e., cash is included in the portfolio calculations and is deemed to have a duration and yield of 0.00.). MAPF will often have relatively large cash balances, both credit and debit, to facilitate trading. Figures presented in the table have been rounded to the indicated precision.

Credit distribution is:

| MAPF Credit Analysis 2011-8-31 | |

| DBRS Rating | Weighting |

| Pfd-1 | 0 (0) |

| Pfd-1(low) | 50.1% (+2.4) |

| Pfd-2(high) | 21.4% (+1.0) |

| Pfd-2 | 0 (0) |

| Pfd-2(low) | 20.1% (+0.3) |

| Pfd-3(high) | 2.9% (+0.2) |

| Pfd-3 | 4.1% (-4.3) |

| Pfd-4(low) | 1.3% (+1.3) |

| Cash | +0.1% (-0.8) |

| Totals will not add precisely due to rounding. Bracketted figures represent change from August month-end. | |

| A position held in ELF preferreds has been assigned to Pfd-2(low) | |

| A position held in CSE preferreds has been assigned to Pfd-3 | |

The increase in Pfd-4(low) holdings at the expense of Pfd-3 is due to the downgrade of YLO.

Liquidity Distribution is:

| MAPF Liquidity Analysis 2011-9-30 | |

| Average Daily Trading | Weighting |

| <$50,000 | 12.8% (+6.9) |

| $50,000 – $100,000 | 16.0% (-5.2) |

| $100,000 – $200,000 | 20.4% (+1.9) |

| $200,000 – $300,000 | 42.3% (+17.1) |

| >$300,000 | 8.4% (-19.8) |

| Cash | +0.1% (-0.8) |

| Totals will not add precisely due to rounding. Bracketted figures represent change from August month-end. | |

The increase in the proportion of issues with an Average Daily Trading Value less than $50,000 is mainly due to the migration of CCS.PR.C and ELF.PR.G. The decrease in those with more than $300,000 is mainly due to the migration of SLF.PR.E, MFC.PR.C and BNS.PR.X.

MAPF is, of course, Malachite Aggressive Preferred Fund, a “unit trust” managed by Hymas Investment Management Inc. Further information and links to performance, audited financials and subscription information are available the fund’s web page. The fund may be purchased either directly from Hymas Investment Management or through a brokerage account at Odlum Brown Limited. A “unit trust” is like a regular mutual fund, but is sold by offering memorandum rather than prospectus. This is cheaper, but means subscription is restricted to “accredited investors” (as defined by the Ontario Securities Commission) or those who subscribe for $150,000+. Fund past performances are not a guarantee of future performance. You can lose money investing in MAPF or any other fund.

A similar portfolio composition analysis has been performed on the Claymore Preferred Share ETF (symbol CPD) as of August 31, 2010, and published in the September, 2010, PrefLetter. While direct comparisons are difficult due to the introduction of the DeemedRetractible class of preferred share (see above) it is fair to say:

- MAPF credit quality is better

- MAPF liquidity is a higher

- MAPF Yield is higher

- Weightings in

- MAPF is much more exposed to DeemedRetractibles

- MAPF is much less exposed to Operating Retractibles

- MAPF is slightly more exposed to SplitShares

- MAPF is less exposed to FixFloat / Floater / Ratchet

- MAPF weighting in FixedResets is much lower

In your comments above you say:

“DeemedRetractibles are comprised of all Straight Perpetuals (both PerpetualDiscount and PerpetualPremium) issued by BMO, BNS, CM, ELF, GWO, HSB, IAG, MFC, NA, RY, SLF and TD”

But ELF preferred shares contain a conversion to common feature, so I wonder why you still consider them a DeemedRetractable?

But ELF preferred shares contain a conversion to common feature, so I wonder why you still consider them a DeemedRetractable?

I don’t. The sentence you quote continues “which are not exchangable into common at the option of the company“

[…] PrefBlog Canadian Preferred Shares – Data and Discussion « MAPF Portfolio Composition: September, 2011 […]