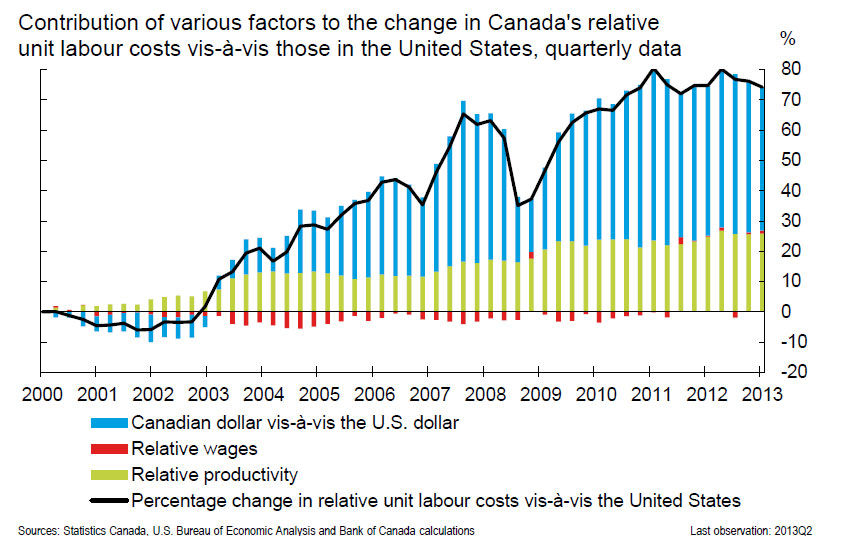

Tiff Macklem gave a speech to the Economic Club of Canada titled Global Growth and the Prospects for Canada’s Exports – I found Chart 12 to be of great interest:

A second factor influencing our exports is competitiveness. Between 2000 and 2012, the labour cost of producing a unit of output in Canada compared with the United States, adjusted for the exchange rate, increased by 75 per cent (Chart 12). The majority of this loss of competitiveness reflects the appreciation of the Canadian dollar (shown in blue), but weak productivity growth in Canada relative to the United States also played a significant role (shown in green).

From the bureaucrats at the UBC Staff Pension Plan comes an excellent lesson in bafflement via bullshit:

“We have what is called a target benefit plan,” says Mr. Parker, who is executive director of the University of British Columbia’s staff pension plan.

…

In a target plan, the employer and its employees make fixed contributions, similar to a defined contribution plan. The payouts that can be expected are set as a target, which depends on projections, made by actuarial experts, of what the plan will be able to afford.

So in other words, it’s a Defined Contribution plan but they don’t want to say the words, so instead of handing over the dollar value of the account on retirement, they hand over a package of benefits, that may or may not increase or decrease and which will disappear when the beneficiary dies. Well done!

Fitch is unimpressed with the games in Washington:

The US government shutdown is not in itself a downgrade trigger for the sovereign’s ‘AAA’/Negative rating. However, it undermines confidence in both the budgetary process and critically in the prospect of the debt ceiling being raised in a timely manner to avert the risk of default on US sovereign debt obligations, says Fitch Ratings in a reiteration of its June 28 rating commentary.

A formal review of the rating with potentially negative implications would be triggered if the US government has not raised the federal debt ceiling in a timely manner prior to when the Treasury will have exhausted extraordinary measures and cash reserves. According to official comments by the US Treasury secretary, extraordinary measures could be exhausted by 17 October.

In such a scenario, the Treasury would be forced to dramatically cut back on current spending with adverse implications for the economic recovery. Even if it were to prioritise debt service – something the Treasury has repeatedly stated it has neither the legal authority nor logistical capability to do – it would likely incur arrears on a range of payment obligations and thus continue to incur debt, but in a disorderly and disruptive manner.

Even if the debt limit is not raised in a timely manner we believe there is sufficient political will and capacity to ensure that Treasury securities will continue to be honoured in full and on time. Nevertheless, investor confidence in the full faith and credit of the US would be undermined in such a scenario. This “faith” is a key underpinning of the US dollar’s global reserve currency status and reason why the US ‘AAA’ rating can tolerate a substantially higher level of public debt than other ‘AAA’ sovereigns.

Non-essential operations of the federal government will cease from today – the government shutdown – after the US House of Representatives and Senate failed to agree a continuing resolution to grant it the necessary spending authority.

Further to my rant of September 25, I was infuriated by the “Moment in Time” feature in today’s Globe (not available on-line), which claimed that “[Henry Ford] raised wages so his workers could become customers”, I looked around more carefully and found this:

It should be obvious that this story doesn’t work: Boeing would most certainly be in trouble if they had to pay their workers sufficient to afford a new jetliner. It’s also obviously true that you want every other employer to be paying their workers sufficient that they can afford your products: but that’s very much not the same as claiming that Ford should pay his workers so that they can afford Fords.

…

Ford’s turnover rate was very high. In 1913, Ford hired more than 52,000 men to keep a workforce of only 14,000.

…

Car production in the year before the pay rise was 170,000, in the year of it 202,000. As we can see above the total labour establishment was only 14,000 anyway. Even if all of his workers bought a car every year it wasn’t going to make any but a marginal difference to the sales of the firm.We can go further too. As we’ve seen the rise in the daily wage was from $2.25 to $5 (including the bonuses etc). Say 240 working days in the year and 14,000 workers and we get a rise in the pay bill of $9 1/4 million over the year. A Model T cost between $550 and $450 (depends on which year we’re talking about). 14,000 cars sold at that price gives us $7 3/4 million to $6 1/4 million in income to the company.

It should be obvious that paying the workforce an extra $9 million so that they can then buy $7 million’s worth of company production just isn’t a way to increase your profits. It’s a great way to increase your losses though.

It was a mixed day for the Canadian preferred share market, with PerpetualDiscounts up 30bp, FixedResets off 3bp and DeemedRetractibles gaining 3bp. Not surprisingly, there’s a bit of a skew in the Performance Highlights table towards winning PerpetualDiscounts. Volume was average.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.2853 % | 2,534.8 |

| FixedFloater | 4.29 % | 3.61 % | 31,089 | 18.08 | 1 | 0.7734 % | 3,871.7 |

| Floater | 2.67 % | 2.86 % | 66,116 | 20.11 | 5 | 0.2853 % | 2,736.9 |

| OpRet | 4.63 % | 2.61 % | 63,724 | 0.49 | 3 | 0.1674 % | 2,637.8 |

| SplitShare | 4.76 % | 5.03 % | 60,188 | 4.03 | 6 | 0.1285 % | 2,945.5 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1674 % | 2,412.0 |

| Perpetual-Premium | 5.75 % | 0.37 % | 111,952 | 0.12 | 8 | 0.2829 % | 2,279.5 |

| Perpetual-Discount | 5.50 % | 5.55 % | 148,220 | 14.46 | 30 | 0.3039 % | 2,360.0 |

| FixedReset | 4.94 % | 3.69 % | 237,575 | 3.65 | 85 | -0.0280 % | 2,456.6 |

| Deemed-Retractible | 5.12 % | 4.44 % | 201,038 | 6.89 | 43 | 0.0333 % | 2,381.2 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| MFC.PR.F | FixedReset | -1.80 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.35 Bid-YTW : 4.79 % |

| HSB.PR.D | Deemed-Retractible | -1.40 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.65 Bid-YTW : 5.24 % |

| TRP.PR.A | FixedReset | -1.38 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-01 Maturity Price : 23.76 Evaluated at bid price : 24.21 Bid-YTW : 3.96 % |

| BAM.PF.C | Perpetual-Discount | -1.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-01 Maturity Price : 20.14 Evaluated at bid price : 20.14 Bid-YTW : 6.07 % |

| FTS.PR.F | Perpetual-Discount | 1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-01 Maturity Price : 23.56 Evaluated at bid price : 23.90 Bid-YTW : 5.17 % |

| PWF.PR.R | Perpetual-Discount | 1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-01 Maturity Price : 24.73 Evaluated at bid price : 25.15 Bid-YTW : 5.55 % |

| PWF.PR.P | FixedReset | 1.25 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-01 Maturity Price : 23.19 Evaluated at bid price : 24.21 Bid-YTW : 3.67 % |

| W.PR.H | Perpetual-Discount | 1.26 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-01 Maturity Price : 23.91 Evaluated at bid price : 24.15 Bid-YTW : 5.71 % |

| CGI.PR.D | SplitShare | 1.31 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2023-06-14 Maturity Price : 25.00 Evaluated at bid price : 23.91 Bid-YTW : 4.35 % |

| TRI.PR.B | Floater | 1.39 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-01 Maturity Price : 21.10 Evaluated at bid price : 21.10 Bid-YTW : 2.50 % |

| FTS.PR.J | Perpetual-Discount | 1.90 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-01 Maturity Price : 23.33 Evaluated at bid price : 23.65 Bid-YTW : 5.06 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| CU.PR.C | FixedReset | 104,121 | Desjardins crossed 100,000 at 25.00. YTW SCENARIO Maturity Type : Call Maturity Date : 2017-06-01 Maturity Price : 25.00 Evaluated at bid price : 25.00 Bid-YTW : 4.12 % |

| SLF.PR.H | FixedReset | 59,870 | Nesbitt crossed 50,000 at 24.70. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.57 Bid-YTW : 4.21 % |

| BNS.PR.Q | FixedReset | 52,414 | RBC bought 11,800 from National at 24.80. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.80 Bid-YTW : 3.69 % |

| MFC.PR.B | Deemed-Retractible | 39,809 | Desjardins crossed 15,600 at 21.77, then bought 17,200 from Anonymous at 21.75. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.75 Bid-YTW : 6.33 % |

| BAM.PF.D | Perpetual-Discount | 31,981 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2043-10-01 Maturity Price : 21.26 Evaluated at bid price : 21.26 Bid-YTW : 5.80 % |

| BMO.PR.L | Deemed-Retractible | 31,541 | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-25 Maturity Price : 25.75 Evaluated at bid price : 26.12 Bid-YTW : 4.25 % |

| There were 33 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| RY.PR.B | Deemed-Retractible | Quote: 25.49 – 25.82 Spot Rate : 0.3300 Average : 0.2109 YTW SCENARIO |

| BMO.PR.L | Deemed-Retractible | Quote: 26.12 – 26.42 Spot Rate : 0.3000 Average : 0.1916 YTW SCENARIO |

| CIU.PR.A | Perpetual-Discount | Quote: 20.68 – 21.42 Spot Rate : 0.7400 Average : 0.6337 YTW SCENARIO |

| BAM.PR.X | FixedReset | Quote: 22.44 – 22.88 Spot Rate : 0.4400 Average : 0.3380 YTW SCENARIO |

| HSB.PR.D | Deemed-Retractible | Quote: 24.65 – 24.99 Spot Rate : 0.3400 Average : 0.2458 YTW SCENARIO |

| CIU.PR.C | FixedReset | Quote: 21.82 – 22.39 Spot Rate : 0.5700 Average : 0.4804 YTW SCENARIO |