Dundee Corporation has announced:

Further to Dundee Corporation’s (TSX: DC.A and DC.PR.B) (“Dundee” or the “Company”) news release dated August 26, 2014, the Company announces today the applicable dividend rates for its Cumulative 5‐Year Rate Reset First Preference Shares, Series 2 (“Series 2 Shares”) and its Cumulative Floating Rate First Preference Shares, Series 3

(“Series 3 Shares”).With respect to any Series 2 Shares that remain outstanding on September 30, 2014, holders thereof will be entitled to receive fixed rate cumulative preferential cash dividends on a quarterly basis, as and when declared by the Board of Directors of Dundee and subject to the provisions of the Business Corporations Act (Ontario). The dividend rate for the five‐year period commencing on September 30, 2014 to, but excluding September 30, 2019, will be 5.688%, being equal to the sum of the five‐year Government of Canada bond yield as at September 2, 2014, plus 4.10%, as determined in accordance with the terms of the Series 2 Shares.

With respect to any Series 3 Shares that may be issued on September 30, 2014, holders thereof will be entitled to receive floating rate cumulative preferential cash dividends on a quarterly basis, calculated on the basis of actual number of days elapsed in each quarterly floating rate period divided by 365, as and when declared by the Board of Directors of the Company and subject to the provisions of the Business Corporations Act (Ontario). The dividend rate for the three‐month period commencing on September 30, 2014 to, but excluding, December 31, 2014, will be 5.04%, being equal to the sum of the three‐month Government of Canada Treasury bill yield as at September 2, 2014, plus 4.10%, as determined in accordance with the terms of the Series 3 Shares.

Beneficial owners of Series 2 Shares who wish to exercise their right of conversion should instruct their broker or other nominee to exercise such right before 5:00 p.m. (EDT) on September 15, 2014. Instructions of conversion are irrevocable.

Beneficial owners should direct any conversion inquiries to their broker or Dundee’s Registrar and Transfer Agent, Computershare Investor Services Inc., at 1‐800‐564‐6253.

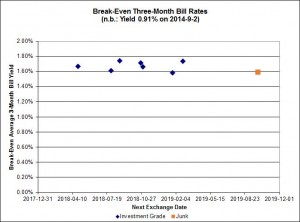

It is difficult to formulate a recommendation regarding whether holders of DC.PR.B should convert. The two issues resulting after partial conversion will, of course, form a Strong Pair and may be analyzed with the Pairs Equivalency Calculator. Performing an analysis of all current FixedReset/FloatingReset pairs results in the following chart:

This chart was created with the assumed price of the new DC FloatingReset set to 25.22, the same as the price of DC.PR.B. According to this, the DC FloatingReset looks a little bit cheap … but not much. To get to the average Breakeven 3-Month Bill Yield of 1.67%, the price would only need to increase by $0.08, to 25.30.

One may, of course, make the argument that the time until the next Exchange Date is greater for DC.PR.B, therefore (given a projection of increasing policy rates) the breakeven rate should be higher, therefore the current price should be somewhat higher than 25.30 and therefore conversion should be favoured … but that’s a matter of opinion, informed or otherwise. I take no position on that – you’re on your own!

Another consideration is the fact that this will be the first Junk Floating Reset. In a logical world this shouldn’t make any difference, since the analysis rests on the idea that the credit quality of each element of the Strong Pair is precisely equal, but since when has the preferred share market been logical? If we look at the other pool of Strong Pairs, the pool that depends upon the prime rate and is predominantly junk (if you believe DBRS) or investment grade (if you believe S&P), one gets a set of break-even rates that implies a much faster increase in Prime, which one may sort-of assume will move in sort-of lockstep with three-month bill rates:

The average breakeven prime rate is 5.38%, a huge increase over the current 3% and much more than the increase in short-rates implied by extant FloatingResets. Looking at things very simply, if we say that the FixedFloater/Ratchet series of strong pairs implies a rate of 5.38%, 238bp over current, then adding 238bp to the 0.91% current three month bill rate means requiring a break-even 3-month-bill rate of 3.29%, which in turn implies a whopping price of 26.90 for the new DC FloatingReset.

I find none of this particularly convincing and think that holders should either convert or hold according to what makes sense for their own portfolios. Those with a taste for speculation, however, will find the conversion to the FloatingReset attractive, since there’s not much downside and potentially quite a bit of upside.

DC.PR.D (the floating reset) started trading today, and is currently around 25.15 vs. 24.60 for the fixed-reset DC.PR.B counterpart. Quite a nice mini-pop!

Thanks for reminding me!