Lowe’s Companies, Inc. and RONA Inc. have announced:

that they have entered into a definitive agreement under which Lowe’s is expected to acquire all of the issued and outstanding common shares of RONA for C$24 per share in cash, and all of the issued and outstanding preferred shares of RONA for C$20 per share in cash. The total transaction value is C$3.2 billion (US$2.3 billion) (the “Transaction”). The offer represents a premium of 104 percent to RONA’s closing common share price on February 2, 2016 and a 38 percent premium to RONA’s 52-week high of C$17.36. Together, Lowe’s Canada and RONA stores will create Canada’s leading home improvement retailer with 2015 pro forma revenues from Canadian operations of approximately C$5.6 billion. Excluding transaction and integration costs, we anticipate the Transaction will be accretive to Lowe’s earnings in the first year following the close of the acquisition.

The Transaction has been unanimously approved by the Boards of Directors of Lowe’s and RONA and is supported by the management teams of both companies. The Transaction is expected to proceed by way of a plan of arrangement by which Lowe’s would acquire all of the outstanding shares of RONA, subject to RONA common shareholder approval and satisfaction of customary conditions, including the receipt of all necessary regulatory approvals. The RONA Board has received an opinion from Scotia Capital Inc. that the consideration to be received by RONA’s common and preferred shareholders pursuant to the Transaction is fair, from a financial point of view.

The RONA Board will recommend that RONA shareholders vote in favor of the plan of arrangement at a special meeting of shareholders expected to be held before the end of the first quarter of 2016. Further information regarding the Transaction will be included in RONA’s information circular to be mailed to RONA shareholders in advance of the special meeting. The arrangement agreement provides that RONA is subject to customary non-solicitation provisions.

$20 is quite the premium over yesterday’s closing quote of 12.41-05!

The consensus is that the deal will succeed – f’rinstance, Frederic Tomesco of Bloomberg:

The fact both boards agreed to the C$3.2 billion ($2.3 billion) offer, along with Lowe’s commitment to preserve head-office jobs and maintain supply agreements, will likely seal the deal. Political conditions in Canada’s second-most populous province also favor the acquisition after helping to scupper a hostile offer in 2012.

Rona’s biggest shareholder, the provincial pension fund manager Caisse de Dépôt et Placement du Québec, said Wednesday it would tender its shares to the offer. Quebec’s new economy minister indicated the government probably wouldn’t stand in the way of a deal.

“If three of the groups that were against Lowe’s last time — the board, the government and the Caisse — are saying it’s a good idea, it would be hard to see it not get the green light,” Karl Moore, a management professor at McGill University’s Desautels Faculty of Management in Montreal, said in a telephone interview. “There’ll be some squawking for sure, but that’s predictable. The opposition has to be against this deal in principle.”

Matthew Townsend and Scott Deveau of Bloomberg point out that the plunging loonie helped a lot:

The Canadian dollar’s loss is Lowe’s gain.

After being rebuffed in its attempt to buy Quebec-based retailer Rona Inc. in 2012, Lowe’s Cos. reached agreement on Wednesday to buy it for C$3.2 billion ($2.3 billion). Two big changes in the past four years made the transaction possible: The Parti Quebecois, which opposed the original deal, is out of power, and the loonie fell to its lowest level against the dollar in more than a decade.

…

Lowe’s withdrew the $1.8 billion unsolicited bid for Rona in 2012 after the board and some Quebec politicians opposed the offer, concerned about a loss of jobs and local control in the French-speaking province. The withdrawal came just 12 days after the separatist Parti Quebecois won elections.Since then, the Liberals have taken power in Quebec, and the loonie has dropped to 72 cents versus the U.S. dollar, compared with parity when Lowe’s pulled its bid, making it cheaper for Lowe’s to offer a richer premium. So while the C$24 a share bid in Canadian dollar terms is about 65 percent higher than the C$14.50 a share bid that was rejected, in U.S. dollar terms the offer is just 16 percent higher.

… and Bloomberg’s Brooke Sutherland suggests it’s all about footprint:

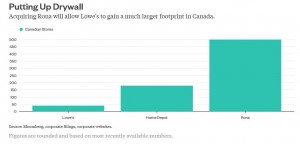

Focusing on Canada may be a distraction, but it’s a distraction that could pay off for Lowe’s. While the home-improvement company has benefited from a rebounding real estate market, the maturing U.S. retail landscape and the rise of online shopping puts a cap on the growth opportunities for big-box vendors. Many are shuttering stores, or at least slowing down expansion.

Lowe’s, for example, had 1,793 U.S. locations as of January 2015 — a gain of about 76 from a year earlier, much of which could be explained by the acquisition of Orchard Supply Hardware. The way to keep growing its store base is to make more acquisitions and push harder into adjacent markets such as Canada, where Home Depot currently has almost five times as many locations as Lowe’s. With Canada’s home improvement industry valued at C$45 billion, Lowe’s can’t really afford to sit on the sidelines.

John Heinzl was kind enough to quote me when discussing the preferred share part of the deal:

Rona Inc.’s battered preferred-share investors may not be getting as fat a premium as common shareholders in the $3.2-billion takeover by Lowe’s Cos. Inc., but they should be thrilled with what they’re being offered, money managers say.

As part of the deal, the U.S. home-improvements chain is offering $20 for each Class A rate-reset preferred share of Quebec-based Rona. The offer, which is based on a fairness opinion from Scotia Capital, represents a 59-per-cent premium to the closing price of Rona’s preferred shares before the deal was announced.

…

Some Rona preferred shareholders said it’s possible Lowe’s might make a higher offer for the preferreds. “Perhaps they could be persuaded to offer more money. Perhaps. I’m not banking on it but not discounting it either,” said Benj Gallander, co-editor of Contra the Heard Investment Letter. “These are early days.”Don’t hold your breath, said preferred-share fund manager James Hymas, president of Hymas Investment Management. Rona’s preferred shareholders don’t have the leverage to squeeze more money out of Lowe’s, he said.

“They can always try, but I don’t know how far they’ll get,” said Mr. Hymas, who does not own Rona’s preferred shares.

…

After all the suffering Rona’s preferred investors have endured, they should be happy that Lowe’s is willing to take them out at $20, Mr. Hymas said.“You don’t want to kill the goose that lays the golden egg,” he said. “They’re not going to sweeten that deal. There is no reason to.”

I base this view on the fact that during the conference call the following statements were made:

what’s important to understand that a positive vote from the pref holders is not a condition precedent to the closing of the transaction.

…

If you don’t have a majority acceptance from the prefs, does RONA continue to report its financial results? … Yes. So the entity would need to continue to report as a public listed entity. Yes.

So a negative vote from RONA preferred shareholders will mean just that the shares will continue to be outstanding. Since RON.PR.A is a FixedReset, 5.25%+265, that commenced trading 2011-2-22 after being announced 2011-2-1, it has a relatively low reset. Absurdly low for junk, albeit more reasonable for investment grade. Investment-grade issues with comparable resets are:

- MFC.PR.J, +261, bid at 17.89

- RY.PR.M, +262, bid at 18.45

- TD.PF.D, +279, bid at 19.00

- SLF.PR.I, +273, bid at 17.45

- BAM.PF.B, +263, bid at 16.46

- BMO.PR.Y, +271, bid at 19.35

So it’s a decent premium over fair value even given an upgrade in credit quality. I’ll suggest that Lowe’s takes the view that they’re willing to give that premium to the preferred shareholders if they’re co-operative, or give it to the lawyers, bookkeepers, auditors and accountants if that’s what the preferred shareholders decide they want. Since the takeover deal is not conditional on preferred shareholder approval they’ve got no reason to pay an extortionate premium for the prefs.

And yes, the credit quality will almost certainly go up if the deal is approved. DBRS confirmed Lowe’s at A(low):

DBRS Limited (DBRS) has today confirmed the Issuer Rating and Senior Unsecured Debt rating of Lowe’s Companies, Inc. (Lowe’s or the Company) at A (low) as well as its Short-Term Rating at R-1 (low), all with Stable trends. This action follows the Company’s announcement that it has entered into a definitive agreement under which Lowe’s is expected to acquire all issued and outstanding common shares of RONA inc. (RONA) for CAD 24 per share in cash and all issued and outstanding preferred shares of RONA for CAD 20 per share in cash. The total transaction value including the assumption of RONA’s debt is CAD 3.2 billion ($2.3 billion; the Transaction or Acquisition).

…

Despite the risks associated with the effective integration of RONA, DBRS believes that the relatively modest magnitude of the Transaction and the temporary increase in financial leverage keep Lowe’s credit risk profile in a range acceptable for the current rating category. Should Lowe’s be challenged to maintain credit metrics in a range acceptable for the current A (low) rating because of weaker-than-expected consolidated operating performance or more aggressive-than-expected financial management (i.e., slower deleveraging), the current ratings could be pressured.

…. while putting RONA on Review-Positive:

DBRS Limited (DBRS) has today placed the ratings of RONA inc. (RONA or the Company) Under Review with Positive Implications following the Company’s announcement that it has entered into a definitive agreement under which RONA will be acquired by Lowe’s Companies, Inc. (Lowe’s; please see separate DBRS press release) for a total transaction value of $3.2 billion (the Transaction). The total transaction value comprises Lowe’s offer to acquire RONA’s issued and outstanding common shares for $24 per share in cash as well as its issued and outstanding preferred shares for $20 per share, plus RONA’s outstanding debt.

…

Rona’s Under Review – Positive Implications status reflects Lowe’s current ratings (A (low) and R-1 (low) as rated by DBRS), the intention to purchase RONA’s outstanding preferred shares and the assumption of RONA’s outstanding senior unsecured debt. As of September 27, 2015, RONA had approximately $313 million of senior unsecured debt outstanding, consisting of $116 million of senior unsecured debentures and $197 million drawn on its revolving credit facility (maximum limit of $700 million). DBRS notes that the Company’s senior unsecured debentures will mature in October 2016.

S&P has also taken a positive view regarding RONA’s ratings:

- •Home improvement retailers Lowe’s Cos. Inc. and RONA Inc. announced today that they have entered into a definitive agreement under which Lowe’s is expected to acquire RONA for about C$3.2 billion

- •As a result, we are placing our ratings on RONA Inc., including our ‘BB+ long-term corporate credit rating on the company, on CreditWatch with positive implications.

- •We intend to resolve the CreditWatch placement on the acquisition’s closing, which we expect by the third quarter of 2016. At that time, we would likely equalize our long-term corporate credit rating on RONA with that on Lowe’s.

…

The CreditWatch placement follows Lowe’s Cos. Inc.’s and RONA Inc.’s announcement that they have entered into a definitive agreement under which Lowe’s is expected to acquire RONA for about C$3.2 billion. As part of the transaction, we expect Lowe’s to purchase all of the issued and outstanding preferred shares of RONA for C$20 per share in cash and assume its C$116.6 million of unsecured notes that mature in 2016.“The positive CreditWatch placement reflects our view of the potential uplift for RONA creditors from the possible acquisition of the company by the higher-rated Lowe’s,” said Standard & Poor’s credit analyst Alessio Di Francesco.

So, assuming the common shareholders vote in favour of the deal, holders of RON.PR.A will wind up in one of two positions:

- Owning a perfectly normal investment-grade preferred share trading somewhere around $17-$19, or

- Getting $20 cash.

I’d rather take the cash and deploy it into something else! However, a formal recommendation will have to await receipt of the management information circular.

At today’s closing bid of 19.95, RON.PR.A yields 4.22% to perpetuity.

Update, 2016-3-3: RONA has filed the Management Proxy Circular with respect to the two offers.

Why should pref shareholders bend over to let commons obtain a substantial premium. Did Repsol offer a 20% discount to par on its takeover of Talisman? Lowes certainly wants to get rid of the prefs. Don’t you believe such precedent will taint this market forever.

Thks James. You above post answers my questions in the REI thread.

In regards to the prospectus, it indicates, “The Series 6 Class A Preferred Shares are redeemable in whole or in part by RONA, at its option, on March 31, 2016, and on March 31 of every fifth year thereafter in accordance with their terms, at a cash redemption price per share of $25.00 together with all accrued and unpaid dividends.”.

Is there a reason why the buy-back is at $20, instead of $25?

Mr Hymas, I am disappointed in your opinion of the Rona pref offer and urge you to reconsider.

First, your statement that “$20 is quite the premium over yesterdays close of ($13)”, while true, is misleading. As you point out yourself, the deal is going to happen regardless. So the premium of the offer should be compared to a price of ~$18, not $13. $13 is irrelevant now, it is not a factor when looking at whether one should accept $20. The Globe article was extremely misleading about this.

Next, all those comparables you mentioned were trading nicely above $22 just a few months ago in November (except the BAM.PF.B which has a ceiling of around $21). Are you again assuming the market is pricing everything efficiently? This Canadian pref market of ours is an abomination of market efficiency. If one were to use the November prices, the Lowes offer is around $2 UNDER “fair value”.

The “premium” offered by Lowes is far too small given current volatility. The preferreds are all over the place these days with 5% daily moves becoming commonplace. You, Scotia Capital, and anyone else recommending we bend over to Lowes, are telling people to accept a mere $2 over the current comparables, all of which are near historic lows. It is highly questionable, in such a volatile environment, to suggest a ~$2 premium is sufficient when some of these prefs can move $2 in a day or two! I think I’d like to hold on to my shares, get paid for doing so, and find out where the market settles months/years from now.

I think the mental stress of this pref crash is getting to you guys. Weak hands have been purging their prefs for over a year now, and I suppose when you’ve been slowly drowning for months on end you’ll be willing to grasp on to any floating logs in the water. But what Lowes is dangling to us isn’t a log, it a piece of …

Now, if RioCan had offered $17 per share to buy back REI.PR.A would you have told everyone to accept that too? “Hey, while we’re at it, let’s just allow any corp to buy back their prefs for $2 over the most recent closing price, no matter how low that price is. If the market last traded there then it must be efficient!” That’s basically what we’re being told to do here! What apparently to you is an “extortionate premium” is what the rest of us know as the call price. Now RioCan abided by the prospectus and will pay the $25 call price. Lowes should have to do the same if they wish to rid themselves of their burden, the call date is conveniently only a couple months away. As someone else here alluded, the precedent being set here is important.

Your point about selling now for $20 and quickly buying some other comparables with the cash while they’re still near all time lows is valid… but I already own all of those companies, and I don’t need more cash. I also don’t care to add more Canadian financial or energy names. I don’t want a portfolio that resembles ZPR! An investment grade Rona spitting out a stream of eligible dividends fits great in my diversified pref portfolio, as I’m sure it would fit nicely in many Canadian portfolios bursting at the seams with financials and energies (it would probably look pretty nice in yours too). Now I hope you can see how baffled I am when I read that one-sided Lowes sponsored Globe article with you pref experts telling me I should be happy to accept their deal. Lowes can come get my Rona preferred shares out of my cold dead hands!

(or pay the friggin call price)

Respectfully,

PrefCandy

Prefcandy has some valid points. On top of it, this deal will take a few months to close and let’s hope that by then the market will get back to more normal valuations…. It may very well be that by then 20 will look low.

I take it that some may find it attractive to take 20 now and reinvest in this depressed market, but I think there is a good chance that this will get sweeten.

At 20 it is not a bad idea to wait at least until the next ex div date which is pretty close, unless they suspend dividend which would be truly abusive…

I have to admit that I am less than impressed by the management team, Scotia and the Board on this one. The Board is supposed to protect the interest of all shareholders and I think that by accepting this offer in its current structure they failed to their mandate towards the pref holders. While I get that all of this could perfectly legal, and that from a strict financial point of view the offer may make some sense in today’s market, I feel that the company had a moral obligation to take out the prefs at the original issue price, which would amount to a 30M$ added to a 3.2B$ transaction ( or a reduction of about 25 cents to the price offered to the commons).

When the company was struggling and needed financing the pref investors came in to support and now some of them may be forced to sell and take a 5$ loss, which means that we will see almost no return on their 5 year investment and that was not the deal. The company is taking advantage of this chage of control offer to give themselves a right that they did not have i.e. to redeem at a lower price and force some holders to redeem in a down market. This is the reverse of DC.pr.a where some pref holders where were cheated of their right to redeemed by a coercitive offer and a vote of the majority. In this case some pref holders will be forced to accept a loss by a vote of the majority while they may have very well preferred to hold on to the original deal, accept the new reset and wait until the market is more stable or keep forever…if Rona wants to redeem at 20, fine but do not force everyone to do so , the same way Dundee should have offered a retraction right at the agreed upon date in its offer. In my mind this is as bad a situation as the Dundee one albeit without the incentive to brokers. This will not help the retail investors faith in the pref market and I wonder how the Scotia brokers ,who sold the initial issue to their customers , will explain that the fairness opinion of their house.

As far as management is concerned, I am not surprised that they did not try to protect the interests of the pref holders as their financial incentives did not aligned. M. Sawyer and team must feel pretty good today with their multi million failure bounty…. After all they were hired to turn around the company and avoid exactly what happen, i.e. a sell to an American company. They did an ok job but after three years most of M. Sawyer ‘s options were under water reflecting the fact that they were only able to keep the boat afloat during their tenure. Today they get a multi million pay back for failing at their mission…..

Before I make these points, let me be clear – I do not own and RON or RON.PR.A or and Lows. These comments are written from an objective, dispassionate view point – and as always, just my humble opinion.

I think that James is right on point with his comments and recommendation regarding the RON.PR.A. The offer was 60% above current market value. Lowes doesn’t have to retire these prefs for the deal to go through – they are being reasonable and offering a premium.

James and many replies have stated that post purchase the company would be investment grade, and James provided relevant fair value comps. Under this view there is still a ~10% premium. This is also fair. Pref holders don’t buy voting rights on deals and give up equity participation – getting a premium is a bonus. Of course its fair to ask for more, but I would expect most institutional investors will tender.

This is different than the REI call – not even comparable. REI.PR.A is being retired under its standard call mechanism during standard operations. If they had tried to call it at a lower price everyone in the market should have, and would have, been up in arms.

There are clear differences from the Talisman deal – but in a comparable way. Their offer was struck when our 5 year rates were 100 bps higher, when our full yield curve was steeper, when everyone still thought rates would move up in the near future and when all seniority spreads were much tighter. While not a proper metric to look at, the Talisman prefs were trading over $15, not $12. It was a different deal in a different market. That said, the credit rating upgrade alone would have taken the Talisman prefs back into the twenties at the time – the equivalent premium on that deal was only slightly more than on this offer. So under the comp, this Lowes deal looks reasonable.

One has every right to feel that the overall pref market might be undervalued (it probably is, and we are all entitled to our opinions). That however is a different issue – Lowes is doing what they should – using the current market values.

Pref market valuations – I still think we have to strongly consider the rates demanded of top tier issuers (TD, RY etc) on their most recent pref issues. The market demanded 5.5% with big resets. The $ price a security traded at 1, 3, 6, 12 etc months ago isn’t all that relevant – intrinsic value is. Current price should be a reflection of fair value.

Since most of the prefs we are talking about are fixed-resets I’ll just lay out some points->

– These are variable rate perpetual fixed income securities.

– The expected value of the future dividend streams for these securities has decreased dramatically in the last 15 months.

– There is no forced call at par on most of these securities.

– Thus the fair value for these securities is far less than it used to be.

– In a volatile low rate environment, these securities should be very volatile.

– These instruments traded at unreasonable valuations, low credit spreads and artificially low volatility for years as an artifact of QE.

After giving serious consideration to the points above, I think the Canadian pref market is only slightly undervalued given current market conditions. Anything resembling a ‘normalization’ will be a fundamental driven move based on rates rising and/ or steepening of the yield curve. The ‘normalization’ effect would be the tightening of seniority spreads that would accompany this.

I fear this will not lead to nearly as dramatic a rise as many pref investors are hoping for though (unless the rate moves are dramatic) – and for this to happen we will need to see some reduction in overall market volatility and likely a bounce in commodities (our rates are dropping as I type).

The positive side of this is that so much risk has been priced in to the prefs you do have a nice risk-reward profile for buying now. And you are getting a very nice carry while waiting for a ‘normalization.’

Sorry for the long diatribe on the valuations – needed to say it before I made this point. I think James’ opinion on the Lowes offer is based in rationality, not mental stress of the ‘pref crash.’ No doubt there have been a lot of week hands shaken out, but that doesn’t mean the entire pref market drop was irrational. Recommending that people take an offer above fair value (not dreaming that par is fair for all prefs) in the face of said mental stress is a clear example of being a professional.

I suppose this issue will change yield to worst calculations.

No where in the press release does it mention that Rona is redeeming the pref shares… Lowe’s is only offering to buy them!

Therefore, I see the dividend being paid by Rona until the shares are redeemed. Eventually, Lowe’s will tell Rona management to redeem the shares at $25 and get rid of me!

Why should pref shareholders bend over to let commons obtain a substantial premium.

Receiving a substantial premium over fair market value hardly constitutes ‘bending over’. Additionally, there is no ‘let the commons’ about it; if the common shareholders vote in favour then they will get their deal.

Is there a reason why the buy-back is at $20, instead of $25?

Yes. $20 is less than $25. Further, Lowe’s evidently believes that $20 is sufficient to achieve a favourable vote, so why would they pay more?

So the premium of the offer should be compared to a price of ~$18, not $13. $13 is irrelevant now, it is not a factor when looking at whether one should accept $20.

Quite true. And still quite the premium.

Next, all those comparables you mentioned were trading nicely above $22 just a few months ago in November (except the BAM.PF.B which has a ceiling of around $21).

Irrelevant.

Are you again assuming the market is pricing everything efficiently?

I wasn’t aware of ever having assumed the market is pricing everything efficiently.

If one were to use the November prices, the Lowes offer is around $2 UNDER “fair value”.

And if one were to use the prices at issue time, the Lowe’s offer would be around $5 under fair value. Again, I question the relevance of this statement.

The “premium” offered by Lowes is far too small given current volatility.

The premium I measured – and which you seem to have accepted – is over the fair market value in the $17-19 range (as of time of writing) over a pretty good range of investment-grade comparables. If you feel that there is a decent chance that market conditions in the future will be such that you will be able to swap into any of the comparables at a greater take-out than what is made possible by the Lowe’s offer, then of course you will seek to have the offer rejected.

I am of the opinion that such an opportunity will not arise in the normal course of events; that the probability of being able to swap into the comparables at better prices than indicated by the Lowe’s offer is vanishingly small.

One way to look at the situation is to look at the total returns since 2015-3-31 (to pick a date that is convenient for my systems). On that date, RON.PR.A was priced at 18.68.

Calculations are screwed up big-time by the change in Credit Quality, which you quite rightly suggest should be ignored. So look at the comparable BAM.PF.B – on that date it was priced at $23.75.

So if we assume a ‘credit-adjusted price’ of RON.PR.A of $23.75 as of 2015-3-31, then total return for the period since then has been comprised of a capital loss of $3.75 and dividends received of about $0.98, total $2.77, or about 11.7%.

The TXPL total return index was 946.17 on 2015-3-31 and is 689.97 today, indicating that total return for FixedResets in general is about -27.1% over the same period.

Thus, even when adjusting for the credit quality uplift, RON.PR.A has outperformed the index since 2015-3-31 by over 15%. When something outperforms by that much, I suggest that the default action is to sell it and buy something that has performed worse.

You, Scotia Capital, and anyone else recommending we bend over to Lowes, are telling people to accept a mere $2 over the current comparables, all of which are near historic lows.

Again, I suggest that accepting a massive premium to fair market value hardly constitutes ‘bending over’. In addition, the fact that the current comparables ‘are near historic lows’ is irrelevant.

THAT MONEY IS GONE. Absolute historical prices are irrelevant; if you are interested in owning a preferred share portfolio that will outperform in the future, you will seek to own shares that are cheaply priced at the moment of trading.

I suppose when you’ve been slowly drowning for months on end you’ll be willing to grasp on to any floating logs in the water. But what Lowes is dangling to us isn’t a log, it a piece of …

No. Anybody who seeks to own this asset class will seek to own the cheapest representatives of this asset class that they can, subject to constraints on credit quality, issuer concentration, etc. Lowe’s is offering a price sufficient to make everything – everything! – else in this market look cheap.

If you were deploying cash in this market, would you buy RON.PR.A at $20? I wouldn’t. I’d buy something cheaper.

Now, if RioCan had offered $17 per share to buy back REI.PR.A would you have told everyone to accept that too?

Almost certainly. $17 would have been a very good price for REI.PR.A, based on the announcement-day levels. The only source of uncertainty would be overall market moves in the period between announcement date and pay date; there is the possibility that $17 would look a bit skinny by the time you actually got the cash; this is the reason why I delay formal recommendations until very shortly before the acceptance notification deadline.

See the post REI.PR.A To Be Redeemed (with the updates) for more commentary on this matter.

It is highly questionable, in such a volatile environment, to suggest a ~$2 premium is sufficient when some of these prefs can move $2 in a day or two.

If I can make $2 every time I execute a swap transaction, then I will do so and it will make me very happy.

Lowes should have to do the same if they wish to rid themselves of their burden, the call date is conveniently only a couple months away.

How sweet. They “should” do the same, even if they don’t have to. Just like in kindergarten.

Who’s going to make them? You and what army of securities lawyers? You have absolutely no leverage to make them. Zip, zero, zilch. Recognize that fact and stop whimpering about “should”.

Your point about selling now for $20 and quickly buying some other comparables with the cash while they’re still near all time lows is valid

Glad to hear it. Did you think I was suggesting that the $20 be spent on beer and prostitutes? Be redeployed into junior oil stocks? What?

My assumption is always that an investor holds a reasonably well diversified portfolio of preferred stocks that, in aggregate, constitute an allocation to the asset class that has been chosen for good reasons.

To change asset class allocation simply because you got lucky on one constituent suddenly going way above fair value – while having negligible effect on the asset class valuation as a whole – would be the act of a fool.

but I already own all of those companies, and I don’t need more cash.

The marvellous thing about the investment business and risk assessment is that you can come up with any number you like, just by changing your risk tolerance numbers.

If you have a disciplined investment approach that demands you pay $2 over fair market value for the diversification represented by RON.PR.A, I challenge you to show me the numbers. It is my professional opinion that that is far too high a price to pay.

Lowes can come get my Rona preferred shares out of my cold dead hands!

(or pay the friggin call price)

If you wait for a call to be an economically reasonable option for Lowe’s, then you may be waiting a long, long time. And during that long, long time, I suggest there is an extremely high probability that the comparators will outperform.

Thank you all for the questions, comments, and responses. I am finding this really educational.

Educational and lively indeed.

A point which has not been discussed is whether, had all the assets of RONA been liquidated for the price offered by Lowes, the pref shareholders would have been made “whole” (getting $25 per share).

If the answers is “yes” as I think it is, I can understand the frustration expressed by PrefCandy. The problem here is that the prefs did not get the same %uplift on the market price of their shares as the ordinaries got. In that sense, unhappy prefholders might have a leg to stand on in their complaints based upon the principle of corporate law that minority shareholders or, I would venturing adding, prefholders cannot be treated unfairly compared with the others.

James is perfectly right that the company or its buyer may rely upon all the fine prints and legalities of what the buyers must have agreed to buying the prefshares. I do however have a major problem with any suggestion that prefs holders should be forced to sell at a price below $25 they do not agree with since this is clearly not disclosed in the prospectus coming with the share.

Yes this may mean that there would only be a few oustanding shares left trading after the majority of prefholders do accept the offer. This could indeed even worsen the secondar market value for the remaining shares compared with where their price was prior to the take over. However, it should be the prefholder’s right to hold onto what he bought and to be paid the dividend coming with it until the company is to get fed up having to report and pay dividends to this stubborn minority.

Unlike ordinary shares which give the holder full voting rights, prefholders do not have that right such that they should be treated as creditors where a company is otherwise not insolvent.

I am not aware (and haven’t searched) for any authority on this but I do note that a source of the relative impopularity of pref shares are those kind of surprises for those who bought shares thinking that they could only be bought up (or reedemed) at $25 without their consent.

Bye!

I’m also glad to see so many well thought out and explored conversations on this blog recently. I’ll attempt to add a couple more points to this one – regarding legal holes popping up. I am not a lawyer and this does not constitute legal advice (however, I have consulted one).

The issuers relying on the prospectus are relying on the law – the clearly defined governing document of ‘the issue’ – not nefarious fine print. This is why we have a reputable, functional capital market.

Unless there is a clearly defined provision for it in the prospectus, an issuer cannot force a holder to take a redemption at less than the par value of the security.

In the case of RON.PR.A (and most fixed-resets), redemption rights are clear:

– The company can call the issue for redemption at par ($25) on conversion / rate reset dates (every 5 years)

– The company can attempt to acquire any or all of the outstanding shares of the issue at any time via open market transactions, private deals or other methods BELOW or at the par price, not above (and it does not matter what holders of the issue desire)

– The issue is a perpetual security with NO provision for holders to force redemption

So, RONA and Lowes cannot force you to tender at $20 – you can hold to your heart’s content. Bear in mind, they are not required to maintain an exchange listing for RON.PR.A – and most likely won’t be able to maintain TSX listing standards after the vast majority tender – so you’ll likely have zero liquidity and be at the mercy of Lowes as to when you can exit your position.

Dissolution and liquidation are clearly defined and the prospectus covers what happens in these cases – the clear definitions also ensure us that they are completely irrelevant to this RON.PR.A discussion.

The prospectus also clearly defines requirements around seniority, dividends and redemption of junior issues. The only provision potentially relevant to our case here is that the RON.PR.A cumulative dividends need to be paid up to date (and they are).

There is no covenant that would require a potential acquirer to offer the same % premium for a preferred and the common nor one that requires they offer at par. There is also no practical reason for them to do so – I think the biggest reason this is even coming up is because the pref and common price happened to be so close pre-offer. Equity holders take the risk and get the reward. My comments on the fairness of the pref tender offer are in an above post.

While we’re talking about rights etc – relating back to the restructuring of various prefs that has happened recently. In case it is still in question – the prospectus clearly defines the amendment process too (required voting levels etc). It is well within a company’s rights to propose amendments. It is in the holders rights to vote for or against said amendments. If the vote passes and you still do not agree, unfortunately you are out of luck – that is how it works. I think James and everyone are correct in being concerned about, and frankly questioning the ethical-ity of, paying holders to vote in favor of an amendment.

this deal will take a few months to close and let’s hope that by then the market will get back to more normal valuations…. It may very well be that by then 20 will look low.

Possibly. That’s why investors should defer finalizing their vote until just prior to the deadline – in order to minimize the chance that random factors will turn their good decision into a bad one.

The company has given specifics of the meeting date on SEDAR at “RONA inc. Feb 9 2016 15:15:20 ET Notice of the meeting and record date – English PDF 105 K”, to wit:

There is no indication as yet of an anticipated closing date, but I assume it will be relatively soon after a successful outcome. The interval between may represent market risk to some investors, but this can be mitigated by buying replacement securities on margin until the cash is received, or – such is the miracle of modern markets – selling on the market, which in terms of total return will come to more or less the same thing (as the market price will normally be at a small discount to the closing price).

Given, however, that the TXPL total return index is down 4.27% from its close February 2 (last close prior to the announcement) to the close February 24, things appear to be moving in the other direction!

I think there is a good chance that this will get sweeten.

Why?

I think that by accepting this offer in its current structure they failed to their mandate towards the pref holders.

I can’t agree with that. A straightforward purchase of all the common by Lowe’s gives the preferred shareholders a gain due to credit improvement of about maybe $5. Then the preferred share deal – which is not necessary for the deal to close, they could have done it like the Capstone deal – gives the preferred shareholders another about maybe $2 on top of that.

How hard should they push? Enough to jeopardize the whole deal, just to get a few cents more for the preferred shareholders?

I will also suggest that unless you were privy to the negotiations – in which case you shouldn’t be commenting! – you have no idea of how hard they pushed or how close Lowe’s was to walking away.

I feel that the company had a moral obligation to take out the prefs at the original issue price

A moral obligation and $2 will get you a cup of coffee. And, as discussed above, I disagree that any such obligation existed.

or a reduction of about 25 cents to the price offered to the commons

Do you want to be the one to tell the common shareholders that? ‘Oh, by the way, we did something we didn’t need to do and it cost you $0.25 a share. Doesn’t that make you feel warm all over?’

When the company was struggling and needed financing the pref investors came in to support

With all due respect, newbiepref, this is horse-patootie. The pref investors came in to make money. This came out as a bought deal for a junk credit and achieved a premium in the first day’s trading.

Anybody who puts their own money on the line to support a struggling company for sentimental reasons is either an idiot or a government, probably both.

now some of them may be forced to sell and take a 5$ loss,

The five dollar loss represents only a fraction of what they should have lost through making an investment that turned out badly.

You cannot blame Lowe’s or RONA for the $5 capital loss. This loss – and much more besides – is a result of changing market conditions, and they have had no more control over that than you or I do.

we will see almost no return on their 5 year investment and that was not the deal.

The deal was outlined in the prospectus. Pays yer money and takes yer chances. Bankruptcy was not the deal, either, but that was also a potential outcome.

The company is taking advantage of this chage of control offer to give themselves a right that they did not have i.e. to redeem at a lower price and force some holders to redeem in a down market.

Wrong. The company is putting a Plan of Arrangement to shareholder vote. If they get two thirds support – which I’d say is a slam-dunk – then the preferred share deal will go through and holders will get $20 cash. If opponents can convince one-third or more of the holders to oppose the deal, then the deal will not succeed. And the issue will trade at a price within range of its comparables, which I estimated as $17-$19 (probably more like $16-$18, after the intervening market weakness) and if you think that will represent a Good Thing and a Victory For The Forces Of Good, then all I can say is that I do not share your view.

if Rona wants to redeem at 20, fine but do not force everyone to do so , the same way Dundee should have offered a retraction right at the agreed upon date in its offer.

At least part of the reason Lowe’s is offering such a good price for RON.PR.A is because this will mean RONA will no longer be a Reporting Issuer, which will save them some money and give them a little more flexibility in managing their operations, so it’s not quite the same thing.

While I agree that ideally preferred shareholders should have the right to hold to the original deal, it doesn’t pay to be too doctrinaire about this. When the new deal is so obviously vastly superior to the old one, I throw away my bureaucratic check-list and say ‘it’s a pleasure doing business with you!’

I wonder how the Scotia brokers ,who sold the initial issue to their customers , will explain that the fairness opinion of their house.

Same way I am, presumably.

I had to laugh when I checked out what other new issues came out at about the same time as RON.PR.A … GMP.PR.B was announced the same day. So on announcement day, the notional swap traded flat: no take-out, no give-up. GMP.PR.B closed at $8.90 on February 24.

Other contemporary new issues announced at about that time were BNS.PR.Z, BAM.PR.X and REI.PR.A … the last of these also having turned out to be a special situation!

I think that James is right on point with his comments and recommendation regarding the RON.PR.A.

Thank you! Have a cookie!

If they had tried to call it [REI.PR.A] at a lower price everyone in the market should have, and would have, been up in arms.

That would only have been possible by shareholder vote. As I’ve stated in the post about the REI.PR.A redemption, I would not only have been happy with less, but I take the view that the CFO was derelict in her responsibility to the common holders in not trying to do exactly that.

– The expected value of the future dividend streams for these [FixedReset] securities has decreased dramatically in the last 15 months.

– There is no forced call at par on most of these securities.

– Thus the fair value for these securities is far less than it used to be.

I don’t quite agree with you on this one. The fair value will depend on what yield you use to discount the future cash flows. If this discounting rate is ‘a fixed spread off Five Year Canadas’, then the fair value of these securities will never change … which is why the structure was so popular when introduced.

Anything resembling a ‘normalization’ will be a fundamental driven move based on rates rising and/ or steepening of the yield curve. The ‘normalization’ effect would be the tightening of seniority spreads that would accompany this.

Here again I’ve got to quibble and suggest that a steepening should be expected to be bad for FixedResets. A 5-30 flattening should be good.

I suppose this issue will change yield to worst calculations.

I confess I’m not sure what you mean by this.

No where in the press release does it mention that Rona is redeeming the pref shares… Lowe’s is only offering to buy them!

Therefore, I see the dividend being paid by Rona until the shares are redeemed. Eventually, Lowe’s will tell Rona management to redeem the shares at $25 and get rid of me!

It’s possible. We’ve seen some strange things happen with captive companies, such as the Junior Preferred shares of Partners Value Split Corp., which usually don’t bother paying their dividends.

I can’t say I understand all the ins and outs of that decision, but given that all the Capital Units of PVS are held by the entity that also holds all the Junior Prefs, I think it’s just a tax-driven revenue-recognition thing. I can’t see any reason why the suggested course of action would be advisable for Lowe’s, but then I’m not a high-priced tax lawyer.

A point which has not been discussed is whether, had all the assets of RONA been liquidated for the price offered by Lowes, the pref shareholders would have been made “whole” (getting $25 per share).

Well, I don’t know. I can say that RONA had over $56-million in “Net deferred tax assets (liabilities)” on its books, goodwill of $365-million and intangibles of $135-million, so the deal you’re proposing wouldn’t be very straightforward. But it’s a moot point.

I do however have a major problem with any suggestion that prefs holders should be forced to sell at a price below $25 they do not agree with since this is clearly not disclosed in the prospectus coming with the share.

From the prospectus (SEDAR, RONA inc. Feb 11 2011 11:08:24 ET Final short form prospectus – English PDF 190 K) :

The terms of the issue can be changed at any time, but a supermajority of the votes is required. The potential for the other shareholders voting in favour of something you consider silly is just another one of the risks of investing.

Yes this may mean that there would only be a few oustanding shares left trading after the majority of prefholders do accept the offer.

In which case the deal loses all value to Lowe’s.

However, it should be the prefholder’s right to hold onto what he bought and to be paid the dividend coming with it until the company is to get fed up having to report and pay dividends to this stubborn minority.

In common shares terms, this is a Squeeze-Out. Like eminent domain, it’s an issue in which all but the most fervent idealogues will admit there is no perfect answer – there’s only a cut-off point which is, hopefully, straightforward, enforceable and mostly fair.

I remember reading Morton Shulman’s book years ago and, even at my tender age, being bewildered that a handful of holders could squeeze ridiculous amounts out of companies that wanted to merge, simply by saying ‘no’.

More recently, I remember being disgusted when reading of things like New York tenants of rent-controlled apartments getting paid ridiculous amounts – like $25-million – to move out of their apartment so a major development could finally happen.

In short: suggest something better. Right now we have a requirement for a super-majority of the holders and the arrangement needs to be blessed by a judge. I think that’s fair enough. Not perfect … but better than giving a tiny minority virtually unlimited powers of obstruction.

Unlike ordinary shares which give the holder full voting rights, prefholders do not have that right such that they should be treated as creditors where a company is otherwise not insolvent.

If they want to be treated like creditors, then they should buy bonds. Of course, that would imply giving up the spread paid on preferred shares. And remember that the terms of bonds can be changed by bond-holder vote as well!

I am not aware (and haven’t searched) for any authority on this but I do note that a source of the relative impopularity of pref shares are those kind of surprises for those who bought shares thinking that they could only be bought up (or reedemed) at $25 without their consent.

I find that more than just a little surprising. If you do search for and find an authority for this assertion, please let us know.

The company can attempt to acquire any or all of the outstanding shares of the issue at any time via open market transactions, private deals or other methods BELOW or at the par price, not above (and it does not matter what holders of the issue desire)

Some people are infuriated by this. I have no idea why.

So, RONA and Lowes cannot force you to tender at $20 – you can hold to your heart’s content. Bear in mind, they are not required to maintain an exchange listing for RON.PR.A – and most likely won’t be able to maintain TSX listing standards after the vast majority tender – so you’ll likely have zero liquidity and be at the mercy of Lowes as to when you can exit your position.

A voluntary delisting when still qualified is something I would consider abusive, but yes, they have that right and yes, it does happen. This was an issue, for instance, with the BRF.PR.E Exchange Offer. Delisting has also been proposed as a method of coercive social justice. I also remember that delisting was proposed as a tactic during the Billes Battle over Canadian Tire to avoid one of the Toronto Stock Exchange rules regarding takeover offers … but this was pre-Internet and links are scarce!

While we’re talking about rights etc – relating back to the restructuring of various prefs that has happened recently. In case it is still in question – the prospectus clearly defines the amendment process too (required voting levels etc). It is well within a company’s rights to propose amendments. It is in the holders rights to vote for or against said amendments. If the vote passes and you still do not agree, unfortunately you are out of luck – that is how it works.

Quite right. It works the same way with government policy and elections, too!