I mentioned yesterday the thesis that depressed markets are due to SWFs cashing out (although whenever I read that acronym, my first thought is “Single White Female”. Blush, blush.) Charles Stein of Bloomberg adds a bit more colour to that idea:

Money managers are having trouble hanging on to money.

Franklin Resources Inc. said Wednesday that investors withdrew $20.6 billion in the fourth quarter, the latest asset manager to highlight the issue of redemptions. Affiliated Mangers Group Inc. said on Tuesday that it had outflows of $6.8 billion, while Waddell & Reed saw $5 billion in withdrawals, contributing to the biggest drop in its stock since the financial crisis of 2008.

Money managers are hurt by slumping stock markets worldwide, which have prompted investors to dump anything perceived as risky. The firms are getting squeezed by sovereign wealth funds in need of cash after oil prices plunged, and the shift by investors from active funds to cheaper ones that track indexes. The preference for passive products and exchange-traded funds has created winners, including Vanguard Group Inc. and BlackRock Inc.

…

Aberdeen Asset Managment Plc last month cited the cash needs of sovereign wealth funds as one of the reasons the firm experienced 9.1 billion pounds ($13.2 billion) of withdrawals in the fourth quarter. The wealth funds from oil-producing nations, which boosted their investments when energy prices were high, are taking money back to fill the budget shortfalls created by cheap oil.“Sovereign wealth funds were set up for a rainy day and that rainy day has arrived,” Aberdeen CEO Martin Gilbert said on a conference call in January. Gilbert in November said that 2016 would be a tough one for the asset management business if oil remained at $45 to $50 a barrel. It sells today for about $30.

Phillips of Casey Quirk estimated that about 70 percent of net global flows in 2015 went into passive products, a business dominated by a small number of players. Vanguard, known for its low-cost index funds and exchange-traded funds, collected a record $236 billion in deposits last year, including more than $58 billion in the fourth quarter.

But what the hell. Every day there’s an announcement of astonishing technological progress:

Scientists at the Max Planck Institute in Germany have successfully conducted a revolutionary nuclear fusion experiment. Using their experimental reactor, the Wendelstein 7-X (W7X) stellarator, they have managed to sustain a hydrogen plasma – a key step on the path to creating workable nuclear fusion. The German chancellor Angela Merkel, who herself has a doctorate in physics, switched on the device at 2:35 p.m. GMT (9:35 a.m. EST).

As a clean, near-limitless source of energy, it’s no understatement to say that controlled nuclear fusion (replicating the process that powers the Sun) would change the world, and several nations are striving to make breakthroughs in this field. Germany is undoubtedly the frontrunner in one respect: This is the second time that it’s successfully fired up its experimental fusion reactor.

So this is just one element in the thesis that technological progress has become so swift that disruptions in the market have become so frequent and fundamental that low growth – at least in the developed world – is virtually inevitable. Disruption is good in the long run, but bad in the short run … it took a long time for stenographers to re-train as administrative assistants, and a long time for companies to realize they needed them! It would be ideal if disruptions were maintained at a constant low level to allow for adjustment without broader-based recessions … but those darned engineers and scientists refuse to cooperate!

It was a good day for the Canadian preferred share market, with PerpetualDiscounts gaining 35bp, FixedResets winning 55bp and DeemedRetractibles up 40bp. The Performance Highlights table is lengthy. Volume was a little below average.

PerpetualDiscounts now yield 5.82%, equivalent to 7.57% interest at the standard equivalency factor of 1.3x. Long corporates continue to yield 4.2%, so the pre-tax interest-equivalent spread (in this context, the “Seniority Spread”) is now about 335bp, a significant decline from the 350bp reported January 27.

For as long as the FixedReset market is so violently unsettled, I’ll keep publishing updates of the more interesting and meaningful series of FixedResets’ Implied Volatilities. This doesn’t include Enbridge because although Enbridge has a large number of issues outstanding, all of which are quite liquid, the range of Issue Reset Spreads is too small for decent conclusions. The low is 212bp (ENB.PR.H; second-lowest is ENB.PR.D at 237bp) and the high is a mere 268 for ENB.PF.G.

Remember that all rich /cheap assessments are:

» based on Implied Volatility Theory only

» are relative only to other FixedResets from the same issuer

» assume constant GOC-5 yield

» assume constant Implied Volatility

» assume constant spread

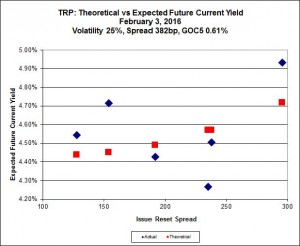

Here’s TRP:

TRP.PR.E, which resets 2019-10-30 at +235, is bid at 17.35 to be $1.15 rich, while TRP.PR.G, resetting 2020-11-30 at +296, is $0.82 cheap at its bid price of 18.10.

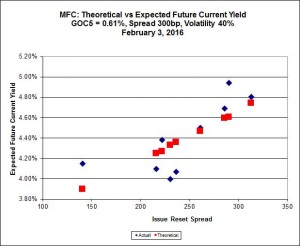

Most expensive is MFC.PR.N, resetting at +230bp on 2020-3-19, bid at 18.20 to be 1.39 rich, while MFC.PR.G, resetting at +290bp on 2016-12-19, is bid at 17.75 to be 1.31 cheap.

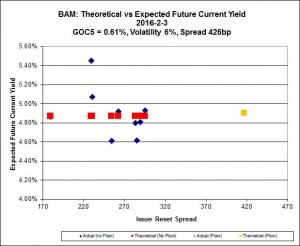

The cheapest issue relative to its peers is BAM.PR.R, resetting at +230bp on 2016-6-30, bid at 13.35 to be $1.59 cheap. BAM.PF.F, resetting at +286bp on 2019-9-30 is bid at 18.80 and appears to be $0.99 rich.

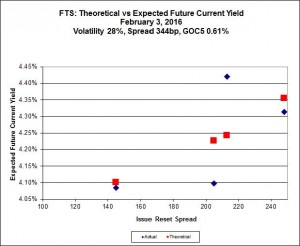

FTS.PR.K, with a spread of +205bp, and bid at 16.23, looks $0.49 expensive and resets 2019-3-1. FTS.PR.G, with a spread of +213bp and resetting 2018-9-1, is bid at 15.50 and is $0.65 cheap.

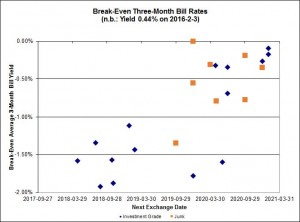

Investment-grade pairs predict an average three-month bill yield over the next five-odd years of -0.98%, with one outlier above 0.00%. There are three junk outliers above 0.00%.

Shall we just say that this exhibits a high level of confidence in the continued rapacity of Canadian banks?

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 5.29 % | 6.43 % | 18,511 | 16.16 | 1 | 0.0000 % | 1,474.7 |

| FixedFloater | 7.60 % | 6.64 % | 28,586 | 15.63 | 1 | 0.8065 % | 2,615.9 |

| Floater | 4.65 % | 4.82 % | 74,649 | 15.80 | 4 | 0.9179 % | 1,650.3 |

| OpRet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0069 % | 2,700.6 |

| SplitShare | 4.89 % | 6.26 % | 80,714 | 2.71 | 6 | -0.0069 % | 3,160.2 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0069 % | 2,465.7 |

| Perpetual-Premium | 5.86 % | 5.83 % | 81,596 | 14.00 | 6 | 0.1201 % | 2,520.6 |

| Perpetual-Discount | 5.79 % | 5.82 % | 98,399 | 14.14 | 33 | 0.3534 % | 2,495.8 |

| FixedReset | 5.49 % | 4.89 % | 226,762 | 14.48 | 83 | 0.5471 % | 1,846.6 |

| Deemed-Retractible | 5.25 % | 5.69 % | 131,408 | 6.94 | 34 | 0.4027 % | 2,574.4 |

| FloatingReset | 3.05 % | 4.68 % | 52,853 | 5.56 | 16 | 1.0284 % | 2,011.0 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PF.B | FixedReset | -5.24 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 16.46 Evaluated at bid price : 16.46 Bid-YTW : 5.35 % |

| BAM.PF.G | FixedReset | -2.55 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 17.98 Evaluated at bid price : 17.98 Bid-YTW : 5.31 % |

| PWF.PR.T | FixedReset | -2.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 21.01 Evaluated at bid price : 21.01 Bid-YTW : 3.85 % |

| BAM.PR.T | FixedReset | -2.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 14.40 Evaluated at bid price : 14.40 Bid-YTW : 5.44 % |

| BAM.PF.E | FixedReset | -1.89 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 17.13 Evaluated at bid price : 17.13 Bid-YTW : 5.18 % |

| FTS.PR.G | FixedReset | -1.59 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 15.50 Evaluated at bid price : 15.50 Bid-YTW : 4.88 % |

| BNS.PR.N | Deemed-Retractible | -1.10 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-01-27 Maturity Price : 25.00 Evaluated at bid price : 25.15 Bid-YTW : 4.68 % |

| BMO.PR.W | FixedReset | 1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 17.03 Evaluated at bid price : 17.03 Bid-YTW : 4.53 % |

| CIU.PR.C | FixedReset | 1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 10.47 Evaluated at bid price : 10.47 Bid-YTW : 4.89 % |

| RY.PR.F | Deemed-Retractible | 1.04 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.35 Bid-YTW : 4.94 % |

| BMO.PR.Y | FixedReset | 1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 19.35 Evaluated at bid price : 19.35 Bid-YTW : 4.52 % |

| RY.PR.P | Perpetual-Discount | 1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 23.72 Evaluated at bid price : 24.06 Bid-YTW : 5.45 % |

| CM.PR.O | FixedReset | 1.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 17.60 Evaluated at bid price : 17.60 Bid-YTW : 4.54 % |

| RY.PR.I | FixedReset | 1.10 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.90 Bid-YTW : 3.90 % |

| TD.PF.B | FixedReset | 1.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 17.39 Evaluated at bid price : 17.39 Bid-YTW : 4.49 % |

| SLF.PR.I | FixedReset | 1.16 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 17.45 Bid-YTW : 8.46 % |

| CU.PR.C | FixedReset | 1.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 17.20 Evaluated at bid price : 17.20 Bid-YTW : 4.56 % |

| CU.PR.H | Perpetual-Discount | 1.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 22.35 Evaluated at bid price : 22.66 Bid-YTW : 5.79 % |

| TRP.PR.F | FloatingReset | 1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 11.79 Evaluated at bid price : 11.79 Bid-YTW : 5.08 % |

| VNR.PR.A | FixedReset | 1.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 16.75 Evaluated at bid price : 16.75 Bid-YTW : 5.39 % |

| TRP.PR.A | FixedReset | 1.35 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 14.29 Evaluated at bid price : 14.29 Bid-YTW : 4.86 % |

| MFC.PR.I | FixedReset | 1.37 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.50 Bid-YTW : 7.94 % |

| NA.PR.S | FixedReset | 1.39 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 17.56 Evaluated at bid price : 17.56 Bid-YTW : 4.66 % |

| RY.PR.L | FixedReset | 1.39 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.85 Bid-YTW : 3.91 % |

| SLF.PR.J | FloatingReset | 1.39 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 11.66 Bid-YTW : 11.63 % |

| BIP.PR.A | FixedReset | 1.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 18.00 Evaluated at bid price : 18.00 Bid-YTW : 6.07 % |

| HSE.PR.A | FixedReset | 1.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 8.62 Evaluated at bid price : 8.62 Bid-YTW : 7.11 % |

| MFC.PR.M | FixedReset | 1.44 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.26 Bid-YTW : 7.80 % |

| BAM.PR.K | Floater | 1.54 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 9.90 Evaluated at bid price : 9.90 Bid-YTW : 4.82 % |

| CCS.PR.C | Deemed-Retractible | 1.57 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.05 Bid-YTW : 6.89 % |

| BNS.PR.F | FloatingReset | 1.58 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.00 Bid-YTW : 7.74 % |

| RY.PR.K | FloatingReset | 1.63 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.82 Bid-YTW : 4.77 % |

| TD.PF.C | FixedReset | 1.64 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 17.40 Evaluated at bid price : 17.40 Bid-YTW : 4.48 % |

| PWF.PR.S | Perpetual-Discount | 1.69 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 21.05 Evaluated at bid price : 21.05 Bid-YTW : 5.74 % |

| BNS.PR.Z | FixedReset | 1.72 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.90 Bid-YTW : 7.16 % |

| TRP.PR.E | FixedReset | 1.76 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 17.35 Evaluated at bid price : 17.35 Bid-YTW : 4.75 % |

| BNS.PR.L | Deemed-Retractible | 1.79 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.48 Bid-YTW : 4.94 % |

| BAM.PR.B | Floater | 1.85 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 9.91 Evaluated at bid price : 9.91 Bid-YTW : 4.82 % |

| RY.PR.M | FixedReset | 1.88 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 18.45 Evaluated at bid price : 18.45 Bid-YTW : 4.58 % |

| MFC.PR.J | FixedReset | 1.88 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 17.89 Bid-YTW : 8.12 % |

| BNS.PR.C | FloatingReset | 2.12 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.16 Bid-YTW : 4.44 % |

| MFC.PR.N | FixedReset | 2.36 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.20 Bid-YTW : 7.78 % |

| FTS.PR.F | Perpetual-Discount | 2.54 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 21.95 Evaluated at bid price : 22.19 Bid-YTW : 5.61 % |

| TRP.PR.C | FixedReset | 2.70 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 11.40 Evaluated at bid price : 11.40 Bid-YTW : 4.93 % |

| SLF.PR.G | FixedReset | 2.75 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 13.10 Bid-YTW : 10.60 % |

| HSE.PR.E | FixedReset | 2.79 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 15.85 Evaluated at bid price : 15.85 Bid-YTW : 6.92 % |

| BNS.PR.B | FloatingReset | 2.95 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.65 Bid-YTW : 4.68 % |

| CM.PR.P | FixedReset | 3.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 17.21 Evaluated at bid price : 17.21 Bid-YTW : 4.54 % |

| FTS.PR.J | Perpetual-Discount | 3.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 21.55 Evaluated at bid price : 21.55 Bid-YTW : 5.62 % |

| HSE.PR.G | FixedReset | 3.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 16.11 Evaluated at bid price : 16.11 Bid-YTW : 6.80 % |

| SLF.PR.H | FixedReset | 4.11 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 14.68 Bid-YTW : 10.13 % |

| HSE.PR.C | FixedReset | 4.48 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 15.15 Evaluated at bid price : 15.15 Bid-YTW : 6.68 % |

| TRP.PR.I | FloatingReset | 5.00 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 10.50 Evaluated at bid price : 10.50 Bid-YTW : 4.77 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| NA.PR.X | FixedReset | 144,750 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 23.13 Evaluated at bid price : 24.97 Bid-YTW : 5.55 % |

| RY.PR.Q | FixedReset | 144,512 | Nesbitt crossed blocks of 50,000 and 59,000, both at 25.62. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 23.32 Evaluated at bid price : 25.59 Bid-YTW : 5.12 % |

| BNS.PR.E | FixedReset | 111,649 | RBC crossed 25,000 at 25.63. Scotia crossed blocks of 40,000 and 20,000, both at the same price. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 23.33 Evaluated at bid price : 25.58 Bid-YTW : 5.11 % |

| BMO.PR.W | FixedReset | 59,769 | Nesbitt crossed 25,100 at 17.00. Desjardins crossed 16,500 at the same price. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 17.03 Evaluated at bid price : 17.03 Bid-YTW : 4.53 % |

| TD.PF.G | FixedReset | 47,207 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2021-04-30 Maturity Price : 25.00 Evaluated at bid price : 25.60 Bid-YTW : 5.07 % |

| BMO.PR.T | FixedReset | 37,422 | Scotia crossed 25,000 at 17.22. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-03 Maturity Price : 17.22 Evaluated at bid price : 17.22 Bid-YTW : 4.51 % |

| There were 28 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| BAM.PF.B | FixedReset | Quote: 16.46 – 17.43 Spot Rate : 0.9700 Average : 0.6121 YTW SCENARIO |

| NA.PR.W | FixedReset | Quote: 16.24 – 17.01 Spot Rate : 0.7700 Average : 0.4632 YTW SCENARIO |

| RY.PR.K | FloatingReset | Quote: 21.82 – 22.83 Spot Rate : 1.0100 Average : 0.7406 YTW SCENARIO |

| FTS.PR.G | FixedReset | Quote: 15.50 – 16.11 Spot Rate : 0.6100 Average : 0.3914 YTW SCENARIO |

| PWF.PR.T | FixedReset | Quote: 21.01 – 21.70 Spot Rate : 0.6900 Average : 0.4862 YTW SCENARIO |

| CIU.PR.A | Perpetual-Discount | Quote: 19.50 – 20.18 Spot Rate : 0.6800 Average : 0.4980 YTW SCENARIO |