Concern about the US debt ceiling is increasing:

The United States faces an “elevated risk” of running out of cash to pay its bills between June 2 and 13 if Congress does not raise or suspend the nation’s debt limit, according to an analysis released on Tuesday by the Bipartisan Policy Center, an influential think tank that carefully tracks federal spending.

…

The center noted that the federal government could get a reprieve if it mustered sufficient revenue to make it to June 15, when quarterly tax payments are due. That could push a default, the so-called X-date, into July.However, Treasury Secretary Janet L. Yellen said this week that she thought it was unlikely that the federal government would have enough cash on hand to make it to mid-June.

There’s one disputed issue that will cause eyes to roll:

The White House is seeking to preserve funding for key components of the federal coronavirus response in debt limit negotiations with House Republicans, according to senior Biden administration officials familiar with the talks.

Administration officials are trying to protect roughly $5 billion in funding for a program to develop the next generation of coronavirus vaccines and treatments. They are also looking to preserve more than $1 billion in funding for an initiative to offer free coronavirus shots to uninsured Americans, according to the officials.

…

As one component of a debt limit deal, House Republicans want to reclaim tens of billions of dollars in unspent funds from Covid-19 relief legislation. It was unclear which funds might be clawed back as part of a deal, though the administration and congressional negotiators have found some agreement on the topic. President Biden said this month that rescinding unspent coronavirus funds was “on the table.”

The pundits tell us this caused yields to spike:

U.S. and Canadian stocks finished sharply lower on Tuesday, and short-term government bond yields shot up, as investor jitters grew over a lack of progress in U.S. debt limit talks.

…

Those yields rose across the curve, catching up with moves in U.S. Treasuries as the Canadian market reopened following the Victoria Day holiday on Monday.

The five-year Canada is now at 3.42%.

Douglas Irwin writes an interesting piece in F&D magazine titled THE RETURN OF INDUSTRIAL POLICY:

While it has become fashionable to disparage the neoliberal economic policies of the Washington Consensus, the openness of that reform period saw convergence—not the divergence that had been the historical norm—between the rich and poor countries around the world. Starting around 1990, developing economies began to grow more rapidly and catch up to the higher income levels enjoyed by advanced economies (Patel, Sandefur, and Subramanian 2021).

The recent debate about whether globalization is dead or not is sterile. Developing economies would be ill-advised to turn their backs on the global economy and give up the idea of supporting exports and acquiring technology from beyond their borders. They still have much to gain from the rest of the world and a lot to lose by returning to the closed-door policies of the past.

François Villeroy de Galhau, Governor of the Bank of France, gave a speech titled Monetary policy transmission: where do we stand?:

Turning now to bank loans to households and firms, let me stress that this credit channel is of primary importance in the euro area – much more so than in the United States – as bank loans remain the dominant source of financing for firms, in particular for smaller firms.1 Overall, the growth rate of loans has slowed due to a combination of higher borrowing rates, lower demand, and – for firms – tighter credit standards.

…

Real rates increased significantly from historically low levels (-4% for the 2y real OIS rate in March 2022, see LHS panel) but remained negative at all maturities until mid-December last year (blue line on the RHS panel). It is only from the end of 2022 that we achieved positive real rates. As we estimate the neutral rate r* to be close to zero, we are now clearly in restrictive territory.

…

First, the current tightening cycle started from exceptionally low levels of real interest rates – as measured by nominal OIS rate deflated by market inflation expectations. \Second, the proportion of fixed-rate long-term loans is particularly high by historical standards. Many borrowers shifted away from floating rate loans after the global financial crisis and the following decade of low rates encouraged longterm borrowing. This is welcome for financial stability, especially for mortgages. But as a result, the pass-through of higher policy rates is more gradual.

Third, the origin and sectorial composition of inflation matters. The current surge in inflation does not primarily originate in overheated demand but in supply shocks. This has implication for the transmission lags.

…

The policy rate hikes already implemented are being transmitted forcefully to the euro area financing and monetary conditions. However, the lags and strength of transmission to the real economy remain more uncertain. I would draw from this three policy conclusions:a. In the usual alleged time lag of one to two years for monetary transmission, our economic situation makes it likely that we are presently closer to the upper range. And hence the commitment I reaffirm today to bring inflation back towards 2% by 2025, is consistent with the full transmission of the monetary tightening that will have been put in place by summer 2023.

b. Against this backdrop of significant transmission “in the pipe“ and still to come, a deceleration in the size of the policy steps (from 50bp to 25 bp) was wise and cautious. We obviously keep our hands free, but we add the capacity of observing and monitoring the pass-through of our substantial and exceptionally rapid past hikes. Persistence is now more important than speed; the duration for which we will maintain rates is now more important than the precise terminal level we will reach. Or in other words, for interest rates as with ballistics, “longer” is becoming more significant than “higher”.

c. Hence, our next rate decisions should not monopolise attention; we already have completed most of our rate-hiking journey, and we are clearly in restrictive territory. That said, as I said already last January, I expect today that we will be at the terminal rate not later than by summer. Summer is a long and beautiful season, which starts in June and ends in September. In the meantime, we have three possible Governing Councils either for hiking or pausing; but don’t deduce a guidance from this or a preference for a given terminal rate. We will remain data driven, looking meeting by meeting at the outlook for headline inflation as well as for the dynamics of underlying inflation and the strength of monetary policy transmission.

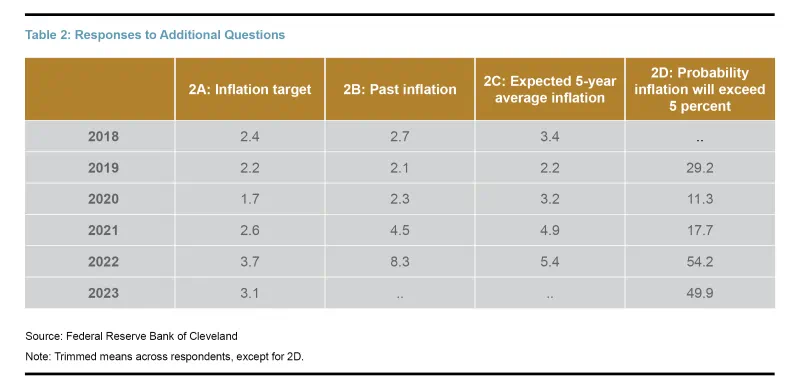

The Cleveland Fed is promoting the The Survey of Firms’ Inflation Expectations:

The inflation expectations of individuals who lead firms can influence the prices that their firms charge customers and hence can influence overall inflation. This Economic Commentary summarizes results from the Survey of Firms’ Inflation Expectations (SoFIE), which asks top business executives for their inflation expectations once per quarter alongside a second question from a rotating set. We document that this group’s inflation expectations increased with the run-up in inflation over 2021 and 2022 but then began to decline in early 2023. The Cleveland Fed will post estimates from the Survey of Firms’ Inflation Expectations each quarter, available via clefed.org/SoFIE.

…

Finally, Table 2 shows the average responses to the rotating questions that are asked in only one quarter per year. Prior to the pandemic, firms generally believed that the Federal Reserve’s inflation target was around 2 percent, that past inflation was around 2.5 percent, and that inflation would average 2 percent to 3 percent over the next five years. As inflation increased in 2021 and 2022, all of these estimates increased, including firms’ expectations for average inflation over the next five years.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 1.0259 % | 2,176.8 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 1.0259 % | 4,175.0 |

| Floater | 10.35 % | 10.56 % | 50,033 | 9.02 | 2 | 1.0259 % | 2,406.1 |

| OpRet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1530 % | 3,356.0 |

| SplitShare | 5.01 % | 6.84 % | 42,336 | 2.57 | 7 | 0.1530 % | 4,007.8 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1530 % | 3,127.0 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1214 % | 2,711.4 |

| Perpetual-Discount | 6.29 % | 6.41 % | 42,348 | 13.30 | 34 | -0.1214 % | 2,956.6 |

| FixedReset Disc | 5.99 % | 8.40 % | 83,189 | 11.27 | 63 | -0.0098 % | 2,080.9 |

| Insurance Straight | 6.22 % | 6.37 % | 58,536 | 13.32 | 19 | -0.9042 % | 2,893.0 |

| FloatingReset | 10.74 % | 11.33 % | 50,719 | 8.48 | 2 | 0.1715 % | 2,370.0 |

| FixedReset Prem | 6.95 % | 6.82 % | 333,102 | 3.82 | 1 | 0.3970 % | 2,326.5 |

| FixedReset Bank Non | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0098 % | 2,127.1 |

| FixedReset Ins Non | 6.08 % | 7.66 % | 78,295 | 11.69 | 11 | -0.9510 % | 2,293.6 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| IFC.PR.F | Insurance Straight | -6.82 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 20.50 Evaluated at bid price : 20.50 Bid-YTW : 6.59 % |

| BIP.PR.A | FixedReset Disc | -2.65 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 16.55 Evaluated at bid price : 16.55 Bid-YTW : 10.00 % |

| BIP.PR.B | FixedReset Disc | -2.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 21.50 Evaluated at bid price : 21.50 Bid-YTW : 8.83 % |

| IFC.PR.C | FixedReset Disc | -1.82 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 16.20 Evaluated at bid price : 16.20 Bid-YTW : 8.56 % |

| GWO.PR.Q | Insurance Straight | -1.70 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 20.20 Evaluated at bid price : 20.20 Bid-YTW : 6.49 % |

| GWO.PR.M | Insurance Straight | -1.43 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 22.56 Evaluated at bid price : 22.82 Bid-YTW : 6.46 % |

| CU.PR.C | FixedReset Disc | -1.35 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 18.25 Evaluated at bid price : 18.25 Bid-YTW : 7.82 % |

| PWF.PR.K | Perpetual-Discount | -1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 19.40 Evaluated at bid price : 19.40 Bid-YTW : 6.46 % |

| BN.PF.J | FixedReset Disc | -1.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 21.25 Evaluated at bid price : 21.25 Bid-YTW : 7.75 % |

| PVS.PR.J | SplitShare | -1.14 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2028-02-29 Maturity Price : 25.00 Evaluated at bid price : 21.75 Bid-YTW : 7.70 % |

| GWO.PR.L | Insurance Straight | -1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 22.03 Evaluated at bid price : 22.26 Bid-YTW : 6.45 % |

| TRP.PR.D | FixedReset Disc | 1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 15.05 Evaluated at bid price : 15.05 Bid-YTW : 9.63 % |

| PVS.PR.G | SplitShare | 1.06 % | YTW SCENARIO Maturity Type : Option Certainty Maturity Date : 2026-02-28 Maturity Price : 25.00 Evaluated at bid price : 23.85 Bid-YTW : 6.70 % |

| BN.PR.K | Floater | 1.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 11.24 Evaluated at bid price : 11.24 Bid-YTW : 10.73 % |

| IFC.PR.K | Perpetual-Discount | 1.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 21.49 Evaluated at bid price : 21.49 Bid-YTW : 6.22 % |

| PWF.PR.T | FixedReset Disc | 1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 17.30 Evaluated at bid price : 17.30 Bid-YTW : 8.39 % |

| MFC.PR.Q | FixedReset Ins Non | 1.19 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 20.49 Evaluated at bid price : 20.49 Bid-YTW : 7.34 % |

| BMO.PR.Y | FixedReset Disc | 1.29 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 17.23 Evaluated at bid price : 17.23 Bid-YTW : 8.27 % |

| BMO.PR.E | FixedReset Disc | 1.45 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 20.30 Evaluated at bid price : 20.30 Bid-YTW : 7.58 % |

| POW.PR.A | Perpetual-Discount | 2.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 21.91 Evaluated at bid price : 22.15 Bid-YTW : 6.41 % |

| FTS.PR.H | FixedReset Disc | 2.87 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 12.20 Evaluated at bid price : 12.20 Bid-YTW : 9.13 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| NA.PR.C | FixedReset Prem | 52,800 | YTW SCENARIO Maturity Type : Call Maturity Date : 2027-11-15 Maturity Price : 25.00 Evaluated at bid price : 25.29 Bid-YTW : 6.82 % |

| TD.PF.E | FixedReset Disc | 49,500 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 17.47 Evaluated at bid price : 17.47 Bid-YTW : 8.29 % |

| RY.PR.J | FixedReset Disc | 28,400 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 17.49 Evaluated at bid price : 17.49 Bid-YTW : 8.30 % |

| TD.PF.K | FixedReset Disc | 27,000 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 20.64 Evaluated at bid price : 20.64 Bid-YTW : 7.36 % |

| NA.PR.W | FixedReset Disc | 15,000 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 16.50 Evaluated at bid price : 16.50 Bid-YTW : 8.38 % |

| MFC.PR.Q | FixedReset Ins Non | 11,600 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2053-05-23 Maturity Price : 20.49 Evaluated at bid price : 20.49 Bid-YTW : 7.34 % |

| There were 1 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| CU.PR.E | Perpetual-Discount | Quote: 19.43 – 23.72 Spot Rate : 4.2900 Average : 2.4596 YTW SCENARIO |

| TRP.PR.E | FixedReset Disc | Quote: 14.47 – 17.45 Spot Rate : 2.9800 Average : 2.0275 YTW SCENARIO |

| IFC.PR.F | Insurance Straight | Quote: 20.50 – 22.35 Spot Rate : 1.8500 Average : 1.1381 YTW SCENARIO |

| CU.PR.C | FixedReset Disc | Quote: 18.25 – 19.54 Spot Rate : 1.2900 Average : 0.9855 YTW SCENARIO |

| PWF.PR.P | FixedReset Disc | Quote: 12.18 – 13.04 Spot Rate : 0.8600 Average : 0.5848 YTW SCENARIO |

| TRP.PR.C | FixedReset Disc | Quote: 10.50 – 11.25 Spot Rate : 0.7500 Average : 0.5064 YTW SCENARIO |