Performance of the HIMIPref™ Indices for June, 2009, was:

| Total Return | ||

| Index | Performance June 2009 |

Three Months to June 30, 2009 |

| Ratchet | -8.20% * | +36.36% * |

| FixFloat | +1.86% | +51.30% ** |

| Floater | -8.20% | +36.36% |

| OpRet | +1.93% | +6.52% |

| SplitShare | +4.02% | +15.63% |

| Interest | +2.03% | +4.77% |

| PerpetualPremium | +1.66%*** | +15.34%*** |

| PerpetualDiscount | +1.66% | +15.34% |

| FixedReset | +2.70% | +11.39% |

| * The last member of the RatchetRate index was transferred to Scraps at the February, 2009, rebalancing; subsequent performance figures are set equal to the Floater index | ||

| ** The last member of the FixedFloater index was transferred to Scraps at the February, 2009, rebalancing. Performance figures to 2009-5-29 are set equal to the Floater index. The FixedFloater index acquired a member on 2009-5-29. | ||

| *** The last member of the PerpetualPremium index was transferred to PerpetualDiscount at the October, 2008, rebalancing; subsequent performance figures are set equal to the PerpetualDiscount index | ||

| Passive Funds (see below for calculations) | ||

| CPD | +1.38% | +12.73% |

| DPS.UN | +2.28% | +17.17% |

| Index | ||

| BMO-CM 50 | +1.60% | +13.49% |

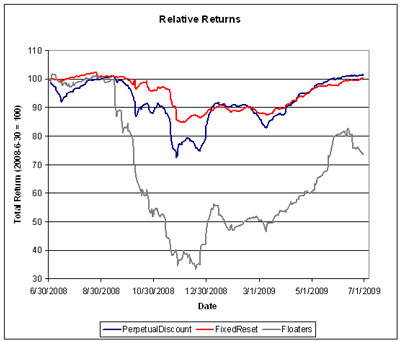

The major indices have managed to stagger into the black over the trailing 12-month period. Full speed ahead!

And yes, what you see is true: PerpetualDiscounts have outperformed FixedResets over the past twelve months. June 2008, now dropped from the trailing year’s return was a horrible, horrible month for them.

Claymore has published NAV and distribution data (problems with the page in IE8 can be kludged by using compatibility view) for its exchange traded fund (CPD) and I have derived the following table:

| CPD Return, 1- & 3-month, to June, 2009 | ||||

| Date | NAV | Distribution | Return for Sub-Period | Monthly Return |

| March 31, 2009 | 14.28 | |||

| April 30 | 15.27 | 0.00 | +6.93% | |

| May 29, 2009 | 15.88 | 0.00 | +3.99% | |

| June 25 | 15.88 | 0.2100 | +1.32% | +1.38% |

| June 30, 2009 | 15.89 | +0.06% | ||

| Quarterly Return | +12.73% | |||

The DPS.UN NAV for June 24 has been published so we may calculate the June returns (approximately!) for this closed end fund. I am rather annoyed that this calculation will not include the distribution with the June 26 ex-Date!

| DPS.UN NAV Return, June-ish 2009 | |||

| Date | NAV | Distribution | Return for period |

| May 27, 2009 | 18.18 | ||

| Estimated May Ending Stub | -0.19% * | ||

| June 24, 2009 | 18.56 | +2.09% | |

| Estimated June Ending Stub** | +0.375% | ||

| Estimated June Return | +2.28% | ||

| ** CPD had a NAV of $16.04 on June 24, paid $0.21 June 25 with a NAV of 15.88 and a NAV of $15.89 on June 30. The return for the period was therefore +0.375%. This figure is added to the DPS.UN period return to arrive at an estimate for the calendar month. | |||

| * CPD had a NAV of $15.85 on May 27 and a NAV of $15.88 on May 29. The return for the period was therefore +0.19%. This figure is subtracted from the DPS.UN period return to arrive at an estimate for the calendar month. | |||

| The June return for DPS.UN’s NAV is therefore the product of three period returns, -0.19%, +2.09% and +0.375% to arrive at an estimate for the calendar month of +2.28% | |||

Now, to see the DPS.UN quarterly NAV approximate return, we refer to the calculations for April and May:

| DPS.UN NAV Returns, three-month-ish to end-June-ish, 2009 | |

| April-ish | +7.72% |

| May-ish | +6.35% |

| June-ish | +2.28% |

| Three-months-ish | +17.17% |

[…] PrefBlog Canadian Preferred Shares – Data and Discussion « Index Performance: June 2009 […]

[…] Now, to see the DPS.UN quarterly NAV approximate return, we refer to the calculations for May and June […]

[…] to see the DPS.UN quarterly NAV approximate return, we refer to the calculations for June and […]