Performance of the HIMIPref™ Indices for September, 2009, was:

| Total Return | ||

| Index | Performance September 2009 |

Three Months to September 30, 2009 |

| Ratchet | +4.62% * | +28.47% * |

| FixFloat | -1.00% | +24.81% |

| Floater | +4.62% | +28.47% |

| OpRet | +0.22% | +3.46% |

| SplitShare | -0.13% | +8.84% |

| Interest | +0.22%**** | +3.46%**** |

| PerpetualPremium | -0.79% | +7.10%*** |

| PerpetualDiscount | -1.20% | +11.17% |

| FixedReset | +0.22% | +3.74% |

| * The last member of the RatchetRate index was transferred to Scraps at the February, 2009, rebalancing; subsequent performance figures are set equal to the Floater index | ||

| *** The last member of the PerpetualPremium index was transferred to PerpetualDiscount at the October, 2008, rebalancing; subsequent performance figures are set equal to the PerpetualDiscount index. The PerpetualPremium index acquired four new members at the July, 2009, rebalancing. | ||

| **** The last member of the InterestBearing index was transferred to Scraps at the June, 2009, rebalancing; subsequent performance figures are set equal to the OperatingRetractible index | ||

| Passive Funds (see below for calculations) | ||

| CPD | -0.59% | +5.93% |

| DPS.UN | -0.60% | +9.75% |

| Index | ||

| BMO-CM 50 | -1.00% | +8.34% |

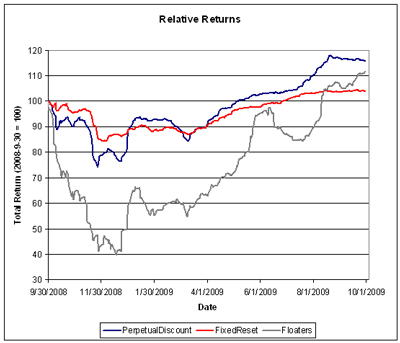

PerpetualDiscounts took a break from their string of gains, posting their first loss since February; FixedResets continued grinding away, unfazed by the recent plethora of new issues.

Meanwhile, Floaters continued their wild ride.

Compositions of the passive funds were discussed in the September edition of PrefLetter.

Claymore has published NAV and distribution data (problems with the page in IE8 can be kludged by using compatibility view) for its exchange traded fund (CPD) and I have derived the following table:

| CPD Return, 1- & 3-month, to September 30, 2009 | ||||

| Date | NAV | Distribution | Return for Sub-Period | Monthly Return |

| June 30, 2009 | 15.89 | |||

| July 31, 2009 | 16.42 | +3.35% | ||

| August 31, 2009 | 16.93 | 0.00 | +3.11% | |

| September 25 | 16.63 | 0.21 | -0.53% | -0.59% |

| September 30, 2009 | 16.62 | 0.00 | -0.06% | |

| Quarterly Return | +5.93% | |||

Claymore currently holds $300,156,763 (advisor & common combined) in CPD assets, up nearly $25-million on the month and a stunning increase from the $84,005,161 reported in the Dec 31/08 Annual Report

The DPS.UN NAV for September has been published so we may calculate the approximate September returns. The Toronto Stock Exchange reports that the ex-dividend date for the current distribution was Sept. 28.

| DPS.UN NAV Return, September-ish 2009 | ||||

| Date | NAV | Distribution | Return for sub-period | Return for period |

| August 26, 2009 | 20.30 | |||

| September 28, 2009 | 19.82 * | 0.30 | -0.89% | -0.89% |

| September 30, 2009 | 19.82 | 0.00% | ||

| Estimated August Ending Stub | +0.29% ** | |||

| Estimated September Return | -0.60% | |||

| *CPD had a NAVPU of 16.62 on both September 28 and September 30. The NAVPU of DPS.UN on this date has been estimated as being equal to its September 30 NAVPU. | ||||

| ** CPD had a NAV of $16.98 on August 26 and a NAV of $16.93 on August 31. The return for the period was therefore -0.29%. This figure is subtracted the DPS.UN period return to arrive at an estimate for the calendar month. | ||||

| The September return for DPS.UN’s NAV is therefore the product of two period returns, -0.89% and +0.29% to arrive at an estimate for the calendar month of -0.60% | ||||

Now, to see the DPS.UN quarterly NAV approximate return, we refer to the calculations for July and August:

| DPS.UN NAV Returns, three-month-ish to end-September-ish, 2009 | |

| July-ish | +4.45% |

| August-ish | +5.71% |

| September-ish | -0.60% |

| Three-months-ish | +9.75% |

[…] halt in September, as the fund underperformed – albeit by a very small amount. As noted in the post Index Performance: September 2009, PerpetualDiscounts eased off after their long run-up; the fund is overweighted in this sector (see […]

[…] Now, to see the DPS.UN quarterly NAV approximate return, we refer to the calculations for August and September: […]

[…] to see the DPS.UN quarterly NAV approximate return, we refer to the calculations for September and […]

[…] to see the DPS.UN quarterly NAV approximate return, we refer to the calculations for September and […]