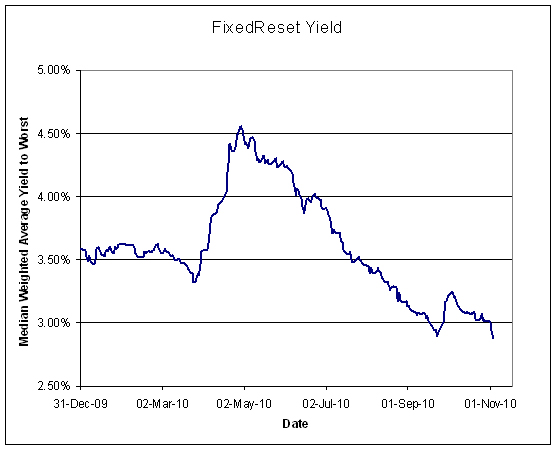

As briefly noted yesterday, the FixedReset Index set a new all-time low yield record as of the close November 3 with a mark of 2.88%.

This is all the more impressive since changes to the index in October added three lower-quality, higher-yielding issues to the index, which had an effect on the determination of the median yield.

To celebrate, I am publishing the constituents of the FixedReset index, sorted in various ways:

Given that the DEX Short-Term Corporate Index yields about 2.5% and the ZCS short term corporate ETF yields 2.4% before fees, a yield of 2.88% is not entirely unreasonable: the interest-equivalent is 4.03%, giving a pre-tax spread of about 150bp to cover things like the additional credit risk and extension risk of the FixedResets. But I’m not entirely convinced that the market actually thinks that way.

[…] has climbed all the back up to 3.58%, which is a big difference from just over a month ago when it set a new all-time low of 2.88%. The current all-time low of 2.84% was reached on November […]