Former Lehman executives (and note that an “executive” can be anybody with a title) who, it would seem, prefer to remain anonymous, are trying to play down Repo 105, discussed on PrefBlog on March 12. But it’s a tangled web we weave…:

The only people who would worry about using an old trick to reduce leverage from 13.9 to 12.1, the second executive said, are “yappers who don’t know anything.”

Again, the examiner’s report takes pains to show otherwise. It quotes a senior vice president calling Lehman’s leverage targets “a very hot topic.” The firm’s own definition of a material leverage shift was one-tenth of a point.

In my experience, 95% of the sell-side are yappers who don’t know anything, and the other 5% are simply disingenuous.

And, of course, blind faith in the regulators is misplaced:

Securities and Exchange Commission Chairman Mary Schapiro said her agency’s oversight of Lehman Brothers Holdings Inc. was “terribly flawed,” days after a bankruptcy examiner found the SEC didn’t try to stop the firm’s exaggeration of liquid assets.

“It was so terribly flawed in design and execution,” Schapiro testified to a Congressional committee today, referring to SEC examinations aimed at monitoring the soundness of Wall Street’s biggest investment banks. “We were ill-suited because of our enforcement and disclosure mentality.”

…

Valukas’s March 11 report describes a gap between how Lehman and the SEC viewed the firm’s so-called liquidity pool, used to pay bills in a pinch, in the firm’s final months. Behind the scenes, the SEC questioned how quickly some assets could really be tapped. Still, Lehman didn’t tell investors that a growing share of the pool was being pledged as collateral to clearing firms, the report found.The SEC deemed assets to be liquid only if they were convertible to cash within 24 hours. Lehman afforded itself five days. The SEC told Lehman it preferred the shorter limit and never enforced it, according to the report.

In another instance, the SEC didn’t take action after determining in June 2008 that Lehman had counted a $2 billion deposit at Citigroup Inc. among cash-like assets available in an emergency, according to the report. SEC analysts deemed the deposit’s designation as “problematic,” because withdrawing the money could have impaired Lehman’s trading.

…

The silence of examiners, who focused more on stability than honesty with investors, was invoked as a defense as Valukas quizzed more than 100 executives and other witnesses about the financial health and reporting at Lehman, based in New York.

The Bloomberg story doesn’t explore the regulators’ obsession with “stability” in detail, or even define what it is. Stability of the Financial System? Stability of Lehman? Stability of their jobs? What? One way or another … so much for the third pillar!

Greece is still trying to extract better terms for its EU bail-out:

As long as “Greece is still borrowing at an unreasonably high interest rate, over 6 percent,” the country will keep “all options open” while preferring an EU solution, Papandreou said at a press conference in Brussels today with European Commission President Jose Barroso.

Bad news at the trough on St. Patrick’s day! The little green piggies haven’t spent enough on lobbying:

“Until government policies favor renewable energy over dirty coal, solar may seem too risky now for some investors,” said Landis, whose $260 million fund include SunPower Corp. and Suntech Power Holdings Co. “Coal may make sense short term.”

Solar companies’ profitability is falling because of competition from China and cuts to state support in Germany and Spain, where about 72 percent power-producing photovoltaic panels were installed in 2008.

…

Germany may install 3,000 megawatts, or about a third of the world’s total, Simonek said. In the Czech Republic, a country of 10 million people, about 900 megawatts of solar power will be deployed, almost matching existing U.S. installations.The rising global demand will help some companies weather the slump in panel prices caused by Chinese manufacturers stepping up production and cuts in solar subsidies in Germany and Spain known as feed-in tariffs, said Richard Caldwell, chairman of Australia’s Dyesol Ltd., which makes a conductive dye that produces electricity on glass and sheet metal.

“Companies in the industry like First Solar have had a shocker,” he said. “The Chinese have been flooding the market with cheap product. And we’re still getting over the change to the German feed-in tariff. It hasn’t been a good market.”

Who woulda thunk it? Competition in solar panels! And there we all were, thinking it was all about peace, love, granola and subsidized green jobs to replace all those subsidized auto jobs that have evaporated! Just think, if they can cut costs by another 90%, maybe it will even be worth thinking about!

Volume was good in the Canadian preferred share market today, but PerpetualDiscounts fell by 7bp. FixedResets gained 2bp to take yields to within a hairsbreadth of their all-time lows … another tenth of a beep in yield and we’ve got a new record.

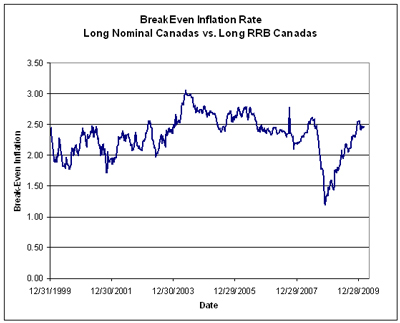

PerpetualDiscounts now yield 5.97%, equivalent to 8.36% interest at the standard equivalency factor of 1.4x. Long Corporates now yield about 5.7% (maybe a little bit more) so the pre-tax interest equivalent spread (also called the seniority spread) now sits at about 265bp, a significant widening from the 245bp reported on March 10. I consider it highly peculiar that the spread should be so wide in the absence of any serious credit-based panics; I can only conclude that retail has decided that massive inflation is imminent – which is consistent with low yields on FixedResets – contrary to the beliefs of institutional bond investors. I note that Long Canadas now yield 4.02% while long RRBs yield 1.57% real, for a breakeven of 245bp.

…. and you can call the recent rocketing in the breakeven spread either a return to normalcy or a harbinger of hyperinflation, depending on what answer you want to get … or what your client wants to hear.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 2.63 % | 2.78 % | 56,234 | 20.84 | 1 | -0.5090 % | 2,103.6 |

| FixedFloater | 5.14 % | 3.25 % | 44,807 | 19.87 | 1 | -1.1677 % | 3,076.3 |

| Floater | 1.93 % | 1.73 % | 45,279 | 23.23 | 4 | -0.2320 % | 2,394.0 |

| OpRet | 4.90 % | 2.62 % | 100,267 | 0.20 | 13 | -0.0149 % | 2,309.3 |

| SplitShare | 6.43 % | 6.53 % | 127,694 | 3.68 | 2 | -0.4198 % | 2,121.1 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0149 % | 2,111.6 |

| Perpetual-Premium | 5.88 % | 5.92 % | 119,405 | 6.86 | 7 | 0.0908 % | 1,891.5 |

| Perpetual-Discount | 5.90 % | 5.97 % | 179,272 | 13.94 | 71 | -0.0675 % | 1,789.2 |

| FixedReset | 5.36 % | 3.47 % | 341,924 | 3.69 | 43 | 0.0161 % | 2,202.4 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| GWO.PR.H | Perpetual-Discount | -1.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-17 Maturity Price : 20.21 Evaluated at bid price : 20.21 Bid-YTW : 6.03 % |

| HSB.PR.D | Perpetual-Discount | -1.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-17 Maturity Price : 20.72 Evaluated at bid price : 20.72 Bid-YTW : 6.06 % |

| BAM.PR.G | FixedFloater | -1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-17 Maturity Price : 25.00 Evaluated at bid price : 21.16 Bid-YTW : 3.25 % |

| BNA.PR.C | SplitShare | -1.08 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2019-01-10 Maturity Price : 25.00 Evaluated at bid price : 19.30 Bid-YTW : 8.08 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| BAM.PR.O | OpRet | 127,900 | Nesbitt crossed 124,400 at 25.85. Nice ticket! YTW SCENARIO Maturity Type : Option Certainty Maturity Date : 2013-06-30 Maturity Price : 25.00 Evaluated at bid price : 25.85 Bid-YTW : 3.85 % |

| TRP.PR.B | FixedReset | 112,157 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-17 Maturity Price : 24.92 Evaluated at bid price : 24.97 Bid-YTW : 3.94 % |

| TD.PR.N | OpRet | 82,165 | National sold 10,000 to Desjardins at 26.00 and 25,000 to RBC at the same price. RBC crossed 25,000 at the same price again. YTW SCENARIO Maturity Type : Call Maturity Date : 2010-05-30 Maturity Price : 25.75 Evaluated at bid price : 26.00 Bid-YTW : 2.46 % |

| TD.PR.E | FixedReset | 66,812 | Nesbitt crossed 35,000 at 28.20, then bought 10,000 from TD at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-30 Maturity Price : 25.00 Evaluated at bid price : 28.11 Bid-YTW : 3.32 % |

| NA.PR.L | Perpetual-Discount | 66,616 | National crossed 61,300 at 20.77. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-17 Maturity Price : 20.72 Evaluated at bid price : 20.72 Bid-YTW : 5.93 % |

| W.PR.H | Perpetual-Discount | 47,100 | Scotia crossed 20,000 at 22.50; RBC crossed 25,000 at the same price. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-03-17 Maturity Price : 22.12 Evaluated at bid price : 22.50 Bid-YTW : 6.22 % |

| There were 41 other index-included issues trading in excess of 10,000 shares. | |||

[…] add that capital levels can be manipulated. Lehman’s Repo 105 transactions, last discussed on March 17, are merely a glaring […]

[…] derivatives are going to settle with central clearing, as discussed on May 11, tangentially on March 17, by John Hull, December 16 and October 5. Lots before then, of course, but those links carry enough […]