Nanex, whose initial report on the Flash Crash was discussed on August 9, has published a new and improved timeline and summary of their version of events. According to them:

It appears that the event that sparked the rapid sell off at 14:42:44:075 was an immediate sale of approximately $125 million worth of June 2010 CME eMini futures contracts followed 25ms later by the immediate sale of over $100 million worth of the top ETF’s such as SPY, DIA, QQQQ, IVV, IWM, SDS, XLE, and EEM. Both the eMini and ETF sales were sudden and executed at prevailing bid prices. The orders appeared to hit the bids.

Quote Saturation (see item 1 on chart)

Approximately 400ms before the eMini sale, the quote traffic rate for all NYSE, NYSE Arca, and Nasdaq stocks surged to saturation levels within 75ms. This is a new and surprising discovery. Previouisly, when we looked at time frames below 1 second, we thought the increase in quote traffic coincided with the heavy sales, but we now know that the surge in quotes preceded the trades by about 400ms. The discovery is surprising, because nearly all the trades in the eMini and ETFs occurred at prevailing bid prices (a liquidity removing event).

While searching previous days for similarities to the time period at the start of the May 6th drop, we found a very close match starting at 11:27:46.100 on April 28, 2010 — just a week and a day before May 6th. We observed it had the same pattern — high, saturating quote traffic, then approximately 500ms later a sudden burst of trades on the eMini and the top ETF’s at the prevailing bid prices, leading to a delay in the NYSE quote and a sudden collapse in prices. The drop only lasted a minute, but the parallels between the start of the drop and the one on May 6th are many. Details on April 28, 2010

The quote traffic surged again during the ETF sell event and remained at saturation levels for nearly 500ms. Additional selling waves began seconds later sending quote traffic rates back to saturation levels. This tidal wave of data caused delays in many feed processing systems and networks. We discovered two notable delays: the NYSE network that feeds into CQS (the "NYSE-CQS Delay"), and the calculation and dissemination of the Dow Jones Indexes (DOW Delay).

Now, this is interesting, because according to the SEC / CFTC Report:

At 2:32 p.m., against this backdrop of unusually high volatility and thinning liquidity, a large fundamental5 trader (a mutual fund complex) initiated a sell program to sell a total of 75,000 E-Mini contracts (valued at approximately $4.1 billion) as a hedge to an existing equity position.

…

However, on May 6, when markets were already under stress, the Sell Algorithm chosen by the large trader to only target trading volume, and neither price nor time, executed the sell program extremely rapidly in just 20 minutes.

Notice that? The time designated by Nanex as the start of the alleged hanky-panky is slap bang in the middle of the execution of the large trade. What’s more:

HFTs and intermediaries were the likely buyers of the initial batch of orders submitted by the Sell Algorithm, and, as a result, these buyers built up temporary long positions. Specifically, HFTs accumulated a net long position of about 3,300 contracts. However, between 2:41 p.m. and 2:44 p.m., HFTs aggressively sold about 2,000 E-Mini contracts in order to reduce their temporary long positions.

…

In the four-and-one-half minutes from 2:41 p.m. through 2:45:27 p.m., prices of the E-Mini had fallen by more than 5% and prices of SPY suffered a decline of over 6%.

…

The second liquidity crisis occurred in the equities markets at about 2:45 p.m. Based on interviews with a variety of large market participants, automated trading systems used by many liquidity providers temporarily paused in reaction to the sudden price declines observed during the first liquidity crisis. These built-in pauses are designed to prevent automated systems from trading when prices move beyond pre-defined thresholds in order to allow traders and risk managers to fully assess market conditions before trading is resumed.

So here’s something for the conspiracy theorists to chew on (this is me here, not Nanex): We can take the existence of Waddell Reed’s sell order for 75,000 contracts ($4.1-billion notional) as a fact, and we can take the start time of 2:32 as a fact. It also seems reasonable to suppose that there was a change in the tone of the market at 2:42, about the time that the HFTs filled up to their position limit of about 3,000 contracts – but that’s speculation which must be investigated. We know that they started selling aggressively – presumably willing to take a loss on their trade rather than keep the exposure – at 2:41: the SEC says so and we can take their statements of fact as accurate (although there will be some who disagree).

So here’s the conspiracy theory: was there quote-stuffing by a predatory algorithm? It seems likely that it is possible to determine that there is a single large, simple algorithm selling contracts; by 2:42 it had been operating for ten minutes, which is a lifetime. Since the algo was provided by Barclays, it is probably quite widespread and has probably been taken apart by a large number of HFTs – maybe even by looking at the source code, perhaps by reverse engineering. But there are a lot of predatory algos that look for signatures of herbivorous algos and eat them alive – that’s common knowledge.

So here’s the hypothetical structure of a hypothetical predatory algo:

- Identify a large selling algo

- Boost surveillance of the market and identify the exhaustion point of the major liquidity providers

- Quote-stuff to drive out the remaining liquidity providers

- Take advantage of the large selling algo with no competition. Do it right and you can max out your position limit on this just a hair above the CME circuit-breaker point

While the SEC / CFTC report dismissed quote-stuffing as the actual cause of the Flash Crash, a careful reading of what they said shows it cannot be ruled out as a possible deliberate accellerator of the decline. It will be most interesting to see how this plays out. I think the critical thing to examine is who bought the contracts in between the onset of order saturation and the tripping of the CME circuit-breaker.

One way or another, Eric Hunsader of Nanex is sticking to his guns:

But Hunsader said regulators largely ignored his ‘quote-stuffing’ theory which argued that high-frequency traders had contributed to the crash by flooding the market with so many orders that it delayed the posting of prices to the consolidated quote system.

‘It just seemed to me too much ink was devoted to try to discredit theories without any evidence, without any basis, other than just, ‘We looked at it, we talked to these people, and now, we dismissed it,” Hunsader said.

‘Obviously they didn’t follow up. I felt everything I sent to them went into a black hole,’ said Hunsader, who runs Nanex, a four-person data provider shop in Chicago.

…

Not only did regulators dismiss his observations, Hunsader said, they made a hash of trading data that exchanges provided them because they relied on one-minute intervals — a far too simplistic approach to understanding the market, he said.‘When we first did this, we did it on a one-second basis and we didn’t really see the relationship between the trades and the quote rates until we went under a second,’ Hunsader said.

‘Clearly they didn’t have the dataset to do it in the first place. One-minute snapshot data, you can’t tell what happened inside of that minute,’ he said.

Themis doesn’t have much to say:

We had anticipated in our previously released paper that the core of their fix would be coordinated circuit breakers with a limit up/limit down feature, and that is in fact where they are leaning in this report. We see no mention at all of order cancellation fees, addressing the validity of rebate maker/taker model, or fiduciary language. We see little language in the way of criticizing a system that involves fifty-plus destinations connected at insane speeds, with different speeds for the public information and the co-located bought-and-paid for information.

We see nothing outside the circuit breakers addressed meaningfully. We were hoping for more in the way of solutions, rather than just post-mortems. Having said that, we have faith in Chairman Schapiro, and realize that this must be the first step, and that we all must be patient. This is a report presented to the advisory committee; recommendations are to come from them.

Update: One totally fascinating snippet I didn’t mention above is detailed with cool charts by Nanex:

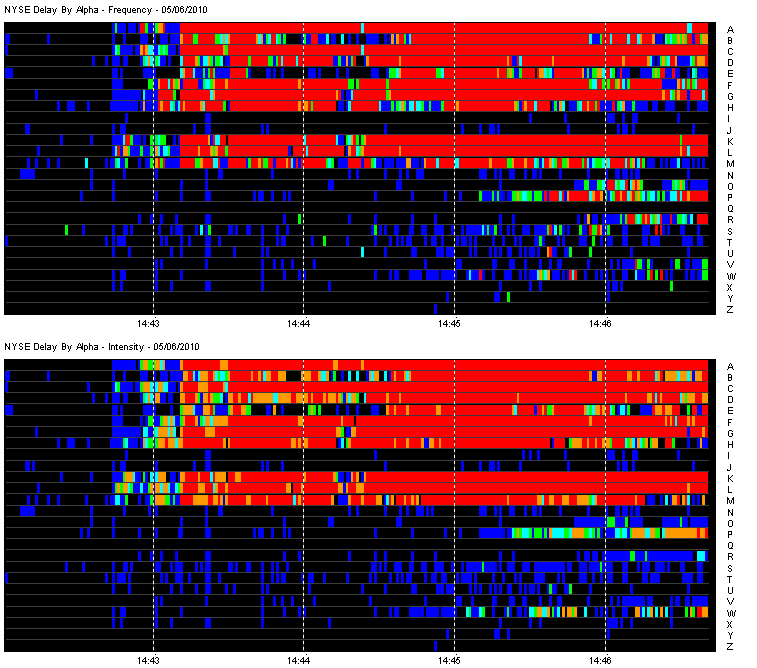

The chart above shows the frequency and intensity of the delay in NYSE’s quote sent to CQS grouped by the symbol’s first character. Stocks beginning with letters A through M, except for I and J saturate to higher levels, and more quickly than stocks beginning with other letters. The stock symbol GE was found to have reached a delay of 24 seconds.

It would be fascinating to learn whether the bifurcation was due to the NYSE’s inputs, or due to their internal computer systems.

“It would be fascinating to learn whether the bifurcation was due to the NYSE’s inputs, or due to their internal computer systems.”

NYSE updated equipment that processed roughly half their symbols at the beginning of the week of May 6th as stated in the SEC report. The alpha graphs we showed correctly identified which symbols ran on the upgraded (though still slow) equipment.

Eric Hunsader

Thank you, sir! Fascinating, indeed!

[…] that it is possible that the Opportunistic Buyers were dissuaded from entering the market through the quote-stuffing identified by Nanex, which has yet to be explained in a satisfactory manner. Based on our analysis, we believe that […]