Markets remain unimpressed by the Irish bail-out:

The difference in yield between Italian 10-year bonds and German bunds widened to 199 basis points after reaching 212 points earlier. The Spanish-German yield spread rose 17 basis points to 284 basis points and the yield premium for Belgian 10- year bonds reached 131 basis points, the most since January 2009.

…

Credit-default swaps insuring Italian government bonds rose 24 basis points to 270, contracts on Spain increased 16 basis points to 368 and Portugal climbed 12 basis points to 552, all record highs, according to CMA, a data provider.

DBRS has assigned ratings to Loblaw’s shelf prospectus:

DBRS has today assigned a rating of BBB with a Stable trend to Loblaw Companies Limited’s (Loblaw or the Company) new $1 billion Short Form Base Shelf Prospectus, dated November 25, 2010.

This prospectus will enable Loblaw to offer and issue up to $1.0 billion of debentures and second preferred shares during the 25-month period the base shelf prospectus remains valid. Additionally, DBRS has assigned a new rating of Pfd-3 to the Company’s preferred share portion of this prospectus.

Connor Clark & Lunn, best known for the default of their highly structured RPB.PR.A offering (among others) are reinforcing their effort (kicked off with the issue of HBanc Capital Securities Trust, discussed on October 13) to win the covetted PrefBlog “Most Ridiculous Family of Funds” award with the issue of Australian Banc Capital Securites Trust. It should do quite well; the underwriting fee on the Class A units is 5.25%, not that that will have anything to do with the success of the offering, of course.

Coincidentally, a team of analysts has commented on the Aussie Dollar:

Cricket’s oldest international rivalry resumed last week in Australia without a traditional taunt of traveling English fans: “We’re fat, we’re round, three dollars to the pound.”

…

The dollar chant “won’t be coming out of the songbook this time,” Barmy Army spokeswoman Becky Fairlie-Clarke said in a telephone interview. “It’s more like 1 1/2 now.”

It was a poor day for the Canadian preferred share market, with PerpetualDiscounts down 24bp and FixedResets losing 10bp. Volume was heavy.

PerpetualDiscounts now yield 5.41%, equivalent to 7.57% interest at the standard equivalency factor of 1.4x. Long Corporates continue to yield about 5.4% (maybe a little under) , so the pre-tax interest-equivalent spread is now about 220bp, a significant widening from the 210bp reported on November 24, although it must be noted that the spread has been bouncing between these two levels all month.

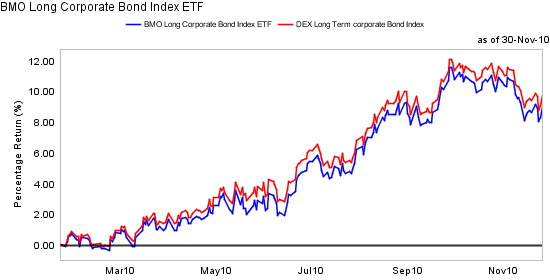

It is instructive to review the performance of the BMO Long Corporate ETF for the month:

Long Corporates had a total return of about -1% on the month.

And that’s a wrap for November, 2010!

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.3250 % | 2,261.0 |

| FixedFloater | 4.81 % | 3.46 % | 28,565 | 19.13 | 1 | 0.0442 % | 3,497.2 |

| Floater | 2.63 % | 2.36 % | 53,681 | 21.37 | 4 | -0.3250 % | 2,441.3 |

| OpRet | 4.78 % | 3.39 % | 62,105 | 2.40 | 8 | -0.6087 % | 2,381.6 |

| SplitShare | 5.45 % | 0.42 % | 123,529 | 1.02 | 3 | -0.2064 % | 2,467.6 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.6087 % | 2,177.8 |

| Perpetual-Premium | 5.69 % | 5.47 % | 159,226 | 5.39 | 24 | -0.2281 % | 2,009.3 |

| Perpetual-Discount | 5.36 % | 5.41 % | 273,381 | 14.81 | 53 | -0.2378 % | 2,038.9 |

| FixedReset | 5.23 % | 3.29 % | 341,256 | 3.15 | 51 | -0.1020 % | 2,270.8 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.I | OpRet | -4.17 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2011-07-30 Maturity Price : 25.25 Evaluated at bid price : 25.75 Bid-YTW : 3.84 % |

| BAM.PR.O | OpRet | -1.22 % | YTW SCENARIO Maturity Type : Option Certainty Maturity Date : 2013-06-30 Maturity Price : 25.00 Evaluated at bid price : 25.90 Bid-YTW : 3.89 % |

| RY.PR.C | Perpetual-Discount | -1.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-11-30 Maturity Price : 22.35 Evaluated at bid price : 22.50 Bid-YTW : 5.14 % |

| TD.PR.R | Perpetual-Premium | -1.02 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-05-30 Maturity Price : 25.00 Evaluated at bid price : 25.20 Bid-YTW : 5.58 % |

| BNS.PR.Y | FixedReset | 1.77 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-11-30 Maturity Price : 25.19 Evaluated at bid price : 25.24 Bid-YTW : 3.40 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| GWO.PR.N | FixedReset | 589,994 | Inventory Clearance Sale YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-11-30 Maturity Price : 24.45 Evaluated at bid price : 24.50 Bid-YTW : 3.70 % |

| FTS.PR.H | FixedReset | 194,600 | Nesbitt crossed 177,900 at 25.55. YTW SCENARIO Maturity Type : Call Maturity Date : 2020-07-01 Maturity Price : 25.00 Evaluated at bid price : 25.50 Bid-YTW : 3.76 % |

| GWO.PR.I | Perpetual-Discount | 62,260 | Nesbitt crossed 50,000 at 21.45. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-11-30 Maturity Price : 21.40 Evaluated at bid price : 21.40 Bid-YTW : 5.35 % |

| BNS.PR.K | Perpetual-Discount | 58,105 | TD crossed 50,000 at 23.80. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-11-30 Maturity Price : 23.39 Evaluated at bid price : 23.65 Bid-YTW : 5.12 % |

| RY.PR.I | FixedReset | 56,650 | RBC crossed 20,000 at 26.25 and bought 15,000 from anonymous at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-26 Maturity Price : 25.00 Evaluated at bid price : 26.21 Bid-YTW : 3.43 % |

| RY.PR.A | Perpetual-Discount | 51,980 | Nesbitt crossed blocks of 20,000 and 16,000, both at 22.43. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-11-30 Maturity Price : 22.25 Evaluated at bid price : 22.40 Bid-YTW : 4.99 % |

| There were 55 other index-included issues trading in excess of 10,000 shares. | |||

[…] spread is now 210bp, an apparrent, but probably meaningless, tightening from the 220bp reported at month-end (i.e., […]

[…] spread of PerpetualDiscounts over Long Corporates (which I also refer to as the Seniority Spread) ended the month at 220bp, a significant decline from the 235bp reported at October month end. Long corporate yields […]

[…] to as the Seniority Spread) ended the year at 225bp, a slight increase from the 220bp reported at November month end. Long corporate yields remained constant 5.4% during the period (albeit with interesting things […]