Turnover remained fairly constant in November, at just under 30%.

Trades were, as ever, triggered by a desire to exploit transient mispricing in the preferred share market (which may be thought of as “selling liquidity”), rather than any particular view being taken on market direction, sectoral performance or credit anticipation.

| MAPF Sectoral Analysis 2010-11-30 | |||

| HIMI Indices Sector | Weighting | YTW | ModDur |

| Ratchet | 0% | N/A | N/A |

| FixFloat | 0% | N/A | N/A |

| Floater | 0% | N/A | N/A |

| OpRet | 0% | N/A | N/A |

| SplitShare | 2.2% (+0.8) | 5.97% | 6.70 |

| Interest Rearing | 0% | N/A | N/A |

| PerpetualPremium | 18.9% (+10.3) | 5.76% | 9.49 |

| PerpetualDiscount | 65.1% (-9.5) | 5.51% | 14.65 |

| Fixed-Reset | 10.2% (0) | 3.36% | 3.11 |

| Scraps (FixedReset) | 3.6% (0) | 6.83% | 12.58 |

| Cash | 0.2% (-1.4) | 0.00% | 0.00 |

| Total | 100% | 5.39% | 12.24 |

| Totals and changes will not add precisely due to rounding. Bracketted figures represent change from October month-end. Cash is included in totals with duration and yield both equal to zero. | |||

The “total” reflects the un-leveraged total portfolio (i.e., cash is included in the portfolio calculations and is deemed to have a duration and yield of 0.00.). MAPF will often have relatively large cash balances, both credit and debit, to facilitate trading. Figures presented in the table have been rounded to the indicated precision.

The increase in PerpetualPremium holdings at the expense of PerpetualDiscounts is related to a shift in credit quality from the Pfd-1(low) bucket to the Pfd-2(high) bucket and will be discussed below.

As reported in the post HIMIPref™ Index Performance, November 2010, PerpetualDiscounts significantly outperformed PerpetualPremiums over the month; unfortunately, heterogeniety of the data set does not allow us to conclude that Implied Volatility increased. In fact, for the three issuers with a sufficient sample of dividend rates, volatility was relatively constant, although it became more homogeneous between these specific issuers.

Analysis of the data using the Straight Perpetual Implied Volatility Calculator produces the following table:

| Fits to Implied Volatility | ||||

| Issuer | 2010-10-29 | 2010-11-30 | ||

| Yield | Volatility | Yield | Volatility | |

| PWF | 4.40% | 25% | 4.45% | 25% |

| CM | 4.80% | 17% | 4.13% | 24% |

| GWO | 0.99% | 35% | 3.60% | 30% |

| Calculations are performed with a time horizon of three years for all issues | ||||

As discussed in the October edition of PrefLetter, the implied volatility calculated for GWO is very high and implies a questionable assessment of the probability distribution of future yields, but it looks like the market is finding a level for Implied Volatility in the mid- to high-twenties.

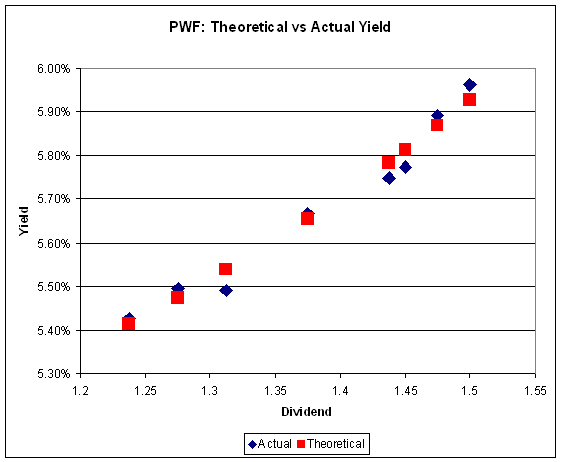

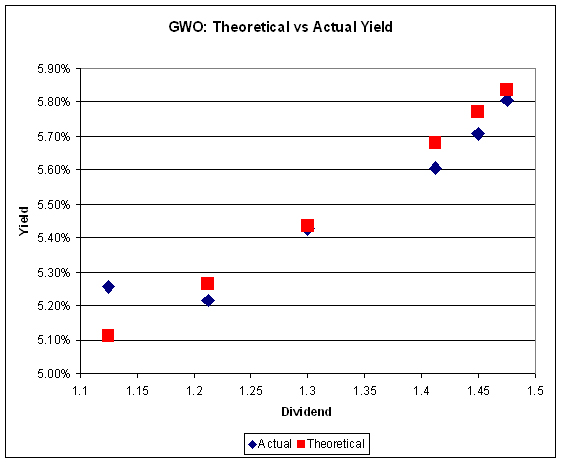

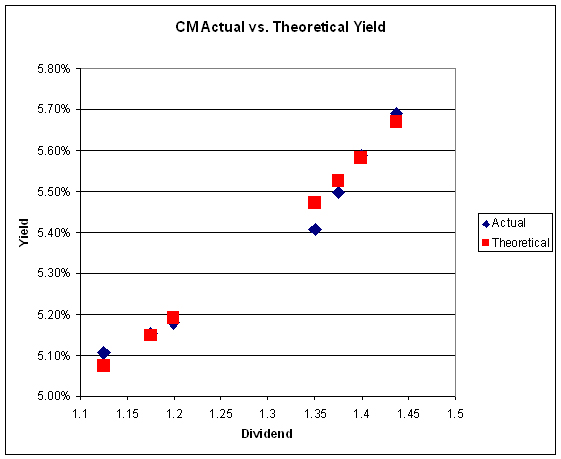

Graphs from the Straight Perpetual Volatility Calculator for November 30 are:

The yield pick-up for holding high-coupon Straights is such one should no longer automatically buy the deepest-discount issue in a series!

Credit distribution is:

| MAPF Credit Analysis 2010-11-30 | |

| DBRS Rating | Weighting |

| Pfd-1 | 0 (0) |

| Pfd-1(low) | 54.5% (-10.1) |

| Pfd-2(high) | 21.9% (+8.7) |

| Pfd-2 | 0 (0) |

| Pfd-2(low) | 19.9% (+2.9) |

| Pfd-3(high) | 3.6% (0) |

| Cash | 0.2% (-1.4) |

| Totals will not add precisely due to rounding. Bracketted figures represent change from October month-end. | |

As noted earlier, the shift in holdings weight from Pfd-1(low) to Pfd-2(high) is related to the shift from PerpetualDiscounts to PerpetualPremiums. Most of the move is explained by the following trades:

| November Swap from Low-Coupon CM to High-Coupon IAG | |||

| Date | CM.PR.I | CM.PR.H | IAG.PR.F |

| 10/29 Bid |

22.48 | 22.93 | 25.40 |

| 11/5 Trade |

Sold 22.83 |

Sold 23.29 |

Bot 25.49 |

| 11/30 Bid |

22.80 | 23.17 | 25.18 |

| Dividends | Earned 0.36875 11/24 |

||

| This table represents an attempt to present fairly the net effect of a sequence of trades. Full particulars of all fund transactions will be disclosed when the fund’s audited financials are published. | |||

Liquidity Distribution is:

| MAPF Liquidity Analysis 2010-10-29 | |

| Average Daily Trading | Weighting |

| <$50,000 | 0.0% (0) |

| $50,000 – $100,000 | 11.6% (-1.3) |

| $100,000 – $200,000 | 18.9% (-5.3) |

| $200,000 – $300,000 | 20.3% (+0.3) |

| >$300,000 | 49.1% (+7.2) |

| Cash | 0.2% (-1.4) |

| Totals will not add precisely due to rounding. Bracketted figures represent change from October month-end. | |

MAPF is, of course, Malachite Aggressive Preferred Fund, a “unit trust” managed by Hymas Investment Management Inc. Further information and links to performance, audited financials and subscription information are available the fund’s web page. The fund may be purchased either directly from Hymas Investment Management or through a brokerage account at Odlum Brown Limited. A “unit trust” is like a regular mutual fund, but is sold by offering memorandum rather than prospectus. This is cheaper, but means subscription is restricted to “accredited investors” (as defined by the Ontario Securities Commission) and those who subscribe for $150,000+. Fund past performances are not a guarantee of future performance. You can lose money investing in MAPF or any other fund.

A similar portfolio composition analysis has been performed on the Claymore Preferred Share ETF (symbol CPD) as of August 31, 2010, and published in the September, 2010, PrefLetter. When comparing CPD and MAPF:

- MAPF credit quality is better

- MAPF liquidity is a higher

- MAPF Yield is higher

- Weightings in

- MAPF is much more exposed to Straight Perpetuals

- MAPF is much less exposed to Operating Retractibles

- MAPF is slightly more exposed to SplitShares

- MAPF is less exposed to FixFloat / Floater / Ratchet

- MAPF weighting in FixedResets is much lower

[…] PrefBlog Canadian Preferred Shares – Data and Discussion « MAPF Portfolio Composition: November 2010 […]