Manulife has announced that:

Between October 1, 2010 and December 31, 2010, the Company:

- Shorted approximately $5 billion of equity futures contracts as part of the Company’s macro hedging program.

- Modestly increased its dynamic variable annuity hedging program by adding $800 million of in-force variable annuity guaranteed value to the program.

- Sold $200 million of on-balance sheet public equities backing insurance liabilities

The WSJ has a story today titled Bondholders Are Rattled by Prepayment Covenants, republished by the Globe, but not on-line. It seems there are a lot of calls for redemption in the junk bond world, surprising many managers … I tell you, it’s a good thing so few of my competitors read prospectuses; that would make outperformance more difficult.

Assiduous Reader DW brings to my attention a working paper by Zhiwu Chen, Roger G. Ibbotson and Wendy Hu titled Liquidity as an Investment Style:

We first show that liquidity, as measured by stock turnover or trading volume, is an economically significant investment style that is distinct from traditional investment styles such as size, value/growth, and momentum. We then introduce and examine the performance of several portfolio strategies, including a Volume Weighted Strategy, an Earnings Weighted Strategy, an Earnings-Based Liquidity Strategy, and a Market Cap-Based Liquidity Strategy. Our backtest research shows that the Earnings-Based Liquidity Strategy offers the highest return and the best risk-return tradeoff, while the Volume Weighted Strategy does the worst. The superior performance of the liquidity strategies are due to equilibrium, macro, and micro reasons. In equilibrium, liquid stocks sell at a liquidity premium and illiquid stocks sell at a liquidity discount. Investing in less liquid stocks thus pays. Second, at the macro level, the growing level of financialization of assets in the world makes today’s less liquid securities increasingly more liquid over time. Finally, at the micro level, the strategy avoids, or invests less, in popular, heavily traded glamour stocks and favors out-of-favor stocks, both of which tend to revert to more normal trading volume over time.

…

The negative relation between liquidity and stock returns is not always straight forward. Lee and Swaminathan (1998) show that the return spread between past winners and past losers (i.e., the momentum premium) is much higher among high-volume stocks. Trading volume serves as an indicator of demand for a stock. When a stock falls into disfavor, the number of sellers dominates buyers, leading to low prices and low volume. When a stock becomes popular or glamorous, buyers dominate sellers, resulting in higher prices and higher volume. Thus, relatively low turnover is indicative of a stock near the bottom of its expectation cycle, while a relatively high turnover is indicative of a firm close to the top of its expectation cycle.

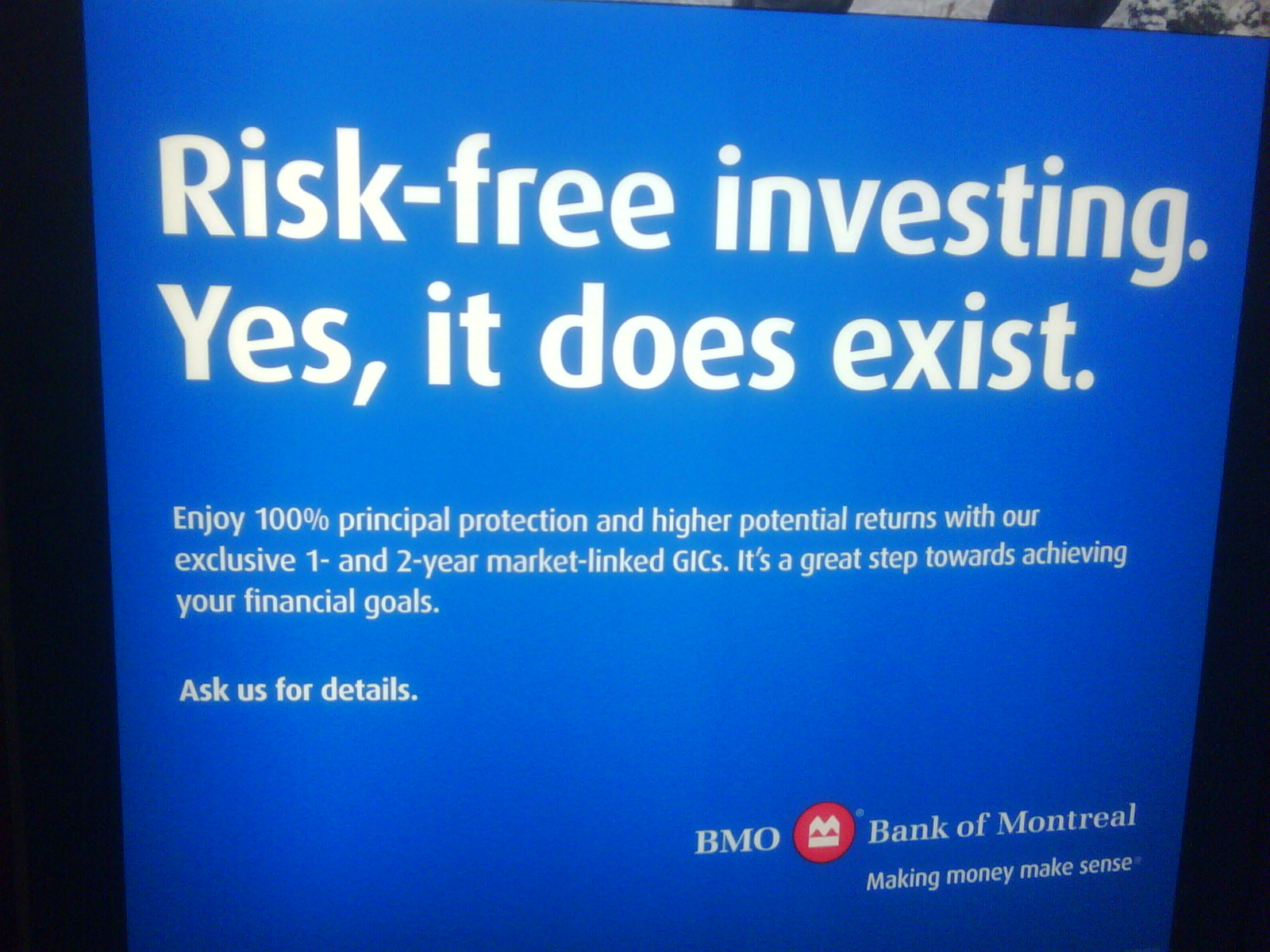

Today’s installment in the “Incredible Bullshit Banks are Allowed To Get Away With” series features the Bank of Montreal:

Risk Free! Lehman should have thought of that line, they would have been able to sell a great many more of their PPNs.

A mixed day on the Canadian preferred share market, with PerpetualDiscounts gaining 10bp and FixedResets losing 16bp. Volume was on the high side of average.

PerpetualDiscounts now yield 5.43%, equivalent to 7.60% interest at the standard equivalency factor of 1.4x. Long corporates now yield about 5.5%, so the pre-tax interest-equivalent spread (also known, around here, as the Seniority Spread) is now about 210bp, a dramatic tightening from the 225bp reported on December 31.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.2099 % | 2,311.5 |

| FixedFloater | 4.81 % | 3.54 % | 29,719 | 18.92 | 1 | 0.0000 % | 3,495.6 |

| Floater | 2.59 % | 2.38 % | 47,327 | 21.27 | 4 | 0.2099 % | 2,495.8 |

| OpRet | 4.78 % | 3.27 % | 65,364 | 2.33 | 8 | -0.1290 % | 2,400.5 |

| SplitShare | 5.34 % | 1.30 % | 692,021 | 0.92 | 4 | 0.3945 % | 2,446.8 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1290 % | 2,195.0 |

| Perpetual-Premium | 5.64 % | 5.31 % | 124,903 | 5.31 | 20 | 0.1120 % | 2,021.2 |

| Perpetual-Discount | 5.43 % | 5.49 % | 233,261 | 14.71 | 57 | 0.1049 % | 2,034.5 |

| FixedReset | 5.23 % | 3.46 % | 304,306 | 3.08 | 52 | -0.1590 % | 2,267.3 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.O | OpRet | -1.33 % | YTW SCENARIO Maturity Type : Option Certainty Maturity Date : 2013-06-30 Maturity Price : 25.00 Evaluated at bid price : 26.05 Bid-YTW : 3.27 % |

| BNS.PR.Y | FixedReset | -1.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-05 Maturity Price : 24.85 Evaluated at bid price : 24.90 Bid-YTW : 3.46 % |

| NA.PR.O | FixedReset | -1.01 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-17 Maturity Price : 25.00 Evaluated at bid price : 27.57 Bid-YTW : 3.53 % |

| BNA.PR.C | SplitShare | 1.10 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2019-01-10 Maturity Price : 25.00 Evaluated at bid price : 22.10 Bid-YTW : 6.31 % |

| GWO.PR.F | Perpetual-Premium | 1.30 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2011-02-04 Maturity Price : 25.50 Evaluated at bid price : 25.75 Bid-YTW : -5.08 % |

| HSB.PR.C | Perpetual-Discount | 1.34 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-05 Maturity Price : 23.21 Evaluated at bid price : 23.45 Bid-YTW : 5.47 % |

| IAG.PR.A | Perpetual-Discount | 1.94 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-05 Maturity Price : 21.01 Evaluated at bid price : 21.01 Bid-YTW : 5.52 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TD.PR.I | FixedReset | 95,421 | TD crossed four blocks; 20,000 shares, 41,900 shares, 12,600 and 12,400, all at 27.75. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 27.56 Bid-YTW : 3.61 % |

| GWO.PR.H | Perpetual-Discount | 76,071 | Desjardins crossed three blocks, one of 11,400 and two of 25,000 each, all at 23.50. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-05 Maturity Price : 23.07 Evaluated at bid price : 23.30 Bid-YTW : 5.23 % |

| PWF.PR.M | FixedReset | 71,772 | Nesbitt crossed 50,000 at 27.00; RBC crossed 20,700 at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-02 Maturity Price : 25.00 Evaluated at bid price : 27.00 Bid-YTW : 3.64 % |

| TRP.PR.A | FixedReset | 61,113 | RBC crossed 38,000 at 25.96. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-01-30 Maturity Price : 25.00 Evaluated at bid price : 25.94 Bid-YTW : 3.61 % |

| TRP.PR.C | FixedReset | 46,815 | RBC crossed 40,000 at 25.43. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-05 Maturity Price : 25.30 Evaluated at bid price : 25.35 Bid-YTW : 3.95 % |

| BNS.PR.Q | FixedReset | 38,522 | YTW SCENARIO Maturity Type : Call Maturity Date : 2013-11-24 Maturity Price : 25.00 Evaluated at bid price : 26.03 Bid-YTW : 3.32 % |

| There were 33 other index-included issues trading in excess of 10,000 shares. | |||

[…] on the other hand, are indeed “careful and intelligent readers.”. I proved this on January 5: Click for […]