Moody’s has downgraded Egypt:

Moody’s Investors Service cut its rating on Egypt’s debt on Monday on concern about its public finances, becoming the second credit agency to turn negative since the country was plunged into political crisis.

Moody’s … said the one-notch downgrade, to Ba2 from Ba1 with a negative outlook, was prompted by a significant rise in political risk and concern that the government’s response to mounting unrest could undermine Egypt’s already weak public finances.

…

Moody’s joined peer Fitch Ratings, which cut the outlook on its BB+ country ceiling to negative on Friday, in saying the political turmoil would likely undermine Egypt’s economic reform programme.

There was a demonstration at Dumbass Square. I liked this guy’s sign:

You don’t make a currency global by joining the UN and passing resolutions. You make a currency global by using it to settle international transactions:

HSBC Bank Canada said Wednesday it has completed the first Canadian trade using the yuan exclusively, as the Chinese currency continues to gain traction as an international reserve alongside the U.S. dollar. The deal was conducted for B.C.-based industrial auctioneer Maynards Industries.

Fabrice de Dongo, a spokesman for HSBC Canada, said HSBC made a direct payment in the yuan currency on behalf of Maynards to a company in China. Previously, the payment would have first been converted into U.S. dollars, used for the majority of global trade.

…

China has only recently begun allowing international trade using its currency, beginning with a pilot program in 2009 involving five Chinese cities and member countries of the Association of Southeast Asian Nations. The program was expanded to include all foreign countries, including Canada, in June 2010.

Interest rate modifications don’t work too well with underwater mortgages:

The re-default rate for the Making Home Affordable Program averaged 20.4 percent after 12 months, 15.9 percent after nine months, 10.7 percent after six months and 4.6 percent after three months, according to a report released today by the Treasury Department.

…

In December, 30,030 homeowners newly qualified for permanent modifications that reduce home payments to 31 percent of gross income, the department said today. A total of 58,020 permanent loan modifications have been canceled since 2009.

…

The median loan balance was just over $232,196 after a modification and the median mark-to-market loan-to-value was 118 percent, meaning most homeowners had negative equity or were “underwater.” The median monthly payment reduction was more than $520 or about 40 percent.

It was a mixed and volatile day on the Canadian preferred share market as PerpetualDiscounts gained 17bp and FixedResets lost 4bp. Volume ticked up a bit to above average.

PerpetualDiscounts now yield 5.28%, equivalent to 7.39% interest at the standard equivalency factor of 1.4x. Long Corporates now yield about 5.5%, so the pre-tax interest-equivalent spread is now about 190bp, a slight and perhaps spurious increase from the 185bp recorded on January 26.

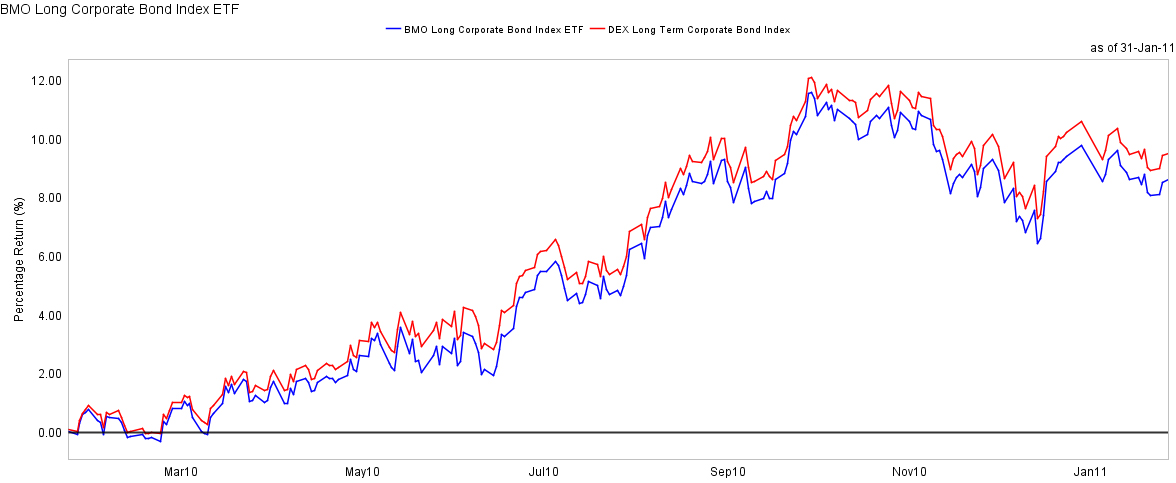

ZLC, the BMO Long Corporate ETF, was not particularly exciting this month:

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.9479 % | 2,399.0 |

| FixedFloater | 4.71 % | 3.23 % | 25,060 | 19.09 | 1 | 1.7621 % | 3,615.7 |

| Floater | 2.50 % | 2.29 % | 44,236 | 21.53 | 4 | 0.9479 % | 2,590.3 |

| OpRet | 4.81 % | 3.43 % | 69,190 | 2.26 | 8 | 0.0386 % | 2,389.4 |

| SplitShare | 5.30 % | 1.64 % | 379,245 | 0.85 | 4 | -0.3239 % | 2,465.8 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0386 % | 2,184.9 |

| Perpetual-Premium | 5.64 % | 5.25 % | 137,575 | 5.30 | 20 | 0.0629 % | 2,035.7 |

| Perpetual-Discount | 5.30 % | 5.28 % | 261,178 | 14.96 | 57 | 0.1709 % | 2,089.4 |

| FixedReset | 5.26 % | 3.59 % | 279,855 | 3.02 | 52 | -0.0405 % | 2,269.1 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| HSB.PR.C | Perpetual-Discount | -1.56 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-31 Maturity Price : 23.74 Evaluated at bid price : 24.01 Bid-YTW : 5.36 % |

| RY.PR.A | Perpetual-Discount | 1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-31 Maturity Price : 22.75 Evaluated at bid price : 22.94 Bid-YTW : 4.85 % |

| CM.PR.I | Perpetual-Discount | 1.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-31 Maturity Price : 23.44 Evaluated at bid price : 23.66 Bid-YTW : 4.98 % |

| RY.PR.D | Perpetual-Discount | 1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-31 Maturity Price : 22.73 Evaluated at bid price : 22.91 Bid-YTW : 4.91 % |

| CM.PR.J | Perpetual-Discount | 1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-31 Maturity Price : 23.07 Evaluated at bid price : 23.27 Bid-YTW : 4.85 % |

| RY.PR.E | Perpetual-Discount | 1.24 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-31 Maturity Price : 22.75 Evaluated at bid price : 22.93 Bid-YTW : 4.91 % |

| IAG.PR.E | Perpetual-Premium | 1.24 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2019-01-30 Maturity Price : 25.00 Evaluated at bid price : 26.11 Bid-YTW : 5.43 % |

| RY.PR.G | Perpetual-Discount | 1.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-31 Maturity Price : 22.77 Evaluated at bid price : 22.94 Bid-YTW : 4.90 % |

| BAM.PR.R | FixedReset | 1.75 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2016-07-30 Maturity Price : 25.00 Evaluated at bid price : 26.15 Bid-YTW : 4.55 % |

| BAM.PR.G | FixedFloater | 1.76 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-31 Maturity Price : 22.95 Evaluated at bid price : 23.10 Bid-YTW : 3.23 % |

| BAM.PR.J | OpRet | 1.87 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2018-03-30 Maturity Price : 25.00 Evaluated at bid price : 26.67 Bid-YTW : 4.41 % |

| PWF.PR.A | Floater | 3.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-31 Maturity Price : 23.21 Evaluated at bid price : 23.51 Bid-YTW : 2.19 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| BNS.PR.J | Perpetual-Discount | 211,008 | Desjardins crossed blocks of 125,000 and 75,000, both at 25.00. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-31 Maturity Price : 23.40 Evaluated at bid price : 24.98 Bid-YTW : 5.20 % |

| NA.PR.O | FixedReset | 69,676 | Nesbitt sold 18,600 to anonymous at 27.46. National crossed 25,000 at 27.48 and 10,000 at 27.49. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-17 Maturity Price : 25.00 Evaluated at bid price : 27.35 Bid-YTW : 3.38 % |

| CM.PR.I | Perpetual-Discount | 53,318 | RBC crossed 25,000 at 23.46. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-31 Maturity Price : 23.44 Evaluated at bid price : 23.66 Bid-YTW : 4.98 % |

| BNS.PR.M | Perpetual-Discount | 44,821 | TD crossed 25,000 at 23.10. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-31 Maturity Price : 23.03 Evaluated at bid price : 23.22 Bid-YTW : 4.87 % |

| CM.PR.D | Perpetual-Premium | 41,164 | Desjardins crossed 32,500 at 25.55. YTW SCENARIO Maturity Type : Call Maturity Date : 2011-05-30 Maturity Price : 25.25 Evaluated at bid price : 25.52 Bid-YTW : 2.46 % |

| BNS.PR.X | FixedReset | 40,682 | RBC crossed 29,000 at 27.27. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-25 Maturity Price : 25.00 Evaluated at bid price : 27.25 Bid-YTW : 3.45 % |

| There were 37 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | |||

| Issue | Index | Quote Data | Notes |

| TRI.PR.B | Floater | Quote: 22.75 – 24.64 Spot Rate : 1.8900 Average : 1.2570 |

YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-31 Maturity Price : 22.49 Evaluated at bid price : 22.75 Bid-YTW : 2.29 % |

| FTS.PR.H | FixedReset | Quote: 25.55 – 25.99 Spot Rate : 0.4400 Average : 0.2938 |

YTW SCENARIO Maturity Type : Call Maturity Date : 2015-07-01 Maturity Price : 25.00 Evaluated at bid price : 25.55 Bid-YTW : 3.89 % |

| BAM.PR.N | Perpetual-Discount | Quote: 20.90 – 21.15 Spot Rate : 0.2500 Average : 0.1467 |

YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-31 Maturity Price : 20.90 Evaluated at bid price : 20.90 Bid-YTW : 5.76 % |

| CIU.PR.A | Perpetual-Discount | Quote: 22.50 – 23.00 Spot Rate : 0.5000 Average : 0.3997 |

YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-01-31 Maturity Price : 22.35 Evaluated at bid price : 22.50 Bid-YTW : 5.19 % |

| BAM.PR.I | OpRet | Quote: 25.55 – 25.98 Spot Rate : 0.4300 Average : 0.3325 |

YTW SCENARIO Maturity Type : Call Maturity Date : 2011-07-30 Maturity Price : 25.25 Evaluated at bid price : 25.55 Bid-YTW : 3.99 % |

| GWO.PR.J | FixedReset | Quote: 26.75 – 27.15 Spot Rate : 0.4000 Average : 0.3028 |

YTW SCENARIO Maturity Type : Call Maturity Date : 2014-01-30 Maturity Price : 25.00 Evaluated at bid price : 26.75 Bid-YTW : 3.68 % |

[…] PerpetualDiscounts now yield 5.26%, equivalent to 7.36% interest at the standard equivalency factor of 1.4x. Long Corporates have popped up to 5.6%, so the pre-tax interest-equivalent spread (also called the Seniority Spread) is now about 175bp, a significant narrowing from the 190bp reported at month-end. […]

[…] spread of PerpetualDiscounts over Long Corporates (which I also refer to as the Seniority Spread) ended the month at 190bp, a significant decline from the 225bp reported at year-end. The decline may be attribute […]