The day started with rumours that some of the owners of Alpha Trading Systems don’t want big brother to get married:

Four of the country’s six largest banks are lining up to raise red flags about the planned merger of the parent companies of the Toronto Stock Exchange and the London Stock Exchange, saying the country risks losing clout as a financial centre.

…

The banks plan to lay out their concerns this week in a public letter. The wording of the letter, tentatively titled “Let’s build on a Canadian success story,” has not been finalized, nor has the list of signatories, but sources said Tuesday that the banks that were on side as of then included Toronto-Dominion Bank, which is co-ordinating the effort, as well as Bank of Nova Scotia, Canadian Imperial Bank of Commerce and National Bank of Canada.

Hey, if you can’t compete, run home crying to mommy, that’s what I always say! Boyd Erman comments:

There’s no doubt that on some level, Alpha may be factoring into the calculations, but the web of conflicting behaviour suggests that Alpha is not the driving factor behind whether banks support or oppose the TMX-LSE deal.

The last argument is the old small-town one, that the banks would like to remain the big fish in a small pond. It may be that the banks are being parochial, and want to keep control of the TMX within walking distance of their own head offices. This one probably has the most weight.

How are you going to keep the boys on the farm, once they’ve seen the City? And the furrinners might not have the proper reverence for Canadian banks, or might send in their resumes once their regulatory stint is over. Another mouth to feed!

As it turns out the Financial Post has published the letter. It’s vagueness, incoherence and prediliction for sweeping fearmongery make it clear to me that whatever they’re talking about, it’s not the merits of the deal.

Bloomberg reports on today’s testimony to a parliamentry committee. Caldwell has a number of fish to fry with respect to exchange mergers, but had the right idea:

“Of course they’re against it because it provides real competition for Alpha,” said Brendan Caldwell, Chief Executive Officer of Caldwell Investment Management Ltd., a money manager that owns shares in TMX. “They banks don’t like real competition, they like the little oligopoly where they divvy up the financial pie of Canada amongst themselves. It’s quite incestuous.”

The Globe plays up support for the deal from the Toronto Financial Services Alliance. I confess I don’t know much about this group, but they repeat that hoary canard about the WEF ranking of banks around the world on the front page of their website, so their opinions can’t be worth much.

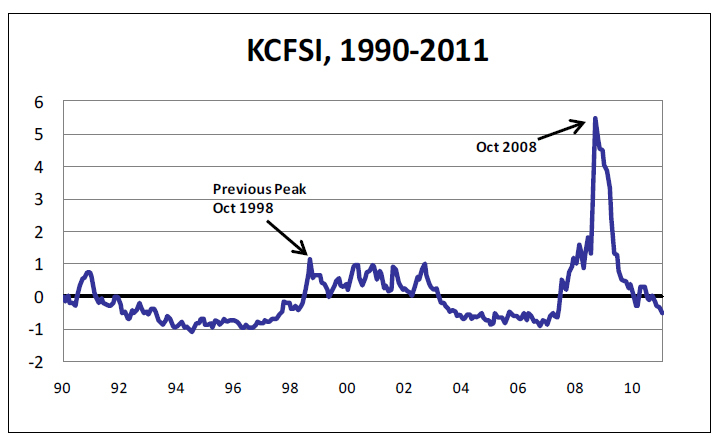

The Kansas City Financial Stress Index is at its lowest level since June 2007:

Another mixed day in the Canadian preferred share market, with PerpetualDiscounts up 22bp, FixedResets gaining 3bp and DeemedRetractibles slipping 4bp. Only one entry – which barely made it – in the Performance Highlights table. Volume remained high.

PerpetualDiscounts now yield 5.64%, equivalent to 7.33% interest at the new standard equivalency factor of 1.3x. Long corporates now yield about 5.6% (ok, maybe a tiny bit less) so the pre-tax interest-equivalent spread is now about 175bp, a slight (and perhaps spurious) decline from the 180bp reported on March 2.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1428 % | 2,399.0 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1428 % | 3,608.1 |

| Floater | 2.50 % | 2.27 % | 44,728 | 21.54 | 4 | 0.1428 % | 2,590.3 |

| OpRet | 4.87 % | 3.49 % | 56,958 | 0.38 | 9 | 0.1204 % | 2,392.7 |

| SplitShare | 5.09 % | 3.02 % | 208,689 | 1.03 | 5 | 0.0640 % | 2,485.9 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1204 % | 2,187.9 |

| Perpetual-Premium | 5.74 % | 5.56 % | 135,565 | 6.24 | 10 | 0.0496 % | 2,033.8 |

| Perpetual-Discount | 5.51 % | 5.64 % | 125,895 | 14.37 | 14 | 0.2190 % | 2,117.2 |

| FixedReset | 5.21 % | 3.54 % | 202,236 | 2.98 | 54 | 0.0307 % | 2,280.7 |

| Deemed-Retractible | 5.23 % | 5.27 % | 360,715 | 8.27 | 53 | -0.0359 % | 2,078.1 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| HSB.PR.D | Deemed-Retractible | 1.00 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.14 Bid-YTW : 5.57 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| MFC.PR.B | Deemed-Retractible | 89,987 | RBC crossed 80,000 at 22.45. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.33 Bid-YTW : 6.02 % |

| BMO.PR.P | FixedReset | 67,888 | Desjardins crossed blocks of 26,600 and 30,000, both at 26.75. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-03-27 Maturity Price : 25.00 Evaluated at bid price : 26.72 Bid-YTW : 3.61 % |

| TCA.PR.X | Perpetual-Premium | 45,874 | Nesbitt crossed 40,000 at 50.40. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-03-09 Maturity Price : 46.98 Evaluated at bid price : 50.31 Bid-YTW : 5.56 % |

| TRP.PR.A | FixedReset | 38,901 | TD crossed 19,700 at 25.85. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-01-30 Maturity Price : 25.00 Evaluated at bid price : 25.80 Bid-YTW : 3.65 % |

| FTS.PR.G | FixedReset | 38,125 | RBC crossed 30,000 at 25.85. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-10-01 Maturity Price : 25.00 Evaluated at bid price : 25.90 Bid-YTW : 3.78 % |

| SLF.PR.G | FixedReset | 38,089 | Scotia crossed 20,000 at 25.25 and bought 10,000 from anonymous at the same price. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.15 Bid-YTW : 4.11 % |

| There were 53 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| FTS.PR.H | FixedReset | Quote: 25.20 – 25.50 Spot Rate : 0.3000 Average : 0.1971 YTW SCENARIO |

| TRI.PR.B | Floater | Quote: 23.00 – 23.79 Spot Rate : 0.7900 Average : 0.6877 YTW SCENARIO |

| HSB.PR.C | Deemed-Retractible | Quote: 24.63 – 24.99 Spot Rate : 0.3600 Average : 0.2665 YTW SCENARIO |

| GWO.PR.L | Deemed-Retractible | Quote: 24.80 – 25.07 Spot Rate : 0.2700 Average : 0.1811 YTW SCENARIO |

| BMO.PR.H | Deemed-Retractible | Quote: 25.22 – 25.47 Spot Rate : 0.2500 Average : 0.1690 YTW SCENARIO |

| TD.PR.G | FixedReset | Quote: 27.26 – 27.49 Spot Rate : 0.2300 Average : 0.1512 YTW SCENARIO |

[…] PerpetualDiscounts now yiel 5.59%, equivalent to 7.27% interest at the now standard equivalency factor of 1.3x. Long corporates now yield about 5.5% (OK, maybe a little bit less) so the pre-tax interest-equivalent spread is now about 180bp, not much different from the 175bp reported on March 9. […]