Somewhat to my surprise, the problems in the bond insurance industry continue to make headlines – much to the chagrin of the risk-control specialists at Royal Bank:

At the time, “we had noted there that we had exposure to one monoline [bond insurer] that was rated a single-A, that we had taken a provision against that exposure, and [that] the current mark-to-market as of Oct. 31st was $104-million,” RBC chief financial officer Janice Fukakusa told a financial services conference Tuesday.

“That monoline subsequently is in difficulty, so we have written off the balance of our exposure there in our first quarter results,” she said. That quarter ends this week, on Jan. 31, and the bank will release its results in late February.

There is the usual speculation regarding the monolines – Naked Capitalism sticks to its gloomy view:

So the benefit of this operation is not to assure payouts, but to prevent a downgrade because that leads to forced sales by investors who can only hold paper than falls in certain ratings buckets, and in turn forces the Street to price similar holdings lower. But the level of capital required to maintain an AAA is far larger than that required to merely assure that claims are paid for the next year or two

… while CreditSights (a subscription-based ratings agency often quoted in the press) feels that the monolines are in a losing race against time:

“Given the number of competing interests and levels of commitment of participants involved, we think it is unlikely that an agreement sponsored by Dinallo could be hammered out within the appropriate timeframe,” CreditSights analysts Rob Haines, Craig Guttenplan and Joe Di Carlo in New York wrote in a report. “In the offchance that any deal could be solidified, the rating agencies are likely to have already taken action.”

The Fed will announce its rate decision tomorrow. The target rate for FedFunds is now 3.5%, but the futures contract is showing almost certainty of a cut to 3.0% … and about 2.5% by May. Economic concern is growing as the real (after inflation) rate approaches 0%; this concern is dismissed by others:

To be sure, inflation excluding food and energy prices — so-called core inflation — has exceeded the upper end of the Fed’s implicit comfort zone during most of the past four years. Including food and energy prices, the overage has been much more pronounced. Therefore, the emphasis of some Fed officials on preventing further increases in inflation is understandable. However, core inflation exhibits substantial inertia, so upward movements in inflation usually occur gradually. In contrast, output and employment can slump more rapidly, and the fragile state of the financial system today accentuates the risk of a reinforcing downward spiral. With a possible plunge on one side of the road and a less abrupt embankment on the other, a wise driver stays on the side of the shallower drop.

Not much new regarding the SocGen Futures Fiasco today … but a Jerome Kerviel fansite has been started! (hat tip: Financial Webring Forum). Apparently, SocGen is having a little difficulty convincing the authorities that actual criminal fraud was involved.

French prosecutors will not appeal against a decision to throw out the accusation of fraud levelled against a trader blamed for huge losses at Societe Generale, a senior judicial source said on Tuesday.

If confirmed, the move would represent a blow for SocGen managers, who last week branded trader Jerome Kerviel a “fraudster” and said the bank had been the victim of “massive fraud.”

The refusal to lay fraud charges will, in fact, be appealed, which leaves the “senior judicial source” looking a little silly.

In other enforcement news, the FBI confirms it’s looking at sub-prime:

The Federal Bureau of Investigation is investigating 14 corporations for possible accounting fraud and other crimes related to the subprime lending crisis, officials said.

…

The probes add to federal and state scrutiny of the home- loan industry as prosecutors and regulators seek to assign culpability for the mortgage rout that has forced people from their homes and resulted in losses to investors. The biggest banks and securities firms have posted at least $133 billion in credit losses and writedowns related to the loans, which are typically made to buyers with the weakest credit.

And also related to sub-prime, the current House Resolution 1540 increases the maximum mortage size for Fannie Mae, Freddie Mac & the FHA, e.g.:

For mortgages originated during the period beginning on July 1, 2007, and ending at the end of December 31, 2008:

- (1) FANNIE MAE- With respect to the Federal National Mortgage Association, notwithstanding section 302(b)(2) of the Federal National Mortgage Association Charter Act (12 U.S.C. 1717(b)(2)), the limitation on the maximum original principal obligation of a mortgage that may be purchased by the Association shall be the higher of–

- (A) the limitation for 2008 determined under such section 302(b)(2) for a residence of the applicable size; or

- (B) 125 percent of the area median price for a residence of the applicable size, but in no case to exceed 175 percent of the limitation for 2008 determined under such section 302(b)(2) for a residence of the applicable size.

… and the jerks are so desperate to appear to be Doing Something that they didn’t even bother to extract any capitalization-related concessions from the GSEs as a condition of increasing the limit.

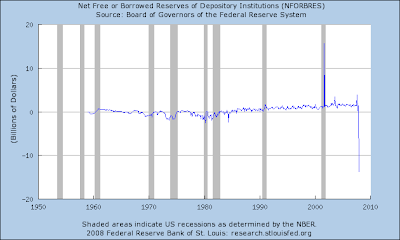

Naked Capitalism is very concerned about a precipituous decline in non-borrowed reserves at the Fed, but I’m not convinced there’s a story here. In the current H3 release, it is disclosed that, of $41,475-million in reserves, only $199-million are non-borrowed. Usually, non-borrowed reserves will be roughly equal to total reserves – implying that net free reserves is about zero. The chart tells the story:

So … what are reserves? The Fed has the answer:

- Reserve requirements, a tool of monetary policy, are computed as percentages of deposits that banks must hold as vault cash or on deposit at a Federal Reserve Bank.

- Reserve requirements represent a cost to the banking system. Bank reserves, meanwhile, are used in the day-to-day implementation of monetary policy by the Federal Reserve.

- As of December 2006, the reserve requirement was 10% on transaction deposits, and there were zero reserves required for time deposits.

There are two things to note here: first, Canada does not have a fractional reserve requirement and second, banks get ZERO interest on their reserves:

The Fed has long advocated the payment of interest on the reserves that banks maintain at Federal Reserve Banks. Such a step would have to be approved by Congress, which traditionally has been opposed because of the revenue loss that would result to the U.S. Treasury. Each year the Treasury receives the Fed’s revenue that is in excess of its expenses. The payment of interest on reserves would, of course, be an additional expense to the Fed.

Thus, all banks will attempt to keep their reserves as close to their requirements as possible. If they have any excess in the system, they will either try to lend them on the Fed Funds market – at the infamous Fed Funds Rate – or withdraw them, to invest the money in … basically anything. Even a one-week T-bill, even now, pays more than ZERO.

Now, along comes the Term Auction Facility. Its value of $40,000-million is – surely not fortuitously! – roughly equal to the total US bank reserve requirement … and it’s available cheap – 3.123%, as pointed out by Naked Capitalism.

If these borrowed term funds were to be left at the Fed – on top of the reserve balances that had been held there previously – then the banks would be borrowing at 3.123% and lending at ZERO. It is my understanding that this sort of negative margin on loans is not considered the road to riches at banking school. But an American stockbroker heard about this, got all excited and appears to have stampeded Naked Capitalism into unnecessary worry.

A good day in the preferred market – as noted by a New Assiduous Reader on another thread – but the index is still negative on the month. Volume was on the light side, but reasonable.

| Note that these indices are experimental; the absolute and relative daily values are expected to change in the final version. In this version, index values are based at 1,000.0 on 2006-6-30 | |||||||

| Index | Mean Current Yield (at bid) | Mean YTW | Mean Average Trading Value | Mean Mod Dur (YTW) | Issues | Day’s Perf. | Index Value |

| Ratchet | 5.55% | 5.57% | 54,952 | 14.60 | 2 | -0.0576% | 1,065.7 |

| Fixed-Floater | 5.05% | 5.64% | 76,760 | 14.64 | 9 | -0.1107% | 1,015.7 |

| Floater | 4.91% | 4.96% | 82,974 | 15.57 | 3 | +1.0930% | 859.6 |

| Op. Retract | 4.82% | 1.51% | 83,553 | 2.72 | 15 | +0.3561% | 1,045.2 |

| Split-Share | 5.34% | 5.53% | 101,376 | 4.23 | 15 | +0.3860% | 1,030.3 |

| Interest Bearing | 6.31% | 6.59% | 62,974 | 3.59 | 4 | +0.5419% | 1,069.4 |

| Perpetual-Premium | 5.80% | 5.58% | 64,317 | 6.99 | 12 | +0.2494% | 1,017.7 |

| Perpetual-Discount | 5.54% | 5.57% | 307,820 | 14.33 | 54 | +0.5918% | 928.1 |

| Major Price Changes | |||

| Issue | Index | Change | Notes |

| SBN.PR.A | SplitShare | +1.0891% | Asset coverage of 2.1+:1 as of January 24, according to Mulvihill. Now with a pre-tax bid-YTW of 4.93% based on a bid of 10.21 and a hardMaturity 2014-12-01 at 10.00. |

| BNS.PR.M | PerpetualDiscount | +1.1505% | Now with a pre-tax bid-YTW of 5.37% based on a bid of 21.10 and a limitMaturity. |

| SLF.PR.E | PerpetualDiscount | +1.1561% | Now with a pre-tax bid-YTW of 5.42% based on a bid of 21.00 and a limitMaturity. |

| RY.PR.A | PerpetualDiscount | +1.2019% | Now with a pre-tax bid-YTW of 5.30% based on a bid of 21.05 and a limitMaturity. |

| HSB.PR.D | PerpetualDiscount | +1.2048% | Now with a pre-tax bid-YTW of 5.57% based on a bid of 22.68 and a limitMaturity. |

| SLF.PR.D | PerpetualDiscount | +1.2136% | Now with a pre-tax bid-YTW of 5.40% based on a bid of 20.85 and a limitMaturity. |

| BAM.PR.K | Floater | +1.2658% | |

| BNS.PR.L | PerpetualDiscount | +1.3384% | Now with a pre-tax bid-YTW of 5.34% based on a bid of 21.20 and a limitMaturity. |

| BAM.PR.I | OpRet | +1.3649% | Now with a pre-tax bid-YTW of 5.42% based on a bid of 25.25 and a softMaturity 2013-12-30 at 25.00. |

| CM.PR.H | PerpetualDiscount | +1.4085% | Now with a pre-tax bid-YTW of 5.58% based on a bid of 21.60 and a limitMaturity. |

| SLF.PR.C | PerpetualDiscount | +1.4493% | Now with a pre-tax bid-YTW of 5.36% based on a bid of 21.00 and a limitMaturity. |

| BSD.PR.A | InterestBearing | +1.6129% | Asset coverage of just under 1.6:1 as of January 25, according to Brookfield Funds. Now with a pre-tax bid-YTW of 7.18% (mostly as interest) based on a bid of 9.45 and a hardMaturity 2015-3-31 at 10.00. |

| PWF.PR.H | PerpetualDiscount | +1.6466% | Now with a pre-tax bid-YTW of 5.43% based on a bid of 25.31 and a limitMaturity. |

| BAM.PR.B | Floater | +2.0997% | |

| PWF.PR.L | PerpetualDiscount | +2.1314% | Now with a pre-tax bid-YTW of 5.57% based on a bid of 23.00 and a limitMaturity. |

| BAM.PR.M | PerpetualDiscount | +2.3090% | Now with a pre-tax bid-YTW of 6.47% based on a bid of 18.61 and a limitMaturity. |

| BAM.PR.H | OpRet | +2.5130% | Now with a pre-tax bid-YTW of 5.15% based on a bid of 25.70 and a softMaturity 2012-3-30 at 25.00. |

| BAM.PR.N | PerpetualDiscount | +2.6010% | Now with a pre-tax bid-YTW of 6.50% based on a bid of 18.54 and a limitMaturity. |

| NA.PR.K | PerpetualDiscount | +2.6016% | Now with a pre-tax bid-YTW of 5.58% based on a bid of 25.24 and a call 2012-6-14 at 25.00. |

| Volume Highlights | |||

| Issue | Index | Volume | Notes |

| SLF.PR.A | PerpetualDiscount | 113,412 | Now with a pre-tax bid-YTW of 5.37% based on a bid of 22.36 and a limitMaturity. |

| SLF.PR.C | PerpetualDiscount | 109,060 | Now with a pre-tax bid-YTW of 5.36% based on a bid of 21.00 and a limitMaturity. |

| CM.PR.I | PerpetualDiscount | 83,426 | Now with a pre-tax bid-YTW of 5.79% based on a bid of 20.46 and a limitMaturity. |

| BAM.PR.M | PerpetualDiscount | 81,400 | Now with a pre-tax bid-YTW of 6.47% based on a bid of 18.61 and a limitMaturity. |

| BAM.PR.N | PerpetualDiscount | 76,029 | Now with a pre-tax bid-YTW of 6.50% based on a bid of 18.54 and a limitMaturity. |

There were nineteen other index-included $25.00-equivalent issues trading over 10,000 shares today.

very updated analysis here! . . . and thank you for your thoughts on my prime/dividend arbitrage idea! . . . all of your “possibilities” are very real, and of course, are always part of this kind of investment.

I wanted to share an observation on the pref market in general. Last fall, about the time that we had 3 banks issuing 5.3% prefs, RBC put out an economic policy statement confirming their thinking that the sub-prime fiasco was sufficiently under control, and that after a short interest rate adjustment cycle, the general policy of raising rates would resume. They went on to declare their position that fixed income had no realistic growth outlook over the mid to long term, and hence, should be sold.

Living on Level II, I quickly discovered large volumes of prefs (of all issuers) being sold aggressively by number “2” (RBC). Of particular interest was their willingness to take massive losses as they liquidated their positions. Best example would be the selling they did on their own prefs (RY.PR.A through RY.PR.G). They continually brought these issues to new all time lows, and the selling was relentless. It continued with consistency up until Christmas, at which point it appeared to vanish . . . only to resume in early January.

Then, as quickly as it started, a new update was released by RBC suggesting they were now “unsure” about the direction of rates; I believe they used the term, “murky”. Suddenly the RBC fund managers were no longer on the “sell” side, and the market started to show some energy. Until BNS and TD put out the 5.6% prefs . . . although the ensuing slide in the market only lasted a trading session or 2.

Also of note on the RBC dumping observation, it was BMO that did most of the buying . . . they were all over the pref market with these 2000 share “iceberg” buy orders, just eating up all of RBC’s aggressive pref selling. I’ve noticed over the past week or so, and for the first time in the last year, that BMO is showing up on the sell side, presumably taking some profit on RBC’s unfortunate strategy. Readers might want to keep their eyes open for moves by these two players as an indication of where the market is going to go.

For anyone holding fixed income mutual funds at RBC, and want to know why their statements are probably looking somewhat sorry these days, this is one reason why. This is a danger in investing in mutual funds of any kind. I was shocked that one financial institution had sufficienct mass to move an entire market the way they did, but the sobering reality set in quickly that they do . . . and will . . . act in this way. Scary.

madequota

Thanks for your observations! At some time, perhaps, given sufficient data, it would be interesting to publish statistics on which house is driving the market, whether up or down.

I’m not convinced, though, that the ultimate culprit is RBC’s mutual funds. While I have no direct knowledge, I know that Sentry Select is tight with RBC and I have previously blamed Sentry Select’s DPS.UN for a chunk of the selling – which was not a market call, but a covering of client retractions.

In fact, I’m not even sure that RBC’s fixed income funds do appreciably worse than any other banks’. They might! I just don’t know.

More generally, I have three rules when reading brokerage research:

Data? They’re super. Excellent data, and they can get more for you if you have sufficient clout (i.e. trading volume) to talk to the right people.

Ideas? Not bad! They bring a lot of ideas forward … many of which are thought provoking and some of which are even worth doing some work elaborating.

Actual trading and strategy recommendations? Hahahahahahahaha!

RBC back at it again . . . OK here’s the situation: CCS.PR.C . . . heavily bid from $17.90 down to $17.00 . . . no offers until $20.20 . . . except for RBC, 2000 offerred at $18.00, where it’s been trading all day . . . as soon as it’s filled, another 2000 offerred at $18 by RBC . . . frustrating for those holding CCS . . . if he simply stepped his offer through to $20, he would realize a pile more cash for his [client’s] shares, and take the overhang away as well . . . this kind of trading by so-called “institutional professionals” boggles the mind.

is there any way we might convince him to take a vacation or something? his clients would really benefit from it!

madequota

In all fairness, we don’t know what the trader’s instructions are … and we also don’t know for sure that all the buyers happily chipping away at an $18.00 offer would be quite so happy to lift a $20.00 offer.

At $20, CCS.PR.A yields somewhere around 6.25%, way below, f’rinstance, the Weston issues, while at $18.00 the yield is marginally higher.

I also note that somebody trading via National Bank has lost all patience and has sold a small batch at $17.90.

At $18, the yield is approx 6.9%, and without checking the S&P ratings, I would guess that CCS is probably at least a 2, Weston probably a 3 or even 4 with all the Loblaws issues. Not an apples to apples comparison I suspect.

You are right; at $20 we don’t know what the interest level would be, but my point is this: if there’s nothing offered until $20, and you have a volume to be sold, why not put a “step” order in, say, at 500 share and .25 intervals in that void, and test how high the market will go . . . if there’s no action, you can still go back to the original strategy of “giving it away” at $18!

[…] I discussed the effect of the TAF on bank reserves – and hysterical reactions thereof – on January 29. Naked Capitalism is now republishing a UBS research note that, frankly, I don’t understand at all: What if the Fed’s rate cuts aren’t motivated by the desire to stave off recession, rather they’re to prevent a major banking crisis. Not one of escalating subprime losses or monoline downgrades, but actually a sheer lack of cash. The Fed’s not telling anyone what it’s up to because it doesn’t want to cause panic, but the evidence is actually there in its own data… […]

[…] There has been an amusing twist to the increase in the allowed size of GSE mortgages, which was discussed on January 29. The effective infusion of new money into the jumbo mortgage sector will, in the absence of other factors, affect prices of existing securities: If larger loans can be packaged into guaranteed securities that can trade in the TBA market, the difference between their rates and those on other prime mortgages would probably fall to between 4 basis points and 19 basis points, from more than 80 basis points today, New York-based Credit Suisse analysts Mukul Chhabra, Chandrajit Bhattacharya, and Mahesh Swaminathan wrote in a report last week. The rates offered on other prime mortgages would climb by a similar amount, they said. […]

[…] PrefBlog in the post US Fed and Negative Non-Borrowed Reserves, which was largely a copy/paste from January 29, 2008. The former post has just been updated, by the way, with a note from the Fed confirming that […]

[…] The Fed’s ambition to pay interest on reserve deposits has been discussed on PrefBlog on May 16, May 7, April 29 and January 29. […]