Boyd Erman’s piece in the Globe today, Risk factors weaken attraction of Ontario’s bonds (in the print edition, the headline was “Budget-challenged Ontario pays the price with its bonds) does a disservice to those investors who wish to understand the bond market:

Ontario is being treated more and more like the increasingly risky borrower that it is.

As the Ontario government focuses on finding ways in Tuesday’s budget to eliminate the persistent annual deficit, the bond market is exacting a steadily bigger toll for financing the government’s growing debt.

…

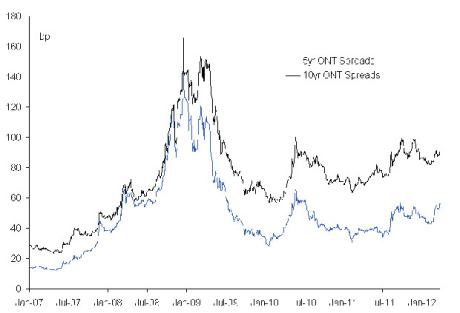

But stand back and look at a chart of the spreads over five years and there’s no doubt the general move is to wider spreads. Ontario is simply paying more, relative to Ottawa, than in the past.

…

When the bull market in government bonds ends and yields start to rise, as some observers believe is already happening, what will happen to Ontario then?

He attaches the requisite Cool Chart:

Without saying so in so many words, Mr. Erman appears to be ascribing the entire widening of the spread to credit risk – and the world is a lot more complicated than that. There is a liquidity premium – the Canada bond market is a lot bigger than the Ontario bond market, as are issue sizes and idiosyncratic measures of tradeability and hedgeability with futures. There is also a segmentation issue: many international investors will buy only sovereigns and not even consider subnationals. I am not sure, but there may be pledging issues with the Bank of Canada – if I had more time I would check, but I’m not sure if there are any eligibility or haircut differences between Canadas and Ontarios.

And … if we just glance at the chart, we can see that the shape seems to be reasonably well correlated with corporate spreads – which widened during the crisis not so much out of credit fears, but out of liquidity issues.

How much is liquidity and how much is credit? I don’t know. You could spend your lifetime studying provincial spreads and still have to guess! But to ascribe the entire widening to credit risk is a bold and audacious analysis that is treated in the column as a matter of basic fact.

Be that as it may, Ontarios are basically steady today:

Ontario bond yields didn’t make any drastic moves the morning after Canada’s largest province released its annual budget, but there was enough activity to suggest investors were a bit surprised by the provincial government’s steps to rein in spending.

Although yields for Ontario’s 5-year and 10-year bonds haven’t moved much, there was enough of a dip in early morning trading to make observers speculate that some investors are covering their short positions. These bets were initially made because investors assumed the budget wouldn’t be bold enough to tackle the province’s massive debt load.

Back in the old days at Greydanus Boeckh, I was notorious for refusing to allow staff to install any software beyond the bare-bones system we needed – we continued to use DOS, for instance, until Windows NT came out, skipping the whole Windows Crash-dot-Incompatible mess. Staff would tell me how wonderful and cheap the software was, and I would carefully explain to them that taking the software out of the shrink-wrap was when your costs started. I believe opinion was divided as to whetherr I was just saying no to demonstrate my awesome power and be mean to them, or whether I was just an idiotic technophobe.

However, we have now reached a new level of cost calculation. I bought a new laptop on the weekend for $565 (it’s incredible how cheap these things are!) and have now spent about two hours alone and about two hours on the ‘phone with tech support just trying to get the internet connection to work. So never mind the labour cost of new software – the labour cost of tranferring programmes and data to a new machine now outweighs the cost of the machine itself!

To make things worse, the new machine would not work with the old modem, and in attempting to jam the square machine into the round modem, my ISP eliminated internet access for the old machine, which is why this report is so late Ain’t life grand! But things seem to be back to normal now – and I have a shiny new modem!

It was a mixed day for the Canadian preferred share market, with PerpetualPremiums gaining 5bp, FixedResets down 11bp and DeemedRetractibles losing 17bp. Volatility was quite good. Volume was below average.

PerpetualDiscounts (all seven of them!) now yield 5.33%, equivalent to 6.93% interest at the standard equivalency factor of 1.3x. Long corporates now yield about 4.55%, so the pre-tax interest-equivalent spread (in this context, the Seniority Spread) is now about 240bp, a sharp widening from the 205bp reported March 21.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.9012 % | 2,369.0 |

| FixedFloater | 4.47 % | 3.82 % | 38,926 | 17.46 | 1 | 0.4255 % | 3,486.4 |

| Floater | 3.05 % | 3.05 % | 45,566 | 19.60 | 3 | -0.9012 % | 2,557.9 |

| OpRet | 4.93 % | 3.38 % | 66,391 | 1.22 | 6 | -0.6660 % | 2,497.9 |

| SplitShare | 5.28 % | 0.14 % | 83,610 | 0.72 | 4 | -0.2087 % | 2,677.4 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.6660 % | 2,284.1 |

| Perpetual-Premium | 5.45 % | 3.28 % | 96,294 | 0.81 | 25 | 0.0500 % | 2,207.3 |

| Perpetual-Discount | 5.21 % | 5.33 % | 194,080 | 14.95 | 7 | 0.2779 % | 2,376.8 |

| FixedReset | 5.07 % | 3.14 % | 193,751 | 2.23 | 67 | -0.1074 % | 2,379.1 |

| Deemed-Retractible | 4.97 % | 4.04 % | 211,396 | 2.85 | 46 | -0.1694 % | 2,294.3 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| FTS.PR.E | OpRet | -2.49 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2013-06-01 Maturity Price : 25.75 Evaluated at bid price : 26.24 Bid-YTW : 3.42 % |

| BAM.PR.B | Floater | -1.66 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-03-28 Maturity Price : 17.21 Evaluated at bid price : 17.21 Bid-YTW : 3.05 % |

| CM.PR.K | FixedReset | -1.33 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-31 Maturity Price : 25.00 Evaluated at bid price : 26.00 Bid-YTW : 3.37 % |

| GWO.PR.I | Deemed-Retractible | -1.27 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.38 Bid-YTW : 5.38 % |

| IAG.PR.A | Deemed-Retractible | -1.26 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.60 Bid-YTW : 5.36 % |

| SLF.PR.B | Deemed-Retractible | -1.09 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.56 Bid-YTW : 5.59 % |

| SLF.PR.C | Deemed-Retractible | -1.05 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.57 Bid-YTW : 5.78 % |

| IGM.PR.B | Perpetual-Premium | 1.40 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2016-12-31 Maturity Price : 25.50 Evaluated at bid price : 26.40 Bid-YTW : 4.85 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| ENB.PR.D | FixedReset | 84,600 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-03-28 Maturity Price : 23.16 Evaluated at bid price : 25.15 Bid-YTW : 3.86 % |

| POW.PR.G | Perpetual-Premium | 75,548 | YTW SCENARIO Maturity Type : Call Maturity Date : 2021-04-15 Maturity Price : 25.00 Evaluated at bid price : 25.60 Bid-YTW : 5.36 % |

| TD.PR.O | Deemed-Retractible | 74,657 | YTW SCENARIO Maturity Type : Call Maturity Date : 2012-04-27 Maturity Price : 25.75 Evaluated at bid price : 26.01 Bid-YTW : 1.19 % |

| TRP.PR.B | FixedReset | 70,613 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-03-28 Maturity Price : 23.44 Evaluated at bid price : 25.29 Bid-YTW : 2.88 % |

| ENB.PR.B | FixedReset | 70,515 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-03-28 Maturity Price : 23.21 Evaluated at bid price : 25.17 Bid-YTW : 3.88 % |

| HSE.PR.A | FixedReset | 62,800 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-03-28 Maturity Price : 23.45 Evaluated at bid price : 25.64 Bid-YTW : 3.31 % |

| There were 25 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| GWO.PR.M | Deemed-Retractible | Quote: 25.96 – 26.30 Spot Rate : 0.3400 Average : 0.2133 YTW SCENARIO |

| MFC.PR.F | FixedReset | Quote: 24.06 – 24.49 Spot Rate : 0.4300 Average : 0.3107 YTW SCENARIO |

| BNA.PR.D | SplitShare | Quote: 26.25 – 26.60 Spot Rate : 0.3500 Average : 0.2361 YTW SCENARIO |

| BAM.PR.J | OpRet | Quote: 26.90 – 27.33 Spot Rate : 0.4300 Average : 0.3401 YTW SCENARIO |

| IAG.PR.A | Deemed-Retractible | Quote: 23.60 – 23.90 Spot Rate : 0.3000 Average : 0.2117 YTW SCENARIO |

| IFC.PR.C | FixedReset | Quote: 25.51 – 25.74 Spot Rate : 0.2300 Average : 0.1443 YTW SCENARIO |

[…] PerpetualDiscounts now yield 5.26%, equivalent to 6.84% interest at the standard equivalency factor of 1.3x. Long corporates now yield about 4.5% (maybe just a little bit over) so the pre-tax interest-equivalent spread (in this context, the “Seniority Spread”) is now about 230bp, a significant narrowing over two days from the 240bp reported March 28. […]