An Assiduous Reader wrote in:

Hi James: I have been tracking your recommendations supplied through Cdn Moneysaver.

I know you had covered this interest bearing preferred and wondered if it is still on your recommended list.

I was especially concerned with the EPS of negative 3.51 on this stock.Thank you for the Moneysaver articles’ and your educational blog site.

Negative 3.51? That doesn’t tie in with anything I remember! So I asked for the source:

this is the GlobeInvestor site I referenced…

http://www.globeinvestor.com/servlet/Page/document/v5/data/stock?id=BSD.PR.A-T&pi_sponsor=

Thank you.

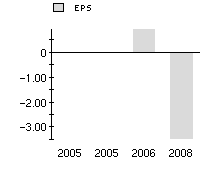

And hey, looky looky! He’s right! It says right there: EPS -3.51. There’s even a graph:

This is very odd, and not just because I don’t understand how the x-axis of the graph is labelled. I don’t understand this -3.51 business at all … which seems to be tied in (somehow) with a gross loss of 23.96-million, except that I don’t really understand how they labelled their table, either.

When in doubt, go to source documents! On the fund’s report page are annuals and quarterlies to 2Q08. After poking around a while, we open the full annual report for 2007 … and there it is. A loss of 23.96-million. In 2006.

The Globe & Mail – or their data supplier – might wish to update their figures.

Incidentally, looking at the 2Q08 Report, we derive the following table:

| BSD.UN P&L Unaudited Summarized by James Hymas [$ thousands] |

|

| Gross Income | $5,200 |

| Fees & Expenses | $805 |

| BSD.PR.A Interest | $1,705 |

| Realized & Unrealized Capital Gains Net of cost |

$5,226 |

| Capital Units Distribution from capital | $1,359 |

| Results of Operations | $6,556 |

Note that in addition to the $1,359 return of capital, the capital unitholders also got $1,505 from net investment income.

The important thing to take from the table, however, is that Income after fees & expenses, but before Preferred Share distributions was $5,200 – $805, or $4,395. Since preferred share distributions are $1,705, income coverage is about 2.6:1, a very good figure. It’s not just a fluke – the figure for 2007 was 2.8:1.

There’s no guarantees this will continue to be the case, especially since the fund has a heavy weighting in resources. But that’s an excellent figure for Income Coverage.

Asset coverage has been bruised over the past year, but remains at just under 1.5:1 as of September 12, according to the company. Besides the layer of capital protection, preferred shares are protected by a covenant that there will be no distributions to Capital Unit Holders if the asset coverage thereby becomes less than 1.4.

Bottom line? Check source documents and make up your own minds (or subscribe to PrefLetter!). At the close last night, BSD.PR.A was bid at 8.88 to yield 8.33% (mostly as interest) until hardMaturity 2015-3-31 at 10.00.

BSD.PR.A is tracked by HIMIPref™ and incorporated in the InterestBearing index.

[…] BSD.PR.A is tracked by HIMIPref™ and is part of the InterestBearing index. It was last discussed on PrefBlog in a September post, BSD.PR.A: Globe & Mail Gets the Numbers Wrong. […]