Julia Dickson, OFSI Superintendent, has released a speech made to Langdon Hall Life Insurance Forum:

It is best to see the current cycle through before making major changes to Minimum Continuing Capital and Surplus Requirements (MCCSR);

…

Pillar 3 is all about disclosure and transparency. Shedding additional light on these issues will encourage better risk management. Sunlight is a great disinfectant and I think it encourages good risk management.

…

The changes OSFI made to the seg fund guarantee capital requirements reflected the same thinking – the need for something that stands up to evaluation and is reasonable.

The trouble is, of course, is that

- A massive change has been made to the MCCSR rules

- OSFI itself is a secretive organization that seldom, if ever, justifies or explains its decisions

- The reasoning behind the seg fund guarantee requirements has not even been exposed for evaluation, much less stood up to it.

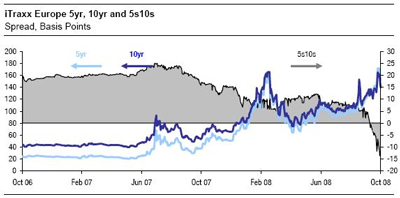

There has been an inverted credit curve on some financial issues for quite some time, but FT Alphaville has pointed out this is now more common than not:

FT Alphaville claims this is due to front-end-loaded default fears, but Across the Curve says there’s another factor in play:

Time Warner offering of 5 year and 10 year bonds. The 10 year priced at T+525 and recently someone quoted the issue 510/490.

That two tranche offering yesterday pricedwith an inverted credit curve. As I mentioned the 10 year was T+525 but the 5 year issue required a wider spread to Treasury paper and that paper priced at T+590. This phenomenon is not confined to Time Warner but manifests itself in quite a few other names.

Traditionally, that would indicate that investors see a greater a chance for default sooner rather than later and require a wider spread to protect portfolios from that risk.

Conversations with market participants, though, lead to a different conclusion. The credit spread inversion is a function of demand for duration. There is much more demand for 10 year assets from insurance companies and pension funds and that demand is evident in the number of credits which experience the inversion.

Like everything else in the investment world, I’ll suggest that there’s a bit of truth to every half-way reasonable explanation. Here in the preferred share world, I’ve been puzzled for some time as to why BAM Perps yield less than BAM retractibles (discussed on August 22) … the duration hypothesis from Assiduous Reader prefwatcher didn’t convince me at the time and doesn’t convince me now … but who knows?

| Note that these indices are experimental; the absolute and relative daily values are expected to change in the final version. In this version, index values are based at 1,000.0 on 2006-6-30. The Fixed-Reset index was added effective 2008-9-5 at that day’s closing value of 1,119.4 for the Fixed-Floater index. |

|||||||

| Index | Mean Current Yield (at bid) | Mean YTW | Mean Average Trading Value | Mean Mod Dur (YTW) | Issues | Day’s Perf. | Index Value |

| Ratchet | N/A | N/A | N/A | N/A | 0 | N/A | N/A |

| Fixed-Floater | 4.96% | 4.92% | 68,535 | 15.77 | 6 | +0.7286% | 1,057.2 |

| Floater | 8.23% | 8.40% | 54,615 | 10.92 | 2 | -9.0582% | 425.0 |

| Op. Retract | 5.27% | 5.38% | 135,966 | 3.77 | 15 | -0.0489% | 1,004.1 |

| Split-Share | 6.41% | 11.07% | 58,013 | 3.90 | 12 | +1.4277% | 930.0 |

| Interest Bearing | 8.00% | 14.20% | 56,292 | 3.23 | 3 | +1.9802% | 888.3 |

| Perpetual-Premium | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| Perpetual-Discount | 6.99% | 7.07% | 176,307 | 12.50 | 71 | -0.1135% | 781.7 |

| Fixed-Reset | 5.40% | 5.14% | 931,016 | 15.09 | 12 | -0.0500% | 1,079.1 |

| Major Price Changes | |||

| Issue | Index | Change | Notes |

| BAM.PR.B | Floater | -13.1892% | |

| BAM.PR.J | OpRet | -7.1429% | Now with a pre-tax bid-YTW of 11.89% based on a bid of 16.25 and a softMaturity 2018-3-30 at 25.00. Compare with BAM.PR.H (8.86% to 2012-3-30), BAM.PR.I (9.03% to 2013-12-30) and BAM.PR.O (10.86% to 2013-6-30). Closing quote of 16.25-40, 2×13. Day’s range of 16.40-17.50. |

| BAM.PR.K | Floater | -5.3684% | |

| LBS.PR.A | SplitShare | -4.0184% | Asset coverage of 1.7-:1 as of November 13 according to Brompton Group. Now with a pre-tax bid-YTW of 9.60% based on a bid of 8.36 and a hardMaturity 2013-11-29 at 10.00. Closing quote of 8.36-70, 3×3. Day’s range of 8.69-72 … so the reported drop is more a measure of the thinness of the market than anything else. Maybe! |

| BAM.PR.M | PerpetualDiscount | -3.0209% | Now with a pre-tax bid-YTW of 9.72% based on a bid of 12.52 and a limitMaturity. Closing quote 12.52-00, 4X16. Day’s range 12.50-99. Note the inversion against the retractibles! |

| RY.PR.F | PerpetualDiscount | -2.8153% | Now with a pre-tax bid-YTW of 6.49% based on a bid of 17.26 and a limitMaturity. Closing Quote 17.26-69, 5×3. Day’s range of 17.60-00. |

| W.PR.J | PerpetualDiscount | -2.7207% | Now with a pre-tax bid-YTW of 8.13% based on a bid of 17.52 and a limitMaturity. Closing Quote 17.52-84, 5X4. Day’s range of 17.50-70. |

| MFC.PR.B | PerpetualDiscount | -2.5107% | Now with a pre-tax bid-YTW of 6.94% based on a bid of 16.77 and a limitMaturity. Closing Quote 16.77-00, 9×2. Day’s range of 16.85-69. |

| FTN.PR.A | SplitShare | -2.2843% | Asset coverage of 1.9-:1 as of October 31 according to the company. Now with a pre-tax bid-YTW of 10.00% based on a bid of 7.70 and a hardMaturity 2015-12-1 at 10.00. Closing quote of 7.70-80, 5X5. Day’s range of 7.69-80. |

| BNS.PR.K | PerpetualDiscount | -2.1610% | Now with a pre-tax bid-YTW of 6.70% based on a bid of 18.11 and a limitMaturity. Closing Quote 18.11-78, 10×12. Day’s range of 18.11-80. |

| GWO.PR.G | PerpetualDiscount | -2.0635% | Now with a pre-tax bid-YTW of 7.16% based on a bid of 18.51 and a limitMaturity. Closing Quote 18.51-71, 4×4. Day’s range of 18.50-98. |

| BAM.PR.O | OpRet | +2.3018% | See BAM.PR.J, above. |

| FIG.PR.A | InterestBearing | +2.5992% | Asset coverage of 1.3-:1 as of November 11, based on a Capital Unit NAV of 3.92 and 0.71 Capital Units per Preferred. Now with a pre-tax bid-YTW of 12.49% based on a bid of 7.50 and a hardMaturity 2014-12-31 at 10.00. Closing quote of 7.50-63, 16×1. Day’s range of 7.35-50. |

| BCE.PR.I | FixFloat | +2.7111% | |

| STW.PR.A | InterestBearing | +2.7778% | Asset coverage of 1.4+:1 as of November 6, according to Middlefield. Now with a pre-tax bid-YTW of 14.01% based on a bid of 9.25 and a hardMaturity 2009-12-31 at 10.00. Closing quote of 9.25-47, 20×3. Day’s range of 9.25-28. |

| PWF.PR.K | PerpetualDiscount | +3.1609% | Now with a pre-tax bid-YTW of 6.97% based on a bid of 17.95 and a limitMaturity. Closing Quote 17.95-99, 3X10. Day’s range of 17.98-07. |

| PWF.PR.I | PerpetualDiscount | +3.5645% | Now with a pre-tax bid-YTW of 7.06% based on a bid of 17.95 and a limitMaturity. Closing Quote 21.50-99, 2×10. One trade at 22.50. |

| FBS.PR.B | SplitShare | +25.00% | Asset coverage of 1.4+:1 as of November 6 according to TD Securities. Now with a pre-tax bid-YTW of 11.65% based on a bid of 8.35 and a hardMaturity 2011-12-15 at 10.00. Closing quote of 8.35-60, 6×5. Day’s range of 8.01-40 … yesterday’s vanishing bid made an appearance! |

| Volume Highlights | |||

| Issue | Index | Volume | Notes |

| TD.PR.C | FixedReset | 217,947 | Nesbitt bought two blocks of 49,900 and one of 50,100 from anonymous, then crossed 50,000, all at 25.08. |

| RY.PR.L | FixedReset | 202,105 | TD bought 12,700 from Nesbitt at 25.00; RBC bought blocks of 10,000 and 11,300 from anonymous at 24.99. |

| BAM.PR.B | Floater | 145,522 | Desjardins crossed 131,000 at 9.50 |

| BAM.PR.K | Floater | 138,040 | Desjardins crossed 131,000 at 9.50. Tax loss swap vs. BAM.PR.B? |

| SLF.PR.D | PerpetualDiscount | 79,731 | National Bank crossed 60,000 at 15.00. Now with a pre-tax bid-YTW of 7.69% based on a bid of 14.75 and a limitMaturity. |

There were twenty-eight other index-included $25-pv-equivalent issues trading over 10,000 shares today.

STW.PR.A has 2 capital shares per unit, so coverage actually better than stated above, but market has eroded this further. There are 30% more pref shares outstanding then capital shares, so I expect fairly large call of pref shares on annual redemption (announcement should be Nov 30ish). Call would be $10.20, maybe 10-40% of shares, depending on amount of capital units surrendered.

I stand corrected: the Toronto Stock Exchange shows 8.414-million STW.UN outstanding vs. 5.881-million STW.PR.A

STW.PR.A has been called at $10.2 + accrued for total of $10.3173913 per share. 33.8575% of preferred shares have been called. This is a good premium to last friday’s trading price.

I am unable to confirm this. What is your source?

source is bloomberg, under news of the capital shares

I grabbed the screen at work. It will trade ex-redemption on Dec 9th, and supposed to get redeemed on Dec 12th

There’s no press release and nothing on SEDAR – not that that means a lot, there was also a stealth redemption in 2006.

I have a call in to Middlefield to confirm; the investor relations clerk said he’d get back to me ‘within the hour’, but so far he’s missed his cue.

One wonders why they make selective disclosure to Bloomberg …

[…] essence of the redemption noted by Assiduous Reader erikd has been confirmed: STW.PR.A has been called at $10.2 + accrued for total of $10.3173913 per share. […]