The Bank of England has announced the release of the 2009 Q3 issue of the Bank of England Quarterly Bulletin with the usual top-notch research. This quarter’s articles are:

- Foreword

- Markets and operations

- Global imbalances and the financial crisis

- Household saving

- Interpreting recent movements in sterling

- What can be said about the rise and fall in oil prices?

- Bank of England Systemic Risk Survey

- Monetary Policy Roundtable

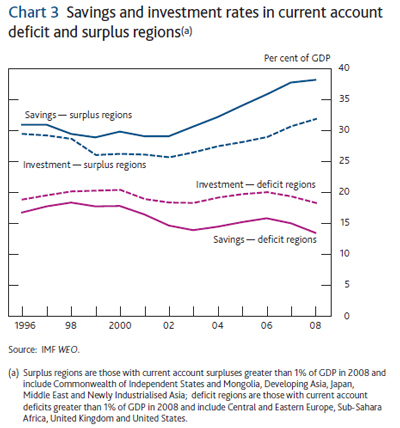

The article on Global imbalances seeks to challenge Taylor’s assertion that there was no global saving glut by focussing on gross, not net numbers:

An important factor was the adoption of managed exchange rate policies by some EAEs [East Asian Economies],(2) whereby a particular level of their currency was targeted, usually against the US dollar. This policy was prompted, in part, by the aim of spurring economic development through exports, thereby addressing extensive rural underemployment.(3)(4) The desire to accumulate foreign exchange reserves as insurance against a repeat of the 1997–98 Asian currency crises was an additional motivation.(5) Another factor may have been the slow pace of financial development in many EAEs which meant that there was a dearth of domestic investment opportunities (see Caballero et al (2008)). This may have necessitated savings being channelled to the deeper and more liquid financial markets in western economies.

…

Bernanke (2005) has argued that the low and falling savings rates in deficit countries which accompanied the credit boom, were principally the outcome of an endogenous process by which the excess savings of the surplus countries — the ‘global

savings glut’ — were recycled.

Meanwhile, banks were exposing themselves to liquidity risk:

An associated innovation was that banks changed their funding models. In particular, banks sold the new types of securities to

end-investors via the so-called ‘shadow banking system’, encompassing structured investment vehicles (SIVs) and conduits, which provided a framework for lending and borrowing without accepting deposits. This was termed the ‘originate to distribute’ model: aiming to spread the risks associated with securitised assets off their balance sheets, banks sold them to SIVs, which then aimed to sell them on to end-investors.(1) At the same time, banks increasingly relied on wholesale funding markets, including in selling the securitised assets, see the October 2008 Financial Stability Report. The magenta bars in Chart 8 show that the share of funding by UK banks derived from securitisations increased between 2000 and 2008.(2)

The authors repeatedly emphasize this point:

The funding structure of financial institutions, with its reliance on wholesale markets and the use of securitised assets (Chart 8), was a related vulnerability. In particular, this funding model relied on the continued functioning of those markets. This funding often came from foreign investors and this, together with banks’ increased lending overseas and the growth of the shadow banking system, generated the further vulnerability of increased and complex cross-border linkages between both financial institutions and between countries more generally. Such complex international linkages potentially give rise to unappreciated, but potent, interconnections between firms in the global financial system.

The article on oil prices makes a claim of regulatory significance:

The price of oil rose steadily between the middle of 2003 and the end of 2007, rose further and more rapidly until mid-2008 and fell sharply until the end of that year. Commentators agree that a significant part of the increase in the oil price over that period was due to rapid demand growth from emerging markets, but there are substantial differences of view about the relative importance of other factors, and limited work thus far in explaining the large fall in oil prices in the second half of 2008. The purpose of this article is to analyse the main explanations for the rise and fall in oil prices in the five years until the end of 2008. It argues that shocks to oil demand and supply, coupled with the institutional factors of the oil market, are qualitatively consistent with the direction of price movements, although the magnitude of the rise and subsequent fall during 2008 is more difficult to justify. The available empirical evidence suggests that financial flows into oil markets have not been an important factor over the period as a whole. Nonetheless, one cannot rule out the possibility that some part of the sharp rise and fall in the oil price in 2008 might have had some of the characteristics of an asset price bubble.