The Bank of Canada has released the December 2009 Financial System Review with special reports on:

- Liquidity Standards in a Macroprudential Context

- Improving the Resilience of Core Funding Markets

- Reform of Securitization

- Towards a Stress-Testing Model Consistent with the Macroprudential Approach

The article on Liquidity Standards takes note of the resilience of Canadian banks:

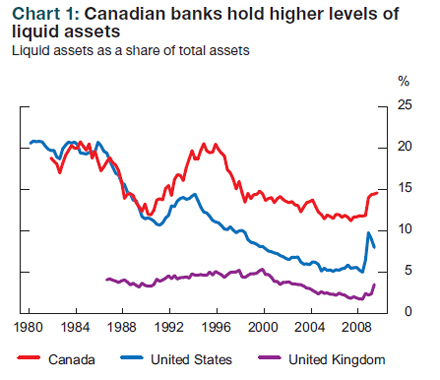

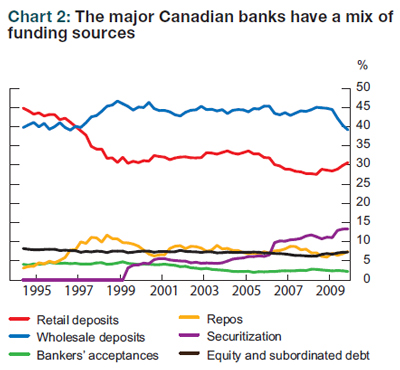

Several factors help to explain this relative resilience of Canadian banks. First, they did not hold the same quantity of “toxic” assets as their international peers and had strong capital ratios and high-quality capital that enabled them to absorb the losses that did occur. For example, Canadian banks were not involved in the U.S. subprime-mortgage market to the same extent as many of their major foreign counterparts, and thus were (generally) seen as less-risky counterparties in funding markets. Second, and perhaps even more important, were their liquidity and funding profiles. While Canadian banks have, over time, reduced their holdings of liquid assets as a share of total assets, the relative decline was more modest than in some other countries (Chart 1). Third, while Canadian banks have increasingly relied on funding from capital markets, this has been balanced to some extent by continued reliance on retail deposits for a significant share of their funding (Chart 2). Moreover, their reliance on securitization markets has been markedly less than was the case internationally. As noted by the International Monetary Fund (IMF), with relatively larger holdings of liquid assets and more stable sources of funding, Canadian banks were better positioned to handle liquidity shocks than many foreign banks.

The IMF paper has been discussed on PrefBlog; I was beginning to wonder if I’d just imagined it, given OSFI’s lack of intellectual integrity in refusing to acknowledge the matter.

The second article makes an interesting point on CMB spreads:

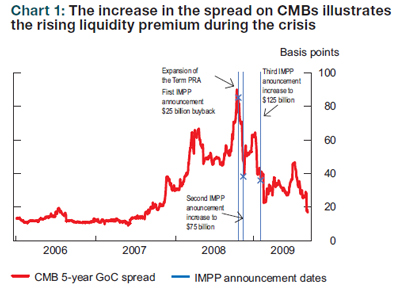

The behaviour of spreads on Canada Mortgage Bonds (CMBs) during the recent period of market turmoil suggests that this contagion channel was at work. CMBs are explicitly guaranteed by the Government of Canada (GoC) and, thus, changes in the spreads of CMBs (above the yields on bonds issued directly by the GoC) refl ect a lack of market liquidity, not changes in the risk of default. Following the collapse of Lehman Brothers in September 2008, CMB spreads rose markedly from relatively low and stable levels (Chart 1). As is well known, spreads across fixed-income markets also widened sharply over this period. The rise in corporate bond spreads, or other non-government securities, also reflected expectations of a deteriorating economic environment and the associated increase in defaults. The same cannot be said of the rise in CMB spreads. It is therefore likely that a rising system-wide liquidity premium explains the common increase in all fixed-income spreads relative to more-liquid GoC securities.

…

The impact of the Bank’s Term Purchase and Resale Agreement (PRA) Facility1 and the federal government’s Insured Mortgage Purchase Program (IMPP),

introduced in October 2008, also suggests that illiquidity was a key factor in rising spreads.2 For example, by December 2008 just prior to the second IMPP announcement, CMB spreads had dropped by around 33 basis points, while all other spreads had increased as the crisis intensified (including spreads on high-quality provincial bonds). By January 2009, CMB spreads had fallen further, while all other spreads were either fl at or higher. With the generalized improvement in market conditions that took hold in March 2009, all spreads tightened considerably.

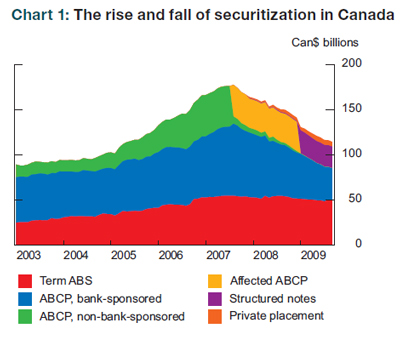

The article on securitization has a great chart:

The article was a little spoiled by the assertion that only Credit Rating Agencies are smart enough to understand securitization:

CRAs may have little incentive to make their methodologies, assumptions, and information used in the rating process transparent. Yet, investors and regulators need this information to manage and control risk.

Bull. Investors and regulators need a model of some kind, certainly. And they need to understand the model – naturally. And they may wish to delegate the building of that model to the CRA’s – it’s cheaper! But the implicit assertion that CRAs must disclose their analytical methodology because they’re the only smart guys in town would be insulting if it wasn’t so ridiculous.

Their statement also appears to contradict the most sensible thing ever written by a Bank of Canada analyst (Mark Zelmer in the Dec ’07 FSR):

In the end though, investors need to accept responsibility for managing credit risk in their portfolios. While complex instruments such as structured products enhance the benefits to be gained from relying on credit ratings, investors should not lose sight of the fact that one can delegate tasks but not accountability.

However, the authors, Jack Selody and Elizabeth Woodman, redeem themselves somewhat by pointing out the flaws in regulation:

The potential for regulatory arbitrage arises when prudential regulation does not properly recognize implicit contingent claims. Ignoring these claims leads to the assumption that risk to the fi nancial system is eliminated when securitized products are moved off the balance sheet of the original lender. As a result, capital is not required, even though the originator or sponsor, in effect, retains a partial liability associated with the instrument. Thus, when markets for these products froze and values declined, there was instability in the financial system as retained but uncapitalized and uncommunicated liabilities came to light, causing investors to question the valuations they placed on the equity of financial institutions.

They would have redeemed themselves completely if they had pointed out that Money Market Funds are a form of securitization!

They state:

The alignment of incentives could be improved by requiring issuers to retain a portion of an issue of a new debt instrument, thereby sharing in the risk.

… which is also an element in the UK FSA Plan. Come on, now! Are these securitization or covered bonds? Make up your minds! Tranche retention is simply a method whereby the big banks can protect their moat and reduce competition. Besides, if tranche retention is made mandatory, then incompetent portfolio managers won’t be able to blame the vendors for their poor performance, increasing the risk that they’ll be driven out of business and consequently unable to hire ex-regulators for their compliance departments. And if ex-regulators can’t get jobs in the business, then what’s the point of regulation, anyway?

The authors then have a good cry about just how compwicated investing is:

If products are too complex, investors have difficulty understanding and managing the risks inherent in the asset-backed debt instruments they hold.

I have difficulty understanding why such investors would buy the stuff – and why I should care if they do.

[…] the authors of this particular paper (as was the case with the authors of the December 2009 Review) drink the regulatory Kool-aid and insist that everybody is at fault except the guys who actually […]