In a working paper published by the Bank for International Settlements, authored by Peter Hördahl and Oreste Tristani, titled Inflation risk premia in the US and the euro area:

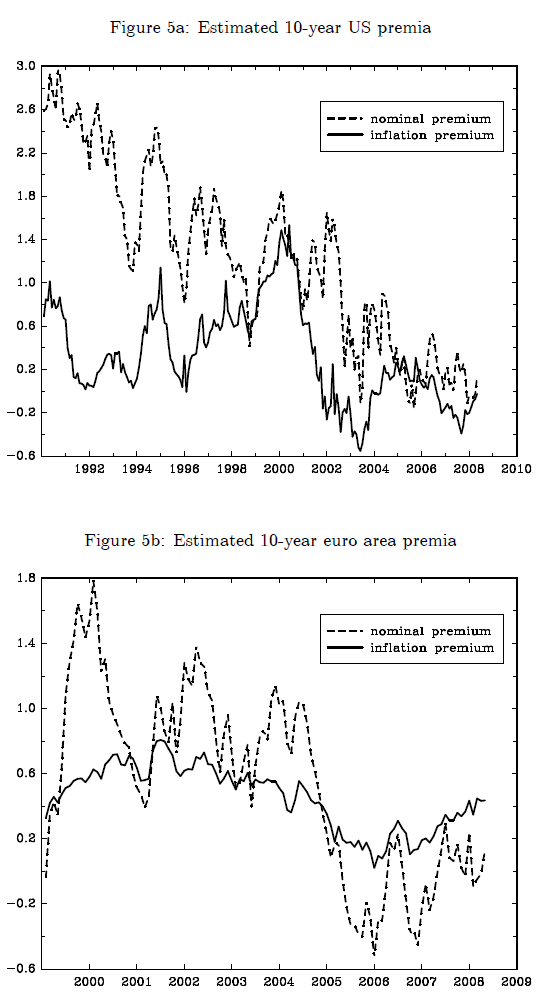

We use a joint model of macroeconomic and term structure dynamics to estimate inflation risk premia in the United States and the euro area. To sharpen our estimation, we include in the information set macro data and survey data on inflation and interest rate expectations at various future horizons, as well as term structure data from both nominal and index-linked bonds. Our results show that, in both currency areas, inflation risk premia are relatively small, positive, and increasing in maturity. The cyclical dynamics of long-term inflation risk premia are mostly associated with changes in output gaps, while their high-frequency fluctuations seem to be aligned with variations in inflation. However, the cyclicality of inflation premia differs between the US and the euro area. Long term inflation premia are countercyclical in the euro area, while they are procyclical in the US.

This model is much more macro-oriented than most:

In this paper we focus on modelling and estimating the first of these two components – i.e. the inflation risk premium – in order to obtain a “cleaner” measure of investors; inflation expectations embedded in bond prices. In doing so, we try to reduce the risk that liquidity factors might distort our estimates by carefully choosing when to introduce yields on index-linked bonds in the estimations. We also include survey information on expectations, which should aid us in pinning down the dynamics of key variables in the model. Moreover, in order to understand the macroeconomic determinants of inflation risk premia we employ a joint model of macroeconomic and term structure dynamics, such that prices of real and nominal bonds are determined by the macroeconomic framework and investors’ risk characteristics. More specifically, building on Ang and Piazzesi (2003), we adopt the framework developed in Hördahl, Tristani and Vestin (2006), in which bonds are priced based on the dynamics of the short rate obtained from the solution of a linear forward-looking macro model and using an essentially a¢ ne stochastic discount factor (see Duffie and Kan, 1996; Dai and Singleton, 2000; Duffee, 2002).

They find a rather peculiar difference in the responses of EUR denominated bonds vs Treasuries to output-gap shocks:

There is however one striking di¤erence in the conditional dynamics of risk premia in the two currency areas. While we find that inflation premia always respond positively to upward inflation shocks, the response to output gap shocks di¤er between the US and the euro area. A positive output shock results in a higher inflation premium in the US, while it lowers it in the euro area. The positive relationship for the US could reflect perceptions of a higher risk of inflation surprises on the upside as the output gap widens, while the euro area result is consistent with investors becoming more willing to take on risks – including inflation risks – during booms, while they may require larger premia during recessions.

The model’s detailed results are:

Looking at the results in more detail, Figure 9 shows that a one standard deviation upward shock to the output gap (about 0.4%) in the US pushes the 10-year break-even rate up by around 15 basis points on impact. About two thirds of this e¤ect is due to a rising inflation premium, while one third corresponds to an increase in expected inflation as a result of the expansionary shock. At the 2-year horizon, the effect on the break-even rate is even larger, at around 26 basis points on impact, but now the bulk of this response is due to rising inflation expectations (16 basis points), whereas the inflation premium accounts for the remaining 10 basis points. Hence, a shock to the output gap seems to result in a parallel shift in the inflation premium, while inflation expectations react much more strongly for short horizons than long, reflecting the short- to medium-term persistence of output gap shocks. In the euro area, a positive shock to the output gap also raises expected inflation – and more so at the 2-year horizon than the 10-year horizon – but the inflation premium response is uniformly negative (Fig. 11). Moreover, as the expected inflation response declines with the horizon, the break-even response goes from being positive at the 2-year horizon to being slightly negative at 10 years.

The authors conclude, in part:

Our results show that the inflation risk premium is relatively small, positive, and increasing with the maturity, in the United States as well as in the euro area. Our estimated inflation premia vary over time as a result of changes to the state variables in the model. Specifically, in both economies the output gap and inflation are the main drivers of inflation premia. The broad movements in long-term inflation risk premia largely match those of the output gap, while more high-frequency premia fluctuations seem to be aligned with changes in the level of inflation.