This is cool: Capital Structure Arbitrage-Implied Index Trading:

In this paper, we develop long-short trading strategies derived from the work of Merton [1974], which provides theoretical relationships between equity, equity volatility, and credit. We then apply the strategies to index products structured primarily based on U.S. investment grade assets.

We find that an optimized Merton-based strategy results in significant trading profits when applied over the span of time for which data is available. Furthermore, we find that trading profits can be enhanced by incorporating information derived from short-term volatility. Given the unlimited number of index combinations spanning different asset classes, geographies and tranche levels, we recommend that further work be allocated to the promising area of capital-structure arbitrage implied index trading.

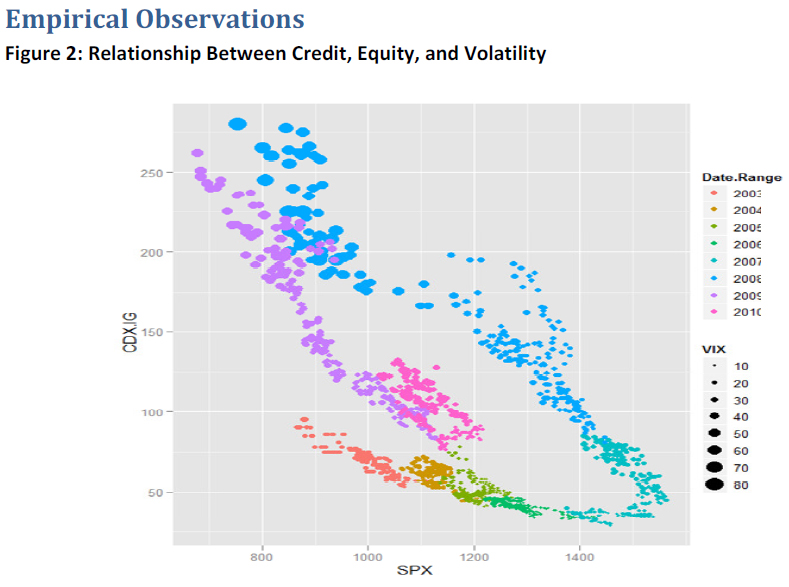

Figure 2 shows a graphical summary of the relationship among the CDX Investment Grade index, S&P 500, and the VIX. There are a few general qualitative observations from this graph. First of all, high levels of CDX IG are typically accompanied by high levels of volatility. This suggests that volatility may be a reasonable predictor for the credit spread. Another important observation is that the slope of CDX.IG as a function of SPX changes over time and over different market conditions. The time-varying relationship is expected, since credit spread is fundamentally a stationary process, while the equity index is obviously non-stationary. This time-varying relationship makes it difficult to directly use the slope as the hedge ratio in the credit-index index arbitrage.

Overview of Merton Model

In a seminal paper, Merton [1974] proposed a structural model that provides a theoretical relationship between a firm’s equity value and its credit risk. The key concept behind the Merton model is that default occurs when the firm’s asset value falls below its debt value. Hence, investment in a firm’s equity can be viewed as purchasing a call option on the firm’s assets, with the value of the debt as the strike price. The Merton model makes the same assumptions as in the Black-Scholes options pricing framework, such as the log-normal distribution of asset value.

Italian regulators are ratcheting up pressure on short-sellers:

Italy’s market regulator has recommended to stakeholders who have lent shares in Italian companies to retrieve them, Consob head said on Wednesday, confirming reports of a move aimed at curbing short-selling. “Yes, we’ve exercised moral suasion by asking all those who have lent shares to retrieve them,” Consob Chairman Giuseppe Vegas told journalists on the sideline of a conference.

He added the request was not binding.

More opinions on the Yellow / Trader / Apax deal:

Moody’s has trouble wrapping its head around the [Trader] company’s strength as it moves into the digital environment.

“While this is a plausible proposition that has been successfully executed in the U.K. and elsewhere using the Trader brand, there is some uncertainty that the same formula can be applied in Trader’s circumstances in Canada,” the rating agency noted.

“Trader will have to grow its per digital customer yield and increase market penetration, neither of which is a given.”

Moody’s ultimately slapped a B3 rating on the name.

Speaking of Moody’s they put the US on Review Negative:

Moody’s Investors Service put the U.S. under review for a credit rating downgrade as talks to raise the government’s $14.3 trillion debt limit stall, adding to concern that political gridlock will lead to a default.

The Aaa ratings of financial institutions directly linked to the U.S. government, including Fannie Mae, Freddie Mac, the Federal Home Loan Banks, and the Federal Farm Credit Banks, were also put on review for cuts, Moody’s said in a statement today.

The U.S., rated Aaa since 1917, was put on review for the first time since 1995 on concern the debt limit will not be raised in time to prevent a missed payment of interest or principal on outstanding bonds and notes even though the risk remains low, Moody’s said. The rating would likely be reduced to the Aa range and there is no assurance that Moody’s would return its top rating even if a default is quickly cured.

DBRS has released its Split Share Funds Quarterly Report – Q2 2011:

Q2 2011 was the first quarter since Q2 2010 that the average downside protection for split shares rated by DBRS decreased. Notwithstanding the declines over the past three months, the average downside protection of DBRS-rated preferred shares was about 51% at the end of Q2 2011, a signifi cant increase over the 45% and 40% averages at the end of Q2 2010 and Q2 2009, respectively. As a result of the additional buffer of downside protection built up over time, it is expected that the negative performance during Q2 2011 will generally not result in negative rating actions for preferred shares or securities rated by DBRS.

It was a mixed day in the Canadian preferred share market, with PerpetualDiscounts winning 25bp, FixedResets up 16bp and DeemedRetractibles down 8bp. Not much volatility. Volume was average.

PerpetualDiscounts now yield 5.45%, equivalent to 7.08% interest at the standard equivalency factor of 1.3x. Long Corporates now yield about 5.2% (!) so the pre-tax interest-equivalent spread is now about 190bp, a significant widening from the 175bp reported on July 6, as preferreds did not participate in the extraordinary 15bp week’s decline in long corporate yields.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1650 % | 2,441.3 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.1650 % | 3,671.7 |

| Floater | 2.48 % | 2.32 % | 42,413 | 21.41 | 4 | -0.1650 % | 2,635.9 |

| OpRet | 4.86 % | 2.06 % | 63,754 | 0.22 | 9 | -0.0171 % | 2,444.7 |

| SplitShare | 5.24 % | 2.02 % | 55,511 | 0.62 | 6 | -0.0287 % | 2,508.0 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0171 % | 2,235.5 |

| Perpetual-Premium | 5.69 % | 5.15 % | 133,485 | 0.78 | 13 | 0.0748 % | 2,090.6 |

| Perpetual-Discount | 5.44 % | 5.45 % | 110,902 | 14.72 | 17 | 0.2466 % | 2,199.1 |

| FixedReset | 5.14 % | 3.15 % | 212,031 | 2.67 | 58 | 0.1606 % | 2,323.2 |

| Deemed-Retractible | 5.10 % | 4.87 % | 261,071 | 8.09 | 47 | -0.0828 % | 2,153.5 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| PWF.PR.A | Floater | -1.32 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-07-13 Maturity Price : 22.22 Evaluated at bid price : 22.50 Bid-YTW : 2.32 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| RY.PR.I | FixedReset | 207,525 | Nesbitt crossed five blocks: 50,000 shares, 54,000 shares, 40,000 shares, 20,000 shares and 30,000 shares; all at 26.20. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-02-24 Maturity Price : 25.00 Evaluated at bid price : 26.21 Bid-YTW : 3.34 % |

| IFC.PR.A | FixedReset | 140,800 | Recent new issue. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.01 Bid-YTW : 4.09 % |

| RY.PR.X | FixedReset | 116,473 | Nesbitt crossed 50,000 at 27.58; Desjardins crossed blocks of 40,00 and 10,000 at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-24 Maturity Price : 25.00 Evaluated at bid price : 27.46 Bid-YTW : 3.22 % |

| RY.PR.R | FixedReset | 51,900 | TD crossed 40,000 at 27.25; Desjardins crossed 10,000 at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-02-24 Maturity Price : 25.00 Evaluated at bid price : 27.22 Bid-YTW : 3.05 % |

| MFC.PR.B | Deemed-Retractible | 45,290 | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.43 Bid-YTW : 6.06 % |

| CM.PR.G | Perpetual-Premium | 41,630 | RBC crossed 29,200 at 25.15. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-01 Maturity Price : 25.00 Evaluated at bid price : 25.11 Bid-YTW : 5.15 % |

| There were 33 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| NA.PR.L | Deemed-Retractible | Quote: 24.86 – 25.15 Spot Rate : 0.2900 Average : 0.1944 YTW SCENARIO |

| GWO.PR.J | FixedReset | Quote: 26.90 – 27.25 Spot Rate : 0.3500 Average : 0.2557 YTW SCENARIO |

| SLF.PR.A | Deemed-Retractible | Quote: 22.68 – 22.97 Spot Rate : 0.2900 Average : 0.2149 YTW SCENARIO |

| BNA.PR.E | SplitShare | Quote: 24.16 – 24.44 Spot Rate : 0.2800 Average : 0.2053 YTW SCENARIO |

| GWO.PR.F | Deemed-Retractible | Quote: 25.24 – 25.43 Spot Rate : 0.1900 Average : 0.1260 YTW SCENARIO |

| RY.PR.X | FixedReset | Quote: 27.46 – 27.70 Spot Rate : 0.2400 Average : 0.1819 YTW SCENARIO |

Re: Capital Structure Arbitrage (Figure 2).

1. The figure shows CORRELATION of Vix and spread — which is not surprising. It doesn’t show whether Vix leads spread (forecasts), lags or is simultaneous. Seems to me a forecast is necessary to make money. and I’m not sure Vix is any better than timing off the magnitude of the spread itself.

2. Use of Log of SPX would tend to make the correlations a bit more linear (as might some log of yield (spread plus risk free rate over rfr).

Probably the previous comment can be deleted because

I looked up the original paper and see that Vix is used to model a spread which is compared to the observed spread. “Over” and “Under” conditions are used to buy equity / short credit (or the reverse). Thus, the authors are essentially fiddling with the intercept of the correlation of Vix-spread rather than the correlation itself.

A few large wins and losses seem to characterize historical results — which is a completely different subject.

A few large wins and losses seem to characterize historical results — which is a completely different subject.

I think this is characteristic of screens with small amounts of input data, which is why I prefer lots and lots of indicators, applied on a weighted basis.

[…] spread (also called the Seniority Spread) is now about 200bp, a widening from the 190bp reported on July 13, as yields have increased on PerpetualDiscounts and stayed put for […]