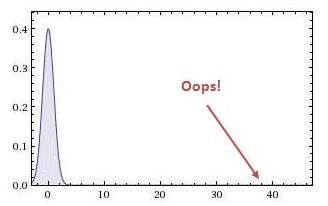

Dealbreaker has an entertaining observation regarding the UBS unauthorized losses. After examining the bank’s published VaR calculations:

Oops! UBS’s maximum 95% value-at-risk in the second quarter was 98mm CHF, or around 85mm USD at current exchange rates. So if its returns are normally distributed and that’s a one-tail confidence interval it should have daily losses of over $52mm less than 16% of the time, $85mm less than 5% of the time, $104mm less than 2.3% of the time, $155mm or than 0.14% of the time …

You see where I’m going with this. A $2 billion loss is, um, 38.5 standard deviations. That exploded Excel’s brain but goofier methods suggest that a loss that big should occur about once in 10^324 days. Or the odds of it happening in the history of the universe are one in a googol. Cubed.

They have another thoughtful piece on how the lines between prop-trading and client trading can get blurred:

Perhaps I’m naïve in thinking that this is the circle of life. You’ll certainly see people who believe that the unpleasantness at UBS reveals that financial innovation and complexity should be banned, or that any units of banks with Greek letters in their names should be shut down. My own view is that you can’t really legislate a world where market makers don’t put their capital at risk – that’s what a market maker does. And if you’re willing to tolerate any form of financial complexity, you will have a world where the risks that market makers take are multiform, and where market makers have a lot of “proprietary” discretion to decide which risks to keep and which to hedge. And relying on forms of words like “proprietary trading” and “client facilitation” is not an intelligent way to think about systemic management of those risks.

In the meantime the accused trader has been charged:

Kweku Adoboli, the trader arrested Sept. 15 after UBS AG (UBSN) said it discovered unauthorized trades that caused a $2 billion loss, was charged with fraud and two counts of false accounting dating back to 2008.

The 31-year-old was taken into custody at a magistrates court in London yesterday until Sept. 22, when he can make an application for bail. Adoboli’s false accounting offenses started in October 2008, according to the court charge sheet. He is also charged with fraud dating back to January 2009.

Not an overnight thing!

Jefferson County may have avoided bankruptcy:

Jefferson County, Alabama, commissioners approved a settlement with holders of $3.14 billion of sewer debt to avert what would have been the largest municipal bankruptcy in U.S. history.

The County Commission voted 4-1 today to accept the terms of the agreement, which includes $1.1 billion in concessions from creditors. JPMorgan Chase & Co. (JPM), which arranged most of the debt, would take the biggest loss.

…

The threat of bankruptcy has loomed over Jefferson County, home to Birmingham, Alabama’s biggest city, for more than three years as officials sought to keep sewer fees from ballooning to pay off the debt. The deal hinges on action by the state Legislature, and Commission President David Carrington said bankruptcy is still possible if final terms aren’t agreed on.The deal calls for three annual sewer-rate increases of 8.2 percent, followed by future annual boosts of no more than 3.25 percent.

BIS has released a working paper by Stephen Cecchetti, Madhusudan Mohanty and Fabrizio Zampolli titled The real effects of debt:

At moderate levels, debt improves welfare and enhances growth. But high levels can be damaging. When does debt go from good to bad? We address this question using a new dataset that includes the level of government, non-financial corporate and household debt in 18 OECD countries from 1980 to 2010. Our results support the view that, beyond a certain level, debt is a drag on growth. For government debt, the threshold is around 85% of GDP. The immediate implication is that countries with high debt must act quickly and decisively to address their fiscal problems. The longer-term lesson is that, to build the fiscal buffer required to address extraordinary events, governments should keep debt well below the estimated thresholds. Our examination of other types of debt yields similar conclusions. When corporate debt goes beyond 90% of GDP, it becomes a drag on growth. And for household debt, we report a threshold around 85% of GDP, although the impact is very imprecisely estimated.

The OSC released its decision on the Sino-Forest puts:

IT IS ORDERED, pursuant to section 144 of the Act, that the Cease Trade Order is hereby varied solely to permit (a) the holders of outstanding Put Contracts issued and cleared by CDCC to exercise their Put Contracts, whether or not such holder is a person described in paragraph 6(i) or 6(ii); (b) the holders of the Put Contracts to sell common shares of the Issuer under the terms of the Put Contracts; (c) the sellers of such Put Contracts to perform their obligations to purchase common shares of the Issuer under the terms of the Put Contracts; and (d) CDCC and its members to carry out their respective obligations under the Rules of CDCC, including all requisite acts in furtherance of the trades described in (a), (b) and (c), provided that this order shall not apply to permit the sale of Issuer common shares by a person described in paragraph 6(i) who does not currently own common shares, or who is an insider or other person described in paragraph 6(ii), and provided further that the Cease Trade Order shall otherwise remain in effect, unamended except as expressly provided in this order.

It looks to my untrained eye as if it’s illegal to borrow shares to make good delivery. I say the integrity of Canadian capital markets has taken a hit.

It was a modestly good day for the Canadian preferred share market, with PerpetualDiscounts winning 10bp, FixedResets up 6bp and DeemedRetractibles gaining 2bp. Volatility was low. Volume was extremely low.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -1.5163 % | 2,144.6 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -1.5163 % | 3,225.5 |

| Floater | 3.03 % | 3.35 % | 60,246 | 18.89 | 3 | -1.5163 % | 2,315.6 |

| OpRet | 4.81 % | 2.47 % | 62,302 | 1.64 | 8 | -0.0819 % | 2,461.8 |

| SplitShare | 5.36 % | 0.58 % | 50,594 | 0.45 | 4 | 0.2178 % | 2,503.5 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0819 % | 2,251.1 |

| Perpetual-Premium | 5.61 % | 4.49 % | 116,949 | 1.08 | 16 | 0.0995 % | 2,118.3 |

| Perpetual-Discount | 5.26 % | 5.32 % | 110,732 | 14.97 | 14 | 0.0983 % | 2,261.7 |

| FixedReset | 5.15 % | 3.11 % | 208,160 | 2.62 | 59 | 0.0618 % | 2,331.0 |

| Deemed-Retractible | 5.04 % | 4.58 % | 238,585 | 5.92 | 46 | 0.0174 % | 2,202.2 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| PWF.PR.A | Floater | -3.72 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-09-16 Maturity Price : 20.71 Evaluated at bid price : 20.71 Bid-YTW : 2.55 % |

| BAM.PR.X | FixedReset | 1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-09-16 Maturity Price : 22.67 Evaluated at bid price : 23.85 Bid-YTW : 3.63 % |

| IAG.PR.F | Deemed-Retractible | 1.17 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 26.00 Bid-YTW : 5.40 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| HSB.PR.E | FixedReset | 63,659 | RBC traded 50,000 at 27.30. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-06-30 Maturity Price : 25.00 Evaluated at bid price : 27.25 Bid-YTW : 3.14 % |

| CM.PR.G | Perpetual-Premium | 46,488 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-09-16 Maturity Price : 24.81 Evaluated at bid price : 25.11 Bid-YTW : 5.44 % |

| SLF.PR.A | Deemed-Retractible | 39,393 | Nesbitt crossed 25,000 at 23.13. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.06 Bid-YTW : 5.76 % |

| SLF.PR.F | FixedReset | 31,412 | RBC crossed 15,100 at 26.65. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-06-30 Maturity Price : 25.00 Evaluated at bid price : 26.65 Bid-YTW : 3.44 % |

| TD.PR.S | FixedReset | 29,380 | RBC crossed 25,000 at 26.02. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 26.04 Bid-YTW : 2.96 % |

| SLF.PR.H | FixedReset | 25,375 | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.86 Bid-YTW : 3.84 % |

| There were 12 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| ELF.PR.F | Perpetual-Discount | Quote: 23.30 – 23.83 Spot Rate : 0.5300 Average : 0.3707 YTW SCENARIO |

| SLF.PR.F | FixedReset | Quote: 26.65 – 26.90 Spot Rate : 0.2500 Average : 0.1803 YTW SCENARIO |

| FTS.PR.H | FixedReset | Quote: 25.40 – 25.72 Spot Rate : 0.3200 Average : 0.2571 YTW SCENARIO |

| SLF.PR.G | FixedReset | Quote: 25.12 – 25.30 Spot Rate : 0.1800 Average : 0.1297 YTW SCENARIO |

| PWF.PR.K | Perpetual-Discount | Quote: 23.98 – 24.15 Spot Rate : 0.1700 Average : 0.1224 YTW SCENARIO |

| MFC.PR.A | OpRet | Quote: 25.43 – 25.58 Spot Rate : 0.1500 Average : 0.1091 YTW SCENARIO |