The Fed is pushing hard for a CDS Clearinghouse:

The Federal Reserve has given U.S. futures exchanges until Oct. 31 to present written plans on how they’ll make the $55 trillion credit swaps market less risky, according to four people familiar with the discussions.

…

Federal Reserve officials are not aiming to pick a winner to operate a clearinghouse, the people said. Rather, the central bank is hoping to set up a framework for the eventual winner.

…

The four groups vying to operate clearing operations include partnerships of Chicago-based CME Group and Citadel Investment Group LLC, and Intercontinental Exchange, dealer-owned Clearing Corp. and credit-swap index owner Markit Group Ltd. Eurex AG and NYSE Euronext also have submitted proposals.

The last major review of the clearinghouse on PrefBlog was my reaction to Accrued Interest‘s plan. On September 22 I deprecated his idea of trading only CDSs with a recovery lock.

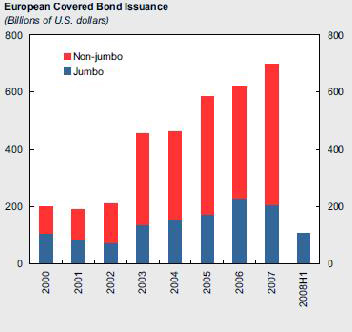

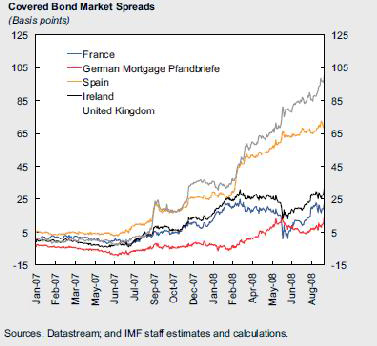

On VoxEU, John Kiff, Paul Mills and Carolyne Spackman project a resurgence of covered bonds. While the essay suffers from the mind-set that the credit crunch happened because credit rating agencies are dumb and more rules will make them smart, the provide some interesting charts:

In a welcome piece of news, Bloomberg reports:

Sales of longer-term commercial paper soared 10-fold after the Federal Reserve began buying the corporate IOUs, a sign that the central bank’s efforts to unlock the market may be working.

Companies yesterday sold more than 1,500 issues totaling a record $67.1 billion of the debt due in more than 80 days, compared with a daily average of 340 issues valued at $6.7 billion last week, according to data published by the Fed. Most of the difference was probably absorbed by the Fed, said Adolfo Laurenti, a senior economist at Mesirow Financial Inc.

The source data from the Fed shows that the increase in issuance was almost entirely at the long-end, probably 90-day paper.

Accrued Interest looks at agency paper and likes it, despite the fact that position limits for Taiwanese insurers are being reduced:

The danger is that Asia doesn’t seem to agree. Selling of both Agency debt and MBS securities have been concentrated in Asia the last several days. We know that that Taiwanese insurance regulators are limiting allowable exposure to U.S. agency mortgage-backed securities, claiming the credit rating cannot be believed. If China or Japan were to come to the same conclusion, there would be real problems real fast.

The good news is that despite heavy selling from Asia, agency spreads (and MBS spreads for that matter) have moved wider slowly. Agency spreads are about 60bps wider this month, whereas corporate spreads have moved 117bps wider.

The Taiwanese rule change is:

Where previously there was no limit to investments in MBS issued by US federal housing loan agencies, namely Fannie Mae, Freddie Mac and Ginnie Mae, insurers will now be given a maximum ceiling of 50% of their offshore investment limit to such products by the three institutions. Maximum exposure to MBS and collateralised issues by any of the individual agencies will be set at 25%.

Now, this is the danger. On the weekend, I discussed the Fed’s balance sheet in terms of the Fed intermediating between the banks and credit risk, in the same manner as banks intermediate between Granny Oakum and credit risk. This is a natural thing and this is a good thing, but the Fed’s ability to do so is constrained by the ability to sell Treasury debt. Eight years of fiscal profligacy have eroded the available excess capacity … I don’t think we’re in trouble yet, but this is the type of thing that signifies trouble.

Just because equities were up so much today doesn’t mean we can relax! There are rumours that Barclays has foreclosed a hedge fund:

Barclays Plc, the U.K.’s second- largest bank, is seeking bids for $1.5 billion of bonds and $3.5 billion of credit-default swap contracts held by a hedge fund, according to people with knowledge of the auction.

The bank is selling bonds from European, Asian and U.S. issuers, according to the people, who asked not to be identified because the sales aren’t being made public. Barclays is also selling $970 million of assets, primarily high-yield, high-risk loans, the people said. Bids on both portfolios are due today.

Somewhat to my chagrin, I see that FixedReset issues are trading as if they were actually 5-year paper, rather than as perpetual paper with a five year call. The recently announced new issues offer a 5.60% coupon, with a continued reset to 5.60 if 5-year Canadas remain unchanged; rather than falling a lot, to offer equivalent perpetual yields, extant Fixed-Resets have fallen a little, to offer equivalent five-year yields with the assumption of a call at par.

In fact, yields to first call of the extant fixed resets are in excess of 5.60%, implying that the new issues will trade at an immediate (small) discount, rather than at the premium they would command otherwise. It’s a funny old world.

Another day of heavy volume, with a number of dealers crossing significant blocks.

| Note that these indices are experimental; the absolute and relative daily values are expected to change in the final version. In this version, index values are based at 1,000.0 on 2006-6-30. The Fixed-Reset index was added effective 2008-9-5 at that day’s closing value of 1,119.4 for the Fixed-Floater index. |

|||||||

| Index | Mean Current Yield (at bid) | Mean YTW | Mean Average Trading Value | Mean Mod Dur (YTW) | Issues | Day’s Perf. | Index Value |

| Ratchet | N/A | N/A | N/A | N/A | 0 | N/A | N/A |

| Fixed-Floater | 5.60% | 5.91% | 69,804 | 14.56 | 6 | -1.7991% | 924.2 |

| Floater | 6.76% | 6.76% | 45,037 | 12.70 | 2 | +3.0226% | 510.0 |

| Op. Retract | 5.32% | 6.16% | 135,341 | 4.05 | 14 | +0.7795% | 994.6 |

| Split-Share | 6.43% | 11.35% | 57,579 | 3.96 | 12 | -0.2786% | 912.1 |

| Interest Bearing | 8.40% | 14.74% | 61,279 | 3.15 | 3 | +1.2322% | 840.7 |

| Perpetual-Premium | 7.13% | 7.24% | 52,016 | 12.23 | 1 | -4.2395% | 870.2 |

| Perpetual-Discount | 6.95% | 7.03% | 175,229 | 12.55 | 70 | -0.2954% | 780.7 |

| Fixed-Reset | 5.38% | 5.10% | 806,853 | 15.15 | 10 | -0.2224% | 1,068.6 |

| Major Price Changes | |||

| Issue | Index | Change | Notes |

| CU.PR.B | PerpetualDiscount | -5.7816% | Now with a pre-tax bid-YTW of 6.95% based on a bid of 22.00 and a limitMaturity. Closing quote 22.00-23.50, 12×8. Day’s range 22.50-23.50. |

| BCE.PR.R | FixFloat | -4.5238% | |

| BAM.PR.N | PerpetualDiscount | -4.3887% | Now with a pre-tax bid-YTW of 9.93% based on a bid of 12.20 and a limitMaturity. Closing Quote 12.20-44, 1X11. Day’s range of 12.00-13.00. |

| CL.PR.B | PerpetualPremium (for now!) | -4.2395% | Now with a pre-tax bid-YTW of 7.24% based on a bid of 21.91 and a limitMaturity. Closing Quote 21.91-22.96, 3×7. Day’s range of 21.90-23.20. |

| ELF.PR.G | PerpetualDiscount | -4.0000% | Now with a pre-tax bid-YTW of 8.35% based on a bid of 14.40 and a limitMaturity. Closing Quote 14.40-00, 2X2. Day’s range of 14.00-35. |

| ELF.PR.F | PerpetualDiscount | -2.9254% | Now with a pre-tax bid-YTW of 8.2529% based on a bid of 16.26 and a limitMaturity. Closing Quote 16.26-99, 3X1. Day’s range of 16.00-99. |

| BCE.PR.I | FixFloat | -2.8916% | |

| GWO.PR.H | PerpetualDiscount | -2.8824% | Now with a pre-tax bid-YTW of 7.46% based on a bid of 16.51 and a limitMaturity. Closing Quote 16.51-00, 3X3. Day’s range of 16.55-17.55. |

| SLF.PR.A | PerpetualDiscount | -2.8369% | Now with a pre-tax bid-YTW of 7.34% based on a bid of 16.44 and a limitMaturity. Closing Quote 16.44-94, 3X9. Day’s range of 16.40-00. |

| SLF.PR.B | PerpetualDiscount | -2.8235% | Now with a pre-tax bid-YTW of 7.38% based on a bid of 16.52 and a limitMaturity. Closing Quote 16.52-87, 5X8. Day’s range of 16.49-00. |

| PWF.PR.L | PerpetualDiscount | -2.6667% | Now with a pre-tax bid-YTW of 7.04% based on a bid of 21.65 and a limitMaturity. Closing Quote 18.25-74, 1X1. Day’s range of 18.00-75. |

| PWF.PR.H | PerpetualDiscount | -2.4775% | Now with a pre-tax bid-YTW of 6.69% based on a bid of 21.65 and a limitMaturity. Closing Quote 21.65-22.70, 7X11. Day’s range of 21.51-23.00. |

| RY.PR.W | PerpetualDiscount | -2.4324% | Now with a pre-tax bid-YTW of 6.80% based on a bid of 18.05 and a limitMaturity. Closing Quote 18.05-20, 5X5. Day’s range of 18.04-70. |

| PWF.PR.F | PerpetualDiscount | -2.1295% | Now with a pre-tax bid-YTW of 7.07% based on a bid of 18.71 and a limitMaturity. Closing Quote 18.71-50, 1X3. Day’s range of 18.65-19.90. |

| BNS.PR.R | FixedReset | -2.1295% | According to me, yield-to-first-call is 7.48%, YTW is 5.37%. Is it through or wide of the new issues? Take your pick. |

| SLF.PR.E | PerpetualDiscount | -1.9520% | Now with a pre-tax bid-YTW of 7.29% based on a bid of 15.66 and a limitMaturity. Closing Quote 15.66-95, 6X20. Day’s range of 15.57-94. |

| TD.PR.S | FixedReset | +2.0399% | Yield-to-first-call, 5.95%. YTW, 4.75%. Through or wide? |

| PWF.PR.J | OpRet | +2.0833% | Now with a pre-tax bid-YTW of 5.20% based on a bid of 24.50 and a softMaturity 2013-7-30 at 25.00 |

| STW.PR.A | InterestBearing | +2.0925% | Asset coverage of 1.4+:1 as of October 23 according to the company. Now with a pre-tax bid-YTW of 13.21% based on a bid of 9.27 and a hardMaturity 2009-12-31 at 10.00 |

| POW.PR.D | PerpetualDiscount | +2.1752% | Now with a pre-tax bid-YTW of 7.28% based on a bid of 17.38 and a limitMaturity. Closing Quote 17.38-87, 5×2. Day’s range of 16.84-17.88. |

| ALB.PR.A | SplitShare | +2.1768% | Asset coverage of 1.5+:1 as of October 23 according to Scotia Managed Companies. Now with a pre-tax bid-YTW of 8.47% based on a bid of 23.00 and a hardMaturity 2011-2-28 at 25.00. Closing quote of 23.00-18, 50×1. Both of today’s trades were at 22.51 (odd-lot excepted). |

| BMO.PR.J | PerpetualDiscount | +2.5397% | Now with a pre-tax bid-YTW of 7.13% based on a bid of 16.15 and a limitMaturity. Closing Quote 16.15-30, 6×1. Day’s range of 16.00-30. |

| BAM.PR.K | Floater | +5.0000% | |

| BAM.PR.I | OpRet | +5.1282% | Now with a pre-tax bid-YTW of 10.25% based on a bid of 20.50 and a softMaturity 2013-12-30 at 25.00. Compare with BAM.PR.H (11.82% to 2012-3-30), BAM.PR.J (9.15% to 2018-3-30) and BAM.PR.O (10.99% to 2013-6-30). |

| POW.PR.B | PerpetualDiscount | +5.8172% | Now with a pre-tax bid-YTW of 7.08% based on a bid of 19.10 and a limitMaturity. Closing Quote 19.10-49, 1×1. Day’s range of 18.98-19.99. |

| RY.PR.H | PerpetualDiscount | +7.7000% | Now with a pre-tax bid-YTW of 6.56% based on a bid of 21.54 and a limitMaturity. Closing Quote 21.54-16, 3×4. Day’s range of 21.00-22.50. |

| IAG.PR.A | PerpetualDiscount | +14.0413% | Now with a pre-tax bid-YTW of 7.30% based on a bid of 16.00 and a limitMaturity. Closing Quote 16.00-79, 10×2. Day’s range of 15.20-16.50. |

| Volume Highlights | |||

| Issue | Index | Volume | Notes |

| GWO.PR.X | OpRet | 936,734 | CIBC crossed 924,100 at 25.90. Now with a pre-tax bid-YTW of 4.09% based on a bid of 25.90 and a softMaturity 2013-9-29 at 25.00. |

| MFC.PR.A | OpRet | 310,500 | CIBC crossed 200,000 at 24.10,then another 100,000 at the same price. Now with a pre-tax bid-YTW of 4.83% based on a bid of 24.05 and a softMaturity 2015-12-18 at 25.00. |

| MFC.PR.C | PerpetualDiscount | 286,655 | Nesbitt crossed 100,000 at 15.60, then another 12,300 at the same price. RBC crossed 50,000 at 15.70, then Scotia crossed 100,000 at 15.70. Now with a pre-tax bid-YTW of 7.26% based on a bid of 15.78 and a limitMaturity. |

| GWO.PR.I | PerpetualDiscount | 229,040 | RBC crossed 205,200 at 16.60. Now with a pre-tax bid-YTW of 7.04% based on a bid of 16.21 and a limitMaturity. |

| GWO.PR.F | PerpetualDiscount | 216,397 | CIBC crossed 213,000 at 22.90. Now with a pre-tax bid-YTW of 6.70% based on a bid of 22.30 and a limitMaturity. |

| MFC.PR.B | PerpetualDiscount | 178,758 | Nesbitt crossed 30,000 at 17.20, TD crossed 85,000 at 17.19, then CIBC crossed 50,000 at 17.19. Now with a pre-tax bid-YTW of 7.06% based on a bid of 16.75 and a limitMaturity. |

| BMO.PR.H | PerpetualDiscount | 173,600 | CIBC crossed 171,000 at 19.15. Now with a pre-tax bid-YTW of 7.13% based on a bid of 19.01 and a limitMaturity. |

| DC.PR.A | Scraps (Would be OpRet but there are credit concerns) | 159,190 | Scotia crossed 150,000 at 13.25. Now with a pre-tax bid-YTW of 16.33% based on a bid of 13.06 and a softMaturity 2016-6-29 at 25.00. |

| PWF.PR.D | OpRet | 118,735 | CIBC crossed 115,000 at 25.15. Now with a pre-tax bid-YTW of 5.16% based on a bid of 25.05 and a softMaturity 2012-10-30 at 25.00. |

| SLF.PR.B | PerpetualDiscount | 111,707 | CIBC crossed 100,000 at 16.99. Now with a pre-tax bid-YTW of 7.38% based on a bid of 16.52 and a limitMaturity. |

| NTL.PR.G | Scraps (would be Ratchet, but there are credit concerns) | 108,880 | National crossed 61,500 at 3.00. |

There were forty-four other index-included $25-pv-equivalent issues trading over 10,000 shares today.

[…] Fixed-Reset 5.60%+267 closed today, an event fraught with interest due to the question posed on October 28: “through or […]

[…] lacking. At some point – as has happened in Taiwan with insurers and agency paper, as mentioned October 28 – the rest of the world will decide it has quite enough US paper, thank you very much, and then […]