Bank of Montreal has announced:

it has closed its domestic public offering of Non-Cumulative 5-Year Rate Reset Class B Preferred Shares Series 46 (Non-Viability Contingent Capital (NVCC)) (the “Preferred Shares Series 46”). The offering was underwritten on a bought-deal basis by a syndicate of underwriters led by BMO Capital Markets. Bank of Montreal issued 14 million Preferred Shares Series 46 at a price of $25.00 per share to raise gross proceeds of $350 million.

The Preferred Shares Series 46 were issued under a prospectus supplement dated April 10, 2019, to the Bank’s short form base shelf prospectus dated May 23, 2018. Such shares will commence trading on the Toronto Stock Exchange today under the ticker symbol BMO.PR.F.

BMO.PR.F is a FixedReset 5.10%+351, NVCC-compliant issue announced April 8. It will be tracked by HIMIPref™ and is assigned to the FixedReset (Premium) subindex.

The issue traded 2,191,850 shares today in a range of 25.05-24 before closing at 25.22-23. Vital statistics are:

| BMO.PR.F | FixedReset Prem | YTW SCENARIO Maturity Type : Call Maturity Date : 2024-05-25 Maturity Price : 25.00 Evaluated at bid price : 25.22 Bid-YTW : 4.93 % |

2.2-million shares is an awesome trading volume for a medium-sized issue such as BMO.PR.F, even though the total places it only at #27 on the all-time (well … since 1993, anyway) list. Only thirty-eight entries in my database crack the 2-million mark, an achievement managed only twice in 2017, four times in 2016 and, prior to then, just once in each of 2008 and 2007, with a host of earlier dates. The last 2-million-plus day was June 2, 2017, when CM.PR.R managed the feat.

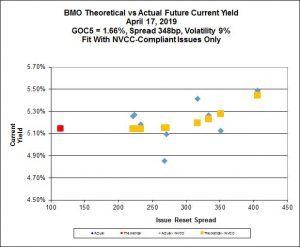

The new issue is somewhat expensive according to Implied Volatility Analysis:

According to this analysis BMO.PR.F is fairly valued at 24.49 (down 0.11 from announcement date) and is therefore 0.73 rich – although holders can take some solace, perhaps, from the fact that BMO.PR.E may be considered 1.28 rich to its fair value of 21.07

It’s interesting to note that the theoretical spread (on a notional non-callable perpetual resettable annuity) of 348bp is roughly the same as the actual issue spread on BMO.PR.F of 351bp – which means that BMO is basically getting the call options on the issue for free.

[…] is a FixedReset 5.10%+351, NVCC-compliant issue that commenced trading 2019-4-17 after being announced 2019-4- 8. It is tracked by HIMIPref™ and is assigned to the FixedReset […]