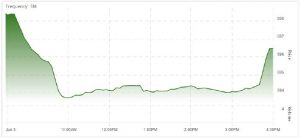

It was a wild day, with new 52-week lows all over the place, but the cavalry arrived at 3:40pm to stave off disaster.

TXPR closed at 596.46, down 0.34% on the day after touching a new 52-week low of 593.67 (down 80bp). Volume was 3.12-million, the highest of the past thirty days.

CPD closed at 11.915, down 0.46% on the day, after hitting a new 52-week low of 11.85. Volume of 231,500 was the second-highest of the past thirty days – eclipsed only by yesterday.

ZPR closed at 9.565, down 0.16% on the day, after hitting a new 52-week low of 9.47. Volume of 254,264 was the third-highest of the past thirty days, eclipsed only by yesterday and (just barely) May 31.

Five-year Canada yields were down 4bp to 1.30% today.

Bond strength (lowering yields) has been attributed to a poor US jobs outlook:

U.S. private employers added 27,000 jobs in May, well below economists’ expectations and the smallest monthly gain in more than nine years, a report by a payrolls processor showed on Wednesday.

Economists surveyed by Reuters had forecast the ADP National Employment Report would show a gain of 180,000 jobs, with estimates ranging from 123,000 to 230,000.

…

May’s increase was the smallest since March 2010.

PerpetualDiscounts now yield 5.59%, equivalent to 7.27% interest at the standard equivalency factor of 1.3x. Long corporates now yield 3.60%, so the pre-tax interest-equivalent spread (in this context, the “Seniority Spread”) is now about 365bp, a sharp widening from the 345bp reported May 29.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.2577 % | 1,973.2 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.2577 % | 3,620.8 |

| Floater | 5.95 % | 6.38 % | 62,668 | 13.25 | 3 | -0.2577 % | 2,086.7 |

| OpRet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0343 % | 3,302.7 |

| SplitShare | 4.72 % | 4.77 % | 77,242 | 4.25 | 7 | 0.0343 % | 3,944.2 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0343 % | 3,077.4 |

| Perpetual-Premium | 5.64 % | -6.52 % | 78,012 | 0.08 | 7 | 0.0113 % | 2,929.6 |

| Perpetual-Discount | 5.52 % | 5.59 % | 71,805 | 14.43 | 26 | -0.2569 % | 3,051.0 |

| FixedReset Disc | 5.57 % | 5.44 % | 174,848 | 14.67 | 70 | -0.1004 % | 2,045.0 |

| Deemed-Retractible | 5.34 % | 6.12 % | 95,867 | 8.05 | 27 | -0.2751 % | 3,041.7 |

| FloatingReset | 4.11 % | 4.99 % | 50,818 | 2.54 | 4 | -0.2117 % | 2,335.4 |

| FixedReset Prem | 5.15 % | 4.05 % | 223,247 | 1.88 | 16 | 0.5079 % | 2,562.1 |

| FixedReset Bank Non | 2.00 % | 4.54 % | 162,651 | 2.56 | 3 | 0.2396 % | 2,617.0 |

| FixedReset Ins Non | 5.35 % | 7.60 % | 102,879 | 8.17 | 22 | 0.0732 % | 2,130.2 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PF.B | FixedReset Disc | -2.30 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 17.01 Evaluated at bid price : 17.01 Bid-YTW : 6.19 % |

| RY.PR.Z | FixedReset Disc | -1.92 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 17.40 Evaluated at bid price : 17.40 Bid-YTW : 5.16 % |

| RY.PR.H | FixedReset Disc | -1.60 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 17.22 Evaluated at bid price : 17.22 Bid-YTW : 5.29 % |

| BMO.PR.S | FixedReset Disc | -1.55 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 17.20 Evaluated at bid price : 17.20 Bid-YTW : 5.40 % |

| MFC.PR.I | FixedReset Ins Non | -1.51 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.88 Bid-YTW : 7.69 % |

| NA.PR.E | FixedReset Disc | -1.47 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 18.80 Evaluated at bid price : 18.80 Bid-YTW : 5.49 % |

| CU.PR.F | Perpetual-Discount | -1.45 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 20.45 Evaluated at bid price : 20.45 Bid-YTW : 5.54 % |

| BIP.PR.D | FixedReset Disc | -1.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 21.25 Evaluated at bid price : 21.25 Bid-YTW : 6.02 % |

| MFC.PR.L | FixedReset Ins Non | -1.39 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 16.28 Bid-YTW : 8.59 % |

| SLF.PR.I | FixedReset Ins Non | -1.28 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.46 Bid-YTW : 7.62 % |

| CM.PR.S | FixedReset Disc | -1.26 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 18.77 Evaluated at bid price : 18.77 Bid-YTW : 5.34 % |

| POW.PR.B | Perpetual-Discount | -1.26 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 23.26 Evaluated at bid price : 23.56 Bid-YTW : 5.76 % |

| TRP.PR.E | FixedReset Disc | -1.25 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 15.80 Evaluated at bid price : 15.80 Bid-YTW : 5.95 % |

| NA.PR.S | FixedReset Disc | -1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 16.89 Evaluated at bid price : 16.89 Bid-YTW : 5.73 % |

| PWF.PR.F | Perpetual-Discount | -1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 22.98 Evaluated at bid price : 23.25 Bid-YTW : 5.71 % |

| BAM.PF.E | FixedReset Disc | -1.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 15.77 Evaluated at bid price : 15.77 Bid-YTW : 6.36 % |

| EMA.PR.F | FixedReset Disc | -1.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 17.20 Evaluated at bid price : 17.20 Bid-YTW : 5.86 % |

| IAF.PR.I | FixedReset Ins Non | -1.00 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.71 Bid-YTW : 6.68 % |

| MFC.PR.G | FixedReset Ins Non | -1.00 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.80 Bid-YTW : 7.60 % |

| CU.PR.I | FixedReset Prem | 1.04 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2020-12-01 Maturity Price : 25.00 Evaluated at bid price : 25.26 Bid-YTW : 3.82 % |

| BAM.PF.H | FixedReset Prem | 1.07 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2020-12-31 Maturity Price : 25.00 Evaluated at bid price : 25.50 Bid-YTW : 4.28 % |

| TD.PF.H | FixedReset Prem | 1.07 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2021-10-31 Maturity Price : 25.00 Evaluated at bid price : 25.48 Bid-YTW : 4.23 % |

| TRP.PR.D | FixedReset Disc | 1.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 16.39 Evaluated at bid price : 16.39 Bid-YTW : 5.85 % |

| SLF.PR.G | FixedReset Ins Non | 1.11 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 13.61 Bid-YTW : 9.64 % |

| RY.PR.M | FixedReset Disc | 1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 18.47 Evaluated at bid price : 18.47 Bid-YTW : 5.38 % |

| CM.PR.R | FixedReset Disc | 1.17 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 21.27 Evaluated at bid price : 21.55 Bid-YTW : 5.47 % |

| MFC.PR.M | FixedReset Ins Non | 1.22 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 17.41 Bid-YTW : 8.03 % |

| TRP.PR.A | FixedReset Disc | 1.26 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 13.69 Evaluated at bid price : 13.69 Bid-YTW : 5.99 % |

| IAF.PR.G | FixedReset Ins Non | 1.33 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.59 Bid-YTW : 6.36 % |

| BMO.PR.D | FixedReset Disc | 1.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 21.28 Evaluated at bid price : 21.28 Bid-YTW : 5.33 % |

| IFC.PR.C | FixedReset Ins Non | 1.33 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.24 Bid-YTW : 7.71 % |

| IFC.PR.A | FixedReset Ins Non | 1.36 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 14.96 Bid-YTW : 9.38 % |

| BIP.PR.F | FixedReset Disc | 1.48 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 20.61 Evaluated at bid price : 20.61 Bid-YTW : 6.20 % |

| SLF.PR.H | FixedReset Ins Non | 1.48 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 15.79 Bid-YTW : 8.72 % |

| NA.PR.G | FixedReset Disc | 1.82 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 20.66 Evaluated at bid price : 20.66 Bid-YTW : 5.29 % |

| BAM.PF.J | FixedReset Disc | 2.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 22.13 Evaluated at bid price : 22.60 Bid-YTW : 5.32 % |

| GWO.PR.N | FixedReset Ins Non | 2.19 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2030-01-31 Maturity Price : 25.00 Evaluated at bid price : 14.00 Bid-YTW : 9.08 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TD.PF.H | FixedReset Prem | 203,200 | YTW SCENARIO Maturity Type : Call Maturity Date : 2021-10-31 Maturity Price : 25.00 Evaluated at bid price : 25.48 Bid-YTW : 4.23 % |

| TD.PF.M | FixedReset Disc | 173,410 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 22.99 Evaluated at bid price : 24.54 Bid-YTW : 5.00 % |

| CM.PR.Y | FixedReset Disc | 133,615 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 22.86 Evaluated at bid price : 24.22 Bid-YTW : 5.14 % |

| BAM.PR.K | Floater | 111,000 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 11.03 Evaluated at bid price : 11.03 Bid-YTW : 6.39 % |

| BMO.PR.T | FixedReset Disc | 92,450 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 16.80 Evaluated at bid price : 16.80 Bid-YTW : 5.39 % |

| PWF.PR.L | Perpetual-Discount | 80,087 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2049-06-05 Maturity Price : 22.40 Evaluated at bid price : 22.66 Bid-YTW : 5.69 % |

| There were 63 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| BAM.PF.D | Perpetual-Discount | Quote: 20.60 – 21.20 Spot Rate : 0.6000 Average : 0.3701 YTW SCENARIO |

| MFC.PR.K | FixedReset Ins Non | Quote: 18.42 – 19.09 Spot Rate : 0.6700 Average : 0.4605 YTW SCENARIO |

| BMO.PR.C | FixedReset Disc | Quote: 21.94 – 22.40 Spot Rate : 0.4600 Average : 0.2788 YTW SCENARIO |

| BAM.PF.E | FixedReset Disc | Quote: 15.77 – 16.18 Spot Rate : 0.4100 Average : 0.2456 YTW SCENARIO |

| TD.PF.L | FixedReset Disc | Quote: 24.47 – 24.90 Spot Rate : 0.4300 Average : 0.2674 YTW SCENARIO |

| GWO.PR.Q | Deemed-Retractible | Quote: 22.85 – 23.26 Spot Rate : 0.4100 Average : 0.2717 YTW SCENARIO |

Love the photo. Do you keep an album of these stashed somewhere for days like these?

It is crazy what is happening considering there is technically neither a recession yet nor anything actually happened to interest rates! I thought holders of preferred shares had more patience and long term view than regular holders, apparently I was wrong. Not even minimum rate resets are spared.

I can understand why floaters and rate resets would be under pressure if one believed that rates would remain low over an extended period of time, but doesn’t that imply then that preps should be doing well?

I think that the answer is that the asset class has generally fallen out of favour and retail investors aren’t in a rush to come back.

Good news for those of us in it for the long term.

paradon

All good points.

Here’s an interesting data point, looked at from another perspective.

The SPREAD over GOC 5 year for certain issues is now larger than the yield on the long bonds for those issuers.

These are all blue chips and we have this state of affairs. How can we not have a compelling buying opportunity here?

I can understand why floaters and rate resets would be under pressure if one believed that rates would remain low over an extended period of time, but doesn’t that imply then that preps should be doing well?

Yes. The elevated level of Straight Perpetual spreads, together with the fact that they remain slightly above FixedResets in terms of yield, suggests to me that Straights are now being priced off FixedResets (and maintaining a positive spread) rather than directly from corporate bonds or ‘bigger picture’ forecasts of policy rates.

I think that the answer is that the asset class has generally fallen out of favour and retail investors aren’t in a rush to come back.

Good news for those of us in it for the long term.

Yes, the nice thing about inflated liquidity premia is that you get paid for waiting for the situation to normalize!

jiHymas says , ” Yes, the nice thing about inflated liquidity premia is that you get paid for waiting for the situation to normalize!” , as a long term investor , that lives off my dividends and reinvests the excess back into more dividend payers , i dont want the situation to normalize .